rubio_n ( PDF ) - Center for Latin American Studies

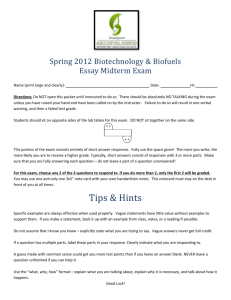

advertisement