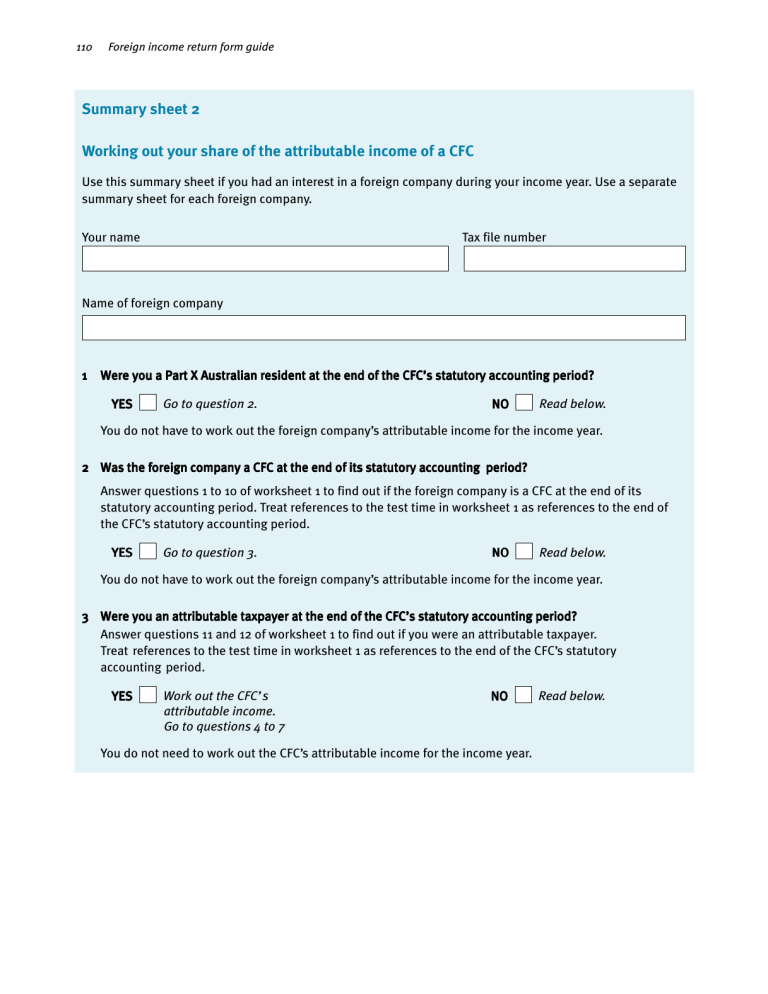

Summary sheet 2 Working out your share of the attributable income

advertisement

110 Foreign income return form guide Summary sheet 2 Working out your share of the attributable income of a CFC Use this summary sheet if you had an interest in a foreign company during your income year. Use a separate summary sheet for each foreign company. Your name Tax file number Name of foreign company 1 Were you a Part X Australian resident at the end of the CFC’s statutory accounting period? YES Go to question 2. NO Read below. You do not have to work out the foreign company’s attributable income for the income year. 2 Was the foreign company a CFC at the end of its statutory accounting period? Answer questions 1 to 10 of worksheet 1 to find out if the foreign company is a CFC at the end of its statutory accounting period. Treat references to the test time in worksheet 1 as references to the end of the CFC’s statutory accounting period. YES Go to question 3. NO Read below. You do not have to work out the foreign company’s attributable income for the income year. 3 Were you an attributable taxpayer at the end of the CFC’s statutory accounting period? Answer questions 11 and 12 of worksheet 1 to find out if you were an attributable taxpayer. Treat references to the test time in worksheet 1 as references to the end of the CFC’s statutory accounting period. YES Work out the CFC’s attributable income. Go to questions 4 to 7 NO You do not need to work out the CFC’s attributable income for the income year. Read below. Appendix 4—Summaries and worksheets 111 4 Was the CFC resident in a broad-exemption listed country or in a non-broad-exemption listed country at the end of the statutory accounting period? BROAD-EXEMPTION LISTED COUNTRY NON-BROAD-EXEMPTION LISTED COUNTRY State below the name of the country or countries of residence. State below the name of the country or countries of residence. 5 Did the CFC pass or fail the active income test? Use summary sheet 3 and associated worksheets to determine whether the CFC passed the active income test. PASS 6 What was the CFC’s attributable income? FAIL $ Complete worksheet 6 to answer this question. Copy the amount at label A of that worksheet to this box. 7 What was your share of the CFC’s attributable income? Complete worksheet 6 to answer this question. Copy the amount at label B of that worksheet to this box. $