Guide to Importing and Exporting

advertisement

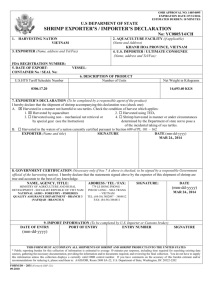

- GUIDE TO IMPORTING AND EXPORTING - GUIDE to IMPORTING and EXPORTING INTERNATIONAL BANKING MAY 2015 - VERSION 4.0 2 - GUIDE TO IMPORTING AND EXPORTING - TABLE of CONTENTS INTRODUCTION1 WE HAVE THE SOLUTIONS FOR YOUR NEEDS1 IMPORTANT INFORMATION GETTING STARTED 1 2 WHAT DO I DO FIRST? GO TO SCHOOL USE THE SUPPORT NETWORKS AND GOVERNMENT AGENCIES 2 RISK ISSUES 2 2 3 TYPES OF RISKS 3 Transfer or Payment Risks 3 Country Risk 4 Transport Risk Exchange Rate Risks4 Non Delivery / Performance 4 5 MAKING AND RECEIVING INTERNATIONAL PAYMENTS 5 CLEAN PAYMENTS 5 What are clean payments? 5 Types of clean payments 6 DOCUMENTARY COLLECTIONS7 WHAT ARE DOCUMENTARY COLLECTIONS? 7 TYPES OF DOCUMENTARY COLLECTIONS MECHANICS OF DOCUMENTARY COLLECTION 7 8 - GUIDE TO IMPORTING AND EXPORTING - LETTERS OF CREDIT11 WHAT ARE LETTERS OF CREDIT?11 TYPES OF LETTERS OF CREDIT 11 LETTERS OF CREDIT MAY BE CONFIRMED 12 MECHANICS OF LETTERS OF CREDIT 13 DOCUMENTATION 15 INTERNATIONAL TRADE ENABLER: AN ELECTRONIC SOLUTION FOR IMPORTERS15 MANAGING THE CASH FLOW 16 TRADE FINANCE 16 DEBTOR FINANCE 17 FOREIGN CURRENCIES AND PAYMENTS 17 INTERNATIONAL BANK DRAFT 17 TELEGRAPHIC TRANSFERS FOREIGN CURRENCY ACCOUNTS17 17 GUARANTEES18 WHAT ARE GUARANTEES? 18 TYPES OF GUARANTEES 18 Bid guarantee 18 Advance payment guarantee 18 Performance guarantee 18 Standby letter of credit18 MECHANICS OF GUARANTEES CONTACT US 19 19 - GUIDE TO IMPORTING AND EXPORTING - INTRODUCTION This guide is designed to assist you in understanding some of the important issues, products, services and documentation associated with international trade. If you have never been involved in dealing with overseas customers or suppliers, you should find this guide particularly useful. This guide is not comprehensive. It offers pointers, places for further information and brief summaries of products and services. Should you require further assistance, Bank of Queensland Limited (BOQ) is ready to help. WE HAVE THE SOLUTIONS FOR YOUR NEEDS BOQ offers a wide range of solutions and products to importers and exporters as well as providing access to our specialists to discuss your individual requirements and circumstances. You might need to: • Finance your shipments of goods • Establish documentary letters of credit and monitor their progress • Have a bank collect bills of exchange and documents from your suppliers bank • Make payments overseas • Arrange for the processing of your export documentation, letters of credit or collections and receipts • Take out protection against exchange rate movements • Manage your cash flows in foreign currency A BOQ branch manager or business banking manager is ready to meet with you and discuss how we can help you grow your importing or exporting business. He or she has access to all our international trade and foreign exchange specialists and can call on this expertise to assist you further. Call us on 1300 55 72 72 today to arrange an appointment or email us via the following link – https://www.boq.com.au/ContactUs/CU_IntBanking.aspx if you would like any further information or to discuss your individual requirements. IMPORTANT INFORMATION The information contained in this guide is general in nature and has been prepared for business customers by BOQ, for information purposes only. The products and services described are only available to approved customers. Terms and conditions, fees and charges may apply. For further information, contact BOQ. Any advice contained in the document has been prepared without taking into account your personal objectives, financial situation or needs. You should consider the appropriateness of any advice before acting on it. You should obtain and consider any relevant Product Disclosure Statement, terms and conditions and Financial Services Guide before making any decision about whether to acquire or continue to hold any products referred to in this guide. All products referred to in this guide are issued by Bank of Queensland Limited (ABN 32 009 656 740). 1 - GUIDE TO IMPORTING AND EXPORTING - GETTING STARTED WHAT DO I DO FIRST? Like any situation, you first need to consider the marketplace for the products you are looking to import or export. Consider the following: • Is your product unique or new to the potential market? Will it have appeal? • Analyse the costs? What is the cost of the product? Where are the competing products priced at? Is there a sufficient margin for you, the wholesaler and the retailer? • Are there any legal, tax or regulatory issues or restrictions with the product or where it comes from or where it is going to? • Is the market growing for this product? Do you have to create a new market? • Is there a reliable supply of the product? Is the quality consistent? GO TO SCHOOL Apart from some of the obvious issues discussed above, there are some additional ones that are specific to importing and exporting. • Learn about import duties, customs procedures, regulation and compliance, particularly quarantine. • Gain an understanding of the documentation involved. • Learn about the time goods are in transit and relevant costs. • Learn about the country you are looking to do business with, local customs, and business practices. Some of the support groups listed below are very useful sources of information in relation to these issues. USE SUPPORT NETWORKS AND GOVERNMENT AGENCIES Most overseas countries have embassies, high commissions or other representation in Australia and provide links to trade organisations that promote international trade between Australia and their respective countries. These organisations can be an excellent source of information and advice. You would also be well served by speaking to other business people with experience in importing or exporting, particularly those dealing with the same countries you are considering dealing with. There are also a number trade and industry associations that provide useful forums for discussion and ideas. These include: 2 - GUIDE TO IMPORTING AND EXPORTING The Australian Trade Commission (Austrade) www.austrade.gov.au The Australian Institute of Export www.aiex.com.au International Chamber of Commerce www.iccwbo.org World Chambers Network www.worldchambers.com Sea Freight Councils www.seafreightcouncils.com.au Australian Industry Group www.aigroup.asn.au Australian Federation of International Forwarders www.afif.asn.au Customs Brokers & Forwarders Council of Australia www.cbfca.com.au RISK ISSUES International trade involves a number of risks you would not need to consider if doing business solely in Australia. These include the consequences of economic or political instability, less control over quality, more complicated transportation processes and exchange rate fluctuations. The reality is that these risks are effectively managed every day by thousands of businesses. In order to successfully manage the risks, you need to have a strategy that is built around taking sensible precautions. Most risks can be effectively managed by knowing your customers and suppliers, insurance and by selecting the most appropriate payment method. TYPES OF RISKS Transfer or Payment Risks Many countries have government regulations that can prevent or restrict payments or receipts in foreign currencies (or their own currency). Sometimes these regulations can be changed without warning, meaning that transactions already agreed to may not be able to be completed, resulting in financial loss to either or both parties. Mitigants Always try to deal with suppliers or customers in countries with stable political environments or where the risk of unforseen government regulation that restricts trade is unlikely. Exporters or the bank may also be able to insure some of these risks via entities such as Atradius Credit Insurance NV (www.atradius.com/au/). 3 - GUIDE TO IMPORTING AND EXPORTING Country Risk Country risk is the ultimate risk of dealing with a foreign country. If there is a significant event such as war, terrorism, failure of government, government bankruptcy or economic embargoes, payments or goods may not be able to leave a country. Sometimes these circumstances can change without warning, meaning that transactions already agreed to may not be able to be completed, resulting in financial loss to either party. Business laws in certain countries also require close scrutiny. This should include the likelihood that they may change and their compatibility with laws in Australia. Mitigants Exporters or the bank may be able insure some of these risks via entities such as Atradius Credit Insurance NV (www.atradius.com/au/). Importers and exporters can also consult the various trade and industry associations mentioned on page (3) for assistance in evaluating these risks. Transport Risk Goods should always be insured during transit. Who pays for insurance and how the goods are insured is a matter of negotiation between the two parties involved. Make sure this is very clear. It is essential to understand what the insurance covers and if there are gaps. For example, in an import transaction, and if the supplier has paid for the insurance, you may not be covered after the goods arrive at an Australian port. You should also ensure you are satisfied in relation to the issue of where claims are payable. Mitigants Various commercial insurance companies and insurance brokers can assist with insurance requirements. Exchange Rate Risks Movements in exchange rates can significantly affect the profit margin you expect to retain on your international trade transaction. Once you have ordered goods from overseas or have received an order from a buyer overseas that requires a payment in foreign currency, you have an exchange rate risk. Mitigants If you like to have more certainty around the exchange rates you will transact at, you may elect to enter into a forward exchange contract. (www.boq.com.au/business_international_hedging.htm). This contract is where you agree to purchase (or sell) a fixed amount of foreign currency at a fixed exchange rate on an agreed future date, a date which aligns with a scheduled payment you need to make to a supplier or expect to receive from a customer. By entering into a forward exchange contract, you will know how many Australian dollars you will need to pay for a fixed amount of foreign currency on that future date or conversely how many Australian dollars you will receive in exchange for a fixed amount of foreign currency. 4 - GUIDE TO IMPORTING AND EXPORTING Non Delivery / Performance When dealing with any suppliers there is always a risk of non-performance and this is heightened when dealing with people overseas. Non performance may mean delivering inferior product, not delivering at all or not at the agreed time. Sometimes these events may be the result of things outside the control of the supplier, like industrial action, shipping availability or in an extreme case, acts of war or other violence. The non-performance, whatever the cause, may have an adverse effect on your business; you may lose customers or miss sales as a result. For the exporter, the major risk is the risk of not being paid in terms of the sales contract. Efforts to recover unpaid monies can be costly and time consuming. Mitigants There are no guaranteed ways of eliminating all these risks, but they can be managed using appropriate document control and payment methods. Note: This is not a comprehensive list of all of the risks that may apply and other risks may be relevant depending on your individual circumstances. MAKING AND RECEIVING INTERNATIONAL PAYMENTS Making and receiving payments is integral in overseas trade. This section covers the main payment and control methods available. There are three main ways of making and receiving international payments and controlling the document flow and access to goods. • Clean payments • Documentary collections • Letters of credit Each is explained in more detailed below, and the key points of each are set out in a table format. CLEAN PAYMENTS What are clean payments? Clean payments are characterised by trust. Either the exporter sends the goods and trusts the importer to pay once the goods have been received, or the importer trusts the exporter to send the goods after payment is effected. In the case of clean payment transactions, all shipping documents, including title documents, are handled directly by the trading parties. The role of banks is limited to clearing funds as required. 5 - GUIDE TO IMPORTING AND EXPORTING The diagram below highlights the flow of goods and the flow of payment. EXPORTER PAYMENT GOODS IMPORTER Types of clean payments There are two types of clean payments. Open Account • The importer is trusted to pay the exporter after receipt of the goods. • The exporter ships the goods and the documents directly to the importer and waits for the Importer to send payment. Payment in Advance • An arrangement whereby the exporter is trusted to ship the goods after receiving payment from the Importer. • The importer sends payment directly to the exporter and waits for the exporter to send the goods and documents. The following table and diagram highlight the key points in relation to these two payment methods. OPEN ACCOUNT • Assumes fewer risks IMPORTER EXPORTER • Delays use of cash reserves PAYMENT IN ADVANCE • Assumes greater risks, including the risk of not receiving the goods • More financing requirements • Assumes greater risk of not being paid • May help clinch sale by offering this option • Assumes fewer risks • Assists in cash flow by receiving payment in advance 6 - GUIDE TO IMPORTING AND EXPORTING The following diagram compares the risks of each type of clean payment. Highest risk to exporter Least risk to importer OPEN ACCOUNT Least risk to exporter Highest risk to importer PAYMENT INAVANCE DOCUMENTARY COLLECTIONS WHAT ARE DOCUMENTARY COLLECTIONS? A documentary collection is a method of payment used in international trade whereby the exporter entrusts the handling of commercial and often financial documents to banks and gives the banks instructions concerning the release of these documents to the importer. Documentary collections are subject to the Uniform Rules for Collections published by the International Chamber of Commerce. The last revision of these rules came into effect on 1st January 1996 and is referred to as the URC 522. TYPES OF DOCUMENTARY COLLECTIONS Documentary collections may be processed in two ways: Documents against payment • Documents are released to the importer only against payment. • This is known as a sight collection or cash against documents (CAD). Documents against acceptance • Documents are released to the importer only against acceptance of a draft (bill of exchange) • This is known as a term collection. 7 - GUIDE TO IMPORTING AND EXPORTING The following table highlights the key points for the two collections types. DOCUMENTS AGAINST PAYMENT (D/P) • Ability to examine documents prior to payment • Line of credit not required IMPORTER DOCUMENTS AGAINST ACCEPTANCE (D/A) • Payment is deferred until after goods have been accessed, assisting cash flow • Release of transport documents • Ability to examine documents prior to acceptance and subsequent access to goods only made after payment • Release of transport documents and subsequent access to goods only made after acceptance of payment terms • Dishonouring accepted draft carries legal liability, business reputation implications exist • Documents not released to • Risk of non-acceptance of importer until payment effected documents EXPORTER • Less costly than letter of credit • Banks do not guarantee payment • Risk of refusal of payment exists • Legal enforcement of unpaid obligations are expensive and • Commercial / country risks still exist time consuming MECHANICS OF DOCUMENTARY COLLECTION The mechanics of a documentary collection are separated into the following three steps: Flow of Goods After the importer and the exporter have established a sales contract and agree on a documentary collection as the method of payment, the exporter ships the goods. In a documentary collection, the importer is known as the “drawee” and the exporter as the “drawer”. EXPORTER / DRAWER GOODS IMPORTER / DRAWEE 8 - GUIDE TO IMPORTING AND EXPORTING Flow of Documents After the goods are shipped, documents originating with the exporter (e.g. commercial invoice) and the transport document (e.g. bill of lading) are delivered to a bank, called the remitting bank in the collection process. The role of the remitting bank is to send these documents, accompanied by a collection instruction giving complete and precise instructions to a bank in the importer’s country, referred to as the collecting/ presenting bank. The collecting/ presenting bank acts in accordance with the instructions given in the collection instruction and releases the documents to the importer against payment or acceptance, according to the remitting bank’s collection instructions. Note: The exporter’s bank and the remitting bank need not be the same. Also, the collecting bank and presenting bank need not be the same. Each role could be performed by a different bank. See illustration below. Flow of Payment Payment is forwarded to the remitting bank for the exporter’s account and the importer can now present the tra nsport document to the carrier in exchange for the goods. See illustration next page. FLOW OF DOCUMENTS EXPORTER / DRAWER DOCUMENTS GOODS IMPORTER / DRAWEE REMITTING BANK DOCUMENTS DOCUMENTS COLLECTING / PRESENTING BANK 9 - GUIDE TO IMPORTING AND EXPORTING FLOW OF PAYMENT EXPORTER / DRAWER PAYMENT REMITTING BANK GOODS IMPORTER / DRAWEE PAYMENT PAYMENT COLLECTING / PRESENTING BANK The following diagram illustrates the degree of risk with documentary collections, compared to the two types of clean payments. Highest risk to exporter Least risk to importer OPEN ACCOUNT DOCUMENTARY COLLECTIONS • Documents Against Acceptance • Documents Against Payment Least risk to exporter Highest risk to importer PAYMENT INAVANCE 10 - GUIDE TO IMPORTING AND EXPORTING - LETTERS OF CREDIT WHAT ARE LETTERS OF CREDIT? A letter of credit is a written undertaking by the importer’s bank, known as the issuing bank, on behalf an importer (applicant), promising to effect payment in favour of the exporter (beneficiary) up to a stated sum of money, within a prescribed time limit and against stipulated documents. A key principle underlying letters of credit is that banks deal only in documents and not in goods. The decision to pay under a letter of credit will be based entirely on whether the documents presented to the issuing bank appear on their face to be in accordance with the terms and conditions of the letter of credit. It would be prohibitive for the banks to physically check whether all merchandise has been shipped exactly as per each letter of credit. The International Chamber of Commerce (ICC) publishes internationally agreed-upon rules, definitions and practices governing letters of credit, called “Uniform Customs and Practice for Documentary Credits” (UCP). The last revision of these rules was effective 1st July 2007 and is referred to as the UCP 600. TYPES OF LETTERS OF CREDIT There are two types of letters of credit, revocable or irrevocable. 1. A revocable letter of credit can be revoked without the consent of the exporter, meaning that it may be cancelled or changed up to the time the documents are presented. Revocable letters of credit are very rarely used. 2. An irrevocable letter of credit cannot be cancelled or amended without the consent of all parties including the exporter. Unless otherwise stipulated, all letters of credit are irrevocable. Letters of credit may be settled either by sight or by acceptance: • If payment is to be made at the time that documents are presented, this is referred to as a sight letter of credit. • If payment is to be made at a future fixed time from the presentation of documents, this is referred to as a term letter of credit. 11 - GUIDE TO IMPORTING AND EXPORTING The following table highlights the key elements of the two settlement types in letters of credit SIGHT LETTER OF CREDIT • Assured that all conditions of letter of credit must be met prior to payment being made to exporter IMPORTER • Ability to negotiate more favourable terms with exporter when letter of credit offered TERM LETTER OF CREDIT • Same as for sight letter of credit with additional advantage of deferred payment • No guarantee that goods will be as specified • Ties up line of credit • Undertaking from issuing bank that you will be paid if you meet all terms of the letter of credit • Shifts credit risk from importer to the issuing bank EXPORTER • Not obliged to ship goods if letter of credit is not as agreed in sales contract • Documents must be prepared in strict compliance with letter of credit • Same as for sight letter of credit but payment is deferred • By offering a deferred payment to the importer, you may secure a sale or a better price • Failure to comply with the letter of credit leaves you at risk of non payment LETTERS OF CREDIT MAY BE CONFIRMED Under a confirmed letter of credit, a bank, called the confirming bank, adds its commitment to that of the issuing bank to pay the exporter under the letter of credit provided all terms and conditions of the letter of credit are met. The confirming bank is usually located in the same country as the exporter. An exporter would request a confirmed letter of credit if it does not consider the financial strength of the issuing bank or the country in which it is located to be acceptable risks. 12 - GUIDE TO IMPORTING AND EXPORTING MECHANICS OF LETTERS OF CREDIT The mechanics of a letter of credit are separated into the following three steps: Issuance After the trading parties agree on a sale of goods where payment is made by letter of credit, the importer requests that its bank (the issuing bank) issue a letter of credit in favour of the exporter (beneficiary). The issuing bank then sends the letter of credit to the advising bank. A request may be included for the advising bank to add its confirmation. The advising bank is usually located in the country where the exporter does business and may be the exporter’s bank, but does not have to be. Next, the advising/confirming bank verifies the letter of credit for authenticity and sends it to the exporter. The following diagram illustrates the issuance process. EXPORTER / BENEFICIARY Advice / confirmation of the letter of credit Contract Negotiations Request to advise and possibly confirm the letter of credit Importer applies for letter of credit IMPORTER / DRAWEE REMITTING BANK COLLECTING / PRESENTING BANK 13 - GUIDE TO IMPORTING AND EXPORTING Flow of Goods Upon receipt of the letter of credit, the exporter reviews the letter of credit to ensure that it corresponds to the terms and conditions in the purchase and sales agreement; that the documents stipulated in the letter of credit can be produced; and that the terms and conditions of the letter of credit can be fulfilled. Assuming the exporter is in agreement with the above, it arranges for shipment of the goods. After the goods are shipped, the exporter presents the documents specified in the letter of credit to the advising/ confirming bank. Once the documents are checked and found to comply with the letter of credit (i.e. without discrepancies), the advising/ confirming bank forwards these documents to the issuing bank. In turn, the issuing bank examines the documents to ensure they comply with the letter of credit. If the documents are in order, the issuing bank will obtain payment from the importer so payment can be made to the exporter’s bank. Documents are delivered to the importer to allow it to take possession of the goods. Flow of Payments The payment under the letter of credit is either made at the time the documents are released to the importer (sight letter of credit) or on acceptance of the bill of exchange (term letter of credit). The importers bank then sends the payment or advice of acceptance to the exporters bank. The following diagram illustrates the flow of documents and payment under a letter of credit. PAYMENTS EXPORTER / BENEFICIARY DOCUMENTS GOODS ADVISING / CONFIRMING BANK DOCUMENTS PAYMENT PAYMENTS IMPORTER / APPLICANT DOCUMENTS ISSUING BANK 14 - GUIDE TO IMPORTING AND EXPORTING The following diagram illustrates the degree of risk involved across all three payment types. Highest risk to exporter Least risk to importer OPEN ACCOUNT DOCUMENTARY COLLECTIONS • Documents Against Acceptance • Documents Against Payment LETTERS OF CREDIT • Unconfirmed • Confirmed Least risk to exporter Highest risk to importer PAYMENT INAVANCE DOCUMENTATION International trade involves documentation, there is no escaping it. The documentation provides evidence that goods have been shipped, that legal and regulatory requirements are met and that the goods are described correctly. They also confirm the financial arrangements and the method of payment. The commercial contract you agree with the supplier or customer will detail all the documentation that will be required. Correct documentation is essential if you are to be a successful international trader. Errors or omissions in documentation can lead to delays in receiving goods, delays in making payments, both of which have the potential to cost you money and also damage the relationships you have developed. The trade and industry associations mentioned on page 4 are useful resources in the completion of correct documentation and determining what documentation you will need to receive. INTERNATIONAL TRADE ENABLER: AN ELECTRONIC SOLUTION FOR IMPORTERS AND EXPORTERS. BOQ provides an on-line solution to importers and exporters who are dealing in documentary letters of credit, documentary collections and other trade finance instruments known as International Trade Enabler. This system will save you time and money in the establishment and amendment of letters of credit and also provides a detailed diary function and reporting capability which will keep you up to date with the progress of your transactions.Your transactions and other records are protected and kept secure by 128-bit encryption technology. International Trade Enabler is very easy to use and there are no set up fees for BOQ customers. 15 - GUIDE TO IMPORTING AND EXPORTING Access International Trade Enabler via the BOQ website at www.boq.com.au/international_business_tradeenabler.htm MANAGING THE CASH FLOW This section of the guide discusses the finance options for importers and exporters and highlights the instruments used to effect payments and manage foreign currency cash flows and risks. The management of cash flow is critical for any business. The additional time involved in transporting goods to and from overseas may put extra pressure on your cash flow. There is likely to be a significant period between the time you have to pay for the goods and the time you are paid for on-selling them, or perhaps a gap between the time when you manufacture and the time you are paid by your customer. Short-term finance can ease this pressure and the most popular methods are trade finance and debtor finance. Your BOQ manager and trade finance specialist can help you with the most appropriate solution, depending on your individual circumstances. TRADE FINANCE Trade Finance is designed to provide short term funding for international trade transactions. Obtaining Trade Finance or other finance from BOQ will usually be more cost effective than obtaining payment terms from your supplier. If you’re an exporter, you may need to grant payment terms to a customer which will affect your cash flow. Find out more about Trade Finance via the BOQ website at www.boq.com.au/business_international_trade.htm 16 - GUIDE TO IMPORTING AND EXPORTING DEBTOR FINANCE BOQ Debtor Finance is a financing product that allows you to maximise your cash flow through borrowing against the outstanding value of your trade debtors. This product is suitable for businesses experiencing rapid growth that sell goods or services on credit terms, but have restricted liquidity. Find out more about Debtor Finance via the BOQ website at www.boq.com.au/business_loan_debtorfinance.htm FOREIGN CURRENCIES AND PAYMENTS International bank drafts and telegraphic transfers are used to make payments overseas to suppliers or receive payments from customers. INTERNATIONAL BANK DRAFT An international bank draft is a bank cheque drawn in a foreign currency. Given that the draft must be posted or couriered to the supplier, this method is usually used when the amount is small or the time factor is not critical. Find out more about international bank drafts via the BOQ website at www.boq.com.au/business_international_exchange.htm TELEGRAPHIC TRANSFERS Telegraphic transfers are an electronic payment made by one bank to another for the credit of a nominated bank account. These payments are secure, fast and can be made almost anywhere in the world. Find out more about telegraphic transfers via the BOQ website at www.boq.com.au/business_international_exchange.htm FOREIGN CURRENCY ACCOUNTS Foreign currency accounts are another way to help you manage your foreign currency cash flows. Rather than convert every single payment from Australian dollars to foreign currency, you could hold an amount of the foreign currency in an account from which payments can be made. This has particular application when you also have receipts in the same currency, by removing or reducing the need to convert all payments. Foreign currency accounts are available in several major currencies. Find out more about telegraphic transfers via the BOQ website at www.boq.com.au/business_international_foreigncurrency.htm 17 - GUIDE TO IMPORTING AND EXPORTING - GUARANTEES WHAT ARE GUARANTEES? A guarantee is issued by a bank on behalf of its customer, the exporter, as financial assurance to the importer to be collected in the event that the exporter defaults on certain specified contractual obligations. The bank that issues a guarantee will pay the named beneficiary the amount specified on presentation of a written demand as outlined in the guarantee. While there are standard guarantee formats, guarantees can be tailored to meet your specific contractual needs. TYPES OF GUARANTEES These types of guarantees are commonly requested in foreign contracts. Bid guarantee An importer will often ask foreign contract bidders to post a bid guarantee as evidence of serious intent to supply the goods or services if selected. In the event that the selected supplier is unwilling or unable to carry out the contract, the importer can collect the amount of the bid guarantee. Advance payment guarantee An advance payment guarantee covers the amount of the down-payment the exporter requests from the importer and provides the importer with some security that, if the exporter does not deliver under the terms of the contract, the amount of the down-payment would be retrievable. Performance guarantee A performance guarantee permits the importer to draw on the guarantee if the exporter fails to perform according to the terms of the contract. For example, in the event that the exporter is unable to complete the contract as agreed halfway through a project, the importer is compensated with the amount of the performance guarantee. Standby letter of credit Often standby letters of credit are used instead of guarantees. Standby letters of credit work in much the same way as guarantees, offering financial assurance to the importer if the exporter defaults on agreed-upon contractual obligations. However, there are at least two important ways in which standby letters of credit differ from guarantees. 1. Standby letters of credit are governed by the international chamber of commerce’s UCP while guarantees are subject to the laws of the country of the issuing bank. 2. Banks in several countries, including the United States, are not empowered to issue guarantees, and therefore use standby letters of credit instead. 18 - GUIDE TO IMPORTING AND EXPORTING MECHANICS OF GUARANTEES During contract negotiations, the importer requests that the exporter provide a guarantee securing an aspect of the contract (e.g. bid, advance payment). The exporter (applicant) enlists its bank (issuing bank) to issue the guarantee in favour of the importer (beneficiary) for a specified amount and within a stated time frame. In the event of default by the exporter, the importer would make a demand against the guarantee through the advising bank. EXPORTER / APPLICANT Applies for Guarantee REMITTING BANK Guarantee is sent to a correspondent bank of the Issuing Bank for advice to the importer Contract Negotiations Advice of the Guarantee IMPORTER / BENEFICIARY ADVISING BANK CONTACT US BOQ has a number of specialist trade finance managers who can work with our business and retail bankers to create tailored solutions to the funding needs of both importers and exporters. For assistance with trade finance and services contact one of our international services experts on 1300 55 72 72 or email us via the following link – https://www.boq.com.au/ContactUs/CU_IntBanking.aspx Bank of Queensland Limited ABN 32 009 656 740 (BOQ).