ANNUAL REPORT

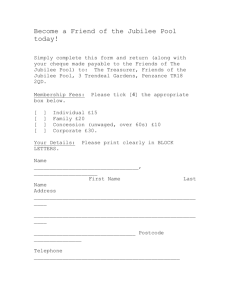

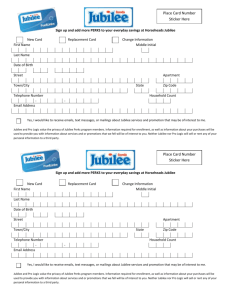

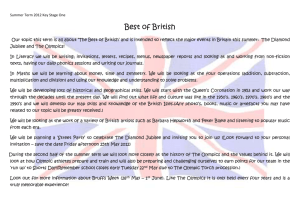

advertisement