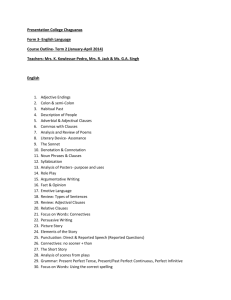

Business Law Exemption Clauses EXAMPLE OF A LIMITATION

advertisement

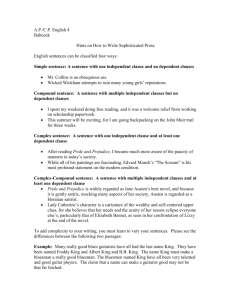

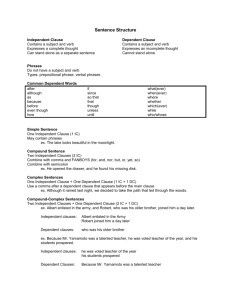

10/27/2011 Today’s Lecture Business Law • What are exemption clauses? • Common law controls on exemption clauses Week 6 Controls on Exemption Clauses and Unfair Terms Exemption Clauses Limitation Clauses Clauses which limit a party’s liability and so the amount of damages which can be claimed in pp the event of a breach are capped Exclusion Clauses Clauses which totally exclude a party’s liability so no damages are payable in the event of a breach • Statutory controls on exemption clauses EXAMPLE OF A LIMITATION CLAUSE THE OWNERS RESERVE THE RIGHT TO PAY A MAXIMUM OF £5 FOR ANY ARTICLE LOST OR O £ O C OS O DAMAGED WHILST LEFT IN THIS CLOAKROOM EXAMPLES OF EXCLUSION CLAUSES CUSTOMERS NO RETURN ON SALE GOODS PLEASE NOTE USERS OF THIS CAR WASH DO SO ENTIRELY AT THEIR OWN RISK 1 10/27/2011 Why are exemption clauses useful tools for businesses? • Limit the amount of potential liability Allocation of risk “up up front front” • Allocation of risk • Might reduce cost of insurance • Might discourage potential claimants Why it is necessary to control the use of exemption clauses? Controls on Exemption Clauses • Judicial Controls • Might not be freely negotiated • Parties might not have equal bargaining strengths • Consumers need protection Incorporation ‐ Is the clause actually a term of the contract? SEE THE CASES ON PAGES 59 – 61 • By reasonable notice before contract is formed the exemption clause must be incorporated within the contract; and it’s wording must be clear and unambiguous • Statutory Controls the exemption clause must not be rendered ineffective by statute – Unfair Contract Terms Act 1977 (UCTA) – Unfair Terms in Consumer Contracts Regulations 1999 – (this statute only applies to consumer contracts) Construction Does the wording of the exemption clause actually cover the loss/damage that the party is trying to exclude/limit? is trying to exclude/limit? • By signature • By a previous course of dealings Apply the Contra Proferentem Rule 2 10/27/2011 Statutory Controls • UCTA 1977 – applicable when the party seeking to rely on the exemption clause and g p y g g refusing to pay damages is acting in the course of a business UCTA 1977 • Is the party seeking to rely on the exemption clause acting in the course of a business? • What liability has been excluded/limited? h li bili h b l d d/li i d? – Note rules regarding certain liability • Unfair Terms in Consumer Contracts Regulations 1999 – only apply to contracts with consumers NEGLIGENCE • Although the title of the statute refers to ‘contract terms’ it also regulates non contractual notices EG – notice outside premises stating people enter at their own risk See S.2 for death and damage to property caused by negligence How do you assess “reasonableness”? First, look at Section 11 of UCTA – S.11(1)/(3) – fair and reasonable in all the circumstances – S.11(5) – burden of proof is on party seeking to rely on the clause • Assess reasonableness of the exemption clause – note that this is not always relevant Attempts to exclude/limit terms implied by Ss 13 + 14 of Sale of Goods Act 1979 • Contracts with consumers – such clauses are rendered VOID d d VOID (S.6(2) UCTA) (S 6(2) UCTA) • Contracts with businesses – such clauses are VALID IF REASONABLE (S.6(3) UCTA) How do you assess “reasonableness”? Then consider the guidelines in Schedule 2 of UCTA – Relative bargaining strength – Was an inducement given? – Did customer know about the term? – Special order? 3 10/27/2011 Unfair Terms in Consumer Contracts Regulations 1999 • Applies ONLY to contracts between businesses + consumers • Only applies to terms which have not been freely negociated – see the printed contract you get with your mobile phone or credit card for what these look like • Term is unfair if:‐ A Quick Reminder………… – It is contrary to good faith – Causes a significant imbalance in the bargaining powers to the detriment of the consumer • First, consider judicial controls – Incorporation – Construction • Then, consider statutory controls – UCTA • Party acting in course of a business? Party acting in course of a business? • What liability is being excluded/limited? What does UCTA say about such exclusions/limitations? • Do you need to assess reasonableness? – Are the UTCC Regulations relevant? 4