THE PERFECT FIT

*

BUSINESS PROPOSAL AND

MARKETING PLAN

<names deleted>

*

All rights reserved.

THE PERFECT FIT

Business Proposal and Marketing Plan

Table of Contents

EXECUTIVE SUMMARY................................................................................................................................... 3

OVERVIEW ......................................................................................................................................................... 3

MISSION STATEMENT ......................................................................................................................................... 3

MARKETING PLAN .............................................................................................................................................. 3

MARKETING PLAN........................................................................................................................................... 5

PRODUCT AND SERVICE CONCEPT ....................................................................................................................... 5

TARGET MARKET ANALYSIS ............................................................................................................................... 5

EVIDENCE OF MARKET NEED .............................................................................................................................. 7

COMPETITIVE ANALYSIS ..................................................................................................................................... 8

2

THE PERFECT FIT

Business Proposal and Marketing Plan

EXECUTIVE SUMMARY

Overview

The Perfect Fit, Inc. (“TPF,” “Company”) will provide tailored business wear for the plus size

woman. The initial store location will be at Sage Plaza in the Galleria District of Houston, Texas

and will open for business May 2007 with a second store slated to open in the fall of 2009. The

company will incorporate as a C-corporation.

Plus-size apparel is currently the fastest growing retail segment. In 2006, it generated over $19

billion in sales. When you consider the fact that, since 1985, the average woman’s size has gone

from a size 8 to a size 14, it’s not surprising that retailers have begun to focus on this segment

(Matis, par. 3). It is literally - and figuratively – a growing industry and retailers around the country

are scrambling to meet the demand for it.

Mission Statement

The Perfect Fit provides premium women’s business wear that is customized to perfectly fit each

customer. Our objective is to establish The Perfect Fit as one of the most recognized names in

women’s business wear

The company plans to establish and expand retail operations in Houston before leveraging The

Perfect Fit brand to other select locations. The development of new distribution channels and

target markets will enable the company to pursue other growth opportunities, including the

development of an online store.

Marketing Plan

Product

TPF offers a full line of tailored, plus size business wear including both two and three piece

pantsuits and skirt-suits as well as individual blazers, skirts, pants, shirts, shells, hosiery and

other accessories in classic tones and fabrics. The tailored feature of the product line is achieved

by taking individual body measurements using the [TC]2 3D Body Scanner. This type of customer

service will set TPF apart from other retailers, as each customer’s clothing will be the perfect fit.

This offering of clothing will limit the need for fashion trend adjustments often seen in the more

popular casual clothing market for plus size women.

Target Market & Market Evidence

TPF has identified professional plus size females, both married and single, ranging in age from

25 to 64 years with an income level ranging from $35,000 to $75,000 as its target market. This

represents approximately 275,465 women in the city of Houston alone. In 2005, Houston Texas

3

had the highest obesity rate in the United States. Of note, “retail growth in the US has declined

with pressures from the economy, yet the plus-size niche has maintained consistent growth” (Matis,

par. 8). From just March 2005 to February 2006, sales of plus-size women’s apparel were $19

billion – an increase of nearly 7% over the previous period – while the entire women’s clothing

industry grew only 3.4% to $101 billion (NPD, par.3).

TPF surveyed females to determine if there was demand for customized business wear and found

that not only does strong demand exist, but that women would be willing to pay a premium for

such clothing.

Marketing & Sales Strategy

The ability of the [TC]2 body scanner provides a significant competitive advantage. With it, TPF

can guarantee fit. The company will generate brand awareness by using a variety of marketing

promotions and resources including television, radio, newspaper, and the Internet. TPF has

developed a pricing strategy that is affordable compared to established premium retailers but still

provides a sufficient return to outside investors.

4

MARKETING PLAN

Product and Service Concept

The Perfect Fit will usher in a new feel to the plus-size women’s clothing industry. From March

2005 to February 2006, sales of plus-size women's apparel rose by nearly 7 percent to $19

billion, according to the NPD Group, a consumer research firm. That compares with a 3.4

percent increase in sales of women's clothing as a whole to over $101 billion (Yao, p.3).

TPF will open as a retail apparel store that will cater to the plus-size women’s market segment

by offering business wear with electronic measurements and hand tailoring. The retail apparel

store will be equipped with a body scanner, which has the ability to map a person’s body more

accurately than any tailor. TPF will provide its customers with the perfect shopping experience:

premium women’s fashion – be it off the rack or made-to-wear – that fits exactly to their body.

TPF affords plus size women the opportunity to improve their image, thereby enhancing their

career opportunities. The company’s product line of pantsuits, skirt-suits, blazers, skirts, pants,

blouses, hosiery and scarves offers a professional look that doesn’t take away from a woman’s

individual style. Unlike other plus size clothing retailers, TPF minimizes the need for a new

wardrobe with every changing trend by utilizing classic styles, tones and fabrics.

TPF offers its customers a unique and specialized shopping experience by providing:

• Premium personal shopper to assist with wardrobe selection;

• Full service tailoring;

• Customized body measurement service.

This combination of services provides a shopping experience that will ensure the company’s

“Perfect Fit” customer satisfaction guarantee.

The Company offers a product and service that is unmatched by both direct and indirect

competitors in the area of Houston, Texas. The appeal of the product offered by TPF is bolstered

by the unique ability to design a garment that is completely customized to the wearer’s body. By

creating a shopping experience that is pleasurable and not yet another task on the calendar of a

busy woman, TPF will become the preferred business wear provider in a steadily growing

market.

Target Market Analysis

The most overlooked population in the apparel industry is plus-size professional women. While

the apparel market as a whole has slowed considerably over the last five years, the plus size

clothing market has shown a trend of consistent growth. Apparel manufacturers and wholesalers

have largely neglected the plus size women’s market as they have traditionally focused their

efforts on smaller sizes.

5

Plus size apparel has continued to become more attractive to retailers of the apparel industry. An

industry source stated that when compared with other women, significantly more plus-size

women say they “dress to impress” themselves, not men or other women. Plus-size women tend

to “plan their purchases” and as a result, are significantly more concerned with quality than other

women. “About 70% prefer to buy clothing that is higher in quality rather than more fashionable,

compared with 57% of other respondents” (Textile, par. 1). The plus-size apparel market has seen a

dynamic shift of growth over the past few years and this growth is anticipated to increase as the

attitudes about plus-size body types change.

The retail apparel industry is very competitive, and easy entry results in a high rate of startups

and failures. However, research indicates that the plus-size, petite and maternity wear market

reached $42 billion in 2005, and accounted for 54% of the total women's clothing market. Since

2000, this market experienced a 12% increase in current dollars, and outpaced the growth in total

women's clothing market by 10% (Buswire, par. 1). There is no indication that it will slow down

anytime soon. The women's plus-size clothing market alone generated $19 billion in sales in

2005 (Cohen, 3). Marshal Cohen, chief industry analyst at NPD Group, expects the overall plus-size

market to grow 15 percent over the next four to five years.

Geographic Demographics

The Company has chosen Houston, Texas as the location for its first store due to a number of

factors:

Large, growing population (see table below)

Relatively high median income;

The high occurrence of obesity.

Population

% Increase

2005

2,016,582

3.2%

2000

1,953,631

1.9%

1990

1,630,553

---

Quick Facts: Houston:

Item

Total Population (2005)

Total Female Population

Females between 25 and 65

Total Females Employed

Females: 25 – 65 & Employed *

Household %age earning $35K - $75K *

Females: 25-65, Empl., & Inc $35K-$75K *

Median Household Income

Median Family Income

Per Capital Income

Growth rate/year (15 year average)

Job Growth (Recent)

Job Growth (Prospective)

(Source: US Census Bureau)

* = Estimate. Calculations are available in the Appendix.

6

Amount

2,016,582

1,004,013

540,711

737,717

618,036

44.6%

275,465

$36,894

$40,172

$22,534

1.5%

2.6%

15.4%

Evidence of Market Need

Government statistics show that more than 60 million Americans already qualify as obese, up

from 23 million in 1980. Another 28 million are expected to join their ranks by 2013.

Researchers at the University of Iowa have found that obesity rates are rising most rapidly

among urbanites that earn $60,000 or more per year (Crawford, p8).

According to the Center for Disease Control, the U.S. is experiencing an “epidemic” of

overweight and obesity, with the proportion of people overweight having increased dramatically

since the late 1980’s. Almost two out of every three adults today are overweight – defined as

having a body mass index (BMI) of 25 to 30. Of those considered overweight, thirty percent are

considered obese – BMI > 30 (AOA, table 1) – an increase of sixty percent since 1991. In a study of

the obesity rate in 25 cities, Houston (Harris county) ranked highest for overweight people in

four of the last five years. According to the 2002 BRFSS data based on BMI calculations, 36%

of surveyed Harris county adults were overweight, 37% of adult Texans were overweight and

37% of U.S. adults were overweight. Twenty-four percent of Harris county adults were obese,

compared with 26% of Texas adults and 22% of U.S. adults (Houston, p 14).

Plus-size women are driven to buy apparel for different reasons than other women. Again, 70%

prefer to buy clothing that is higher in quality rather than more fashionable, compared with 57%

of other respondents (Textile, par.1). These findings suggest that the plus-size consumer will respond

better to apparel advertising that touts benefits, rather than sex appeal.

Women who wear a size 12 or larger have different attitudes toward wearing apparel than

women who wear a size 11 or smaller. Among plus-size women, 44% agree with the statement

“Because of my size, I don’t feel comfortable wearing the same styles as my friends,” compared

with 14% of all other women. An explanation lies in the fact that two-thirds of plus-size

consumers state that current styles do not flatter their shapes (compared with 51% of other

consumers). This percentage of women is within the same statistical range as in 1998, indicating

that while plus-size retailers may be benevolent with offerings, they are not meeting the ultimate

need of the plus-size consumer—to flatter her shape (Mintel, 06).

TPF surveyed women in the target market age and income group to identify if there was demand

for customized business wear and found that not only did strong demand exist, but that women

would be willing to pay a premium for it. In particular, the survey found that over 70% have

difficulty shopping for business wear and roughly the same percentage would be interested in a

store that offered business wear and tailoring services. Topping off the evidence, nearly 75% of

the women surveyed believed that a better image would enhance their career opportunities. The

results can be found in the Appendix A.

Fifty percent of the female population wears plus-size clothing but only 26% of women’s

clothing is in the plus-size category (Seckler, par.1). General business statistics show that the plus

size market is growing with increasing profitability of 67% and with overall business growth of

40%. Even prior to September 2001, the plus-size market was growing at a 4-6% margin

compared to the 2% margin of the apparel industry as a whole (Facts, par. 4). The evidence

overwhelmingly is indicative of a growing need for plus-size women’s apparel.

7

Competitive Analysis

Market conditions within the US apparel & accessories market have been characterized by

relatively uninspiring rates of growth over the last five years. The market was worth $282 billion

in 2003, but intense competition keeps any significant growth from occurring. Women’s clothing

is the major source of revenue for the US market, due in part to the rapidly evolving nature of

women’s fashion. Modern consumers, particularly women, are willing to pay more in order to

differentiate themselves in terms of fashion, allowing clothing manufacturers to produce huge

collections of apparel and accessories for them.

The plus-size segment of the retail apparel industry is a market that is now being targeted by

both manufacturers and retailers. Approximately 52 million plus-size women live in the United

States – approximately 37% of the nation’s female population. According to market researcher

NPD Fashion world, women’s plus-size clothing sales in 2001 were $17.3 billion. Similarly,

men’s big-and-tall market comprises about 20.1 million individuals, or roughly 15% of the US

male population, with $5.6 billion in annual sales. According to Packaged Facts, a division of

MarketResearch.com, plus-size apparel accounts for 20% of the total apparel market and is

expected to reach $47 billion by 2005, up from $32 billion in 2000.

As of September 2006, sales for the retail apparel industry were $119.8 billion. Using the 20%

factor above, the overall size of the plus-size portion of the retail apparel industry can be

estimated at $24.0 billion. Although this figure is understated, as revenue for the same period

from just seven key competitors examined represents $25.9 billion, it does show the size of the

plus-size market. Plus-size retailers, have seen their sales expand along with women's

waistlines.

Competitors

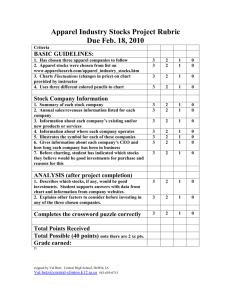

The key competitors that TPF has chosen to examine include: Ann Taylor (ANN), Charming

Shoppes (CHRS), Talbots (TLB), Coldwater Creek (CWTR), and Nordstoms (JWN). A sixth

business, TJX Company’s, Inc. (TJX), which is a competitor of Charming Shoppes, is also

included in this discussion due to its marketing targets.

8

The tables below summarize the competition’s key financial metrics. The competitive analysis of

each competitor follows after the table. Additional information is available in Appendix B.

2006

Sales - 5 Year Growth

Annual Sales ($ mil.)

Est. Attributable to Plus Size Sales

Working Capital

Current Ratio

Acid Test (Quick Ratio)

Current Cash Debt Coverage

Inventory Turnover

Days in Inventory

Total Debt to Equity

Debt to Total Assets

Cash Debt Coverage

Gross Margin

Profit Margin

Return on Assets

Return on Investment

Return on Sales

Residual Income ($ mil)

Industry

10.9%

$22,354

--2.3

1.1

--4.7

76.9

24.0%

----38.8%

6.8%

12.1%

16.7%

-----

ANN

11.0%

$2,073

$2,073

418.6

2.6

1.8

1.2

4.7

76.8

44.3%

0.3

0.7

50.9%

3.9%

5.5%

7.9%

6.7%

$17.2

CHRS

11.4%

$2,756

$2,756

338.6

1.8

0.9

0.5

5.8

62.3

92.4%

2.1

0.2

30.6%

3.6%

13.2%

12.2%

5.5%

$71.6

TLB

2.6%

$1,809

$1,809

376.2

2.5

1.5

1.0

4.8

75.7

82.8%

0.5

0.4

36.2%

5.2%

8.1%

14.9%

8.2%

$24.2

CWTR

11.2%

$780

$780

132

2.0

1.3

0.9

5.7

63.6

84.5%

0.5

0.6

45.6%

5.3%

9.1%

16.7%

9.0%

$14.3

JWN

6.9%

$7,723

$1,545

1250.9

1.8

1.2

0.5

5.2

69.0

135.2%

0.6

27.4%

36.7%

7.1%

11.2%

26.34%

11.5%

$321.1

TJX

10.9%

$16,058

$3,212

888.20

1.4

0.3

0.5

5.2

69.1

190.4%

0.7

0.3

23.4%

4.3%

12.6%

36.5%

6.3%

$830.8

Charming Shoppes (CHRS):

Charming Shoppes, Inc. is a multi-channel, multi-brand specialty apparel retailer primarily

focused on plus-size women's apparel. It has three distinct brands: Lane Bryant, Fashion Bug

and Catherines Plus Sizes. As of January 2006, Charming Shoppes operated 2,236 stores in 48

states.

Lane Bryant is a recognized name in plus-size fashion. It offers apparel in plus-sizes, 14-28,

including intimate apparel, wear-to-work and casual sportswear, as well as accessories.

Catherines Plus Sizes is particularly known for its extended sizes (over size 28) and petite plussizes. Catherines offers classic apparel and accessories for wear-to-work and casual lifestyles and

their customers generally range in age from 40 to 65 years old, shop in the moderate price range,

and are concerned with fit and value when purchasing clothes. Fashion Bug stores specialize in

selling a variety of plus-size, misses and junior apparel, accessories, intimate apparel and

footwear. Fashion Bug customers generally range in age from 20 to 49 years old and shop in the

low-to-moderate price range.

Charming Shoppes ventures is brick-and-mortar as well as e-commerce based. Catherines was

established as an e-commerce business line in 2002. In fiscal 2006, Catherines averaged more

than 400,000 visitors per month – more than could be seen in any one store. Lane Bryant and

Fashion Bug also have e-commerce sites established. Fashion Bug started its e-commerce

venture in 2004 and averaged more than 800,000 visitors per month in fiscal 2006. Lane Bryant

introduced its e-commerce site in March of 2003. It averaged more than 1.8 million visitors per

month in fiscal 2006 and has an established online community.

9

SWOT Analysis: Charming Shoppes strength lies in its e-commerce endeavors. Charming

Shoppes has fostered growth in e-commerce, developing an online community with significant

hits per month. A second strength of CHRS is its inventory turnover is better than the industry:

5.78 versus 4.68. This translates to an inventory turnover cycle almost 2 weeks faster than the

industry as a whole.

Charming Shoppes is highly leveraged. Debt to Equity has ranged from 88% to 106% in the

past 5 years averaging 96% for the 5 year period examined. In addition, its gross and net profit

margins lag the industry. Gross Margin for 2006 trails the industry by more than 8% and by

slightly more than 10% for the 5-year average. The profit margin also trails the industry.

CHRS

Gross Margin

Profit Margin

2006

30.6%

3.6%

5 YR Industry

AVG

2006

28.8% 38.8%

2.7%

6.8%

Industry

5 YR AVG

37.1%

5.6%

Charming Shoppes has considerable “foot traffic” through its e-commerce web sites. The firm

has the opportunity to convert this traffic into sales. Obtaining small sales from a relatively

small portion of the traffic would translate to sales beyond what even large stores could compete

against. Charming Shoppes’ stock price, when analyzed over its entire period, 1986 and forward,

has been on a linearly decreasing path. Its current stock price is sufficiently low, given its ecommerce strengths, to potentially attract interest – friendly or otherwise.

Ann Taylor (ANN):

Ann Taylor markets upscale women's clothing designed exclusively for its stores, offering

apparel, shoes, and accessories. It is known for its quality suits, separates, dresses, shoes and

accessories, providing women with polished, classical styling. Ann Taylor sells a full range of

career, casual and special occasion clothing at each store. Their collections are classical in

nature and can be mixed and match season-to-season. Ann Taylor is committed to creating a high

level of client loyalty.

Ann Taylor targets fashion-conscious professional women and is one of the country’s leading

retailers, operating about 825 stores in 46 states across the nation including the District of

Columbia and Puerto Rico. Most Ann Taylor stores are located in malls and upscale retail

centers. Ann Taylor LOFT stores offer their own label of mid-priced apparel while Ann Taylor

Factory Stores offer clearance merchandise. Ann Taylor also has two websites.

Ann Taylor develops most of the merchandise it retails using its in-house product design and

development teams. Merchandise is manufactured in over 25 countries, with approximately 28%

of its merchandise manufactured in China, 15% in Hong Kong and 13% in the Philippines. A

centralized distribution system is utilized through its distribution center located in Louisville,

Kentucky.

10

SWOT Analysis: Ann Taylor outpaces the retail industry in terms of its gross margin. ANN’s

gross margin for fiscal 2006 was 50.9% and has a 52.1% 5-year average while the apparel

industry had a gross margin of 38.8% and 37.1%, respectively. Ann Taylor has had gross

margins that have consistently out-performed the apparel industry over the past 5 years.

Surprisingly, its net profit margins lag the industry, as do its operational margins, which implies

operational inefficiencies. Over the past years, there have also been issues with inventory

turnover lagging the industry.

ANN

Gross Margin

Profit Margin

2006

50.9%

3.9%

5 YR Industry

AVG

2006

52.1% 38.8%

4.3%

6.8%

Industry

5 YR AVG

37.1%

5.6%

Ann Taylor is an established business seeking to serve professional women. Given that this is an

under-served market, ANN would seem to have the operations in place to increase market share;

and yet, the perception of operational and managerial inefficiencies poses a bigger threat than

any new market entrants.

Talbots (TLB):

Talbots offers specially designed collections of classic sportswear, casual wear, dresses, coats,

sweaters, accessories and shoes, consisting exclusively of Talbots branded products in misses,

petites, women’s and women’s petite sizes. Women’s sizes are offered through size 24. There

are also product lines for infants, toddlers, boys, girls and Talbot’s Mens, which offers a classic

line of men’s sportswear and more formal attire. Talbots’ strategy focuses on a classic look of

timeless styling and quality. The classic styling allows the customer to create a wardrobe that

lasts across the seasons and the years.

Talbots’ channels include its retail stores, catalogs and e-commerce website. Its customers are

believed to be professional, more affluent and attracted to its personalized customer service and

high quality merchandise.

Talbots’ direct marketing business, which includes its catalog and Internet channels, has also

undergone significant changes since inception. Talbots currently circulates 48 million catalogs

per year and has a website, which is a natural extension of the company’s existing store and

catalog channels. The same broad assortment of Talbots’ existing store and catalog classic

merchandise is available online with one-stop shopping for Talbots misses, petites, woman,

woman petites, accessories & shoes, kids, men’s, and a limited selection of collection apparel.

In May 2006 Talbots acquired the J. Jill Group for about $517 million in cash. J. Jill markets

sophisticated casual apparel through its retail stores, catalog, and e-commerce business. It

targets a similar consumer market, affluent women, 35 or older. Talbots expects to expand its

business, opening new Talbots and J. Jill retail stores.

11

SWOT Analysis: Talbots’ key strengths are merchandise quality and personalized service.

Talbots historically also has had a higher inventory turnover than the industry. While it is still

higher in 2006 and its 5-year average is higher than the industry 5-year average, it has declined

11% since 2005. Talbot’s gross margin is close to the industry’s, but its profit margin is lagging

and on a declining trend. ROI and residual income are also declining. This implies potential inhouse operational inefficiencies exist.

TLB

Gross Margin

Profit Margin

2006

36.2%

5.2%

5 YR Industry

AVG

2006

37.9% 38.8%

6.5%

6.8%

Industry

5 YR AVG

37.1%

5.6%

Talbots has established direct marketing through its two e-commerce websites, which allow for

sales orders to be fulfilled efficiently. Moreover, customers can check the status of their order

online and if a product is unavailable, a substitute product is offered. A big plus of their website

is its “online chat” feature which allows customers to communicate with customer service

representatives. Another nice feature is the ability of a customer to select merchandise online and

then reserve it at a store of their choice. As with the catalog, customer online purchases can be

returned by mail or at any Talbots retail store (Talbots, AR05).

Talbots’ website seeks to extend its personalized service to its online customers. Their website

will allow them to provide additional services to their customers as well as potentially attract

new ones. As an example, Lane Bryant has been able to attract 1.8 million consumers annually

to one of their web stores.

One potential issue concerns Talbot’s financials. Debt to Equity has steadily increased over the

past 5 years by 78.8%. During this same time frame, ROI and residual income have decreased,

by 33.0% and 62.5% respectively. Combining this with a market that is under-served and in

which the firm only targets a select portion can be the cause of future concern.

Coldwater Creek (CWTR)

Coldwater Creek Inc. is a specialty retailer of women's plus-size apparel, accessories, jewelry

and gift items, marketing through multiple sales channels: retail and direct. The company's retail

segment consists of its full-line retail, resort and outlet stores. The company's direct segment

consists of its catalog and Internet-based businesses. Coldwater’s merchandise is fashionable

with classic lines and is designed for each aspect of a woman’s life. The company markets to

women over the age of 35 with income exceeding $75,000.

As of 2006, Coldwater Creek operated 174 retail stores. The Company operates one outlet store

for every eight retail stores. Excess merchandise is marketed through its 22 outlet stores.

Coldwater also has a direct segment which includes 3 catalogs and its e-commerce website. The

website offers the same full price clothing offered in its retail shops, as well as discounted

merchandise offered through its outlets.

12

Its three regular catalogs – Northcountry, Spirit and Coldwater Creek – along with its other

catalogs –Holiday, Gifts-to-Go and Sport – allow it to differentiate its merchandise. Thus,

Coldwater can cater to the various lifestyles of its customers via a particular catalog.

Northcountry focuses on casual clothing, emphasizing comfort while Spirit features fine fabrics

and upscale detailing, such as fully lined jackets at higher price points. Along with apparel

offered in sophisticated fabrics like linen and matte jersey, the Spirit assortment also features

merchandise designed for easy care travel, including items in knit and cotton twills. This apparel

is merchandised with versatility in mind, making it simple for the customer to mix and match

items to create a personal look.

The Coldwater Creek catalog is designed to drive traffic to its retail. Therefore, it focuses on

merchandise that can be purchased in its retail stores. Gifts-to-Go has an assortment of the most

popular items from its Northcountry and Spirit lines. Coldwater also offers a new line of activewear apparel under the Sport catalog title.

SWOT Analysis: Coldwater Creek has a significant selection of quality women’s clothing

featuring unique detailing and superior fabrics. The quality of design, materials, detailing, and

workmanship combine to offer a superior product that enhances the image a woman wishes to

project. Coldwater Creek admittedly markets to women with a household income of $75,000

and above. Its prices are higher than that of its competitors, but then, so is the quality of its

merchandise.

CWTR has the opportunity to market its merchandise to other women on the basis of its

enhanced features, superior fabrics, and detailing. While women with lower incomes may not

be able to purchase large quantities of CWTR merchandise, they could certainly purchase select

pieces that would enhance their wardrobe and their look.

CWTR

Gross Margin

Profit Margin

2006

45.6%

5.3%

5 YR Industry

AVG

2006

41.9% 38.8%

3.0%

6.8%

Industry

5 YR AVG

37.1%

5.6%

Marketing to only women with a household income of $75,000 or above is fairly limiting.

Given the prices of its merchandise, the limited size ranges and the direction of the market,

Coldwater Creek could find its market share decreasing due to others who are willing to target

women with slightly less means but larger waist lines.

Nordstrom’s (JWN)

Nordstrom began as a family shoe store started with money from Alaska’s gold rush days.

Nordstrom, Inc., incorporated in 1946. It offers a premium selection of brand name and private

label clothing. Nordstrom offers its products through multiple retail channels, including the

Internet. Nordstrom offers and supports its credit policies, in part, through its wholly-owned

federal savings bank, Nordstrom FSB. This arrangement allows Nordstrom to reward loyal

customers.

13

The company supports direct sales through its catalog and online store, offering a range of

apparel, shoes, cosmetics and accessories. Most sales are shipped through third party carriers

through its order fulfillment center based in Iowa.

SWOT Analysis: Nordstrom has strong revenues and better inventory turnover than the industry.

Its gross margin slightly trails the industry for 2006, but its profit margin slightly leads. The

firm also carries strong brand recognition in that it carries top brands and designer fashions. Its

suits and business wear for women provide sensible, but highly fashionable styling.

JWN

Gross Margin

Profit Margin

2006

36.7%

7.1%

5 YR Industry

AVG

2006

34.8% 38.8%

4.0%

6.8%

Industry

5 YR AVG

37.1%

5.6%

Nordstrom is high leveraged with significant debt to equity ratios. While total debt to equity

still leaves the firm very leveraged, long-term debt to equity ratio shows a steady improvement

over the past 5 years:

JWN

Total Debt to Equity

L/T Debt to Equity

2006 2005 2004 2003 2002

135% 157% 180% 199% 208%

30% 52% 75% 98% 103%

Nordstrom also has the ability to draw increased foot traffic as its stores carry more than just

apparel. Where TPF can look to differentiate is in personalized service that can sometimes be

missing in larger department stores. TPF will also have competitive advantage in terms of

tailored fitting.

TJX Companies, Inc. (TJX)

The TJX Companies, Inc. (TJX) is a discount retailer of apparel and home fashions in the United

States and worldwide via its TJ Maxx, Marshalls and AJ Wright chains in the USA, Winners

chains in Canada and TK Maxx chains in the UK and Ireland. The target customer for most of

the chains is the middle to upper-middle income shopper. TJX also operates Bob’s stores – a

chain that is found in the northeastern United States and markets casual family apparel.

TJX prices are typically 20% to 60% below similar items sold at department stores. Marshalls

offers a bigger men’s department, a larger shoe and jewelry department than TJ Maxx. The

chains target deal-seeking consumers.

14

SWOT Analysis: TJX faces potential liquidity problems as evidenced by its low quick ratio.

The ratio indicates that the firm could have difficulty meeting its current liabilities without the

sale of its inventories. Fortunately for TJX, it has a strong inventory turnover. It surpasses the

industry by approximately 10 days per cycle in fiscal 2006. Other potential issues concern

profitability. TJX trails the industry in both its gross and net profit margins, by 15.4% and 2.5%

respectively.

TJX

Gross Margin

Profit Margin

2006

23.4%

4.3%

5 YR Industry

AVG

2006

24.0% 38.8%

4.6%

6.8%

Industry

5 YR AVG

37.1%

5.6%

TJX’s greatest opportunity lies in targeting value-conscious consumers. However, TJX may find

that it is no longer just competing against department stores. Walmart has been upgrading its

retail clothing and as it transitions from a low-cost strategy to a best-cost strategy, TJX may find

itself in direct competition with the giant corporation.

Barriers to Entry Analysis

Type of Barrier to Entry

Extent of Effectiveness Factor

High Medium Low

None

Comments

[TC] 3D Body Scanner

2

High Start-up Costs

Substantial Expertise Required

Engineering, Mfg Problems

Lack of Suppliers/Distributors

Restrictive Licensing, Regulation

Market Saturation

Trademarks

X

X

(Brochure, Appendix F)

X

X

X

X

X

N/A

N/A

N/A

N/A

N/A

N/A

The plus-size women’s market is an under-served market, so it is important to understand how

easy it is to enter this market. As the table above summarizes, there is nothing of high

importance blocking new entrants. Patents are not required. There are no engineering issues and

manufacturing issues only exist if a firm is planning to either become a manufacturer or market

their own line. Other issues, such as restrictive licensing, regulation and trademarks, also do not

apply.

The analysis above indicates that this particular industry has low barriers to entry. To be

successful, The Perfect Fit must have a competitive edge. TPF’s competitive strength will be

based on the body-scanning device and superior personalized service. Since the Company is

entering into an operating lease for this machine, it is guaranteed to have a state of the art

machine that will only improve over time.

15

E-Commerce

The question regarding e-commerce must be addressed for any business in today’s competitive

environment. How the industry and a firm’s competitors have responded to e-commerce is a

question that grows in importance with the rise in Internet sales.

Charming Shoppes has had significant success in drawing visitors to its online store. In fiscal

2006, Lane Bryant had 1.8 million visitors per month and has been successful in creating an

online community. Other CHRS brands have had success with e-commerce, with significant

numbers of visitors per month. Charming Shoppes is not the only competitor of TPF to have

established an e-commerce business leg. Tabolts uses its online site to enhance its customer

service and Coldwater Creek uses its online sites to augment its catalog sales and drive business

to its brick-and-mortar retail stores.

To be successful, TPF will need to examine e-commerce and understand how it can be utilized to

strategically enhance its offerings. Such offerings should further enhance TPF customer service,

similar to Talbot’s, and drive customers to TPF retail stores, similar to Coldwater Creek.

The Perfect Fit

The Perfect Fit’s projected financial statements are provided and discussed in the Financial Plan.

TPF projects positive profit margins beginning in year three, with continued growth thereafter.

The growing margins are the result of increasing sales, greater brand recognition and the opening

of a second store in year three. By year three, the ratios listed below turn positive and by year

four, TPF is projected to be competitive with key industry ratios, starting with profit margin and

return on sales.

Profit Margin

Return on Sales

Return on Investment

Industry Year 1

Year 2

Year 3

Year 4

Year 5

6.8%

-37.8%

-12.9%

0.1%

5.0%

9.9%

10.6%

-40.5%

-13.8%

0.1%

7.1%

14.2%

16.6%

-91.4%

-68.3%

0.8%

39.2%

47.0%

Advantages over Competition

The [TC]2 3D Body Scanner provides a definite competitive advantage. With it, TPF can

guarantee fit. The scanner is used to assist the consumer in selecting brands that provide the

best fit, ending the frustration of trying on clothes just to find out that they do not fit. TPF’s

other key advantage over the competition is customization. TPF will service customers by

providing in-store alterations and on-site custom fitting.

The customer’s information will be stored locally, but TPF plans to also make it available to

them upon request. Management believes that it is better to give the customer their information

rather than withhold it for exclusive use at the store because of its emphasis on developing longterm, sustaining relationships with clientele that provide repeat sales and hard-to-earn word-ofmouth advertising.

16

Weaknesses/Disadvantages

Existing firms, such as Catherine’s and Lane Bryant have the advantage of name recognition.

They have established reputations supporting plus-size women.

Manufacturers are also beginning to offer customization. It is limited, but as data from body

scanning is accumulated and warehoused, it is possible that customers will be able to take their

measurements to the designer of their choice. The [TC]2 3D Body Scanner is designed to serve

multiple applications which includes helping manufacturers design, make and sell clothes that fit.

In addition, technological innovations can be further used by suppliers to customize their

products and services, potentially providing another source of competition. With this trend

towards customization, TPF could find its competitive advantage slip away before it acquires

sufficient market share.

Houston also has a number of businesses offering alterations and custom tailoring. Research has

indicated that most of these businesses are small sole proprietorships. The market in Houston is

believed to be sufficiently large enough that TPF will be able to penetrate it and gain significant

market share.

The company’s five-year plan includes expanding into the global arena. Foreign competition

already exists as firms from Sweden are already making customized plus-size clothing.

Additionally, firms that provide made to order business wear for plus-size women have been

identified via Internet searches. One is based in Thailand and the other is in California. Both

firms have web-based additions to their businesses and provide online product information and

ordering assistance.

<Snipped remainder of marketing plan,

as well the Operations and Financial Plans>

17