What's the difference? - Penn State Federal Credit Union

advertisement

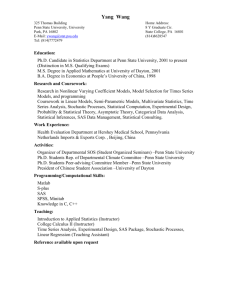

Credit Union 101 What’s the difference? Property of Penn State Federal Credit The Beginning How it all began... The history of credit unions began in 1844, with a group of weavers in Rochdale, England, who established the Rochdale Society of Equitable Pioneers. They sold shares to members to raise the capital necessary to buy goods at lower than retail prices, and then sold the goods at a savings to members. In doing so, they became the first credit union. The movement then spread to Germany in 1850, Canada in 1901 and the United States in 1908. A credit union is a cooperative financial institution that is owned and controlled by its members, and operated for the purpose of promoting thrift, providing credit at reasonable rates, and providing other financial services to its members. Credit unions differ from banks and other financial institutions in that the members who have accounts in the credit union are the owners of the credit union. A credit union’s policies governing interest rates and other matters are set by a volunteer Board of Directors elected by and from the membership itself. Credit unions offer many of the same financial services as banks. How Penn State Federal Credit Union began... Chartered in January 1959, University Park Federal Credit Union began operations in Lawrence and Rose Marriott’s dining room. In 1972 at the University’s request, our name changed to Penn State Federal Credit Union and operations moved to campus. The Credit Union has had several offices on campus and is currently located in the HUB. In 1992 our North Atherton Street location opened and our location in Bellefonte will opened in 2009. How to join a Credit Union... Credit unions are for everyone, but the law places some limits on the people they may serve. A credit union’s charter defines its “field of membership,” which could be an employer, church, school or community. Anyone working for an employer that sponsors a credit union, for example, is eligible to join that credit union. See the next page for a list of businesses in Penn State Federal’s field of membership. Property of Penn State Federal Credit Union Penn State Fedreal Eligibility EMPLOYEES AND FAMILY MEMBERS • Penn State University-faculty, staff, students, retirees & their family members (all branch campuses) • Amberleigh Homeowners Association • American Association of University Women (State College Chapter) • APD Life Sciences • Arris (formerly c-cor.net) • Atlas Realty Management • Autoport Motel & Restaurant • Barnes & Noble (Penn State Bookstore employees) • Beck’s Paving • Bonfatto’s • CATA/Centre Area Transportation Authority • Central Maryland Chapter of the Penn State Alumni Association • Central Pennsylvania Convention & Visitors Bureau • Centre County Association of Realtors • Centre County Chapter of the Penn State Alumni Association • Centre County Women’s Resource Center • Centre Lifelink EMS • Chemcut Corporation • CLC/Centre Learning Community Charter School • Comcast (State College employees) • Conduit Internet Technologies, Inc. • Dairy One • Dickinson School of Law • Downtown State College Improvement District • Drayer Physical Therapy Institute • Eagle Valley Personal Care Home • Eagle Ridge Personal Care Home • Epic Settlement Services & Epic Abstract • Faith United Church of Christ • Foxdale Village • Glenn O. Hawbaker, Inc. (GOH) • Gray’s Cemetery Association of Halfmoon Township • Hearthside Rehabilitation and Nursing Center • Heberling Associates Inc. • Hilex Poly Co., LLC • Hospitality Asset Management Company Inc. • HRI, Inc. • Impact RLW Systems • Joseph C. Hazel, Inc. • KCK Direct • Kid’s Court Child Care & Learning Center, Inc. • Master Computer • Minitab, Inc. • MPI Research • Nittany LERA • Olympus NDT • Omega Piezo Technologies, Inc. • Orchard Creek Homeowner’s Association • • • • • • • • • • • • Penn State Hershey Medical Center Potter Development Services, Inc. Resource Technologies Corporation Restek Corporation South View Farm State College Woman’s Club Strawberry Fields Terra Excavating The Village at Penn State Willomar Partnership Young Scholars of Central PA Charter School ZedX Inc. Property of Penn State Federal Credit Union The Credit Union Difference Our Members… are also owners, helping each other offer lower interest rates and other competitively priced financial services. Becoming a part of Penn State Federal Credit Union now means you may take advantage of all the benefits of membership for as long as you are a member. Once you are a Penn State Federal Credit Union Member, you are ALWAYS a member. What’s The Difference? Credit unions have members, not customers Banks serve anyone in the general public Credit unions are democratically controlled Banks have only investor voting privileges Credit unions are not-for-profit Banks allow profit sharing for investors only (usually in the form of stocks) Locations and Hours 1937 North Atherton Street State College, PA 16803 Mon-Wed 9am to 4pm Thurs - Fri 9am to 5:30pm Loan, Teller and Member Services available LL-009 HUB-ROBESON Center University Park, PA 16802 Mon-Fri 9am to 4pm Loan, Teller and Member Services available 123 Amberleigh Lane Bellefonte, PA 16823 Mon-Wed 9am to 4pm Thurs - Fri 9am to 5:30pm Loan, Teller, Administration and Member Services available Property of Penn State Federal Credit Union Accounts Share Savings Account • • • • • • Required for membership $5 Minimum balance $100 earns dividends ATM card Unlimited free PSFCU ATM and teller transactions and unlimited surcharge free CU$ ATM transactions No withdrawal fees Teen Club Account • • • • • • • No Teen Club membership fee Currently earning .02% interest; rates are subject to change upon board approval $5 minimum balance requirement $5 earns interest No fee teller and PSFCU ATM withdrawals Surcharge free CU$ ATM transactions Upon completion of all four Teen Club classes, you may get a visa debit card and/or Visa credit card Kids Club Account • • • • • • • $5 balance earns dividends ATM card Can be used as overdraft protection on Penn State Federal Checking accounts Small prize for each deposit $1 Birthday Coupon Frequent Saver’s Card - Get stamped for each deposit of at least $10. Collect 10 stamps and we’ll stuff an extra $5 into your account! Certificate of Deposits ($250 minimum) SmartStart Share Account • • • • • • SmartStart Accounts have fixed terms up to 30+ months Interest rate is variable $100 minimum balance & opening deposit $100 balance earns dividends Minimum monthly deposit requirement of $10 Early withdrawal fee Money Market Share Account • • • • $1500 opening deposit Tiered dividend account (see rates page) 6 transactions per month, 3 of which may be checks clearing in that month No charge check writing ability Property of Penn State Federal Credit Union Accounts Vacation Club Account • • • • No minimum balance or opening deposit $100 balance earns dividends Anytime terms No withdrawal fee Holiday Club Account • • • • No minimum balance or opening deposit $100 balance earns dividends October-to-October terms and balance is transferred to Basic Share Savings on September 30 Early withdrawal fee Freedom Checking Account • • • • • No minimum balance or opening deposit Visa debit card (no monthly fee) Free Bill-Pay Free e-statements (required) Unlimited surcharge free CU$ ATM visits and unlimited no-charge check writing ability Thrift Checking Account • • • $100 minimum balance & opening deposit $8 below minimum balance fee per month Unlimited surcharge free CU$ ATM visits and unlimited no-charge check writing ability Premier Checking Account • • • • $2,000 minimum balance & opening deposit $10 below minimum balance fee (per month) $2,000 balance earns dividends Unlimited surcharge free CU$ ATM visits and unlimited no-charge check writing ability Property of Penn State Federal Credit Union Accounts Loans Penn State Federal offers loans for almost anything! Check our website for the interest rate you’ll have to pay on the loans. • Visa Platinum Rewards Credit Card • Car Loans • Home Loans • Credit Lines • Business Loans Other products/services available • • • • • • • • • CDs - Certificates of Deposit IRAs - Individual Retirement Accounts Notary Services Travelers Checks Money Orders Free Financial Education Seminars Business Services Free Identity Theft Protection Mobile Banking Property of Penn State Federal Credit Union Account Access ATM Cards • Automated Teller Machine • Unlimited Penn State Federal ATM visits • Unlimited surcharge free CU$ ATM visits (any ATM with a CU$ displayed) • $300 daily withdrawal limit • 24 hour account access Home/Mobile Banking PENNY-LINE - Free telephone access to your account 814-865-3983 (local) • 800-828-4636 (toll-free) • 24 hour account accessibility • Check balances, make transfers, view history PENNY-ONLINE - Free online access to your account • www.pennstatefederal.com • 24 hour account accessibility • Check balances, make transfers, view history PENNY MOBILE - Download our Free Penny Mobile App for your phone or mobile devices (Android and Apple iOS devices only) • Make a deposit to your Penn State Federal checking or savings account with Mobile Deposit • Check balances • View transaction history • Transfer funds between your Penn State Federal accounts • Pay bills • Locate Penn State Federal branches and ATMs Penny Bill Pay Penny Bill Pay allows you to pay all your bills online. Once you pay a bill, Penny Bill Pay remembers the mailing and account information for you, so paying bills next month is a snap! You can set up recurring or onetime payments to anyone! Get unlimited bill paying, free on-line check copies and unlimited access for free with Freedom Checking (all other checking accounts charge $5 for this service). Allow about 3 business days for your account activation email to arrive. E-Statements Free account statements are available through Penny On-Line. You will be notified through your email each month that your statement is available and will be waiting for you at a secure site online. To receive e-statements, you must agree not to receive a paper, mailed statement. You may already be set up for free E-Statements, make sure to keep your email address information updated though Penny On-Line. When you sign up, there will be a few months of past statements already available. Property of Penn State Federal Credit Union CU Service Centers Credit Union Service Centers You have access to your credit union account at over 5,000 credit union offices nationwide that share transaction services through the CU Service Center Network. The CU Service Center Network allows you to experience the same high quality personal service you have come to expect from Penn State Federal, whether the office is across town or across country. To find a service center location, visit their online directory at www.co-opcreditunions.org or call (800)-919-CUSC (2872). When visiting a shared service branch, simply provide the teller with the full name of your credit union, account number and a photo ID card. The CU Service Center’s member service representative will access your account at Penn State Federal, and you can make deposits, withdrawals, transfers, or loan payments. The CU Service Center network is perfect when traveling. If you are relocating, there is no need to leave Penn State Federal. Property of Penn State Federal Credit Union Glossary Glossary of Terms Annual Percentage Yield (APY)-The percentage, required by Truth in Savings regulations, to be disclosed on interest-bearing deposit accounts that reflect the total interest to be earned on an institution’s compounding method, assuming funds remain in the account for a 365-day year. ATM (Automated Teller Machine)- A terminal activated by a magnetically encoded card that allows customers of a financial institution to conduct transactions such as deposits and withdrawals. An interconnection of these terminals allows customers to conduct certain transactions nation or world wide. ATM Surcharge- Fee charged to use an ATM owned by an institution that isn’t the cardholder’s primary institution. If you use your PSFCU card at another financial institution, you may be subject to this fee. Board of Directors- Group of volunteers charged with providing the general direction and control of the credit union. Officers of the credit union (Chairman, Vice Chairman, etc.) are selected by the board. Dividend- Distribution of earnings to shareholders. In credit unions, it’s the money paid to members for deposits, similar to the interest banks pay to their customers for deposits. E-statement- A detailed electronic record of transactions incurred in a member’s account for a certain period of time (usually monthly or quarterly). Joint Account- An account owned by two or more persons who share equally in the rights and liabilities of the account. NCUA (National Credit Union Association) - Created in 1970 to charter and supervise federal credit unions. Non-Profit Organization- Economic institution that operates like a business but does not seek financial gain. Examples are schools, churches, community service organizations, and credit unions. Non-profit organizations often provide goods and services to consumers while they pursue other rewards such as improving educational standards, seeing the sick become well, and helping those in need. PIN (Personal Identification Number) - A confidential personal identification code, usually consisting of four to six digits, used by members to access their accounts at ATMs. Share Account- a regular or special savings account that isn’t a share certificate account. Property of Penn State Federal Credit Union Quiz Please return to Penn State Federal Credit Union attn. Marketing Department or e-mail your answers to clubteen@pennstatefederal.com. After we receive your quiz answers, you’ll receive credit for Credit Union 101. Credit Union 101 Quiz Name:______________________________________________________________________________ Address:____________________________________________________________________________ Email:_______________________________________________________________________________ 1. Name two groups who are eligible to join Penn State Federal Credit Union. 2. Who owns and operates Penn State Federal? 3. What dividend percent (%) is the Teen Club share account currently earning? 4. Is a share account required for membership? 5. At what dollar amount does the Teen Club share account earn dividends? 6. What does ATM stand for? 7. Why are credit union service centers valuable? 8. What does surcharge mean? 9. What does PIN stand for? 10. Name two ways to transfer funds between accounts if Penn State Federal CU is closed. Property of Penn State Federal Credit Union