Combining Price and Quantity Controls under Partitioned

Combining Price and Quantity Controls under Partitioned

Environmental Regulation

By

Jan Abrell and Sebastian Rausch

∗

PRELIMINARY AND INCOMPLETE. PLEASE DO NOT CITE.

First version: November 24, 2015.

This paper re-visits the fundamental question of combining price and quantity instruments for emissions control if environmental regulation is partitioned and the environmental target is fixed. We both theoretically and empirically analyze hybrid policies that establish bounds on the carbon price or the quantity of abatement in an emissions trading system. We show that hybrid policies provide a way to hedge against differences in firms’ marginal abatement costs. Hybrid policies with price bounds are more effective relative to policies with abatement bounds due to their ability to address uncertainty in both abatement technology and baseline emissions.

In the context of EU Climate Policy, we find that hybrid policies can decrease expected excess costs of regulation (relative to a firstbest policies) by up to 56 (89) percent under second- (third-) best policy environments. Hybrid policies are also highly likely to yield sizeable reductions in ex-post abatement costs. (JEL H23, Q54,

C63)

Should limiting greenhouse gas (GHG) emissions be achieved by a price or a quantity instrument? Under asymmetric information and uncertainty about the costs of GHG control and the damages (or benefits) from averted emissions, combining price and quantity instruments has been shown to achieve ex-post

efficiency ( Roberts and Spence , 1976 ;

Dasgupta, Hammond and Maskin , 1980 ;

2005 ) thereby overcoming the problem that neither pure quantity- nor price-

based pollution controls can reach a first-best solution that maximizes welfare

( Weitzman , 1974 ; Roberts and Spence , 1976 ).

Two major premises underlying this literature seem to be at odds with real-world environmental policies. First,

∗

Abrell: Swiss Federal Institute of Technology Zurich (ETH Zurich), Center for Economic Research

Swiss Federal Institute of Technology Zurich (ETH Zurich), Department of Management, Technology

Switzerland, and Massachusetts Institute of Technology, Joint Program on the Science and Policy of

Global Change, USA (email: srausch@ethz.ch). We are grateful for comments from seminar participants at the EAERE 2015 Annual Meeting, U Basel, and U Strathclyde. We acknowledge the support of the

Swiss Competence Centers for Energy Research, Competence Center for Research in Energy, Society and Transition (SCCER-CREST) and the Commission for Technology and Innovation (CTI).

1

1

2 the costs of emissions control are assumed to be distributed among polluters

(i.e., firms) in a cost-minimizing way. Second, the choice of the environmental target and the choice of policy instruments are viewed as fully intertwined, often simultaneous, policy decisions.

Our paper re-visits the fundamental public policy question of combining prices and quantities for emissions control in a setting that relaxes both assumptions summarized above. Emissions trading programs—as the most prevalent form of quantity control—have become a centerpiece of environmental regulation in many countries but they typically cover only a subset of economy-wide emission sources.

Complementary policy measures regulate non-covered sources in order to meet a pre-defined environmental target. A prominent example for such a partitioned environmental regulation is the EU’s “2020 Climate and Energy Package” which splits the reduction effort between sources covered by the EU Emissions Trading

System (EU ETS) and non-covered sources.

How do hybrid policies perform if environmental regulation is partitioned and the overall environmental target is fixed?

We focus on the question whether it is possible to lower the cost of environmental regulation by designing a hybrid policy that introduces bounds for permit prices or the level of abatement into an ETS when the ETS covers only a subset of the economy’s emission sources and complementary policies are used to regulate emissions not covered by the ETS. In posing the problem, we have in mind a situation where the regulator has to distribute a pre-determined economy-wide emissions reduction target across the ETS and non-ETS partitions and can implement a lower and upper bounds on the permit price or level of abatement in the ETS partition. The regulator has to choose ex-ante a policy design when abatement costs of firms in both partitions are unknown. If firms’ abatement costs are unknown and environmental regulation is partitioned, price or abatement bounds in the ETS provide a way to hedge against differences in marginal abatement costs across the ETS and non-ETS partitions. This has the potential to move firms’ abatement decisions ex-post closer to a first-best solution in which all emitters face identical marginal costs for emissions.

We theoretically characterize ex-ante optimal hybrid policies with bounds on the ETS permit price or the abatement quantity and show that from an ex-ante perspective they can never increase the cost of environmental regulation relative to a pure quantity instrument. But how likely is it that such hybrid policies deliver ex-post cost reductions and how large are potential cost savings? Using a simulation model for European carbon abatement, based on empirically fitted marginal abatement cost (MAC) curves, we compare the costs of achieving a given EU emissions reduction target under alternative hybrid policy designs. We

2

The EU ETS is the world’s largest cap-and-trade program covering about 45% of total EU-wide emissions, mainly from electricity and energy-intensive installations. By 2020 and compared to 2005 levels, a 21% reduction in emissions has to come from sectors covered by the EU ETS and an additional

10% reduction from non-trading sectors covered by the “Effort Sharing Decision”—including transport, buildings, services, small industrial installations, and agriculture and waste.

COMBINING PRICES AND QUANTITIES UNDER PARTITIONED REGULATION 3 find that on average the excess policy cost—measured as the deviation from a first-best policy regime under which instruments can be conditioned on (ex-ante unknown) states of the world—are significantly lower under a hybrid policy as compared to a pure ETS policy: an (ex-ante) optimal second-best hybrid policy can reduce costs by up to 56%, a third-best policy with an exogenously given distribution of the reduction target across partitions as currently specified under

EU climate policy can lower costs by up to 89%.

We examine the performance of hybrid policies under two types of key uncertainties: baseline emissions uncertainty—reflecting common GDP or sectorspecific shocks—and uncertainty with regard to firms’ abatement technologies.

Hybrid policies with price bounds are generally more effective in reducing costs as they enable hedging against uncertainty in firms’ abatement technology by exploiting information on MAC. Hybrid policies with abatement bounds are practically ineffective to address technology uncertainty. The ability of hybrid policies with price bounds to reduce expected abatement costs is particularly large when technology uncertainty is “large” but diminishes as the correlation between sectoral shocks on baseline emissions shocks is strongly positively correlated.

We also investigate the implications of hybrid policies in terms of the distribution of ex-post costs. Hybrid policies with price bounds are highly likely to yield sizeable ex-post costs savings (relative to pure quantity-based regulation): reductions are obtained in 67% (49%) of the cases when sectoral baseline emissions are negatively (positively) correlated). Polices with abatement bounds achieve ex-post reductions in about 66% of the cases if baseline emissions are negatively correlated but yield only negligible cost savings when baseline emissions are negatively correlated. The latter result is due to the inability of abatement bounds to exploit information on firms’ abatement technology.

The present paper is related to the existing literature in three ways. First, the paper contributes to the literature on ex-post efficient permit markets under uncertainty and asymmetric information. As

internalizing the external effects under asymmetric information and uncertainty about the costs of pollution control and damages (or benefits) from pollution will in general yield second-best outcomes with lower welfare as compared to an expost efficient, first-best solution. A relatively large literature on hybrid regulation strategies that combine elements of permit markets and price control and lead to

ex-post efficiency have been proposed in the literature ( Roberts and Spence , 1976 ;

2005 ). By proposing to use different institutional designs, these hybrid strategies

all propose in the end to implement a price-quantity relation for emissions, i.e. a supply function of emissions permits, that approximates the marginal damage function. The welfare gains of ex-post efficient hybrid regulation relative to ei-

ther pure price or quantity controls have shown to be substantial ( Pizer , 2002 ).

In a model of disaggregated firm behavior,

Krysiak ( 2008 ) has shown that be-

sides increasing expected social costs, hybrid policies can have indirect benefits

4 due to reducing the consequences of imperfect competition, enhancing incentives for investment, and generating a revenue for the regulating authority. None of the existing studies, however, does consider the problem of combining prices and quantities under partitioned environmental regulation. Our framework considers a relaxed problem of

Roberts and Spence ( 1976 ) who assume that the cleanup is

distributed among firms in a cost minimizing manner. Moreover, while the existing studies consider the regulatory problem choosing policy instruments and the environmental target simultaneously, a major premise that underlies our analysis is that we view the target setting and instrument choice issues as two distinct policy questions. Second, the present paper draws on a number of studies that have quantified the efficiency costs of partitioned regulation caused by limited sectoral

While this literature has been influential, also for public policy discussions, it does not look at the questions of combining price and quantity controls.

The remainder of the paper is organized as follows. Section

presents our theoretical argument and characterizes ex-ante optimal hybrid policies with price and abatement bounds under partitioned environmental regulation. Section

describes our quantitative framework and its empirical implementation that we use to analyze the effects of hybrid policies for controlling CO

2 emissions in the context of EU climate policy. Section

presents and discusses the findings from our empirical analysis of hybrid policies. Section

concludes.

I.

The Theoretical Argument

In this section, we sketch our theoretical argument for why hybrid policies which combine price and quantity controls in the context of partitioned environmental regulation may decrease rather than increase abatement costs. The argument can be summarized as follows: consider an economy with two polluting firms where emissions from one firm are regulated under an ETS while emissions by the other firms are regulated separately to achieve an economy-wide emissions target. If the regulator is uncertain about firms’ abatement costs, pure quantitybased regulation will fail to equalize marginal abatement costs between firms in all possible states of the world, hence undermining cost-effectiveness. Adding bounds on the permit price or level of abatement in the ETS partition will provide a hedge against too large differences in firms’ marginal abatement costs. This will in turn decrease the expected abatement costs of environmental regulation and potentially bring about reductions in ex-post abatement costs.

3

Cost-effectiveness may also be hampered by strategic partitioning ( B¨ , 2009 ;

of the EU ETS.

COMBINING PRICES AND QUANTITIES UNDER PARTITIONED REGULATION

A.

Basic Setup

5

Although the reasoning below fits alternative applications, we let climate change and CO

2 abatement policies guide the modeling. We have in mind a world of partitioned environmental regulation with two sets of pollution firms: one set, T , participates in an emissions trading system (ETS) while the other set, N , does

We will abstract from decision making within both sets and treat T and N as one firm or sector; in particular, we assume that abatement within a sector is

distributed among firms in a cost-minimizing manner.

FIRMS’ ABATEMENT COSTS AND SOURCES OF UNCERTAINTY.—–

Firm i ’s abatement costs are described by the following abatement cost function: C i

( e

0 i where e i and e

0 i

+ i denote sector i

+ i

− e i

, i

),

’s emissions before and after the policy intervention, respectively. Hence, a i indicates abatement, i.e. the amount of emissions reduced relative to the “no-intervention” baseline emissions level, and is defined as a i

= e 0 i

+ abatement, i.e., i

− e i

. The cost functions are monotone and strictly convex in

∂C i

/∂ ˜ i

> 0 and ∂

2

C i

∂ ˜

2 i

> 0, and are continuously twice differentiable in all arguments.

Abatement costs are known to firms but are uncertain from the point of view of the regulators.

i is a random variable which simply captures all the relevant uncertainty about firms’ abatement costs. We distinguish between technology and baseline emissions uncertainty. First, technology uncertainty arises as the regulators do not know the costs associated with reducing emissions from either substituting carbon with non-carbon inputs in production or from adjusting output (or a combination of both). Second, the regulators do not know the level of

“no-intervention” emissions, beyond the certain level e

0 i

, reflecting the fact that energy demand, GDP growth, and other economic conditions may affect baseline emissions but cannot be known a priori.

i also reflects unmodelled policies such as, for example, renewable energy support policies, which affect firms’ emissions intensity and hence the level of emissions. The two forms of uncertainty are modeled by the same random variable which, however, enters the abatement cost function in different ways. Baseline emissions uncertainty enters through the first argument of C ( a i

, ). Following the definition of a i

, baseline emissions react to the signal in a linear way. Technology uncertainty reacts enters through the second argument of the cost function; we do not impose any assumptions on how specifically affects abatement costs. For example, a positive realization of increases baseline emissions but may positively or negatively impact abatement costs through technology.

i is distributed over compact supports b i joint probability distribution f ( t

,

N

, b i with

). We assume that

E

( i

) = 0. We do not impose any assumptions on the correlation between the two types of uncertainty nor do we assume that e

T and e

N are correlated.

4

The assignment of firms to each set is fixed and exogenously given.

analyze the optimal assignment of activities to trading and tax systems.

5

The terms “firm” and ”sector” are thus used interchangeably throughout the paper.

6

POLICY DESIGN PROBLEM, INFORMATION STRUCTURE, AND FIRM BEHAVIOR.—–

The regulators are faced with the problem of limiting economy-wide emissions at the level e ≥ P i e i

. The major premise underlying our analysis is that the regulation of emissions is partitioned: emissions from sector T only make up some fraction of total economy-wide emissions and are regulated by an ETS whereas sector

N ’s emissions are not covered by the ETS. We assume that emissions control in sector N is achieved in a cost-effective way, for example, by using a carbon tax

In a world of partitioned environmental regulation, and given a constant environmental target on economy-wide emissions, policy has to choose sectoral emissions targets, e i

, thus effectively allocating the economy-wide target among sectors. We define the allocation factor as λ = e

T

/e .

λ reflects a pure quantity-based approach to regulating emissions as it determines both the cap or number of permits in the ETS as well as the maximum amount of allowable emissions in the non-ETS sector. In this paper, we investigate hybrid policy that enlarge the instrument space by allowing introducing either lower and upper bounds ( P , P ) on the ETS permit price or lower and upper bounds on the amount of abatement

( a, a ) in the ETS sector.

The regulators’ problem is to minimize expected total abatement costs

T =

Z b

T Z b

N b

T b

N

(1)

C

T

0

T

− λe,

T

+ C

N

=

E

C

T

˜

0

T

0

N

− [1 − λ ] e,

N f (

T

,

N

) d

T d

N

− λe,

T

+ C

N

0

N

− [1 − λ ] e,

N by choosing either (1) a pure quantity-based regulation ( λ ), (2) hybrid regulation which combines quantity and price controls ( { λ, P , P } ), or (3) hybrid regulation which combines quantity control with bounds on abatement ( { λ, a, a }

The regulators ex ante choose a policy design, i.e. before the realizations of the random variables and hence firms’ abatement cost functions are known. It is assumed that firms know or can find out their abatement costs. The uncertainty therefore attaches only to the regulatory authority. The functions f and C , the first moments of f , and baseline emissions e

0 i are assumed to be “common knowledge”.

Ex post , i.e. after the realizations of the random variables are revealed, firms choose their abatement. Given the price for emissions in each sector, P i

, firms choose a cost-minimizing level of abatement by equating price with marginal abatement costs, i.e.

P i

= ∂C i

( a i

, i

) /∂a i

∀ i

.

We assume that the environmental target is exogenous, constant, and always

6

As long as abatement costs at the sectoral level can be described by some function C

N

, the general formulation of the policy design problem does not rule out the use of non-market regulatory instruments that may lead to cost-ineffective outcomes in sector N .

7

As we seek to characterize (optimal) policy designs which achieve an exogenously set overall emissions target , we abstract here from explicitly including the benefits from averted pollution. As long as

expected difference between benefits and costs.

COMBINING PRICES AND QUANTITIES UNDER PARTITIONED REGULATION 7 has to be fulfilled. Thus, if price or abatement bounds chosen ex ante become binding ex post , sectoral emissions targets have to be adjusted to ensure that the economy-wide emissions target is met. We thus assume that the regulators can implement a mechanism which ex post adjusts the sectoral targets.

B.

First-best Policies

In an environment of complete knowledge and perfect certainty there is a formal identity between the use of prices and quantities as policy instruments. If there is any advantage to employing some forms of hybrid price and quantity control modes, therefore, it must be due to inadequate information or uncertainty

( Weitzman , 1974 ). A useful reference point is thus to define the first-best optimal

policy when state-contingent policies are feasible.

The first-best quantity control, λ

∗

(

T

,

N

), and price control, in the form of an entire schedule, functions of

T and abatements costs among sectors in all possible states.

λ

∗

(

N

T

P

∗

(

T

,

N

), are equalizing marginal

,

N

) and P

∗

(

T

,

N

) are implicitly defined by

(2)

P

∗

(

=

T

,

N

) =

∂C

N e

0

N

∂C

T e

0

T

+

T

− λ

∗

(

T

,

N

) e,

∂a

T

+

N

− (1 − λ

∗

(

T

,

N

)) e,

N

T

∂a

N

.

By employing a first-best policy, uncertainty has effectively been eliminated, and we are in the case in which there is no theoretical difference between price and quantity control modes—and hence no economic rationale for hybrid policies combining elements of price and quantity control.

It should be readily apparent that it is infeasible for the regulators to transmit an entire schedule of ideal price or quantity controls. A contingency message is a complicated, specialized contract which is expensive to draw up and hard to understand. The random variables are difficult to quantify. The remainder of this paper therefore focuses on policies that cannot be made state-contingent.

C.

Pure Quantity Controls

In the presence of uncertainty, price and quantity instruments transmit policy control in quite different ways. Before turning to hybrid price-quantity policies, we first provide basic intuition for a pure quantity-based policy in the context of partitioned environmental regulation.

What is the ex-ante optimal allocation of the economy-wide emissions target among sectors if λ cannot be conditioned on

T and

N

?

Solving the policy

8

Figure 1.

Abatement costs of partitioned environmental regulation under “first-best” [ λ

∗

(

P

∗

(

T

,

N

)], “second-best” pure quantity-based [ λ

∗ ex-ante

] and hybrid [ λ ] policies

T

,

N

),

decision problem in ( 1 ) yields the following condition:

(3)

"

∂C

T

E e

0

T

+

T

− λ

∗ ex-ante e,

T

∂a

T

#

=

E

"

∂C

N e

0

N

+

N

− (1 − λ

∗ ex-ante

) e,

N

∂a

N

#

, which requires that the ex-ante optimal allocation factor λ

∗ ex-ante is chosen such that expected marginal abatement costs among sectors are equalized.

Given incomplete information about firms’ abatement costs and baseline emissions at the time regulators choose λ , in all likelihood λ

∗ ex-ante

= λ

∗

(

T

,

N

) which implies that marginal abatement costs among sectors are not equalized ex post .

Figure

illustrates this situation by depicting ex-post sectoral marginal abatement cost functions, λ

∗ ex-ante

, and λ

∗

(

T

,

N

) for a given environmental target.

Total abatement costs are minimized if the abatement burden is partitioned according to the state-contingent policy functions λ

∗ or P

∗

. It is apparent from

λ

∗ ex-ante

= λ

∗

(

T

, respectively by P

T

N

) that the and P

N realized carbon prices in sectors T and N , denoted

, differ. The excess abatement costs, i.e., change in abatement costs relative to a first-best policy with state-contingent instruments, are equal to the sum of the two gray-shaded areas in Figure

arise because of the uncertainty about firms’ abatement cost. Intuitively, ex-ante policy designs capable of hedging against “too large” differences in ex-post sectoral marginal abatement costs can reduce expected total abatement costs and may even lead to lower ex-post abatement costs when compared to pure quantitybased environmental regulation. This fundamental insight provides the starting point for investigating hybrid policy designs.

COMBINING PRICES AND QUANTITIES UNDER PARTITIONED REGULATION

D.

The Ex-post Effects of Price and Abatement Bounds

9

To derive our results on ex ante optimal policy designs when the regulators can choose { λ, P , P } or { λ, a, a } , it helpful to first develop some intuition for the possible ex post outcomes.

Consider first the case of bounds on the ETS permit price. Given realizations of

T and

N

, three cases are possible. First, if price bounds are not binding, the outcome under a hybrid policy is identical to the one under a pure quantity control. Second, if the price floor becomes binding, and given that the economywide emissions target always has to be met, the emissions target in the ETS sector has to be adjusted downward shifting an equal amount of abatement to the non-

ETS sector. Third, a binding price ceiling will decrease (increase) the abatement requirement in the T ( N ) sector. The ex-post allocation factor therefore is a function of the state variables

T and

N

. The difference to first-best policy is, however, that λ cannot be fully conditioned on

T and

N

; it can rather only be indirectly controlled through the ex ante choice of price bounds.

To see why adding price bounds to a pure quantity-based control scheme can lower abatement costs in a second-best world, consider again Figure

that the regulators have chosen λ

∗ ex-ante and a price floor P . Under pure quantity control (ignoring P ) this would lead to sectoral emissions prices P

T and P

N

.

If the price in the T sector realizes below the price floor ( P

T

< P ), the price bound binds with the consequence that the abatement in the T sector needs to increase in order to increase the price. The abatement in the N sector therefore has to decline to ensure that the economy-wide emissions target holds, which is achieved by adjusting the allocation factor to λ . As abatement in the non-ETS sector decreases, the carbon price in this sector declines from P

N to P

N

. For the case depicted in Figure

1 , the introduction of a price floor therefore moves sectoral

carbon prices, and hence, sectoral marginal abatement costs closer to the firstbest, uniform carbon price P

∗

(

T

,

N

). The hybrid policy therefore decreases the costs of second-best regulation by the light gray-shaded area. A similar argument can be constructed for any price ceiling above the first-best optimal emissions price.

If the regulators imposes a bound on the minimum amount of abatement, the ex post effect is similar to the one under a minimum permit price bound. To see this, consider the case where the regulators have chosen a binding lower abatement bound such that a = λ . This triggers the same ex post adjustment in sectoral emissions budgets as with a binding price floor. Hence the savings in total abatement cost are identical. Following the same reasoning, in Figure

a binding upper bound on abatement is similar to the case of a binding price ceiling.

PROPOSITION 1: Consider an economy with polluting firms i that are partitioned in two sectors i ∈ T ∪ N . Sectoral abatement cost functions are strictly convex in abatement, and environmental policy is concerned with limiting economywide emissions at the level e . Each partition is regulated separately with respective

10 targets e

T and e

N that are pre-determined given the allocation factor

Then, economy-wide abatement costs weakly decrease

λ = e

T

/e .

(a) if the lower (upper) bound on the emissions price in one partition is smaller

(greater) or equal to the optimal permit price P

∗

, or

(b) if the lower (upper) bound on the amount of abatement in one partition is smaller (greater) or equal to the optimal abatement level λ

∗

.

Proof: See Appendix

Proposition

bears out a fundamental insight: under partitioned environmental regulation and given that the environmental target is fixed and always has to be met, economy-wide abatement costs cannot increase as long as the permit price floor is set below or equal to the ex post optimal environmental tax. If the initially chosen allocation factor λ was too high, i.e. abatement in the ETS sector is suboptimally high, then the permit price exceeds the optimal level but the price floor will not be binding. Total abatement costs will therefore not be not affected. If, however, the allocation factor was initially set too low, the ex post re-allocation of sectoral emissions targets following the introduction of a binding price floor will (weakly) decrease total abatement cost. Importantly, Proposition

implies that in a policy environment with partitioned regulation, if regulators have access to an estimate of the optimal permit price—or equivalently an optimal amount of abatement—in one of the sectors, a hybrid policy that introduces bounds on the permit price or on the permissible amount of abatement together with a mechanism that adjusts sectoral environmental targets under an economy-wide constant target can potentially decrease economy-wide abatement costs.

E.

Ex-ante Optimal Policies with Price Bounds

This section characterizes ex-ante optimal hybrid policies with price bounds.

It is useful to re-write total expected abatement costs in ( 1 ) in a way that dif-

ferentiates between situations in which emissions price bounds are binding or

(4)

T λ, P , P =

Z b

T b

T

Z

( λ,P ) (

X

C i e

0 i

( λ,P ) i

+ i

− I

λ

( i ) e, i

+

Z b

T b

T

+

Z b

T b

T

Z

( λ,P )

(

X

C i e

0 i b

T i

(

+ i

− I

λ

( i ) e,

T

Z b

T

( λ,P )

X

C i e

0 i i

+ i

− I

λ

( i ) e,

T

)

)

) f f

(

(

T

T

,

,

N

N

) d

) d

T

T d d

N

N f (

T

,

N

) d

T d

N

,

8

Throughout the analysis we assume an interior solution for λ .

COMBINING PRICES AND QUANTITIES UNDER PARTITIONED REGULATION 11 where I

λ

( i ), I

λ

( i ), and I

λ

( i ) are indicator variables which are, respectively, equal to λ , λ , λ if i = T and (1 − λ ), (1 − λ ), (1 − λ ) otherwise.

The first line in ( 4 ) refers to the case when price bounds are non-binding.

The second and third line refer to respective cases where the price floor or the price ceiling is binding. For any ex ante chosen λ and price bounds in sector

T , there exist cutoff levels for realizations of sector T ’s random variable, ( λ, P ) and λ, P , and cutoff levels for the allocation factor, λ ( λ, P ) and λ λ, P , at which the price floor and ceiling on the emissions price are binding. If either price bound is binding, the allocation factor has to adjust ex post to ensure that the economy-wide emissions target is achieved.

) is equivalent to the one in ( 1 ) if price bounds are

non-binding, i.e. the regulators could choose a price floor equal to zero and a sufficiently large price ceiling such that it never becomes binding.

In such a

case the expected total abatement cost function ( 4 ) is equivalent to the expected

abatement cost function under pure quantity control ( 1 ). The regulators’ problem

of choosing the policy { λ, P , P } thus includes the trivial case of a pure quantitybased regulation.

PROPOSITION 2: Expected total abatement costs under a hybrid environmental policy with emissions price bounds cannot be larger than those under pure quantity-based policy.

Proof: This follows from comparing the regulators’ policy design problems in ( 4 )

and ( 1 ) and noting that it is always possible to choose a pure quantity-based

regulation.

FIRST-ORDER CONDITIONS AND INTERPRETATION.—–

Expected total abatement costs are minimized when the partial derivatives of T

λ , P , and

P

are zero, or when the following conditions hold: 9

(5a) λ :

E

∂C

N

∂a

N

−

∂C

T

∂a

T

≤

T

≤ =

E

ω

λ

∆

N T

= −

E

[ ω

λ

∆

N

|

T

= ]

(5b) P :

E

˜

P

∂C

N

∂a

N

− P

T

≤ =

E

[ ω

P

∆

N

|

T

= ]

(5c) P :

E

˜

P

P −

∂C

N

∂a

N

T

≥ =

E

ω

P

∆

N T

= .

∆

N

= C

N

( a

N

( λ ( λ, P )) ,

N

) − C

N

( a

N

( λ ) ,

N

) denotes the additional abatement cost in the sector N caused by the introduction of a binding price floor in sector

T . ∆

N is defined similarly for the case of a binding price ceiling.

9

See Appendix

for the derivations.

12

PROPOSITION 3: The ex-ante optimal hybrid policy with emissions price bounds in the ETS sector is given by:

(a) λ

∗ ex-ante such that the expected difference of sectoral MACs (1) equals zero conditional on price bounds being non-binding, and (2) equals the (negative) expected excess costs in the non-ETS sector due to the introduction of a price ceiling (floor) conditional on either of the price bound being binding, and

(b) P

∗

( P

∗

) such that the expected difference of sectoral MACs, conditional on the price floor (ceiling) being binding, is equal to the expected excess costs in the non-ETS sector due to the introduction of a price floor (ceiling).

Proof: First-order conditions ( 5a )–( 5c ).

Proposition

provides some first intuition for how the standard “equimarginal” principle for optimal pricing of a pollutant across multiple sources—and polices based on this principle—have to be modified when firms’ abatement cost and the

“no-intervention” level of future emissions are ex ante unknown by the regulators.

Equation ( 5a ) illustrates a fundamental trade-off involved in choosing optimal

hybrid policies with price bounds. As under a pure quantity control scheme, the policy seeks to minimize the expected difference between sectoral MACs (LHS

of ( 5a )). If, however, price bounds in the ETS sector are binding, abatement is

shifted between sectors which implies that abatement costs in the non-ETS sector change relative to a situation without price bounds. Abatement costs in the non-

ETS sector increase if the price ceiling binds and decrease if the price floor binds

(RHS of ( 5a )). The more likely it is that one of the price bounds binds, the larger

is the respective conditional expectation term on the RHS. If, for example, the probability that one of the price bounds will be binding is zero, then the RHS terms are zero and λ is chosen such expected MACs across sectors are equalized

as is the case with a pure quantity-based regulation (compare with equ. ( 3 )).

Equations ( 5b ) and ( 5c ) bear out a similar interpretation. The LHS side, re-

spectively, reflects the objective to minimize MACs across sectors, now at the point where the price floor or ceiling binds for sector T . This has to be tradedoff against the additional costs created from shifting abatement between sectors shown on the RHS.

WEIGHTS AND CUTOFF LEVELS.—–

To further characterize ex-ante optimal hybrid policies with price bounds, we now investigate the ω

terms in conditions ( 5a )–( 5c ).

ω ’s reflects the relative importance of the two motives—equalization of sectoral

MACs vs. additional costs created by introducing price bounds—that have two be traded-off against one another when marginally changing policy variables λ , P , or

P . They can be interpreted as weights indicating how much the optimal hybrid policy deviates from the standard “equimarginal” pricing rule which would apply under a pure quantity-based regulation.

The hybrid policy only differs from a pure quantity control, if there exist states of the world in which price bounds are binding. We thus need to describe how the cutoff levels for the random variable in the ETS sector, ( λ, P ) and λ, P , and

COMBINING PRICES AND QUANTITIES UNDER PARTITIONED REGULATION 13 the cutoff levels for the allocation factor, λ ( λ, P ) and λ λ, P depend on policy choice variables. If the price floor is binding, cost-minimizing behavior of firms requires that marginal abatement costs equal the permit price at the bound. The lower cutoff level for

T and λ

(6a)

(6b)

∂C

T e

0

T

+ ( λ, P ) − λe, ( λ, P )

∂C

T e

0

T

∂a

T

+ − λ ( λ, P ) e,

∂a

T

= P = ⇒ ( λ, P )

= P = ⇒ λ ( λ, P ) .

To see how cutoff levels depend on policy choice variables, partially differentiate

( 6a ) and ( 6b ) with respect to policy choice variables to obtain:

(7a)

− 1

∂

∂P

∂

=

∂P

=

∂

2

C

T

∂a

T

∂a 2

T

∂

T

| {z } emissions uncertainty

+

∂

2

C

T

∂a

T

∂

T

| {z } technology uncertainty

| {z slope effect

}

=: ω

P

(7b)

∂

∂λ

∂

=

∂λ

= e

∂

2

C

∂a

2

T

T

| {z } reallocation effect

ω

P

=: ω

λ

.

(7c)

∂λ

∂P

∂λ

=

∂P

=

ω

P

ω

λ

=: ˜

P

.

The reaction of the cutoff levels for with respect to the price bounds depend on the slope of the MAC curve with respect to at the point where the price

bound binds. This is exactly what is borne out by Equ. ( 7a ) where the terms

in brackets on the RHS indicate the change in marginal abatement costs as changes—due to both affecting baseline emissions and technology, i.e. through the first and second arguments of C ( · ). The “slope effect” is the larger, the less strongly MAC react to changes in . The RHS thus shows how and change if marginal abatement costs change when the carbon price is at the price bound.

ω

P

in ( 5b ) and ( 5c ) is equal to the “slope effect”. Hence, if a given change in the

price bound induces a relatively large change in the cutoff level, a relatively large

10

Upper cutoff levels for

T and λ are defined correspondingly but are not shown for reasons of brevity.

11

Changing λ has not impact on the cutoff level for λ as every change in the ex ante allocation factor is ceteris paribus compensated for by an offsetting change due to adjusting sectoral targets ex post . Thus,

∂λ/∂λ = ∂λ/∂λ = 0 is omitted from the equations below.

14 weight is put on the RHS motive for setting the ex-ante optimal price bound.

Changing λ affects the cutoff levels for in two ways. First, similar to the case of a price bound, there exist a “slope effect”. For a given change in λ , the impact on the cutoff level is the larger, the smaller is the slope of the MAC with respect to . Second, an additional “reallocation effect” arises because changing λ changes how the economy-wide emissions target e is allocated across sectors. The magnitude of this effect depends on the slope of the MAC curve with respect to abatement; the steeper the MAC curve, the more the cutoff level changes in turn implying a larger shift of emissions targets between sectors. For a given change in λ , the more abatement is shifted due to both the slope and reallocation effects, the larger is ω

λ

, hence putting a larger weight on the RHS terms in ( 5a ) that

capture the additional costs created in the non-ETS sector. It is then ex-ante optimal to choose λ such that the expected difference between sectoral MACs is non-zero to take into account the additional costs brought about introducing the price bound.

The weight on the LHS of ( 5b ) and ( 5c ), ˜

P

, represents a combined effect as changing the price bound affects λ both directly and indirectly through impacting the cutoff level for . ˜

P reflects the slope of the MAC curve at the price bound.

The steeper is the slope, the less change MAC for a given change of the respective price bound, and hence the less weight is put on the LHS motive which seeks to equalize the expected MACs across sectors.

We can summarize these insights by the follow proposition:

PROPOSITION 4: The difference between the ex-ante optimal allocation factor

λ

∗ ex-ante under a hybrid policy with bounds price relative to a pure quantity-based environmental regulation is the larger,

(a) the higher is the probability that lower and upper price bounds will be binding, and

(b) the stronger the cutoff levels for

T

, at which the price floor or ceiling will be binding, react to λ . The magnitude of the latter effect inversely depends on the slope of the marginal abatement costs in the ETS sector with respect to

T

, reflecting both uncertainty about baseline emissions and firms’ abatement technology.

Proof: Use the definition for ω

λ

λ

The following corollary follows from inspecting terms on the RHS of ( 7a ) and

( 7c ), and is helpful to illustrate the role of uncertainty in baseline emissions for

the design of the ex-ante optimal hybrid policy with price bounds:

COROLLARY 1: The larger is the baseline emissions uncertainty, the more resembles the ex-ante optimal hybrid policy with price bounds a pure quantity-based regulation scheme.

Proof: Since

T affects abatement in a linear way, it follows that ∂a

T

Given strict convexity of C

ω

P and ω

λ

/∂

T

= 1.

are decreasing

COMBINING PRICES AND QUANTITIES UNDER PARTITIONED REGULATION 15 in the emissions uncertainty (holding technology uncertainty fixed). Using this

in FOCs ( 5a )–( 5c ) completes the proof.

Corollary

bears out an important insight. If the uncertainty in baseline emissions is relatively large, the ex-ante optimal hybrid policy puts more weight on equalizing the expected MACs between sectors rather than hedging against too large price differentials. While this may seem counter-intuitive at first, the reason for this is that higher emissions uncertainty can be more directly addressed by through λ . This follows immediately from the fact that more abatement, brought about by higher baseline emissions given the same sectoral emissions target, implies higher MAC given that MAC are strictly convex in abatement. Note that the same result does not apply for technology uncertainty as we cannot sign

∂

2

C

T

/ ( ∂a

T

∂

T

) on the RHS of ( 7a ) and ( 7c ).

F.

Ex-ante Optimal Policies with Abatement Bounds

We now turn to the situation in which the regulators impose a lower ( a ) and upper ( a ) bound on the amount of abatement in the ETS sector. In this case,

the objective function is similar as in the case with price bounds shown in ( 4 ).

Cutoff levels for

T and the allocation factor are again functions of policy choice variables with the difference that these now depend on abatement bounds rather than on price bounds, i.e.

( λ, a ), ( λ, a ), λ ( λ, a ), and λ ( λ, a ).

Under a hybrid policy with abatement bounds, the cutoff levels are implicitly

(8a)

(8b)

0

T

0

T

+ ( λ, a ) − λe = a = ⇒ ( λ, a )

+ − λ ( λ, a ) e = a = ⇒ λ ( λ, a ) .

Taking partial derivatives of expressions for the cutoff levels for with respect to policy choice variables yields: ∂/∂λ = ∂/∂λ = e and ∂/∂a = ∂/∂a = 1.

As baseline emissions uncertainty linearly affects abatement, a change in the allocation factor shifts the cutoff level by the same amount (taking into account that the allocation factor is defined as share of the total emission level). Similarly, a change in the abatement bound changes the cutoff level by the exact same amount. Policy variables impact the cutoff levels for λ as follows: ∂λ/∂λ =

∂λ/∂λ = 0 and ∂λ/∂a = ∂λ/∂a = − e

− 1

. As in the price bound case, a change in the fulfillment factor does not affect the endogenous fulfillment factor as every change is balanced by the amount reallocated. Changing the abatement bound requires decreasing the allocation factor in order to hold the quantity balance.

PROPOSITION 5: A hybrid policy with abatement bounds fails to exploit information on firms’ abatement technology when setting ex-ante minimum and

12

states the regulators’ objective functions for hybrid policies with abatement bounds.

13

Analogous definitions for the upper cutoff levels apply and are omitted for brevity.

16 maximum bounds on the permissible level of emissions.

Proof: Follows directly from comparing the partial derivatives of cutoff levels of

T and λ with respect to policy choice variables in the case of abatement bounds

with corresponding expressions in ( 7a )—( 7c ).

While Proposition

summarizes a basic insight that is not very surprising— namely that policies aimed at targeting quantities rather than prices an ETS sector do not incorporate any information about the price and hence marginal abatement costs of firms when determining abatement bounds—it bears out a strong implication and, in fact, foreshadows the main drawback of hybrid policies with abatement bounds when compared with policies with price bounds.

Due to their ability to make use of information on firms’ (marginal) abatement costs, hybrid policies with price bounds are better suited to cope with technology uncertainty. While a policy with abatement bounds is able to address baseline emissions uncertainty, it is not effective in dealing with risks that affect firms’ abatement technology. In contrast, a hybrid policy with price bounds can hedge against both types of uncertainty.

Using the definitions of cutoff levels, the FOCs for the ex-ante optimal hybrid

policy with abatement bounds can be written as:

(9a)

(9b)

(9c)

λ :

E

∂C

∂a

N

N

−

∂C

T

∂a

T a :

E

∂C

N

∂a

N

−

∂C

T

∂a

T a :

E

"

∂a

T

∂C

T

−

∂C

N

∂a

N

≤

T

T

≤ =

E

∆

N T

= −

E

[ ∆

N

|

≤ =

E

[ ∆

N

|

T

≥

#

=

E

∆

N

T

T

= ]

= .

T

= ]

The interpretation of FOCs is similar to the case of a policy with price bounds trading off again the expected difference in sectoral MACs (LHS) with the additional costs created by introducing abatement bounds (RHS). A key difference as compared to policies with price bounds is, however, that as abatement bounds are neither capable to infer information on the technology shock nor to include expectation changes in the slope of the MAC curves, all terms transporting information on firms’ abatement technology are missing. That is, all ω terms that

appear in FOCs ( 5a )–( 5c ) for policies with price bounds evaluate in the case of

policies with abatement bounds to unity (this follows directly from Proposition

We can now characterize the case in which ex-ante optimal hybrid policies with price or abatement bounds give rise to identical FOCs:

PROPOSITION 6: Optimal hybrid policies with abatement bounds or price bounds are identical from an ex-ante perspective if in the ETS sector (1) the MAC

14

Appendix

contains the derivations.

COMBINING PRICES AND QUANTITIES UNDER PARTITIONED REGULATION 17 curve is linear (i.e.

sent (i.e.

∂ 2 C

T

/ ( ∂a

T

∂

2

∂

C

T

T

/∂a

2

T

) = 0 ).

= const) and (2) technology uncertainty is ab-

Proof: Follows from comparing ( 5a )–( 5c

) with ( 9a )–( 9c ) and noting that

ω

λ and ω

P

= ˜

P

.

= 1

In this special case, the regulators ex-ante know the constant slope of the MAC curve. It is thus possible to set the minimum and maximum permissible levels of abatement in the ETS sector exactly such that emissions with the policy would be at the level implied by a corresponding optimal hybrid policy with price bounds.

It is important to note that the absence of technology uncertainty alone does not make both types of hybrid policies identical. Even if there was no technology uncertainty, a policy with price bounds would likely differ from a policy with abatement bounds as the latter discards available information on the secondorder properties of firms’ marginal abatement costs.

II.

Quantitative Framework and Empirical Implementation

The analysis carried out in the conceptual framework in the previous section reveals the theoretical effects of ex-ante optimal hybrid policies with price or abatement bounds relative to a (hypothetical) first-best policy, a pure quantitybased environmental regulation. In order to exploit the derived insights in an empirical application, we develop a quantitative framework to analyze the issue of hybrid policy design in the context of EU climate policy and the EU ETS.

We are interested in examining the effects of hybrid policies for controlling CO

2 emissions under the EU policy context of partitioned environmental regulation.

This section describes how we operationalize the theoretical framework presented in the previous section by (1) deriving MAC curves from a large-scale general equilibrium model of the European economy, (2) sampling MAC curves for representative firms the ETS and non-ETS sectors to reflect different types of uncertainty in an empirically meaningful way, and (3) detailing our computational strategy to solve for optimal hybrid policies.

A.

Derivation of Marginal Abatement Cost Functions

Following established practice in the literature

we derive MAC curves from a multi-sector numerical general equilibrium (GE) model of the European economy. The model structure and assumptions follow closely the GE model used in

B¨ ( 2016 ). The advantage of deriving MAC

curves from a GE model is that firms’ abatement cost functions are based on firms’ equilibrium responses to a carbon price reflect both abatement through changing the input mix and the level of output while also taking into account endogenously determined price changes on output, factor, and intermediate input

15

See, for example,

Klepper and Peterson ( 2006 ), B¨ ( 2009 ), and ohringer,

Dijkstra and Rosendahl ( 2014 ).

18 markets. By incorporating market responses on multiple layers, the derived MAC curves go beyond a simplistic technology-based description of firms’ abatement possibilities. The sectoral resolution of the model further enables us to separately identify sectors covered by the EU ETS system as well as non-ETS sectors which is critical for a model-based representation of the partitioned regulatory setup.

OVERVIEW OF GENERAL EQUILIBRIUM MODEL USED TO DERIVE MAC CURVES.—–

We briefly highlight the key features of the numerical GE model here. Appendix

contains more detail along with a full algebraic description of the model’s equilibrium conditions. The model incorporates rich detail in energy use and carbon emissions related to the combustion of fossil fuels. The energy goods identified in the model include coal, gas, crude oil, refined oil products, and electricity. In addition, the model features energy-intensive sectors which are potentially most affected by carbon regulation, and other sectors (services, transportation, manufacturing, agriculture).

It aggregates the EU member states into one single region.

In each region, consumption and savings result from the decisions of a continuum of identical households maximizing utility subject to a budget constraint requiring that full consumption equals income. Households in each region receive income from two primary factors of production, capital and labor, which are supplied inelastically. Both factors of production are treated as perfectly mobile between sectors within a region, but not mobile between regions. All industries are characterized by constant returns to scale and are traded in perfectly competitive markets. Consumer preferences and production technologies are represented by nested constant-elasticity-of-substitution (CES) functions. Bilateral international trade by commodity is represented following the

approach where like goods produced at different locations (i.e., domestically or abroad) are treated as imperfect substitutes. Investment demand and the foreign account balance are assumed to be fixed.

A single government entity in each region approximates government activities at all levels. The government collects revenues from income and commodity taxation and international trade taxes. Public revenues are used to finance government consumption and (lump-sum) transfers to households. Aggregate government consumption combines commodities in fixed proportions.

The numerical GE model makes use of a comprehensive energy-economy dataset that features a consistent representation of energy markets in physical units as well as detailed accounts of regional production and bilateral trade. Social accounting matrices in our hybrid dataset are based on data from the Global Trade

Analysis Project (GTAP) ( Narayanan, Badri and McDougall , 2012 ). The GTAP

dataset provides consistent global accounts of production, consumption, and bilateral trade as well as consistent accounts of physical energy flows and energy prices. We use the integrated economy-energy dataset to calibrate the value share and level parameters using the standard approach described in

Response parameters in the functional forms which describe production technolo-

COMBINING PRICES AND QUANTITIES UNDER PARTITIONED REGULATION 19 gies and consumer preferences are determined by exogenous parameters. Table

in the appendix lists the substitution elasticities and assumed parameter values in the model. Household elasticities are adopted from

and Armington trade elasticity estimates for the domestic to international tradeoff are taken from GTAP as estimated in

elasticities are own estimates consistent with the relevant literature.

B.

Sources of Uncertainty and Sampling of Marginal Abatement Cost Curves

To empirically characterize uncertainty in firms’ abatement technology and baseline emissions, we adopt the following procedure for sampling MAC curves for the ETS and non-ETS sector.

UNCERTAINTY IN FIRMS’ TECHNOLOGY.—–

Firms’ abatement costs depend on their production technology. For each sector (or representative firm in a sector), production functions are calibrated based on historically observed quantities of output and inputs (capital, labor, intermediates including carbon-intensive inputs).

To globally characterize CES technologies, information on elasticity of substitution (EOS) parameters are needed to specify second- and higher order properties of the technology. Given a calibration point, EOS parameters determine MAC curves. Unfortunately, there do not exist useful estimates for EOS parameters in the literature that would characterize uncertainties involved. We assume that

EOS parameters for each sector are uniformly and independently distributed with a lower and upper support of, respectively, 0 and 1.5 times the central case value

which we take from the literature ( Narayanan, Badri and McDougall , 2012 ). We

then create a distribution of 10’000 MAC curves by using least squares to fit a cubic function to the price-quantity pairs sampled from 10’000 runs of the numerical GE model. Each run is based on a random draw of all EOS parameters from their respective distribution. For each draw, we impose a series of carbon taxes from zero to 150 $ /tCO

2

Following the design of the EU ETS, we consider electricity, refined oils, and energy intensive industries to be part of the trading system. All remaining sectors, including final household consumption, are subsumed under the non-trading sector. We carry out this procedure for each partition independently thereby assuming that technology shocks across sectors are uncorrelated.

Figure

shows the resulting distribution of MAC curves for the ETS and non-

ETS sector It is apparent that the variation in the MAC estimates increases with the level of abatement. The MAC curves of the ETS sector tend on average to be less steep implying that firms’ in the ETS sectors bear a larger part of the

16

We assume that the carbon revenue, net of what has to be retained to hold real government spending constant in real terms, is recycled to households in a lump-sum fashion.

17

This is also driven by including the transport sector and final household consumption sector into the non-ETS sector. As the European transport sector is subject to high fuel taxes, this causes large

and costly tax interaction effects ( Paltsev et al.

, 2005 a ; Abrell , 2010 ). Furthermore, we exclude non-

CO

2

20

Figure 2. Distribution of sampled MAC curves for technology uncertainty

Note: The MAC curve of the ETS sector runs from left to right; the one for the non-ETS from right to left. Dotted lines and dark shaded areas refer, respectively, to the mean and the interquartile range.

BASELINE EMISSIONS UNCERTAINTY.—–

The distribution of baseline emissions for each sector is derived by applying the shock terms for the ETS and non-ETS sector on the respective “certain” baseline emissions ( e 0 i

) as given by the numerical GE model. We assume that shocks in both sectors follow a joint truncated normal distribution with mean zero and a standard deviation of .05 percent. Lower and upper bounds for the truncation are [ e

0 i

(1 − γ ); e

0 i

(1 + γ )]. We set γ = .

15. For our quantitative application, we have in mind the European economy around the year 2030. Assuming that baseline emissions grow with a maximum rate of ≈ 1% per year between 2015 and 2030, this would suggest about 15% higher emissions relative to e 0 i

At the same time we want to allow for the possibility of reduced baseline emissions while discarding unrealistically large reductions.

Shocks on sectoral baseline emissions are meant to capture both common GDP shocks, that equally affect both sectors, as well as sector-specific shocks. We thus consider alternative assumptions about the correlation between sectoral baseline emissions shocks; we consider three cases in which the correlation coefficient is

ρ = 0, ρ = − 0 .

5, and ρ = +0 .

5, respectively. Truncated normal distributions

are sampled using 100’000 draws using rejection sampling ( Robert and Casella ,

greenhouse gases from our analysis, in particular methane emissions from agriculture, which offer sizeable

abatement potential and relatively low cost ( Hyman et al.

18

Absent any changes in energy efficiency and structural change, this would correspond to an annual average growth rate of European GDP of the same magnitude.

COMBINING PRICES AND QUANTITIES UNDER PARTITIONED REGULATION 21

COMBINING UNCERTAINTIES AND SCENARIO REDUCTION.—–

The two types of uncertainty are assumed to be independent, i.e. we assume that technology uncertainty is not affected by the baseline emissions uncertainty. We can thus combine the two types of uncertainty by simply adding each technology shock on top of any baseline emission shock and vice versa. The size of the combined sample then comprises 1 e

5 × 1 e

4

= 1 e

9 observations.

To reduce computational complexity, we have to make use of scenario reduction techniques to approximate the distributions. Distributions for technology and baseline emissions uncertainty are approximated each using 100 points which reduces the total number of scenarios to 10’000. Approximation is done using k-

means clustering ( Hartigan and Wong , 1979 ) under a Euclidean distance measure

and calculating centroids as means of the respective cluster. For the technology distributions, we cluster on the linear coefficient of the MAC curve and derive the mean of the higher order coefficients of the cubic MAC function afterwards.

The original and reduced distributions, along with histograms and kernel density estimates of the respective marginal distributions, are shown in Figures

and

in the Appendix.

C.

Computational Approach

States of the world (SOW), indexed by s , are represented by MAC curves for the

ETS and non-ETS sectors, C is

—reflecting uncertainty in firms’ abatement technology and baseline emissions. Let π s denote the probability for the occurrence of state s . Under all policies, the regulators minimize expected total abatement costs

(10)

X

π s

C is s

0 is

− e is subject to an economy-wide emissions target e . ˜

0 is

≥ 0 and e is

≥ 0 denote the level of emissions under “no intervention” and with policy, respectively.

FIRST-BEST AND SECOND-BEST POLICIES WITH PURE QUANTITY CONTROL.—–

The computation of first-best and second-best policies with pure quantity control is straightforward as it involves solving standard non-linear optimization problems.

Under a first-best policy, regulators can condition instruments on SOWs thereby effectively choosing e is

. We can compute first-best policies by minimizing ( 10 )

subject to the following constraints

(11) e ≥

X e is i

( P s

) ∀ s which ensure that the environmental target e is always met.

P s is the dual variable on this constraint and can be interpreted as the (uniform) optimal firstbest emissions permit price.

22

Under the second-best policy with pure quantity control, the regulators decide ex ante on the split of the economy-wide target between sectors, i.e. they choose sectoral targets e i

≥ 0 independent from s . We compute second-best policies with

pure quantity control by minimizing ( 10 ) subject to following constraints:

(12a)

(12b) e ≥

X e i

( P ) i e i

≥ e is

( P is

) ∀ i, s .

( 12a ) ensures that the economy-wide target is met; the associated dual variable

P

is the expected permit price. ( 12b ) ensures that emissions in each SOW are equal

to the respective ex-ante chosen sectoral target. The associated dual variables are the ex-post carbon prices for each sector.

HYBRID POLICIES WITH PRICE AND ABATEMENT BOUNDS.—–

The problem of computing ex-ante optimal hybrid policies with bounds on either price or abatement falls outside the class of standard non-linear programming. The issue is that it is a priori not clear in what SOW the bounds will be binding. Cutoff levels, which define SOW in which bounds are binding, are endogenous functions of the policy choice variables. Hence, the integral bounds in the regulators’ objective function

( 4 ) are endogenous and cannot be known beforehand. We thus need to specify an

endogenous “rationing” mechanism that re-allocates emissions targets between sectors whenever one of the bounds becomes binding.

To this end, we use a complementarity-based formulation which explicitly represents “rationing” variables for lower and upper bounds denoted µ s and µ s respectively. They appear in the following constraints which ensure that ex-post

, emissions in each sector are aligned with the ex-ante emissions allocation:

(13) e i

+ 1

T

( i ) µ s

− µ s

≥ e is

⊥ P is

≥ 0 ∀ i, s where 1

T

( i ) is an indicator variable which is equal to one if i = T and − 1 other-

Condition ( 13 ) is similar to ( 12b ) in the pure quantity control case. The

formulation as complementarity constraints is advantageous here as it enables explicitly representing dual variables ( P is

). This allows us to formulate policies in terms of dual variables which is needed to a representation of the hybrid policies investigated here.

For the case of policies with price bounds, “rationing” variables µ s determined by the following constraints: and µ s are

(14a)

(14b)

P

T s

≥ P ⊥ µ s

P ≥ P

T s

⊥ µ

≥ s

0 ∀ s

≥ 0 ∀ s .

19 find

We use the perpendicular sign z ∈

R n such that F ( z ) ≥ 0, z ≥

⊥ to denote complementarity, i.e., given a function

0, and z

T

F :

R n

−→

R n

F ( z ) = 0, or, in short-hand notation, F ( z ) ≥ 0 ⊥ z ≥ 0.

,

COMBINING PRICES AND QUANTITIES UNDER PARTITIONED REGULATION 23

As long as the price is strictly larger than the price floor, µ s

= 0. If the price floor becomes binding, complementarity requires that µ s

> 0. In this case, the emissions budget in the T ( N ) sector decreases (increases), in turn increasing the price in the T sector.

For the case of abatement bounds, µ s constraints: and µ s are determined by the following

(15a)

(15b) a e

0 is

≥

− e e

0 is is

−

≥ a ⊥ µ s

E is

⊥ µ s

≥ 0 ∀ s

≥ 0 ∀ s .

The problem of optimal policy design can now be formulated as a Mathematical Program with Equilibrium Constraints

(MPEC) minimizing ( 10 ) subject to

constraints ( 12a ), ( 13 ), and either ( 14a ) and ( 14b ) for the case of price bounds

or ( 15a ) and ( 15b ) for the case of abatement bounds. This constitutes a bi-level

optimization problem where the upper level contains a mathematical programming problem which maximizes an objective function subject to a number of constraints. The lower problem is a complementarity problem that characterizes the “equilibrium” conditions for quantities (rationing variables) and shadow prices (state-contingent sectoral carbon prices).

As MPECs are generally difficult to solve due to the lack of robust solvers

The MCP problem comprises complementarity condi-

tions ( 13 ), ( 14a ) and ( 14b

) (for the case of price bounds), ( 15a ) and ( 15b ) (for

the case of abatement bounds), and an additional condition,

(16) C

0 is e

0 is

− e is

≥ P is

⊥ e is

≥ 0 ∀ i, s which determines firms’ cost-minimizing level of abatement in equilibrium. To

find policies that minimize ( 10 ), we perform a grid search over policy choice

variables e i and ( P , P ) or ( a , a

III.

Simulation Results

A.

Policy Context and Assumptions Underlying the Simulation Dynamics

Our quantitative analysis seeks to approximate current EU Climate Policy. Under the “2030 Climate & Energy Framework” proposed by the European Commis-

20

We use the General Algebraic Modeling System

(GAMS) software and the PATH solver ( Dirkse and

Ferris , 1995 ) to solve the MCP problem. We use the CONOPT solve ( Drud , 1985 ) to solve the NLP

problems when computing first-best and second-best pure quantity control policies.

21

We have used different starting values, ranges, and resolutions for the grid search to check for local optima. We find that total cost exhibit an U-shaped behavior over the entire policy instrument space thus indicating the existence of global cost minima.

24

sion ( EC , 2013 ), it is envisaged that total EU GHG emissions are cut by at least

40% in 2030 (relative to 1990 levels). As there is still considerable uncertainty regarding the precise commitment, and given that we do not model non-CO

2

GHG emissions, we assume for our analysis a 30% emissions reduction target which is

formulated relative to the expected value of baseline emissions.

The “Effort Sharing Decision” under the “‘2030 Climate & Energy Package”

( EC , 2008 ) defines reduction targets for the non-ETS sectors. We use this infor-

mation together with historical emissions data from the European Environment

Agency to calculate an allocation factor of ˆ = .

41 which determines the sectoral emissions targets under current EU climate policy.

B.

Ex-ante Assessment of Alternative Hybrid Policy Designs

We start by examining the ex-ante effects of hybrid policies with price and abatement bounds under partitioned environmental regulation relative to pure quantity-based regulation. We analyze hybrid policies in the context of first-

, second-, and third-best regulation. We first focus on the impacts in terms of expected costs which represent the regulators’ objective. We then provide insights into how alternative hybrid policies perform under different assumptions about the type and structure of uncertainty. Finally, we analyze the potential of hybrid policies to lower expected costs in alternative third-best settings.

IMPACTS ON EXPECTED COSTS.—–

Table

presents a comparison of alternative policy designs under first-, second-, and third-best policy environments in terms of expected abatement costs, policy choice variables, and expected carbon prices.

Under a first-best policy which can condition the allocation factor λ (or the uniform carbon price) on states of the world, the expected total abatement costs of reducing European economy-wide CO

2 emissions by 30% are 39.3 bill. $ with an expected carbon price of 86$/ton. 61% of the total expected costs are borne by the ETS sector. Uncertainty increases the expected costs of regulation in second- or third-best best policy environments relative to a first-best policy: if an ex-ante optimal λ can be chosen, costs increase by 2.6 bill.$ or by about 7%; a third-best policy in which λ is exogenously given increases costs by 13.5 bill.$ or by about one third. Importantly, second- and third-best policies using a pure quantity-based approach based on λ , bring about a significantly larger variation in sectoral carbon prices as is evidenced by both lower minimum and higher maximum ETS permit prices as well as larger standard deviations in expected carbon prices in the ETS and non-ETS sectors.

The expected excess costs of environmental regulation relative to a first-best policy are significantly reduced with hybrid policies. Under a second-best world, introducing ex-ante optimal price bounds in the ETS reduces the expected excess total abatement costs to 1.1 bill.$ which corresponds to a reduction of 56% (=

(1 .

1 / 2 .

6 − 1) × 100) in expected excess costs relative to a first-best policy. In the

22

Since we assume

E

( i

) = 0,

E e

0 i

+ i

= e

0 i

.

COMBINING PRICES AND QUANTITIES UNDER PARTITIONED REGULATION 25

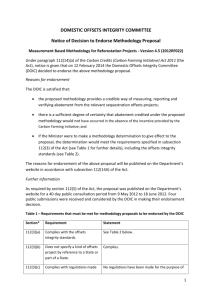

Table 1. Comparison of expected abatement costs, allocation factor and bounds for alternative policy designs under first-, second-, and third-best policy environments a

First-best policy

λ

∗

λ

∗

Second-best policies

λ

∗

, P , P λ

∗

, a, a

Third-best policies

Expected cost (bill. $/per year)

Total 39.3

ETS

Non-ETS

24.2

15.1

Ex-ante allocation factor λ optimal

41.9

25.4

16.6

.34

40.5

24.3

16.1

.34

40.6

24.7

15.8

.33

52.8

11.8

41.0

.41

40.8

24.1

16.6

.41

40.7

24.3

16.3

.41

Carbon permit price ($/ton CO

2

) in ETS min max

37

197

21

278

77

∗

101

∗

51

168

Probability that [lower,upper] price or abatement bound in ETS binds

– – [0.43,0.27] [0.35,0.5]

8

174

86

124

∗

∗

54

165

– [0.95,0] [0.98,0]

Expected carbon price ($/ton CO

2

) and stdev (in parentheses)

ETS

Non-ETS

86 (18)

86 (18)

89 (31)

89 (37)

87 (10)

88 (37)

88 (21)

87 (32)

50 (19) 86 (4) 87 (20)

156 (51) 88 (41) 89 (34)

Notes:

ˆ denotes the “third-best” exogenous allocation factor reflecting the share of the ETS emissions

budgets in total emissions based on current EU climate policy ( EC , 2008 ).

a

∗

Results shown assume negative correlation of baseline emissions shocks between sectors ( ρ = − 0 .

5).

Indicates ex-ante optimal floor and ceiling on ETS permit price.

∗∗

Indicates ex-ante optimal lower and upper bounds on abatement in ETS sector.

third-best world, the cost reduction is particularly large. Here, a ex-ante optimal policy with price bounds reduces expected excess costs to 1.4 bill.$ which equals a 89% (= (1 .

4 / 13 .

5 − 1) × 100) reduction in expected excess costs relative to first-best regulation. The effects of a hybrid policies with abatement bounds on expected costs are of similar magnitudes.

The reason why hybrid policies bring about sizeable reductions in expected costs of environmental regulation relative to pure quantity-based regulatory approaches is that they work as a mechanism to prevent too large differences in MACs between the ETS and non-ETS sectors. This can be seen by noting that the minimum and maximum carbon prices in the ETS sector under hybrid policies in both secondand third-best cases describe a more narrow range around the optimal first-best expected carbon price of 86. In addition, the standard deviation of the expected carbon price in the ETS sector decreases substantially.

While in the second-best cases hybrid policies provide a way to hedge against uncertainty limiting difference in MACs across both partitions, their effectiveness in the third-best cases rests, in addition to addressing uncertainty, on an additional effect stems from correcting the non-optimal allocation factor. ˆ = 0 .

41 as compared to the second-best λ

∗

= 0 .

34 means that there is too little abatement in the ETS sector (or, equivalently, an over-allocation of the emissions budget). By establishing a lower bound for the ETS price or the level of abatement in the ETS

26

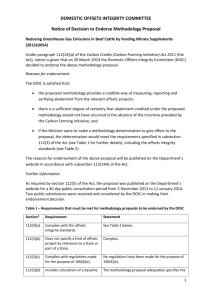

Table 2. Percentage reduction in expected excess abatement costs of hybrid policies relative to pure quantity-based regulation for alternative assumptions about uncertainty a

ρ =

( λ

− 0

∗

.

, P , P

5 ρ

Second-best policies

)

= 0 .

5

( λ

∗

, a, a )

Third-best policies

(

ˆ

) (

ˆ

)

Correlation in sectoral baseline emissions shocks

ρ = − 0 .

5 ρ = 0 .

5 ρ = − 0 .

5 ρ = 0 .

5 ρ = − 0 .

5 ρ = 0 .

5

Baseline emissions + technology uncertainty

56.4

10.2

50.3

0.2

89.3

76.1

89.8

75.1

Only baseline emissions uncertainty

63.4

0.4

63.4

Only abatement technology uncertainty

55.4

55.5

0

0.4

93.6

78.9

93.6

78.7

0 93.7

93.7

95.2

95.2

Note: a

Expected excess abatement costs are defined as the difference in expected costs relative to the first-best policy. Numbers above refer to percentage reductions in expected excess costs of a hybrid policy relative to the respective pure quantity control policy.

sector, hybrid polices effectively shift abatement from the non-ETS to the ETS sector. The lower price bound, set at 86$/ton, binds with a probability of 0.95; the lower bound on abatement binds with a similarly high probability of 0.98. As the motive to correct the non-optimal emissions split is particularly strong under the third-best case, hybrid policies work effectively as a carbon tax.

Introducing hybrid policies in the third-best delivers the same emissions reductions at virtually the same expected costs as would be obtained under second-best optimal hybrid policies; expected costs compared to a second-best optimal pure quantity policy are only slightly lower (about 1 bill.$). This result bears out an important policy implication: if it is politically infeasible to correct policy decisions which have been taken in the past, manifested here through an exogenously given allocation factor, adding price or abatement bounds to the existing policy can improve policy close to the optimum which could have been achieved with previous policy.

IMPACTS UNDER DIFFERENT ASSUMPTIONS ABOUT UNCERTAINTY.—–

In the absence of any uncertainty, there is no distinction between price and quantity controls, and hence no case for hybrid policies which combines elements of price and quantity control. To further investigate the performance of hybrid policies, we thus examine cases where we switch off either type of uncertainty (i.e. baseline emissions or abatement technology uncertainty). In addition, we analyze how the assumed correlation structure between sectoral baseline emissions shocks ( ρ ) affects results.

Table

summarizes the performance of hybrid policies relative to a pure quan-

tity control approach in terms of impacts on expected excess abatement costs

for different uncertainty assumptions.