Global Generics Guide, Third Edition

advertisement

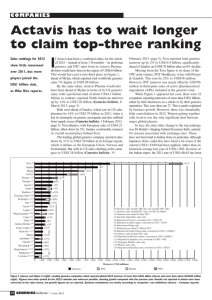

A Datamonitor Report Global Generics Guide, Third Edition Benchmarking Generics Company Capabilities and Strategy Published: Dec-04 Product Code: DMHC2034 Providing you with: • Capabilities and portfolio analysis of the top 20 generics companies operating in the US, Germany, UK, France, Spain and Italy Use this Report to... Identify the optimal portfolio management strategy for your company and the implications of those of your rivals • Case study-based insight into the effectiveness of 15 portfolio management, marketing and growth strategies available to generics players • Strategic profiles of 20 leading generics companies, including growth strategy, competitive positioning and alliance network analysis • Analysis of the country-specific patent expiries for global blockbuster drugs www.datamonitor.com/healthcare Global Generics Guide 3rd Edition: Benchmarking Generics Company Capabilities and Strategy DMHC2034 Introduction With cost-containment, a focus for all healthcare payers, the growth of the generics market is outpacing the branded sector by a considerable margin. However, the operating environment for generics is becoming increasingly competitive pushing existing players further up the pharmaceutical value chain. Brand and generics companies alike must be prepared for this new competition. The Global Generics Guide Third Edition: Benchmarking Generics Company Capabilities and Strategy provides in-depth analysis and insight into the current and future competitive environment within the generics markets of the US, UK, Germany, France, Spain and Italy. Based on comprehensive analysis of the capabilities and portfolios of the leading players in each market, Datamonitor maps the competitive landscape for generic versions of multiple formulation types in each country. Effective evaluation of the competitive environment facing your brand or generic is critical to successful strategic planning. Key findings and highlights • With 79.7% of 2003 blockbuster sales potentially exposed to generic competition by 2010, equating to $103.7 billion worth of products at 2003 sales value, the growth opportunities in the generics sector are significant. However, understanding how different country dynamics shape the competitive landscape is critical to evaluating risk and return. • Effective portfolio management is critical to future success in the generics market. Maintaining breadth of portfolio and low cost supply is critical for commodity generics players, forcing many players to evaluate higher value generic sectors, thus generating new competitors to brand pharma. • In the US, the generic injectables sector retains high barriers to entry, but in Europe, competitive analysis suggests that the market place is more crowded. As such, injectable products may represent a less valuable proposition to European generics players than US analysis would suggest. Reasons to buy • Identify the optimal portfolio management strategy for your company and the implications of those of your rivals • Identify the likely rivals to your brand or generic in each of the six major markets • Assess the implications of generics company strategic development on the success of your late-stage lifecycle management strategies For more information... Contact Neal Hansen, Lead Consultant - Lifecycle Management tel: +44 20 7675 7459 fax: +44 20 7675 7016 email: nhansen@datamonitor.com www.datamonitor.com/healthcare Sample pages from the analysis Key Generics Strategies for Success Partnerships case study – Teva To analyze the types of alliances entered by generics companies, Datamonitor has considered Teva as a case study. Teva, as might be expected of the world’s largest generics company, has an extensive network of alliances. These can be grouped under several alliance types: where Teva acts as a marketing partner; in-licensing and collaborations; technology licensing; and co-development or co-marketing. The most important of Teva’s alliances are outlined below: Generics Market Dynamics Figure 57: Teva’s alliance network Biovail Impax Andrx Israeli academic network Aventis Eisai Acorda BioGeneriX (ratiopharm) Co-development / Co-marketing Teva CAGR of sales of oral generic products, 1999-2003 (%) Lundbeck Figure 24: Leading generics companies’ sales in Germany of oral generic As a marketing Baxter products partner 40% In-licensing / Savient collaboration BetaPharm Technology 30% licensing CyDex Note: This is not an exhaustive list of Teva’s alliances Sandoz Woerwag Microbia NeuraxPharm 10% Teva -200 Active Biotech ratiopharm West Johann Lohmann Mylan, Watson, Schwarz and Par also have some topical sales, although these are of limited importance to each of these companies. Alpharma’s generic topical portfolio Alpharma has experienced a sharp decline over the last five years, from 12.6% to 5.7% of DATAMONITOR 200 400 800 1,000 1,200 company 600 sales. Verla 0% Source: Datamonitor; company reported information Acorda STADA Hexal Generics Market Dynamics 20% 0 PLIVA -10% Schwarz 2003 sales of oral generic products ($m) © Datamonitor (Published 12/2004) This report is a licensed product and is not to be photocopied 30% 20% 10% 0% Dr Reddy's Sanofi Abbott STADA Par Apotex Ranbaxy Sandoz ratiopharm Schwarz Impax PLIVA Alpharma IVAX Teva Barr Watson Mylan Taro Andrx BI Mayne APP Baxter Hospira Merck Biovail Global Generics Guide, 3rd Edition Percentage of sales of Top 20 products derived from each Product Class It is worth noting that of these four alliance types, the first three involveMajor a flowcompanies’ of strategic areas of focus Note: Bubble size represents the percentageand of total product or technology rights into Teva, whereas the co-development co-company Germany sales derived from oralSales products marketing deals involve the flow of product rights out of Teva (as indicated by of thethe top 20 products of each of the major participants in the US generics market Source: MIDAScompanies, sales data, IMSwho Health, Aprilhave 2004 been split according to the product type (commodity generic, specialty direction of the arrows in the figure). For Datamonitor; most generics have a generic, supergeneric or branded product); according to formulation (oral, modified lesser market presence than Teva, it could be expected that out-licensing deals D Atransdermal TAMONITOR release, injectable, inhalable or patch), and according to the magnitude would be more prevalent than in-licensing. of sales of the originator drug in the 12 months before its patent expiry. These figures, shown below, therefore give an insight into the current product focus of leading As a marketing partner (product sourcing) In line with their shares of the total generics market, the market. key players ratiopharm, companies within this Hexal and STADA also dominate the oral generics marketplace. Although ratiopharm Teva has an unmatched presence in the global generics market, and is seen as a also has a broad range of generic formulations, its oral franchise is stillofthe clear Figure 15: Sales breakdown major generics companies’ top 20 US “world-class marketer of generic pharmaceuticals” by its partner Impax. As a result, market leader. All three companies have seen very healthy growthsplit ratesby over the last products, product type (commodity, specialty, Teva has entered many deals to act as a marketing partner for companies with lesser five years, but Hexal and STADA appear to be closingsupergeneric the gap on ratiopharm’s oral or branded) generics business, with both Hexal and STADA realizing five-year CAGRs of well Global Generics Guide, 3rd Edition DMHC2034 over 20%, at 24.5% and 24.8% respectively. Within the smaller players, BetaPharm 100% © Datamonitor (Published 12/2004) Page 186 and Sandoz have both been achieving impressive 90% growth rates of 35.5% and 34.5% This report is a licensed product and is not to be photocopied respectively. NeuraxPharm’s unusual strategy 80% of focusing exclusively on one therapeutic area—CNS products—also appears70% to be paying dividends with its 22.6% Brand Supergeneric CAGR. At the other end of the scale, the oral60% businesses of Alpharma, PLIVA and Specialty Schwarz have not fared so well, with sales declining 50% at CAGRs of -0.2%, -2.7% and Commodity 5.1% respectively. 40% DMHC2034 Page 51 Source: Datamonitor; MIDAS sales data, IMS Health, April 2004 DATAMONITOR rd Global Generics Guide, 3 Edition © Datamonitor (Published 12/2004) DMHC2034 Page 38 This report is a licensed product and is not to be photocopied “...While the uptake of generics in the UK is expected to continue to rise, the increased competition will make it a less attractive market over the next five years...” Generics Company Executive Global Generics Guide 3rd Edition: Benchmarking Generics Company Capabilities and Strategy DMHC2034 Table of contents EXECUTIVE SUMMARY • GENERICS MARKET DYNAMICS • Key findings • Global market sizes - Future market potential • Company positioning - Geographic focus of major generics companies • Country-specific analysis - US Overview Company positioning by product type Major companies' strategic areas of focus Future market potential - UK Overview Major companies' strategic areas of focus Future market potential - Germany Overview Company positioning by product type Major companies' strategic areas of focus Future market potential - France Overview Company positioning by product type Major companies' strategic areas of focus Future market potential - Spain Overview Company positioning by product type Major companies' strategic areas of focus Future market potential - Italy Overview Company positioning by product type Major companies' strategic areas of focus Future market potential KEY GENERICS STRATEGIES FOR SUCCESS • Key findings • Overview Portfolio management strategies - Commodity generics focus Case study – Apotex Case study – Sandoz Outlook - Paragraph IV challenges Terms of 180-day exclusivity Potential revision of 180-day exclusivity provision 30-month stays An increasingly favourable environment for patent challenges Launching generics ‘at-risk’ The threat from 'authorized generics' Case study – Barr Laboratories Case study – Teva Case study – Ranbaxy Case study – Dr Reddy's Outlook - Specialty generics focus Modified-release generics Injectable generics Inhalable generics Topical generics Transdermal generics Products requiring regulatory support or handling restrictions Outlook - Supergenerics focus Is there a market for supergenerics? Regulatory situation Outlook - Biogenerics focus Uncertainty over regulatory situation Progress with the US regulatory pathway The EU regulatory pathway – one step ahead Early approvals – limited to first generation products? Cost and marketing of biogenerics Biogenerics development in the less regulated markets Companies well-placed to lead the biogenerics market Outlook For more information... Contact Neal Hansen, Lead Consultant - Lifecycle Management tel: +44 20 7675 7459 fax: +44 20 7675 7016 email: nhansen@datamonitor.com www.datamonitor.com/healthcare - Branded/innovative products focus - Key companies involved in in-house R&D Key companies involved in branded product licensing/acquisitions Outlook - Niche markets Case study – Impax Outlook - Therapeutic focus Case study – Barr, seizing the opportunity in women's health Case study – NeuraxPharm, entirely focused on CNS generics Case study – Alpharma in Germany Case study – Teva Outlook Marketing Strategies - Branded generics Specialty branded generics Branded generics in specific geographic markets such as Germany - 'Authorized' or 'friendly' generics Case study – Mylan, strongly opposed to authorized generics Case study – GSK's settlement with Par, authorizing generic Paxil Case study – STADA's ‘early entry’ with mirtazapine in Germany - Generic alliances Case study – Teva and Alpharma partnering on gabapentin Case study – licensing of first-to-file status for omeprazole Case study – Mayne Pharma licensing paclitaxel Growth Strategies - Vertical integration - - • • Advantages of integration Advantages of out-sourcing API - Geographical growth US companies Other companies - Growth through Mergers and Acquisitions - Partnerships - STRATEGIC COMPANY PROFILES • Financial measures - Benchmarking by profitability - Benchmarking by operating costs - Benchmarking by financial strength • Profiles of leading companies - Teva Pharmaceutical Industries - Sandoz - IVAX Pharmaceuticals - Merck KGaA - Watson Pharmaceuticals - Ratiopharm - Hexal - Barr Pharmaceuticals - Mylan Laboratories - Apotex - Alpharma - Ranbaxy - STADA - Par Pharmaceutical - PLIVA - Mayne Pharma - Taro Pharmaceuticals - Gedeon Richter - Andrx - Dr Reddy's APPENDIX TABLES Table 1: - API sourcing partnerships Marketing partnerships Partnerships case study – Teva Table 2: Table 3: Table 4: Table 5: Number of analyzed generics companies offering any oral and injectable generic products in each market, 2003 Size of key global generics markets, 2002-2003 Global positioning of major generics companies by sales US generic sales of selected leading generics companies, 2002-2003 German generics market shares of leading generics companies “...Successful players in the commodity generics markets must balance a broad portfolio with maximum geographic reach to generate economies of scale, while managing cost-effective producing and sourcing with a strong corporate brand image ...” Datamonitor Lead Consultant for Lifecycle Management Global Generics Guide 3rd Edition: Benchmarking Generics Company Capabilities and Strategy DMHC2034 Table 6: Table 7: Table 8: Table 9: French generics market shares of leading generics companies Analysis of Impax's top-selling generics, 2003 Profitabilities of leading generics companies, 2003, ranked by operating profitability Long-term financial stability of selected generics companies FIGURES Figure 1: Primary patent expiry years of 2003 blockbuster drugs Figure 2: Leading generics companies' US sales of injectable generic products Figure 3: Leading generics companies' sales in Germany of injectable generic products Figure 4: Percentages of analyzed generics companies offering any oral and injectable generic products in each market, 2003 Figure 5: Breakdown of the global generics market by sales Figure 6: Growth of major generics markets, 2002-2003 Figure 7: Generic penetration as a percentage of total pharmaceutical sales, by country Figure 8: Primary patent expiry years of 2003 blockbuster drugs Figure 9: Global positioning of selected major generics companies Figure 10: Geographic focus of major generics companies Figure 11: US generics market shares of leading generics companies Figure 12: Leading generics companies' US sales of oral generic products Figure 13: Leading generics companies' US sales of injectable generic products Figure 14: Leading generics companies' US sales of inhalable, topical and transdermal generic products Figure 15: Sales breakdown of major generics companies' top 20 US products, split by product type (commodity, specialty, supergeneric or branded) Figure 16: Sales breakdown of major generics companies' top 20 US products, split by product formulation Figure 17: Sales breakdown of major generics companies' top 20 US products, split by peak sales of originator's branded product Figure 18: US 2003 sales of blockbuster products that are expected to lose primary patent protection each year from 2003-2010 Figure 19: Sales breakdown of major generics companies' top 20 UK products, split by product type (commodity, specialty, supergeneric or branded) Figure 20: Sales breakdown of major generics companies' top 20 UK products, split by product formulation Figure 21: Sales breakdown of major generics companies' top 20 UK products, split by peak sales of originator's branded product Figure 22: UK 2003 sales of blockbuster products that are expected to lose primary patent protection each year from 2003-2010 Figure 23: German generics market shares of leading generics companies Figure 24: Leading generics companies' sales in Germany of oral generic products Figure 25: Leading generics companies' sales in Germany of injectable generic products Figure 26: Leading generics companies' sales in Germany of inhalable, topical and transdermal generic products Figure 27: Sales breakdown of major generics companies' top 20 products in Germany, split by product type (commodity, specialty, supergeneric or branded) Figure 28: Sales breakdown of major generics companies' top 20 products in Germany, split by product formulation Figure 29: Sales breakdown of major generics companies' top 20 products in Germany, split by peak sales of originator's branded product Figure 30: 2003 sales in Germany of blockbuster products that are expected to lose primary patent protection each year from 2003-2010 Figure 31: French generics market shares of leading generics companies Figure 32: Leading generics companies' sales in France of oral generic products Figure 33: Leading generics companies' sales in France of injectable generic products Figure 34: Leading generics companies' sales in France of inhalable, topical and transdermal generic products Figure 35: Sales breakdown of major generics companies' top 20 products in France, split by product type (commodity, specialty, supergeneric or branded) For the full list of figures, email hcinfo@datamonitor.com with ‘DMHC2034 TOC’ in the subject line. For more information... Contact Neal Hansen, Lead Consultant – Lifecycle Management tel: +44 20 7675 7459 fax: +44 20 7675 7016 email: nhansen@datamonitor.com www.datamonitor.com/healthcare Datamonitor: Your total information solution Datamonitor is a premium business information company helping 5,000 of the world's leading companies across the Automotive, Consumer Markets, Energy, Financial Services, Healthcare and Technology sectors. Our products and services are specifically designed to support our clients’ key business processes - from corporate strategy to competitive intelligence. We provide an independent and trustworthy source of data, analysis and forecasts to improve these processes and ultimately, to help grow your business. Corporate Strategy & Business Planning Make more effective strategic and business decisions Quality Data Product Development & Commercialization Accelerate delivery of commercial success Expert Analysis Targeting & Influencing the Market Market & Competitive Intelligence Future Forecasts Assess and influence your commercial and market environment HELPING TO GROW YOUR BUSINESS Maintain or obtain critical competitive advantage Nobody speaks louder than our clients 3M Abbott Accenture Alcon Labs Allergan Almirall-Prodesfarma Altana Pharma AG Amersham Amgen Amrad Angelini Acraf AstraZeneca AT Kearney Aventis Baxter Bayer Healthcare AG Beaufour Ipsen Biochemie Biogen Boehringer Ingelheim Boots Bristol-Myers Squibb Vernalis Cantab Caremark International Chiesi Chiron Chugai CMC Co Daiichi Deutsche Morgan Grenfell Elan Eli Lilly Esteve Flamel Fournier Fujisawa Gehe Genzyme Gilead Gist Brocades GlaxoSmithKline IBM Immuno AG Johnson & Johnson Jouveinal LEK Lipha Lundbeck Merck KGaA Merck & Co Millennium Pharmaceuticals Nabi Biopharmaceuticals Novartis Novo Nordisk Pfizer Pharmachemie Pierre Fabre Pliva Procter & Gamble Ranbaxy Recordati Sankyo Sanofi-Synthélabo Schering AG Schering-Plough Schwarz Pharma AG Serono Shire Pharmaceuticals Solvay Pharmaceuticals Takeda TAP Pharmaceutical Teva UCB Uriach Viatris Wyeth 89% of our clients use Datamonitor research to develop competitive intelligence Source: Datamonitor Customer Research Global Generics Guide 3rd Edition: Benchmarking Generics Company Capabilities and Strategy DMHC2034 Interested in this topic? Datamonitor’s 21st Century Insight SPP provides access to detailed research and analysis on a comprehensive range of strategic issues within the global pharmaceutical industry, with actionable recommendations to support your strategic decision-making. • • • • Sales and Marketing R&D and Licensing Pricing and Pharmacoeconomics Business Development Related products available Benchmarking Best Practice at Patent Expiry in Europe – Maximizing Return on Investment of Late-Stage Lifecycle Management Analyzes the impact of patent expiry, combined with in-depth insight into the regulatory and cost-containment policies shaping the post-patent market, competitive landscape and key stakeholder opinions in the five major EU markets Published: Dec-04 Product code: DMHC2061 Benchmarking Best Practice at Patent Expiry in the US – Maximizing Return on Investment of Late-Stage Lifecycle Management Analyzes the impact of patent expiry, combined with in-depth insight into the regulatory and cost-containment policies shaping the post-patent market, competitive landscape and key stakeholder opinions in the US market Published: Dec-04 Product code: DMHC2055 Maximizing Product Returns Through Reformulation: Old Molecules, New Opportunities Reviews reformulation activity within the pharmaceutical industry, employing in-depth case study analysis to examine the success of reformulations launched between 1999 and 2003 Published: Aug-04 Product code: DMHC1994 Biogenerics: Drivers and Resistors of Market Development Gauges the status of biogenerics market development in the US and EU, focusing on regulatory issues, barriers to entry, market potential and strategies of the likely key players Published: Apr-04 Product code: DMHC2019 * Please refer to our website www.datamonitor.com/healthcare for up-to-date prices. You can search for a product by Title or Product Code. For more information on these and other related analyses, go to: www.datamonitor.com/healthcare Subscribe to Healthcare Monitor A monthly update of the latest Healthcare products, events, news and special offers from Datamonitor, delivered to you by email. To subscribe email your contact details to hcmonitor@datamonitor.com with Subscribe in the subject line. www.datamonitor.com/healthcare Place your order now... Fax back to +44 20 7675 7016 (from Europe) or 212 686 2626 (from the US) I would like to order: Product title Product code Price £ / € / $ / ¥ * __________________________________________________________________ ___________________ __________________ __________________________________________________________________ ___________________ __________________ __________________________________________________________________ ___________________ __________________ __________________________________________________________________ ___________________ __________________ __________________________________________________________________ ___________________ __________________ __________________________________________________________________ ___________________ __________________ __________________________________________________________________ ___________________ __________________ __________________________________________________________________ ___________________ __________________ * Please refer to our website www.datamonitor.com/healthcare for up-to-date prices. You can search for a product by Title or Product Code. Complete your details: Complete payment details: Name Please indicate your preferred currency option: UK£ Euro€ US$ Yen¥ I enclose a check payable to Datamonitor plc for _________ (+ p+p $30 UK / $60 rest of world) Job Title Please invoice my company for _______________________ Department (+ p+p $30 UK / $60 rest of world) Please debit my credit/charge card Company Amex Visa Diners Mastercard Address Card No ______________________________________________________________________ State/Province Expiry Date _________ / _________ Cardholder Signature ___________________________ Cardholder address____________________________________________________________ Post Code/ZIP Please supply purchase order number here if required by your accounts department: Country _____________________________________________________________________________ Email EU companies (except UK) must supply: VAT / BTW / MOMS / MWST / IVA / FPA number: Tel ___________________________________________________________________________________________ Fax Datamonitor products and services are supplied under Datamonitor’s standard terms and conditions, copies of which are available on request. Payment must be received within 28 days of receipt of invoice. Sign below to confirm your order: I do not want to receive future mailings from Datamonitor and its related companies. ______________________________________________________________________ Occasionally, our client list is made available to other companies for carefully selected mailings. Please check here if you do not wish to receive such mailings. DMHC2034WEB From Europe: tel: +44 20 7675 7171 fax: +44 20 7675 7016 email: hcinfo@datamonitor.com From the US: tel: +1 212 652 5333 fax: +1 212 686 2626 email: usinfo@datamonitor.com From Asia Pacific: tel: +61 2 9006 1526 fax: +61 2 9006 1559 email: apinfo@datamonitor.com Contact us to find out more about our products and services