ACC 372 David Erkens Spring 2013-1

ACCT 372 – Internal Reporting Issues

Syllabus – Spring 2013

Section 14050R 8:00 – 9:50am MW

Section 14051R 10:00 – 11:50am MW

Section 14052R 12:00 – 1:50pm MW

Professor: David H. Erkens

Office: HOH 817

Office Phone: 213/740-9318

Office Hours: 4:00 – 5:00 MW, additional hours before quizzes and exams (see schedule below for these hours); and by appt.

(also feel free to email me at any time).

E-mail: erkens@marshall.usc.edu

COURSE DESCRIPTION

This is an intermediate course in management accounting. The Institute of Management

Accountants defines management accounting as:

“a value-adding continuous improvement process of planning, designing, measuring and operating non-financial and financial information systems that guides management action, motivates behavior, and supports and creates the cultural values necessary to achieve an organization’s strategic, tactical and operating objectives.”

There are three things that I would like to highlight about this definition. First, it indicates that management accounting involves the preparation and use of information for internal management purposes. Given that these purposes are very different from those of financial accounting, the accounting is very different as well. Second, management accounting is a process that cuts across the entire organization. Therefore, at least some of the material covered in this course will be relevant to you, no matter what kind of organization you work in and what role you play in that organization. Finally, management accounting includes many different types of information, both financial and non-financial.

This course will focus on cost accounting: There are many different ways of computing costs, and it takes a high level of understanding to know which cost figures to use for a specific decision-making purpose. Specifically, I will help you understand the differences between socalled “traditional” cost accounting systems, which allocate most indirect costs on the basis of direct labor hours or dollars, and the more complex, often more accurate, but more difficult to implement, “activity-based” cost systems. You will see that these two types of systems can yield dramatically different reported cost figures and decisions, even though the company’s real economics do not change. I also want you to learn to be appropriately skeptical when you see a cost report. Just because a number is printed on a computer report does not make it true. Cost accounting systems are just models of reality, and there are good and bad models.

1

LEARNING OBJECTIVES

I have designed the course with the following overarching learning outcomes in mind:

To gain knowledge about key concepts and principles that characterize the discipline of

Management Accounting

To become proficient in using managerial accounting information for decision-making in real-world business environments

To learn how to design systems that will produce relevant management accounting information for decision making and decision influencing

To develop capacity to design and implement strategies to solve problems and classes of problems in various organizational settings

REQUIRED MATERIALS

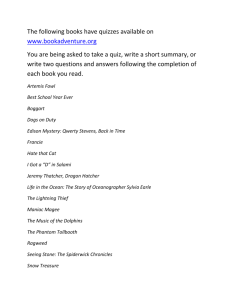

Hongren, Charles T., Srikant M. Datar, and Madhav Rajan [HDR]. 2011. Cost

Accounting: A managerial Emphasis. 14 th

Edition. Upper Saddle River, NJ: Prentice Hall

NOTE: A customized paperback with selected chapters of the text is available at the USC

Bookstore.

Other materials including five case studies will be distributed in class

GRADING

Best 3 Quiz Scores (each 10%)

Mid Term Examination

Final Examination (cumulative)

Total

30%

30%

40%

100%

Quizzes and Exams

Quizzes will include multiple-choice questions and short problems/spreadsheets. Exams will include multiple-choice questions, brief essay questions, and longer problems/spreadsheets. You will be allowed to use simple calculators on quizzes and exams (you must use the calculators that

I provide to you in accordance with Leventhal School policy). Preparing for these quizzes and exams is facilitated by keeping up with the work in class, reworking problems that we have done in class, and trying other problems in MyAccountingLab (accompanies your text).

Grade Determination

Final grades represent how you perform in the class relative to other students. Your grade will not be based on a mandated target, but on your performance. Historically, the average grade for this class is about a B+ (3.3). Three items are considered when assigning final grades: (1) your total score (see above), (2) the median score for the class, and (3) your ranking among all students in the class.

2

Class Participation

It is important for you to attend class every day, be well prepared, and act professionally, which among other factors implies being on time. There are several reasons why this is important. First, material we cover in class is what is considered most important for the course, and therefore is what you will be tested on. Second, quizzes and exams start promptly at the beginning of class; late arrivers will not be given extra time to complete them. Third, I will keep track of your participation during each class. The top contributors in each section (defined as the top 15%-20%, depending on how close the final participation scores are) will be eligible to receive a 1/3 letter grade increase in their final letter grade (e.g., instead of a B- you will receive a B). The scores that I give you will reflect the quality of your contributions to class. High quality contributions include: discussion of relevant points about cases and exercises that demonstrate the student has prepared in advance; insightful questions and/or comments; the use of logical arguments to illustrate or make a point; constructive feedback to the discussion, including counter arguments to the points that have been raised in class; and participation that pushes the discussion of the cases to a higher level.

Policy for Regrading Quizzes and Exams

If you believe that your quiz or exam has been graded in error, I am happy to regrade your paper if you do the following. For a simple mistake, such as an addition error or a multiple-choice answer marked wrong incorrectly, please just show me the error. For a more complicated issue such as a debate about an essay answer or an answer to a longer problem, please put your concern in writing. You must explain why you believe your answer is correct, where “correct” is defined by the solution sheet. NOTE: For either type of issue, you must contact me within 10 days of receiving the quiz or exam. If I do not receive a request for regarding within 10 days of your receipt of the quiz or exam, the grade will be considered final. Additionally, I reserve the right to regrade the entire quiz or exam.

Policy for Making up Quizzes and Exams

Unless you have my prior approval, you MUST take quizzes and exams in the section for which you are registered. The policy of the Leventhal School of Accounting is that you should not miss quizzes/exams unless there is a very serious emergency AND you can properly document this emergency. Also, to the extent possible, you must inform me of the emergency prior to the quiz/exam. If you miss a quiz/exam for something other than a serious emergency and/or you cannot provide documentation, you will receive a grade of -0- on the quiz/exam. If there is a serious emergency and you can provide proper documentation and, where possible, notify me of the situation prior to the quiz/exam, I will not give a makeup quiz/exam. Instead, I will determine your grade from the remaining exams and the quizzes. That is, I will “gross up” the points from the other components of your grade. This policy works to your advantage for two reasons. First, it is impossible to create makeup exams that are of the exact same level of difficulty as the original exam, which often results in the makeup exam being more difficult. Second, if you have experienced an emergency, your performance on an exam shortly thereafter likely would be compromised.

3

ABOUT YOUR PROFESSOR

David H. Erkens is an assistant professor of the Leventhal School of Accounting. He received his

Ph.D. in Business Administration from Arizona State University with a concentration in accounting. He earned his M.E. from Maastricht University in International Management, after which he worked as an associate auditor for PricewaterhouseCoopers.

Professor Erkens specializes in teaching managerial accounting at USC and has done so at the undergraduate, graduate and doctoral level. His research focuses on the determinants and effects of expertise as it relates to management control systems, particularly controls related to compensation arrangements and corporate governance. His research has been published in the Journal of Accounting Research, Journal of Corporate Finance, and The Accounting

Review and has been covered by the press, such as Agenda, CFO Magazine and The Economist.

MARSHALL GUIDELINES

Add/Drop Process

If you miss the first two weeks of the course, I will ask an administrator to drop you from the course. This is so that everyone who wants the chance to take the course will have that chance.

Web registration will be open during the first week of class. After that, I will add people based on the wait list that I am maintaining.

Retention of Graded Coursework

I return all quizzes and exams to you after they are graded. If you are not present on the day a quiz or exam is returned, I will continue to bring the quiz or exam to class for one week after the initial return attempt. After that, I will maintain quizzes and exams in my office for you to pick up during office hours. Any quizzes or exams not picked up will be shredded at the end of the

2014 spring semester.

Technology Policy

Laptop and Internet usage is not permitted during academic or professional sessions. Use of other personal communication devices, such as cell phones, is considered unprofessional and is not permitted during academic or professional sessions. ANY e-devices (cell phones, PDAs, I-

Phones, Blackberries, other texting devices, laptops, I-pods) must be completely turned off during class time. There will be plenty of time for using these devices during class breaks.

Videotaping faculty lectures is not permitted due to copyright infringement regulations.

Audiotaping may be permitted if approved by me. Use of any recorded or distributed material is reserved exclusively for the USC students registered in this class.

Statement for Students with Disabilities

Any student requesting academic accommodations based on a disability is required to register with Disability Services and Programs (DSP) each semester. A letter of verification for approved accommodations can be obtained from DSP. Please be sure the letter is delivered to me (or to your TA) as early in the semester as possible. DSP is located in STU 301 and is open 8:30 a.m.–

4

5:00 p.m., Monday through Friday. The phone number for DSP is (213) 740-0776. For more information visit www.usc.edu/disability .

Statement on Academic Integrity

USC seeks to maintain an optimal learning environment. General principles of academic honesty include the concept of respect for the intellectual property of others, the expectation that individual work will be submitted unless otherwise allowed by an instructor, and the obligations both to protect one’s own academic work from misuse by others as well as to avoid using another’s work as one’s own. All students are expected to understand and abide by these principles. SCampus , the Student Guidebook, ( www.usc.edu/scampus or http://scampus.usc.edu

) contains the University Student Conduct Code (see University Governance, Section 11.00), while the recommended sanctions are located in Appendix A.

Students will be referred to the Office of Student Judicial Affairs and Community Standards for further review, should there be any suspicion of academic dishonesty. The Review process can be found at: http://www.usc.edu/student-affairs/SJACS/ . Failure to adhere to the academic conduct standards set forth by these guidelines and our programs will not be tolerated by the USC

Marshall community and can lead to dismissal.

Emergency Preparedness/Course Continuity

In case of a declared emergency if travel to campus is not feasible, USC executive leadership will announce an electronic way for instructors to teach students in their residence halls or homes using a combination of Blackboard, teleconferencing, and other technologies.

IMPORTANT DATES FOR SPRING 2013 (SECOND HALF – SESSION 442)

First Day of Class

Last Day to Add or Drop w/out a “W” for ACCT courses

Spring Break

Last Day to Drop with a “W” for ACCT courses

Last Class Meeting

Final Examinations

Commencement

Mon., March 11

Mon., March 18

Mon. – Sat., March 18-23

Mon., April 15

Wed., May 1

Wed.-Wed., May 8– 15

Fri., May 17

5

COURSE SCHEDULE

1

2

3

4

5

6

7

8

9

No.

10

Mon. 3/11

Wed. 3/13

Mon. 3/18

Wed. 3/20

Mon. 3/25

Wed. 3/27

Fri. 3/29

Mon. 4/1

Wed. 4/3

Fr. 4/5

Mon. 4/8

Wed. 4/10

Mon. 4/15

Wed. 4/17

Fri. 4/19

Reading Assignments Problems to Try Office Hours

Getting Reacquainted to Cost Terms and Purposes

Job Costing

Spring Break

Spring Break

Process Costing

Quiz 1: Covers class 1 and 2

Process Costing (continued)

HDR: Ch. 1, 2, 3, and

10

HDR: Ch. 4 and

Seligram Inc. Case

HDR: Ch. 17

Forrest Gump Case 4:00-5:00pm

Case problems are listed on slides for class 1

4:00-5:00pm

HDR: Problems 17-30 through 17-32

4:00-5:00pm

HDR: Ch. 18 HDR: Problems 17-33 and 17-34

HDR: Problems 18-17 through 18-20

4:00-5:00pm

10:00am – Noon, and 3:30-4:30pm

4:00-5:00pm Spoilage, rework and Scrap

Quiz 2: Covers HDR Ch. 17

Spoilage, rework and Scrap

(continued) and Midterm Review

Midterm: Covers class 1 through 6

Allocation of Support-Department

Costs, Common, Costs, and Revenues

Cost Allocation: Joint Products and

Byproducts

Activity-Based Costing and Activity-

Based Management

HDR: Ch. 15

HDR: Ch. 16

HDR: Ch. 5 and

Destin Brass Case

HDR: Problems 18-35 through 18-38

4:00-5:00pm

HDR: Problems 15-17 through 15-20 (only linear equations), 15-32, and 15-33

HDR: Problems 16-32,

16-33, and 16-37

10:00am – Noon, and 3:30-5:00pm

4:00-5:00pm

4:00-5:00pm

4:00-5:00pm

Case problems are listed on slides for class 9

4:00-5:00pm

10:00am – Noon, and 3:30-5:00pm

15

Class

No.

11

12

13

14

Date

Mon. 4/22

Wed. 4/24

Fr. 4/26

Mon. 4/29

Wed. 5/1

Fri. 5/10

Topic(s)

Cost Allocation and Customer-

Profitability Analysis

Quiz 3: Covers class 8 and 9

Pricing Decisions and Cost

Management

Pricing Decisions and Cost

Management (Continued)

Quiz 4: Covers class 10 and 11

Review of all materials

Mon. 5/13 from

4:60-6:30pm

Final Exam: Covers all materials covered during course

Reading Assignments Problems to Try Office Hours

HDR: Ch. 14 (skip sales variance analysis) and Kanthal

Case

HDR: Ch. 11 and 12

Case problems are listed on slides for class 10

4:00-5:00pm

4:00-5:00pm

Nissan Motor Corp

Case

10:00am – Noon, and 3:30-5:00pm

Case problems are listed on slides for class 12

4:00-5:00pm

4:00-5:00pm

10:00am – Noon, and 2:00-5:00pm