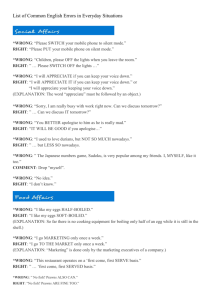

ECON 436 Quiz 2

advertisement

ECON 436 Quiz 2 Name___________________________________ Number_______________________ Honor Pledge: I swear on my honor that I have not received any help from anyone during this quiz. MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) Assume the interest rate is 7 percent on euro-denominated assets and 5 percent on dollar-denominated assets, and assume that the dollar is expected to appreciate 4 percent against the euro next year. Then for French investors the expected relative rate of return from holding dollar-denominated assets relative to euro-denomainated assets is 1) A) 8 percent. B) 2 percent. C) 5 percent. D) 3 percent. E) 16 percent. Answer: B 2) Suppose that the Federal Reserve Bank of U.S. decreases the interest rate and enacts expansionary policy. Everything else held constant, this will cause the demand for TL denominated assets to ________ and the TL to ________. A) increase; depreciate B) decrease; depreciate C) decrease; appreciate D) increase; appreciate 2) Answer: D 3) Suppose that the new Social Security Law went into effect and cost of labor decreased significantly in Turkey. This development will _________ prices of exported goods produced in Turkey. Also, TL will _________ against other currencies. 3) A) increase / depreciate B) decrease / appreciate C) decrease / the answer depends on current exchange rate of TL against Euro. D) increase/ not change Answer: B 4) An increase in the real interest rate paid on TL assets causes the demand for TL denominated assets to ________ and the TL to ________, everything else held constant. A) increase; appreciate B) decrease; appreciate C) increase; depreciate D) decrease; depreciate Answer: A 1 4) 5) Suppose a report was released today that showed the Euro-Zone (group of countries that use Euro as their currency) inflation rate is running above the European Central Bank's inflation rate target. Everything else held constant, the release of this report would immediately cause the demand for U.S. assets to ________ and the U.S. dollar will ________. A) increase; depreciate B) decrease; depreciate C) decrease; appreciate D) increase; appreciate 5) Answer: D 6) Assume that the following are the predicted inflation rates in these countries for the year: 2% for the United States, 3% for Canada; 4% for Mexico, and 5% for Brazil. According to the purchasing power parity and everything else held constant, which of the following would we expect to happen? 6) A) The Brazilian real will depreciate against the U.S. dollar. B) The Canadian dollar will depreciate against the Mexican peso. C) The Mexican peso will depreciate against the Brazilian real. D) The U.S. dollar will depreciate against the Canadian dollar. Answer: A 7) Suppose that there is a positive development in Turkey-EU relations and the expected value of TL against Euro in December 2008 increases. Everything else held constant, this will cause the demand for TL denominated assets to ________ and the TL to ________. A) increase; appreciate B) increase; depreciate C) decrease; depreciate D) decrease; appreciate 7) Answer: C 8) Suppose that Central Bank of Turkey decreases the interest rate due to pressures from textile exporters. Everything else held constant, this will cause the demand for TL denominated assets to ________ and the TL to ________. A) increase; depreciate B) decrease; appreciate C) decrease; depreciate D) increase; appreciate 8) Answer: C 9) Suppose that the Turkish government reduces the tariffs on foreign cars imported into the country. Everything else held constant, this will cause the TL to ____________. A) appreciate B) the answer depends on current exchange rate of TL against Euro. C) depreciate D) not change Answer: C 2 9) 10) Suppose that the European Central Bank conducts an open market sale and reduces the supply of Euro. Everything else held constant, this would cause the demand for TL assets to ________ and the TL will ________against Euro. A) increase; appreciate B) increase; depreciate C) decrease; depreciate D) decrease; appreciate 10) Answer: C 11) Suppose that there is a negative development in Turkey-EU negotiations due to the lawsuit that was opened against AK party. Suppose also that this development caused expected annual rate of inflation in Turkey in year 2008 to increase from 8% to 11%. Everything else held constant, this will cause the demand for TL denominated assets to ________ and the TL to ________. A) decrease; appreciate B) decrease; depreciate C) increase; appreciate D) increase; depreciate 11) Answer: B 12) Suppose that a Whopper menu at Burger King is 7 Euros in Germany and 10 TL in Turkey. Then, according to law of one price, the TL/Euro exchange rate should be equal to A) 1.90 TL/Euro B) 0.70 TL/Euro C) 3 TL/Euro Answer: C 3 D) 1.43 TL/Euro 12)