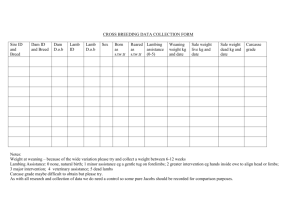

THE NONTRADITIONAL LAMB MARKET: CHARACTERISTICS AND

advertisement