Span Capital Services SCS HOLD

advertisement

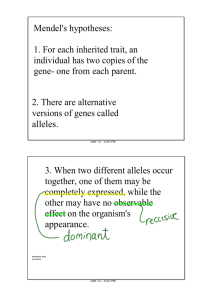

Span Capital Services SCS HOLD Mukta Arts Ltd. (Rs56) Mukta Arts Ltd., is a major movie production house with a market cap of Rs1.26bn (USD26m). Company's latest big budget movie 'Yaadein' (Starring: Superstar Hritik Roshan, Kareena Kapoor and directed by mega-director: Subhash Ghai) did not perform well at the boxoffice. We estimate total revenue from 'Yaadein' to be Rs249m, in CY01, much lower as compared to 'Laagan' and 'Gadar', the blockbusters of the year. Territory Indian Theatrical Overseas Theatrical Indian Music Overseas Music In Cinema Ads Satellite Rights*** DVD/VCD Rights** Total,Rsm Avg. Rev/Territory Yaadein Gadar* Laagan* 112 183 118 21 30 50 65 15 70 16 15 30 30 0 0 10 50 40 5 10 10 259 303 318 37 43 45 * For 10 Weeks, ** Expected, *** Expected after one Year. In CY02, Mukta is expected to release three mid-budget movies including 'Badhai Ho Badhai', in collaboration with 'Kaushik & Kapoor' and a movie directed by David Dhavan. Next big budget Subhash Ghai movie will be released only in CY03. Company has de-risked its business model by entering into studio & equipment hiring business and Non-film music video. We expect a 2 Yr. CAGR of 101% to Rs407m and -17% earnings to Rs42m by CY02. Equipment division is expected to contribute Rs86m at a CAGR of 42%. The company trades at 30.4x CY02, 175% premium to Balaji Telefilms Ltd. (11.1x FY02), though Rs850m+ in cash (Rs38/ per share) is a positive. We initiate coverage with a HOLD. Brief Financial: Year To Dec Revenue, Rsm Earnings, Rsm % Change OPM % NPM % ROE % EPS, Rs PE@Rs56 CY99 237 66 1062% 40% 28% 74% 2.9 19.2 CY00 CY01E CY02F 101 352 407 60 81 42 -9% 34% -48% 66% 33% 17% 60% 23% 10% 9% 7% 3% 2.7 3.6 1.8 21.0 15.7 30.4 Recent Quarterly: Yr to Dec Revenue, Rsm Expenses EBDIT PBT Tax PAT 2QCY01 123 45 78 40 0 40 Q-o-Q 527% 310% 805% 136% 0% 136% CY00 Y-o-Y 101 -57% 34 -76% 66 -30% 77 -15% 17 -32% 60 -9% Key Ratios: CY99 Mcap to Sales Sales to Gross Receivable Days Inventory Days 5 3 22 1 CY00 CY01E CY02F 11 3 3 1 2 1 64 29 31 366 93 67 Stock Market Data: BSE Code BSE Index 3-mth avg daily vol,mn 52 week H/L Promoter Holding 532357 2600 0.8m 295/52 68% Key Data: Market Capitalization Issued Shares Price To Book- CY00A Next Result Stock Price Performance: Rs1.3bn/USD26m 22.6m 1.1x 3QCY01 www.muktaarts.com Earning Statement: Yr to Dec (Rsmn) Film Division Equip. Division Music Album Net OI CY99 228 8 0 237 Expenses Film Production Equipment Division Version Releases Music Album Admin & Selling Pre. Exp. W/off Total Expenses Cash Flow Statement: CY00 CY01E CY02F 58 284 311 43 63 86 0 5 10 101 352 407 129 0 0 0 185 14 280 20 2 0 11 0 142 4 0 26 5 34 0 2 28 6 235 0 5 25 6 336 Oper. Income Other Income Gross Income 95 2 97 66 24 91 117 43 160 71 59 129 Financial Charges Insurance Cover* Depreciation PBT Tax PAT 0 0 6 91 25 66 0 0 14 77 17 60 1 39 25 95 14 81 0 39 32 58 17 42 2.7 21.0 3.6 15.7 1.8 30.4 Yr to Dec (Rsmn) CY99 Sources of Funds Net Profit 66 Depreciation 6 Inc in Equity Capl 0 Inc in Share Pre. 0 Inc in Loan Funds -66 Inc in Curr. Lia. 8 Inc in Provis 20 Total 33 Applications of Funds Dividends 0 Tax on dividend 0 Inc in Gross 2 Inc in CWIP 0 Inc in Investment -16 Inc in Inventories -46 Inc in Debtors 13 Inc in L & A 20 Inc in Misc Exp 0 TOTAL -28 Op cash bal ADD / (Deficit) Cl bal of cash CY00 CY01E CY02F 60 13 30 971 1 54 48 1177 81 25 0 0 -2 -39 -59 5 42 32 0 0 0 10 3 86 0 0 110 0 830 100 2 85 46 1174 0 0 42 0 100 -11 10 -79 -6 55 0 0 92 0 4 -16 8 3 -6 85 69 4 72 72 -50 22 22 1 23 8 61 68 * Insurance Cover For Subhash Ghai EPS, Rs PE@Rs56 2.9 19.2 Balance Sheet: Yr to Dec (Rsmn) Share Capital Share Premium Res & Surplus Networth CY99 0.1 0 121 121 Secured Loans Unsecured Total Loan Total Application of Funds Gross Block Depreciation Net Block Net Investment Investments Current Asset Inventory Debtors Cash & Bank Loans & Adv. Sundry Creditors Provisions Net Curr. Assets MiscExp.Not Woff Total 0 2 2 123 CY00 CY01E CY02F 113 113 113 971 971 971 99 180 221 1183 1264 1305 2 0 2 1185 0 0 0 1264 0 0 0 1305 70 30 40 40 4 180 43 138 138 834 222 68 154 154 934 314 100 214 214 938 149 1 20 69 60 45 25 79 0 123 340 101 22 72 145 99 73 167 46 1185 209 90 32 22 66 60 14 136 40 1264 205 75 39 23 69 70 17 119 34 1305 Key Statistics & Ratios: Yr to Dec CY99 Business Growth Revenue 459% Earnings 1062% Margins OPM 40% Pre-Tax 38% NPM 28% Profitability ROE 74% ROA 53% CY00 CY01E CY02F -57% -9% 249% 34% 16% -48% 66% 77% 60% 33% 27% 23% 17% 14% 10% 9% 9% 7% 7% 3% 3% Price Sensitivity: CY99 Price/ EPS 30 55 90 115 140 165 3 10 19 31 39 48 57 CY00 3 11 21 34 43 53 62 CY01E CY02F 4 2 8 16 15 30 25 49 32 62 39 76 46 90 PE Sensitivity: CY99 EPS 5x 10x 15x 20x 25x 30x 3 15 29 44 58 73 87 CY00 3 13 27 40 53 67 80 CY01E CY02F 4 2 18 9 36 18 54 28 71 37 89 46 107 55 Quarterly Trend: Yr to Dec (Rs.mn) Income Overflow Income Equipment Division Movie Territory Rights Sale Music Rights Sale Net Operational Income Other Income Total Income 1QCY01 2QCY01 15 3QCY01E 4QCY01E CY01E CY00A 16 163 63 198 91 352 43 395 25 101 24 125 33 43 5 20 14 33 15 27 81 123 9 132 179 10 189 17 8 5 30 11 40 Expenditure Cost of Software Admn. And office Exp. Other Expenditure Total Expenditure 0 10 1 11 37 8 0 45 148 15 1 163 0 10 6 16 185 43 7 235 3 26 5 34 Gross Profit Financial Charges* Depreciation PBT Tax PAT 22 0 5 17 0 17 87 39 7 40 0 40 26 0 7 19 0 19 25 0 7 18 0 18 160 40 25 95 14 81 91 0 14 77 17 60 * 2QCY01 Financial charges includes Insurance Premium of Rs39m. Margins % OPM NPM 44% 87% 63% 33% 9% 11% 48% 61% 33% 23% 66% 60% EPS- Annualized PE@Rs56 3.0 18.6 7.1 7.9 3.4 16.5 3.2 17.3 3.6 15.7 2.7 21.0 Mukta Movies: Territory Territory Category/ Film 1 Indian Theatrical Revenue 2 Overseas Theater Sale 3 Indian Music Rights 4 Overseas Music Rights 5 In Cinema Ads 6 Satellite Rights 7 DVD/ VCD Rights Total Revenue, Rsmn Average Territory Revenue, Rsmn Rahul* Yaadein 15 112 12 21 25 65 4.7 16 0 30 1 10 0 5 49 259 7 37 * Revenue for Rahul Adjusted for Return of Rs7.5mn to Distributors ** Badhai Ho Badhai @ David Dhavan Directed Film # Satish Kaushik Directed Film BhB** DDDF@ SKDF# 66 82 61 15 20 15 15 20 7.5 4 8 3 1 1 1 5 5 5 1.5 2 1.5 107 137 94 15 20 13