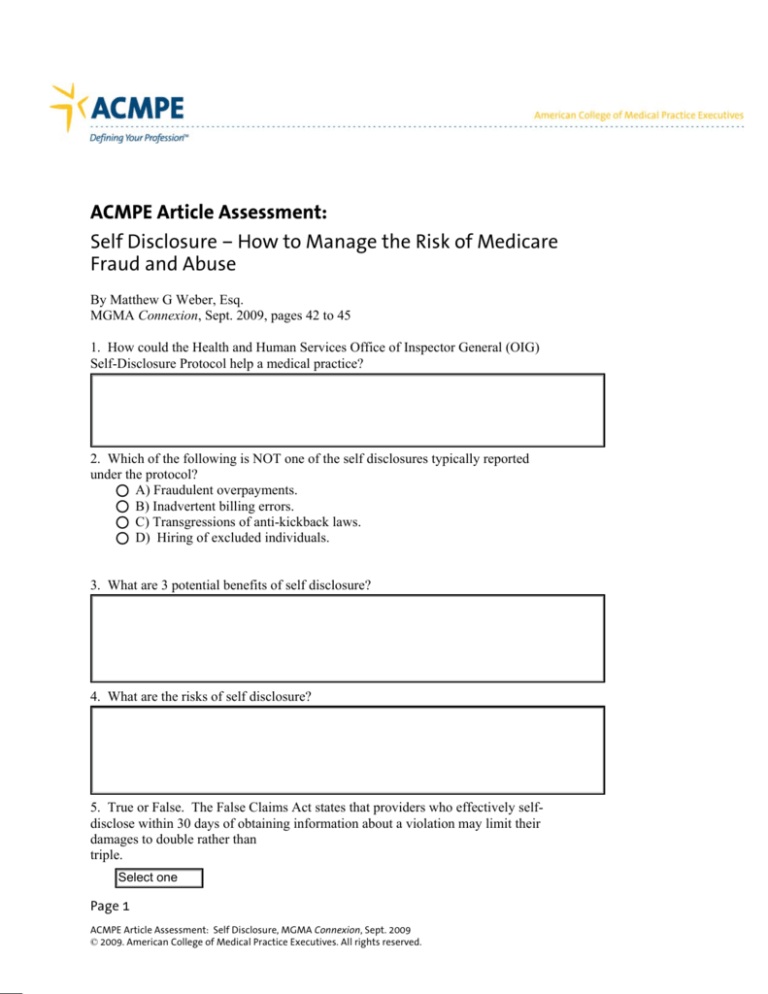

ACMPE Article Assessment:

Self Disclosure – How to Manage the Risk of Medicare

Fraud and Abuse

By Matthew G Weber, Esq.

MGMA Connexion, Sept. 2009, pages 42 to 45

1. How could the Health and Human Services Office of Inspector General (OIG)

Self-Disclosure Protocol help a medical practice?

2. Which of the following is NOT one of the self disclosures typically reported

under the protocol?

A) Fraudulent overpayments.

B) Inadvertent billing errors.

C) Transgressions of anti-kickback laws.

D) Hiring of excluded individuals.

3. What are 3 potential benefits of self disclosure?

4. What are the risks of self disclosure?

5. True or False. The False Claims Act states that providers who effectively selfdisclose within 30 days of obtaining information about a violation may limit their

damages to double rather than

triple.

Select one

Page 1

ACMPE Article Assessment: Self Disclosure, MGMA Connexion, Sept. 2009

© 2009. American College of Medical Practice Executives. All rights reserved.

6. Name at least 3 factors to take into account when considering self disclosure.

7. What are the 5 steps in an action plan to support the decision making and self

reporting process?

8. What documents should be preserved when your practice receives notice that a

federal investigation may take place?

9. Which of the following is NOT an aim of the remediation plan?

A) End the noncompliant conduct.

B) Cover up future abusive conduct.

C) Improve procedures, policies, controls and systems.

D) Train members of the practice in appropriate conduct.

10. How does self-disclosure normally end?

Page 2

ACMPE Article Assessment: Self Disclosure, MGMA Connexion, Sept. 2009

© 2009. American College of Medical Practice Executives. All rights reserved.

Answer key:

1. In appropriate cases, notifying the government of your organization’s error could

mitigate the potentially catastrophic consequences of a fraud and abuse violation.

2. B) Inadvertent billing errors can be handled through other avenues such as

reporting to the Medicare contractor.

3. The OIG may be more lenient toward providers who follow the protocol. The

practice may avoid the presumptive imposition of a corporate integrity agreement

and your practice will have the opportunity to cast the disclosed incident in a manner

that avoids misunderstandings.

4. The protocol provides no guarantees of leniency and resolving issues through

self-disclosure can be expensive and disrupt daily operations and employee morale.

Providing information to the government may create waiver issues related to the

attorney-client privilege and work-product protections.

5. True.

6. The strength of the evidence of intent to defraud. The likelihood of a

whistleblower coming forward. The strength of compliance programs. The

likelihood of criminal exposure and whether disclosure should be made to the OIG

or another agency.

7. Define the scope, preserve relevant documents, investigate, remediate and audit.

8. Hard-copy and electronic files including emails.

9. B.

10. Through settlement.

To obtain ACMPE continuing education credit for completing this assessment, go to

mgma.com/myTranscript and enter your credit in the Distance Learning, Assessment

category on the continuing education entry system. This assessment is worth 1 hour

of credit.

Page 3

ACMPE Article Assessment: Self Disclosure, MGMA Connexion, Sept. 2009

© 2009. American College of Medical Practice Executives. All rights reserved.