Key Points & Facts: Arizona Christian Tuition v. Winn

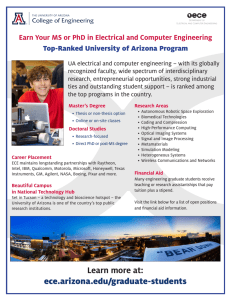

advertisement

Key Points & Facts: Arizona Christian Tuition v. Winn “THE CASE” ‐link to http://topics.law.cornell.edu/supct/cert/09‐987 ‐additional analysis Amici Curiae Catholic Tuition Organization of the Diocese of Phoenix (CTODP) Catholic Tuition Support Organization of the Diocese of Tucson (CTSO) Jewish Tuition Organization (JTO) New Way Learning Academy (NWLA) Lutheran Education Foundation (LEF) Each amici is a § 501(c)(3) Arizona non‐profit corporation What is an STO? How do STOs work? The Arizona Legislature created STO tax credits to encourage individuals and corporations to invest in private education. STOs are private actors organized to support private education. Other private actors – including parents, schools, and community groups ‐ are free to create STOs and organize in the same manner. STOs freely decide which private schools will advance their goals, and may choose to employ a wide variety of limiting principles for the schools they associate with and the scholarships they provide. Each STO must convince each taxpayer each year to take advantage of the tax credit and to contribute to that particular STO. Taxpayers are free to utilize the tax credit by donating to the STO of their choice and, similarly, are free to decide against utilization. STOs reflect and effectuate the private choices of parents, schools, and taxpayers, free of any government endorsement of, hostility to, or preference for religiously based education. Respondents’ Challenge: Respondents do not object to the existence of STOs generally, nor do they object to the eligibility of non‐religious STOs that support only schools organized around a particular educational method or certain children’s special needs. Respondents challenge only those STOs that have decided to provide scholarships solely to students whose parents choose religious schools. Ninth Circuit’s Position: Unlike Arizona, which has remained completely neutral concerning the placement of children and scholarship dollars in participating schools, the Ninth Circuit’s position is not position is not neutral. The Ninth Circuit’s position requires Arizona to exclude religiously based expressive associations from the otherwise­free educational marketplace. The Ninth Circuit’s insistence that each STO be all things to all people by offering religious and non‐religious options would undermine the very freedom of association that the Arizona Legislature attempted to enable. Furthermore, such a blatant limitation of associational rights would cripple many, if not all, STOs by interfering with their ability to compete in the marketplace of educational ideas for the support of private contributors. The Establishment Clause does not impose the constraints suggested by the Ninth Circuit on the private choices of private parties. Key Points from Amicus Brief: ARIZONA HAS CREATED A VIBRANT EDUCATIONAL MARKETPLACE IN WHICH STO‐SPONSORED PRIVATE EDUCATION IS BUT ONE SET OF MANY VOICES o The Arizona legislature has enacted a comprehensive program of public and private school choice to advance the secular goal of improving the quality of education by expanding all kinds of educational options The STO tax credit is only one aspect of a dynamic public and private marketplace of educational ideas and programs available to Arizona families. Because Zelman requires courts to consider “all options” available to Arizona parents and children, the fact that Arizona offers the following educational alternatives is highly relevant: Traditional district‐based public schools Open enrollment policy (a mandate that was successfully designed to increase competition among public schools in order to improve the quality of public education by allowing for untraditional inter‐district student movement) 502 charter schools, each of which has a unique focus, proving children with valuable public alternatives to traditional public schools Home schooling Private schools o The STO tax credit is part of a neutral, generally applicable “genuine system of tax laws” which was designed to encourage private‐sector investments in a variety of beneficial activities, including public and private schools. In addition to requiring courts to consider “all options” available to Arizona parents and children, Zelman requires courts to consider all options available to Arizona taxpayers. Like other states and the federal government, Arizona uses tax credits to encourage a wide variety of private investments Specifically, the Arizona Legislature provides several tax credits that encourage private contributions to both private and public education. o The aggregate amount of all public school tax credits taken from 2002‐2009 was almost identical to the aggregate amount of all private school tax credits taken. o Because a substantial portion of STO tax credit funds end up at non‐religious schools, the total amount of tax credit funding that goes to non‐ religious schools outweighs funding that goes to private religious schools. Example: In 2009, public schools and non­religious STOs receive over two­ thirds (68.12%) of the available private tax credit funding. Importantly, the power to decide which STOs receive money rests in the hands of the private taxpayers who privately decide which credits to take and which organizations they wish to support, or not support, each year. ARIZONA’S STO TAX CREDIT CREATES A MARKETPLACE FOR THE EXPRESSION OF VIEWPOINTS o Arizona’s school­choice program provides four layers of private choice 1. Parents are free to choose to educate their children at any public school, to educate them at home, or to select private education 2. Private citizens ‐ including parents and schools‐ are free to create STOs. So, if existing STOs do not adequately serve the needs and interest of particular groups of parents or schools, those groups can and do create new STOs to meet their needs. 3. Private citizens organized as STOs decide which private schools and scholarships will advance their respective educational goals. 4. Each private taxpayer must decide for themselves on a yearly basis (a) whether to make a contribution; (b) whether to claim the tax credit, take a charitable deduction, or do nothing at all; and (c) how to allocate the credit that they are entitled. o STOs freely decide whether to adopt limiting principles, and which limiting principles, if any, to adopt STOs come in many “flavors” because they are driven by the variety of ideas that Arizonans believe in. The diversity and size of STOs reflect the diversity of the school communities they support. Because Arizona law allows taxpayers the flexibility to support different STOs from year to year and to split their contributions between different STOs in a single year, STOs must compete for taxpayer support. Many STOs depend on expressive association to define their organization in a way that encourages continued contribution: An STO’s statement of purpose defines the STO and the messages it will use to persuade taxpayers to donate Some STOs choose to exercise their freedom of association and encourage contribution by supporting all children and all schools. Most STOs exercise their freedom of association and encourage contribution by distinguishing among the individuals and institutions they will support through the adoption of limiting principles. The types of schools and students an STO supports may be defined by a wide variety of limiting principles, such as geography, special needs, culture, extreme financial need, pedagogical philosophy, shared non‐sectarian school characteristics, self‐selected school groupings, and religious instruction. While many STOs privately choose to adopt limiting principles, they are not encouraged to do so by the government. Furthermore, Arizona does not encourage taxpayers to contribute to any particular kind of STO. Thus, no reasonable observer would perceive any government favoritism for a particular type of STO, taxpayer choice, or type of private school. In making their philosophical and educational judgments, STOs operate in the same manner as private scholarship organizations that are funded solely by tax‐deductable charitable contributions. o Scholarship funds flow to religious schools only because they follow parent’s demand. The U.S. Supreme Court has rejected rules that would evaluate facially neutral laws under the Establishment Clause based on who benefits from time to time at least twice. (See Zelman 526 U.S. at 657; Mueller, 463 U.S. at 401). The law at issue in this case has already been found to be facially neutral. STO funds have followed students and schools as a matter of private choice, not government policy. Importantly, the results of private choices do not provide grounds for invalidating the tax credit under the Establishment Clause. Many STOs give all, or a sizeable portion, of their scholarship funds to students at religious schools because many families prefer to sent their children to those schools, and have helped direct taxpayer contributions to STOs that can fund their particular preferences. Parents do not need, want, or have the state’s encouragement to choose a religious option, nor are they the passive victims of others’ choices. Rather, parents directly drive choices made by STOs and schools to provide religious education. THE NINTH CIRCUIT’S DECISION DISCRIMINATES ON THE BASIS OF EXPRESSION o Respondents challenge “only those STOs that restrict scholarships to religious schools,” rather than challenging STOs in general or STOs that restrict scholarships by some other limiting principle. Though the amici STOs are private actors, Respondents seek to use the Establishment Clause to force them to change their focus and message in order to gain access to a marketplace that is open to all other STOs. o In addition to the fact that the First Amendment does not require private actors to alter their message to gain access to such a forum, a federal decree that the only STOs forbidden from soliciting funds are “those STOs that restrict scholarships to religious schools” would convey a very direct message that religious associations are disfavored in the public square, and that some Arizona taxpayers are “more equal than others.” o The Ninth Circuit’s opinion has “create[d] an inevitable, pervasive, and serious risk of chilling protected speech” and expressive association and should be overturned. Citizens United, 130 S. Ct at 891. For, as the Citizens United Court recently stated, “the Government may commit a constitutional wrong when by law it identifies certain preferred speakers.” 130 S. Ct. at 899. o The Ninth Circuit has no business regulating the content of speech; as the Supreme Court recently stated, “[b]y taking the right to speak from some and giving it to others, the Government deprives the disadvantaged person or class of the right to use speech to strive to establish worth, standing, and respect for the speaker’s voice.” Citizens United, 130 S. Ct. at 899. o The First Amendment protects speech and associational freedom – particularly in the intellectual, expressive realm of education – and it would be the irony of ironies to allow the First Amendment to be used to undermine the legislative and executive branches’ endorsement of private choice and to deprive citizens of their ability to select religious objectives for their private action.