THE ARIZONA BUSINESS LAWYER

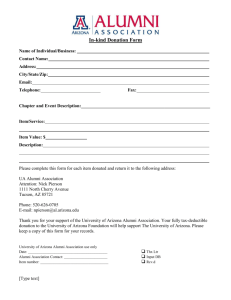

advertisement

THE ARIZONA BUSINESS LAWYER VOLUME 1 what’s inside Can the Implied Covenant of Good Faith and Fair Dealing Override Express Contract Terms . . . . . . .1 Business Law Rocks! . . . . . . . . .3 From Software to Softwar . . . . . . .4 Business Law Section Executive Council . . . . . . . . . . . . . . . . . . . .7 Letter from the Section Chair . . .12 Fundamentals of Business Valuation and Their Application in Legal Disputes - Part II . . . . . . .14 Legal Fees in Business Law Controversies . . . . . . . . . . . . . .16 Author Biographies/Photos . . . .18 NOVEMBER 2002 No. 2 CAN THE IMPLIED COVENANT OF GOOD FAITH AND FAIR DEALING OVERRIDE EXPRESS CONTRACT TERMS? By: Anne L. Kleindienst T he Arizona Court of Appeals in its recent opinion in Bike Fashion Corp. v. Kramer, et al., 46 P.3d 431, 373 Ariz. Adv. Rep. 12 (Ariz. Apps. 2002), reflects on the "turbid" state of the law on the relationship between the express terms of a written contract and the implied covenant of good faith and fair dealing. 46 P.3d at 434. A very fitting description for an area of law that is indeed confused and a bit cloudy. Following the lead of the Arizona Supreme Court earlier this year in Wells Fargo Bank v. Arizona Laborers, Teamsters and Cement Masons Local No. 395 Pension Trust Fund, et al., 201 Ariz. 474, 38 P.3d 12 (2002), the Court of Appeals in Bike Fashion Corp. nevertheless confirms that there are circumstances when express terms of a written contract may be effectively overridden by the implied covenant of good faith and fair dealing. It is well established in Arizona that a covenant of good faith and fair dealing is implied in every contract. Wagenseller v. Scottsdale Memorial Hospital, 147 Ariz. 370, 710 P.2d 1025 (1985); Rawlings v. Apodaca, 151 Ariz. 149, 726 P.2d 565 (1986); see also Restatement (Second) of Contracts § 205 (1981). The covenant is applied to protect the rights of contracting parties to receive the benefits of their agreement. Hence, the Arizona Supreme Court has recognized that the inquiry necessarily must focus on the contract itself to determine the parties' agreement. Wagenseller v. Scottsdale Memorial Hospital, 147 Ariz. at 385; Rawlings v. Apodaca, 151 Ariz. at 154. With respect to the relationship between the implied covenant and a contract's express terms, the Arizona courts have generally applied the rule that the implied covenant cannot contradict an express contract term or, stated in another way, cannot require conduct inconsistent with the contract. Hence, the Supreme Court in Wagenseller held that the implied covenant of good faith and fair dealing in an at-will employment contract did not create a duty for the employer to terminate the employee only for good cause. 147 Ariz. at 385. Similarly, the Supreme Court in Rawlings declined to apply the implied covenant of good faith and fair dealing to an insurance contract to require the insurer to pay claims that were expressly not covered by the contract. 151 Ariz. at 155. In the more recent Wells Fargo case, the Arizona Supreme Court appears to have adopted a more expansive view of the implied covenant's relationship with express contract terms. Wells Fargo arose from the well-publicized Mercado Project involving Arizona's former Governor, J. Fife Symington, III. At issue in Wells Fargo was a Triparty Agreement among Mercado Developers, a partnership headed by Symington and the project’s developer; Wells Fargo's predecessor, First Interstate Bank (the "Bank"), which provided interim construction financing for the project; and various union pension funds (the "Funds"), which had commit- “there are circumstances when express terms of a written contract may be effectively overridden by Editor-in-Chief, Paul J. Buser paulbuserlaw@scottsdaleandphoenix.org Phone: (480) 951-1222 Fax: (480) 951-2568 Contributing Editor, William D. Black william@bblaw.com This newsletter is published by the Business Law Section of the State Bar of Arizona the implied covenant of good faith and fair dealing.” Continued on page 2 The Arizona Business Lawyer (Vol. I, #2) • November 2002 1 IMPLIED COVENANTS OF GOOD FAITH – CONTINUED FROM PAGE 1 ted to provide permanent financing for the project. Under the Triparty Agreement, the Funds could refuse to provide the permanent financing necessary to take-out the Bank if certain conditions were not met or if the Funds were dissatisfied with Symington's financial condition. Also, under the terms of the Triparty Agreement, the Funds were entitled to receive from the Bank financial information on the status of the Mercado construction loan if requested by the Funds. The Triparty Agreement expressly provided, however, that the Bank "shall have no obligation to comply with any of the terms, conditions and provisions of Permanent Commitment [of the Funds] but may, at its election, satisfy such requirements on behalf of Borrower". Wells Fargo v. Arizona Laborers, Teamsters and Cement Masons Local No. 395 Pension Trust Fund, 201 Ariz. at 480. Under the terms of the Permanent Commitment, Symington was expressly obligated to provide specific financial information to the Funds. The Funds complied with the terms of the Permanent Commitment and, pursuant to the Triparty Agreement, took out the Bank on its interim construction loan on or about June 30, 1990. Symington defaulted on the permanent loan in 1992 and filed for bankruptcy after the Funds obtained judgments against Symington personally in 1995. The Funds later claimed that the Bank was guilty of wrongdoing during the months leading up to the June 30, 1990 permanent commitment funding date, allegedly taking actions in concert with Symington which the Funds claimed were intended to make Symington appear to be financially strong and to deprive the Funds of any reason to refuse to fund the Permanent Commitment. The Bank then filed a complaint seeking a declaratory judgment that it had complied with and performed all of its contractual obligations under the Triparty Agreement. Included in the Funds’ counterclaims was the allegation that the Bank’s actions constituted a breach of the covenant of good faith and fair dealing implied in the Triparty Agreement. The trial court entered summary judgment for the Bank on all claims finding that the Bank, among other matters, owed no contractual duty to the Funds to disclose information about Symington's financial condition. The Court of Appeals affirmed. The primary focus of the Supreme Court in Wells Fargo when addressing the Funds’ implied covenant claim was on the Funds’ 2 reasonable expectations. The fact that the express terms of the Triparty Agreement did not require the Bank to make disclosures to the Funds regarding Symington's financial condition was not in dispute. But the Court’s recognition of this fact did not end the inquiry as to whether the Bank breached the implied covenant of good faith and fair dealing by failing to make such disclosures to the Bank. As the Supreme Court stated when reversing the summary judgment in the Bank’s favor on the Funds’ implied covenant claim, “[t]he question is whether a jury might reasonably find that the Bank wrongfully exercised a contractual power for ‘a reason beyond the risks’ that the Funds assumed in the Triparty Agreement, or for a reason inconsistent with the Funds' justified expectations.” 201 Ariz. at 492. It bears noting that the Wells Fargo case involved more than merely non-disclosure of information concerning Symington's financial condition that the Bank had the express contractual right not to disclose. Rather, the facts suggested that the Bank failed to take certain actions, including declaring the interim construction loan in default, which would have revealed Symington's financial problems, actions which the Funds could claim were within their reasonable expectations. The case also involved allegations that the Bank failed to follow federal banking regulations and report non-compliant activity, again actions that the Funds could claim were within their reasonable expectations. Nevertheless, the Supreme Court's ruling on the implied covenant claim raised the possibility that the Funds would be able to recover on a breach of contract claim for conduct that the Bank, in the Triparty Agreement, expressly stated it had no obligation to undertake. The relationship between the implied covenant of good faith and fair dealing and express contract terms was addressed by the Arizona Court of Appeals shortly after the Supreme Court rendered its opinion in Wells Fargo. Bike Fashion Corp. v. Kramer, supra., involved claims brought by partners of a general partnership seeking recovery from other partners and their owners for, among other theories, breach of the implied covenant of good faith and fair dealing in connection with the sale of real estate owned by the partnership without the consent of 51% of the partners. The breach of the implied covenant claim involved conduct that arguably did not conflict with the express terms of the partnership agreement. At issue on appeal was whether the partners were entitled to a new trial on the grounds that the trial court incorrectly instructed the jury that there could be no breach of an implied contract provision if there was an express written contract provision relating to the same subject. The Court of Appeals held that the trial court erred in giving such a jury instruction and reversed the trial court's denial of the partners’ motion for a new trial. The Court of Appeal’s holding in Bike Fashion Corp. confirmed that the implied covenant of good faith and fair dealing may be breached even when the contract includes express terms on the same subject. As described by the court in Bike Fashion Corp., the following two sets of circumstances could result in such a finding under Arizona law: (1) a party’s exercise of discretion expressly granted by the contract “in a way inconsistent with [the other] party’s reasonable expectations,” or (2) a party “acting in ways not expressly excluded by the contract’s terms but which nevertheless bear adversely on the [other] party’s reasonably expected benefits of the bargain.” 46 P.3d at 435. As in Wells Fargo, the focus in Bike Fashion Corp. was on a determination of the reasonable expectations of the party claiming breach of the implied covenant notwithstanding the existence of a written and unambiguous contract term on the same subject. The recent decisions in Wells Fargo Bank and Bike Fashion Corp. reflect the expanding scope of the implied covenant of good faith and fair dealing in Arizona contract law. Not unlike the reassessment required following the Arizona Supreme Court's holding in Darner Motor Sales, Inc. v. Universal Underwriters Ins. Co., 140 Ariz. 383, 682 P.2d 388 (1984), Arizona business lawyers may want to re-examine whether specific assumptions or qualifications addressing the implied covenant of good faith and fair dealing may be warranted when opining as to enforceability of written contracts governed by Arizona law. Practitioners will also no doubt want to consider whether a contracting party may expressly contract away the implied covenant of good faith and fair dealing in order to bring more certainty to the parties' contractual relations. Whether such a contractual provision would be enforced by the Arizona courts is perhaps an issue for another day. November 2002 • The Arizona Business Lawyer Reprinted with permission of The Arizona Business Lawyer, an authorized on-line publication of the Arizona State Bar Association. Ms. Keindienst’s article originally appeared in Vol. 1, #2 (November 2002) of The Arizona Business Lawyer.