DOLPHIN TOWN CENTER

advertisement

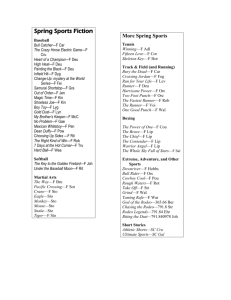

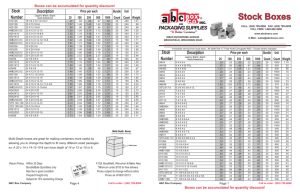

DOLPHIN TOWN CENTER Drew Bowman LaVar Jamison Mike Plakas Jamie Straz LOCATION SITE ANALYSIS Size – 55 acres | Manmade Lake – 22 acres | Interchange of 836 and the Florida Turnpike | Between Dolphin and International Malls | Industrial to the North | Single Family to the South | SITE ANALYSIS: LAND USE | Current Land Use y | Vacant Land Future Land Use Business and Office y Industrial and Office y | Comprehensive Land Use Change y Mixed Use Development SITE ANALYSIS: ZONING Industrial Heavy IU-2 | Zoning Change | y Planned Area Development SITE ANALYSIS: ENVIRONMENTAL IMPACT | Energy Efficiency y y y y | Water Efficiency y y y y | Energy efficient lighting fixtures Use low-e glazing which allows light in but not heat High efficiency HVAC systems Use meters to monitor Efficient irrigation techniques Use native drought resistant plants Collection of water Use high-efficient fixtures Water Retention y Use lake to hold storm water SITE ANALYSIS: ENVIRONMENTAL IMPACT | FEMA Zone AH: Special flood hazard areas subject to inundation by 100-year shallow flooding (usually areas of ponding) where average depths are between one and three feet. Base elevations derived from detailed hydraulic analyses are shown in this zone. Mandatory flood insurance purchase requirements apply. SITE ANALYSIS: TRANSPORTATION | Future Transportation Hub | Bus System | Interchange of 836 and Florida Turnpike SITE ANALYSIS: TRAFFIC COUNTS | East-West on NW 12th St. at NW107th Ave. y | 24,660 Cars North-South on NW107th Ave. at NW12th St. y 50,290 Cars Source: Data Metrics 2004 count MARKET ANALYSIS MARKET ANALYSIS SELECTED N EI G H B O RH O O D D EM O G RA P H I CS N W 1 0 7 th A ve n u e & N W 1 2 th Str e e t M i a m i , Fl o r i d a Ra d i u s 1 .0 M ile Ra d i u s 3 .0 M ile Ra d i u s 5 .0 M i le Po p u l a ti o n 2 0 1 3 Po p u l a ti o n 1 4 ,1 6 5 1 6 4 ,5 7 0 3 3 4 ,5 1 9 2 0 0 8 Po p u l a ti o n 1 3 ,5 6 5 1 5 6 ,2 1 4 3 1 9 ,6 8 4 2 0 0 0 Po p u l a ti o n 1 2 ,1 5 7 1 4 2 ,8 4 8 2 9 5 ,9 0 7 1 9 9 0 Po p u l a ti o n 8 ,4 9 7 1 0 7 ,8 2 8 2 4 1 ,0 5 8 A n n u a l G r o w th 2 0 0 8 - 2 0 1 3 0 .8 7 % 1 .0 5 % 0 .9 1 % A n n u a l G r o w th 2 0 0 0 - 2 0 0 8 1 .3 8 % 1 .1 2 % 0 .9 7 % A n n u a l G r o w th 1 9 9 0 - 2 0 0 0 3 .6 5 % 2 .8 5 % 2 .0 7 % H o u se h o l d s 2 0 1 3 H o u se h o l d s 4 ,6 4 3 5 5 ,9 8 6 1 0 8 ,2 1 9 2 0 0 8 H o u se h o l d s 4 ,4 6 9 5 2 ,9 1 3 1 0 3 ,0 4 7 2 0 0 0 H o u se h o l d s 4 ,0 4 3 4 7 ,9 0 4 9 4 ,5 1 2 1 9 9 0 H o u se h o l d s 2 ,8 5 7 3 5 ,6 0 5 7 6 ,6 9 3 A n n u a l G r o w th 2 0 0 8 - 2 0 1 3 0 .7 7 % 1 .1 4 % 0 .9 8 % A n n u a l G r o w th 2 0 0 0 - 2 0 0 8 1 .2 6 % 1 .2 5 % 1 .0 9 % A n n u a l G r o w th 1 9 9 0 - 2 0 0 0 3 .5 3 % 3 .0 1 % 2 .1 1 % In co m e 2 0 0 8 M e d i a n H o u se h o l d In co m e $ 4 0 ,9 0 7 $ 4 5 ,6 4 7 $ 4 8 ,8 3 0 2 0 0 8 Esti m a te d A ve r a g e H o u se h o l d In co m e $ 4 8 ,5 6 4 $ 6 1 ,3 5 9 $ 6 4 ,0 4 0 2 0 0 8 Esti m a te d Pe r C a p i ta In co m e $ 1 6 ,0 2 4 $ 2 0 ,7 4 1 $ 2 0 ,8 0 5 A g e 2 5 + C o l l e g e G r a d u a te s - 2 0 0 0 1 ,5 2 9 2 2 ,9 5 1 4 3 ,4 8 6 A g e 2 5 + Pe r ce n t C o l l e g e G r a d u a te s - 2 0 0 8 1 6 .3 % 2 1 .6 % 1 9 .5 % MARKET ANALYSIS RETA I L EX PEN D I TU RES ($ 0 0 0 's) SU BJECT'S SU BM A RK ET Ra d iu s 1 .0 M ile Pr o d u ct Sa m p le A ll Reta il Sto res 2008 1 2 6 ,1 6 8 2013 1 5 5 ,2 1 6 Ra d iu s 3 .0 M ile % / Yr 4 .2 % 2008 2013 1 ,6 2 2 ,6 8 6 2 ,0 2 5 ,9 7 4 Ra d iu s 5 .0 M ile % / Yr 4 .5 % 2008 2013 3 ,2 9 0 ,3 1 6 4 ,0 9 1 ,1 0 3 % / Yr 4 .5 % G ro cery Sto r es 3 1 ,5 4 5 3 6 ,4 9 9 3 .0 % 3 7 9 ,2 5 8 4 4 5 ,1 6 1 3 .3 % 7 6 4 ,5 6 5 8 9 1 ,7 3 2 3 .1 % Ea tin g Pla ces 1 5 ,8 1 5 2 0 ,5 0 5 5 .3 % 2 0 4 ,8 5 4 2 7 0 ,2 4 5 5 .7 % 4 0 6 ,2 6 7 5 3 3 ,9 0 5 5 .6 % D rin kin g Pla ces 652 785 3 .8 % 8 ,9 3 1 1 0 ,9 6 8 4 .2 % 1 7 ,9 3 7 2 1 ,9 5 3 4 .1 % H ea lth a n d Perso n a l C a re Sto res 9 ,7 6 6 1 4 ,3 6 1 8 .0 % 1 1 8 ,1 6 9 1 7 4 ,9 5 3 8 .2 % 2 4 4 ,1 3 8 3 5 9 ,4 0 0 8 .0 % Bu ild in g M a teria l & G a r d en Eq u ip m en t & Su p p lies 2 ,7 9 8 3 ,2 7 9 3 .2 % 3 7 ,2 9 7 4 4 ,2 5 3 3 .5 % 7 8 ,5 9 9 9 2 ,7 8 7 3 .4 % 340 415 4 .1 % 4 ,5 1 6 5 ,5 8 6 4 .3 % 9 ,3 5 7 1 1 ,5 2 6 4 .3 % 4 .1 % H a rd w a re Sto r es La w n & G a rd en Eq u ip m en t & Su p p lies D ea lers 410 497 3 .9 % 5 ,3 2 1 6 ,5 6 7 4 .3 % 1 1 ,0 7 7 1 3 ,5 5 2 Fu rn itu r e Sto res 2 ,4 3 1 2 ,9 4 6 3 .9 % 3 4 ,2 5 1 4 2 ,4 0 7 4 .4 % 7 0 ,2 4 9 8 6 ,7 7 9 4 .3 % O th er H o m e Fu rn ish in g Sto res 1 ,5 7 4 1 ,8 9 1 3 .7 % 2 3 ,0 8 0 2 8 ,1 0 5 4 .0 % 4 8 ,7 7 2 5 9 ,1 8 1 3 .9 % 3 .1 % H o u seh o ld A p p lia n ce Sto r es 664 761 2 .8 % 8 ,6 3 7 1 0 ,0 8 6 3 .2 % 1 7 ,7 7 8 2 0 ,6 7 5 1 ,3 9 1 1 ,6 1 6 3 .0 % 1 8 ,6 0 4 2 2 ,0 3 9 3 .4 % 3 7 ,4 3 0 4 4 ,2 6 0 3 .4 % 1 2 ,6 1 8 1 5 ,3 0 7 3 .9 % 1 6 5 ,8 3 3 2 0 3 ,7 1 8 4 .2 % 3 3 6 ,3 7 9 4 1 2 ,4 0 9 4 .2 % C lo th in g a n d C lo th in g A ccesso ry Sto res 8 ,1 6 1 9 ,5 7 5 3 .2 % 1 1 1 ,2 3 7 1 3 2 ,7 9 5 3 .6 % 2 2 4 ,6 8 6 2 6 8 ,0 2 4 3 .6 % Sh o e Sto res 1 ,1 0 7 1 ,2 6 1 2 .6 % 1 4 ,1 6 3 1 6 ,4 2 9 3 .0 % 2 8 ,2 5 2 3 2 ,7 1 0 3 .0 % 1 9 ,0 0 0 2 2 ,8 5 1 3 .8 % 2 4 6 ,0 6 2 2 9 9 ,9 5 1 4 .0 % 4 9 8 ,3 5 0 6 0 5 ,7 9 7 4 .0 % Ra d io / TV/ O th er Electro n ics Sto res D ep a rtm en t Sto res (Exclu d in g Lea sed ) G en era l M erch a n d ise Sto res W a r eh o u se C lu b s a n d Su p ersto res 5 ,0 8 5 5 ,9 6 7 3 .2 % 6 3 ,1 4 7 7 5 ,2 0 1 3 .6 % 1 2 7 ,2 6 5 1 5 0 ,7 8 6 3 .4 % Fu ll Service Resta u ra n ts 7 ,8 2 2 1 0 ,1 2 7 5 .3 % 1 0 6 ,2 4 5 1 3 9 ,8 8 3 5 .7 % 2 1 3 ,1 8 4 2 7 9 ,5 6 9 5 .6 % Fa st Fo o d Resta u ra n ts 7 ,9 9 1 1 0 ,3 7 8 5 .4 % 9 8 ,6 0 5 1 3 0 ,3 5 9 5 .7 % 1 9 3 ,0 7 4 2 5 4 ,3 2 9 5 .7 % Jew elry Sto r es 943 1 ,1 7 6 4 .5 % 1 5 ,4 5 2 1 9 ,3 0 4 4 .6 % 3 2 ,0 8 8 4 0 ,0 8 7 4 .6 % Bo o k Sto res 645 780 3 .9 % 1 1 ,0 6 4 1 3 ,6 6 3 4 .3 % 2 0 ,4 3 1 2 5 ,2 7 7 4 .3 % G ift, N o velty, a n d So u ven ir Sh o p s 596 697 3 .2 % 8 ,4 8 7 1 0 ,0 3 4 3 .4 % 1 7 ,4 1 3 2 0 ,4 6 6 3 .3 % Flo rists 156 184 3 .4 % 2 ,0 8 3 2 ,5 0 8 3 .8 % 4 ,3 6 2 5 ,2 1 4 3 .6 % H o b b y, To y, a n d G a m e Sh o p s 799 929 3 .1 % 1 1 ,0 5 9 1 3 ,1 0 8 3 .5 % 2 2 ,3 6 3 2 6 ,4 3 3 3 .4 % 1 ,0 3 3 1 ,2 6 5 4 .1 % 1 5 ,1 1 3 1 8 ,8 8 5 4 .6 % 3 0 ,5 7 2 3 8 ,2 4 1 4 .6 % 66 72 2 .0 % 1 ,0 1 6 1 ,1 2 2 2 .0 % 2 ,1 0 6 2 ,3 1 4 1 .9 % Sp o r tin g G o o d s Sto res C a m era / Ph o to g r a p h ic Su p p ly Sto res Lu g g a g e a n d Lea th er G o o d s Sto res Sew / N eed lew o rk/ Piece G o o d s Sto res C o n ven ien ce Sto res 98 128 5 .5 % 1 ,5 0 4 1 ,9 7 9 5 .6 % 3 ,1 2 1 4 ,1 0 1 5 .6 % 164 181 2 .0 % 2 ,1 7 4 2 ,4 5 7 2 .5 % 4 ,4 7 4 5 ,0 2 3 2 .3 % 3 .3 % 1 ,3 6 9 1 ,5 9 7 3 .1 % 1 6 ,6 2 3 1 9 ,6 6 6 3 .4 % 3 3 ,3 2 0 3 9 ,1 2 6 H o m e C en ters 701 823 3 .3 % 9 ,4 0 3 1 1 ,1 8 5 3 .5 % 1 9 ,7 9 9 2 3 ,4 5 2 3 .4 % N u rser y a n d G a rd en C en ter s 354 431 4 .1 % 4 ,6 1 1 5 ,7 3 5 4 .5 % 9 ,5 8 8 1 1 ,8 1 8 4 .3 % C o m p u ter a n d So ftw a re Sto res 789 937 3 .5 % 1 1 ,1 7 2 1 3 ,4 2 1 3 .7 % 2 2 ,6 4 2 2 7 ,1 2 3 3 .7 % C lo th in g A ccesso r y Sto res 118 141 3 .6 % 1 ,7 3 7 2 ,0 9 6 3 .8 % 3 ,5 5 4 4 ,2 9 1 3 .8 % 1 9 ,0 4 1 2 4 ,3 4 7 5 .0 % 2 5 6 ,3 9 8 3 3 3 ,9 7 2 5 .4 % 5 2 1 ,4 1 3 6 7 7 ,2 2 1 5 .4 % A u to D ea lers A u to m o tive Pa rt, A ccesso ries & Tire Sto res 1 ,2 3 5 1 ,3 1 4 1 .2 % 1 5 ,6 6 5 1 6 ,9 3 1 1 .6 % 3 1 ,9 2 4 3 4 ,2 7 7 1 .4 % G a so lin e Sta tio n s w ith C o n ven ien ce Sto r es 8 ,6 2 1 1 0 ,8 9 9 4 .8 % 1 0 5 ,6 5 8 1 3 6 ,1 2 3 5 .2 % 2 1 0 ,8 6 2 2 6 9 ,6 4 6 5 .0 % G a so lin e Sta tio n s w ith o u t C o n ven ien ce Sto res 4 ,1 2 5 5 ,4 1 8 5 .6 % 5 0 ,9 8 1 6 8 ,2 6 3 6 .0 % 1 0 1 ,7 0 0 1 3 5 ,1 9 3 5 .9 % Electro n ic Sh o p p in g a n d M a il O rd er 3 ,7 1 0 4 ,6 7 2 4 .7 % 4 9 ,8 5 9 6 3 ,2 1 4 4 .9 % 1 0 1 ,2 0 1 1 2 8 ,0 4 7 4 .8 % 1 9 ,3 9 5 2 4 ,9 8 8 5 .2 % 2 5 6 ,4 6 6 3 3 5 ,8 4 2 5 .5 % 5 1 1 ,6 8 9 6 6 7 ,4 7 0 5 .5 % To ta l A cco m m o d a tio n a n d Fo o d Services MARKET ANALYSIS: RETAIL This market continues to attract numerous companies, due to the robust local economy and the fact that it is a natural choice for European companies looking to do business in America. And, even though Miami-Dade County remains under-retailed, developers are now required to meet stricter underwriting standards which limits the amount of speculative construction. As of last year, the total inventory of multitenant retail centers over 25,000 sf was 29,726,221 sq. ft. That number will rise as construction completions impact inventory. There were also several notable sales which took place in this market for 2007 and 2008. MARKET ANALYSIS: RETAIL MARKET ANALYSIS: RETAIL MARKET ANALYSIS: OFFICE MARKET ANALYSIS: OFFICE MARKET ANALYSIS: OFFICE Despite the stabilizing of vacancy and negative absorption this quarter, the direct weighted average asking rental rate increased by $.20 to $31.30 per sq. ft. full service gross (fsg). The increase of only $.20 is one of the smallest changes in the past several years and is a sign of asking rates beginning to stabilize as demand for space slows. Class A space has increased by $4.29 in the past year and can be attributed availability of Class A space in the Downtown and Brickell submarkets where spaces are now ranging from $32.00 to $50.00 per sq. ft. fsg. MARKET ANALYSIS: OFFICE The Miami office market continues to show overall negative absorption for the year after several years of positive absorption. The negative absorption is mainly due to smaller spaces from construction and residential companies continuing to downsize. The bulk of these industries are affecting the suburban markets more with Kendall and Coral Gables seeing the highest levels of negative absorption. Many companies are also giving back small spaces to landlords while downsizing operations. MARKET ANALYSIS: OFFICE MARKET ANALYSIS: RESIDENTIAL MARKET ANALYSIS: RESIDENTIAL MARKET ANALYSIS: RESIDENTIAL MARKET ANALYSIS: COMPETITIVE PROJECTS | Dolphin Mall MARKET ANALYSIS: COMPETITIVE PROJECTS MARKET ANALYSIS: COMPETITIVE PROJECTS Anchors – y y y y y y y y y y y y y Bass Pro Shops Burlington Coat Marshalls Off Saks 5th Sports Authority Old Navy FYE Neiman Marcus Ross Dress for Less Borders Books DSW Forever XX1 Courtyard by Marriot MARKET ANALYSIS: COMPETITIVE PROJECTS | International Mall MARKET ANALYSIS: COMPETITIVE PROJECTS | Anchors y y y y y Macys Women & Kids Macys Men & Home JC Penny’s Dillard’s Sears MARKET ANALYSIS: COMPARABLE PROJECTS | Sunset Place 3-level Specialty Center y 515,000 SF GLA y Major Retailers y | | | | | | | | AMC Theatres LA Fitness Barnes & Nobles Gameworks Panera Bread Martini Bar Dan Marino’s Splitsville MARKET ANALYSIS: COMPARABLE PROJECTS | The Shops at Midtown 645,000 SF y 26 acres y Major Retailers y | | | | | | | | Target Circuit City Loehmanns PetSmart West Elm Marshalls Ross Linens n Things MARKET ANALYSIS: COMPARABLE PROJECTS Village of Merrick Park | 740,000 GLA | Opened 2002 | 110 Retail Stores | Major Retailers | y y y y y Nordstroms Neiman Marcus Villagio Tiffany’s William Sonoma MARKET ANALYSIS: COMPARABLE PROJECTS Birkdale Village | 52 Acre Mixed- Use Developement | Major Retailers | y y y y y y Dick’s Sporting Goods Pier One Barnes & Nobles Banana Republic Talbots Regal Cinema DEVELOPMENT PROGRAM | Anchor Retail – 175,000 SF | In-Line Retail – 300,000 SF | Office – 305,000 SF | Residential y Apartment – 1,330,000 SF | | | y | 1 BR – 475 units @ 900 SF 2 BR – 350 units @ 1200 SF 3 BR – 150 units @ 1400 SF Townhouse – 82 units @ 2880 SF Hotel – Full Service 185,000 SF Total y 37,000 SF Available for Conference Space y 240 Rooms y FINANCIAL FEASABILITY: ASSUMPTIONS FINANCIAL FEASABILITY: NOI FINANCIAL FEASABILITY: COSTS FINANCIAL FEASABILITY | Stabilized Net Operating Income y | Total Development Cost y | $37,676,475 $374,505,348 Desired Target Return y 10% $37,676,475 / 10% = $376,764,750 Total Value $376,764,750 > $374,505,348 Total Costs PROJECT IS FEASIBLE!!! FINANCIAL FEASABILITY: 10 YEAR CASH FLOW ROLL UP Total Potential Gross Income Market Vacancy Year 1 $64,601,500 -$10,189,525 Year 2 $67,082,560 Year 3 $69,661,357 Year 4 $72,341,770 Year 5 $75,127,830 Year 6 Year 7 Year 8 Year 9 $78,023,729 $81,033,828 $84,162,657 $87,414,931 Year 10 Year 11 $90,795,549 $94,309,606 -$10,595,906 -$11,018,500 -$11,457,955 -$11,914,943 -$12,390,163 -$12,884,344 -$13,398,243 -$13,932,646 -$14,488,372 -$15,066,271 Effective Gross Income $54,411,975 $56,486,654 $58,642,857 $60,883,815 $63,212,887 $65,633,566 $68,149,483 $70,764,414 $73,482,285 $76,307,177 $79,243,335 Total Operating Expenses $16,735,500 $17,321,243 $17,927,486 $18,554,948 $19,204,371 $19,876,524 $20,572,203 $21,292,230 $22,037,458 $22,808,769 $23,607,076 Net Operating Income $37,676,475 $39,165,412 $40,715,371 $42,328,867 $44,008,516 $45,757,042 $47,577,281 $49,472,185 $51,444,827 $53,498,408 $55,636,259 Annual Debt Service $28,649,076 $28,649,076 $28,649,076 $28,649,076 $28,649,076 $28,649,076 $28,649,076 $28,649,076 $28,649,076 $28,649,076 $0 Total Leasing and Capital Costs -$32,560,792 $108,597 $112,398 $116,332 $138,166 $143,002 $0 Cash Flow After Debt Service -$23,533,393 $10,624,933 $12,178,694 $13,796,124 $2,225,510 $19,057,184 $20,956,603 $22,933,917 $24,992,334 $120,404 -$14,882,456 $15,479,844 $128,980 $133,494 SITE MASTER PLAN RENDERINGS RENDERINGS RENDERINGS RENDERINGS ALTERNATIVE PLAN