Example

advertisement

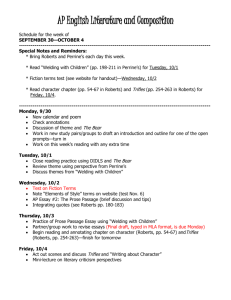

Discounting Finance 100 Prof. Michael R. Roberts Copyright © Michael R. Roberts 1 Copyright © Michael R. Roberts 2 Topic Overview z z z z z The Timeline Compounding & Future Value Discounting & Present Value Multiple Cash Flows “Special” Streams of Cash Flows » Perpetuities » Annuities z Interest Rates 1 1 The Timeline z z Timeline: a linear representation of the timing of potential cash flows. Two types of cash flows: 1. Inflows (i.e., money we get) are represented by positive numbers 2. Outflows (i.e., money we give) are represented by negative numbers z Example: » Assume that you are lending $10,000 today and that the loan will be repaid in two annual $6,000 payments. Copyright © Michael R. Roberts 3 Money’s Time Units z Think of money as having a “time unit” denoting when it is received (or paid) » Just like currency z We can only compare money in the same time units: » It doesn’t make sense to add $50 US to ₤50; and » It doesn’t make sense to add $50 received today with $50 received next year. z Discounting and Compounding are the tools to manipulate money’s time units » Discounting converts money’s time units back in time » Compounding converts money’s time units forward in time Copyright © Michael R. Roberts 4 2 2 Compounding z The Future Value (FVn) of a cash flow T-years from today is: FV = C (1 + r ) T » C = Cash Flow (or “CF”) » r = discount rate z Example: » Would you rather receive $1,000 today or $1,210 in two years if you can earn 10% per year on the $1,000? Timeline and Future Value = ? Copyright © Michael R. Roberts 5 Discounting z The Present Value (PV) of a cash flow T-years from today is: PV = z C (1 + r ) T = C (1 + r ) −T Example: » What is the price of a savings bond that will pay $15,000 in ten years if the annual interest rate is 6%? Timeline = ? Present Value = ? Copyright © Michael R. Roberts 6 3 3 Multiple Cash Flows z Present Value (PV) and Future Value (FV) are linear operators » PV(C1 + C2) = PV(C1)+PV(C2) » FV(C1 + C2) = FV(C1)+FV(C2) z Example: If we can earn a 10% annual interest rate and save $1000 today, and $1000 at the end of each of the next two years how much will we have in 3 years? Timeline = ? FV = ? Copyright © Michael R. Roberts 7 General Stream of Cash Flows z Present Value PV = N ∑ PV (C ) n = 0 z z n N ∑ = n = 0 Cn (1 + r ) n The PV of a stream of cash flows is just the sum of the PVs. Future Value (same idea): FV = N ∑ FV (C ) n = 0 n = N ∑ n = 0 Cn (1 + r ) = PV (1 + r ) n N Copyright © Michael R. Roberts 8 4 4 Perpetuities z A perpetuity is a stream of cash flows with no end: Cash Flows 0 Periods 0 z C1 C2 C3 C4 C5 C6 … 1 2 3 4 5 6 … Examples: » Cencus Agreements issued in 12th century in Italy, France, and Spain to circumvent usury laws of Catholic Church (no principal = no loan) » Hoogheemraadschap Lekdijk Bovendams – 17th century Dutch Water Board to upkeep local dikes (they still pay interest!) » British consol bonds » Panama Canal perpetuities z How do we compute PV? Copyright © Michael R. Roberts 9 Valuing Perpetuities z Step 1: Write out the PV of the perpetuity z Step 2: Pull out the cash flow, C z Step 3: Multiply both sides by 1/(1+r) z Step 4: Subtract (3) from (2) z Step 5: Do some algebra Copyright © Michael R. Roberts 10 5 5 Perpetuity Example z What does the timeline look like ? z The stream of cash flows is a ? with a PV = ? Copyright © Michael R. Roberts 11 Growing Perpetuities z A growing perpetuity is a stream of cash flows that grow at a constant periodic rate, g, with no end. Cash Flows 0 Periods 0 z C 1 C(1+g) C(1+g)2 C(1+g)3 2 3 4 C(1+g)4 C(1+g)5 … 5 6 … Again, infeasible to calculate by brute force so is there a shortcut? PV = C r−g » You should be able to derive this Copyright © Michael R. Roberts 12 6 6 Annuities z An annuity is a level stream of regular payments that last for a fixed number of periods Cash Flows 0 C C C C C … Periods 0 1 2 3 N-1 N … z Examples: » Mortgages » Lottery prizes (sometimes…) » Retirement savings plans z How do we compute PV? Copyright © Michael R. Roberts 13 Valuing Annuities – Part I z An annuity is just the difference in two perpetuities starting at different times! » Perpetuity #1 starts today: Cash Flows 0 Periods 0 CF CF CF CF 1 2 … N-1 CF CF … N N+1 … – It has present value at time 0 equal to C/r. » Perpetuity #2 starts in period N: Cash Flows 0 0 0 0 0 0 CF Periods 0 1 2 … N-1 N N+1 – It has present value at time N equal to C/r and at time 0 equal to (C/r)(1+r)-N … … Copyright © Michael R. Roberts 14 7 7 Valuing Annuities – Part II z Subtracting the cash flow streams of the two perpetuities gives us the cash flow stream for our annuity Cash Flows 0 Periods 0 z CF CF CF CF 1 2 … N-1 CF 0 … N N+1 … Therefore, difference in present values for the two perpetuities must equal the present value of our annuity PV = PV ( Perpetuity #1) − PV ( Perpetuity #2 ) =? z What’s the future value of an annuity ? Copyright © Michael R. Roberts 15 Annuity Example z PV of Option A: » What is the timeline ? » What is the present value of all the cash flows ? z PV of Option B =? Copyright © Michael R. Roberts 16 8 8 Valuing Growing Annuities z A growing annuity is a constant growing stream of regular payments that last for a fixed number of periods Cash Flows 0 CF Periods 0 1 z (1+g)CF (1+g)2CF 2 3 … (1+g)N-2CF (1+g)N-1CF N-1 N 0 … N+1 … The present value of this stream is PV = C ⎡ ⎛ 1+ g ⎞ ⎢1 − ⎜ ⎟ r ⎢⎣ ⎝ 1 + r ⎠ T ⎤ ⎥ ⎥⎦ » You should be able to derive this Copyright © Michael R. Roberts 17 Internal Rate of Return (IRR) z The Internal Rate of Return (IRR) is the one interest rate that sets the net present value of the cash flows equal to zero N ∑ z z Example 1: n = 0 Cn − Initial Cost = 0 (1 + IRR) n » The IRR of a security (e.g., bond, stock, CD, etc.) is just the one interest rate that sets the present value of all the cash flows equal to the price (a.k.a. PV) of the security: N Cn − Price = 0 ∑ n n = 0 (1 + IRR) Example 2: » The IRR of an investment project (e.g., acquisition, merger, capital expenditure, etc.) is just the one interest rate that sets the present value of all the cash flows equal to the initial outlay (a.k.a. PV) of the investment: N ∑ n = 0 Cn − Initial Outlay = 0 (1 + IRR) n Copyright © Michael R. Roberts 18 9 9 Computing the Internal Rate of Return Example z The Timeline = ? z Present Value = ? z IRR = ? Copyright © Michael R. Roberts 19 Effective Annual Rate (EAR) z The Effective Annual Rate (EAR) indicates the total amount of interest that will be earned at the end of one year » Considers the effect of compounding » Also referred to as the effective annual yield (EAY) or annual percentage yield (APY) » We can use this to discount cash flows, as long as we express time in annual units (i.e., years) z So far everything was on an annual basis » Cash flows were every year » Interest was on an annual bases (i.e., compounded once a year) » Therefore, distinction was irrelevant: EAR = r Copyright © Michael R. Roberts 20 10 10 Adjusting the Discount Rate to Different Time Periods z Earning 5% annually is not the same as earnings 2.5% every six months because of compounding × (1 + 0.025 ) $1 z $1.050625 So, if the EAR is 5% but we have semi-annual discounting the Equivalent Periodic Rate (EPR) is (1 + EPR ) z × (1 + 0.025) $1.025 2 − 1 = 5% ⇒ EPR = (1 + 0.05 ) 1/2 − 1 = 0.0247 = 2.47% < 2.5% More generally, EPR = (1 + EAR )1/ m − 1 » where m = # of compounding periods per year (e.g., semi-annual Æ m = 2, quarterly Æ m = 4, monthly Æ m = 12, …) » EPR is just an n-period discount rate Copyright © Michael R. Roberts 21 EAR and EPR Examples z If the EAR is 10% and we have quarterly compounding, what is the EPR ? z If the EPR is 0.6% and we have monthly compounding, what is the EAR? Copyright © Michael R. Roberts 22 11 11 Valuing Monthly Cash Flows Example z Timeline: ? z Monthly EPR = ? Periodic Cash Flow = ? z Copyright © Michael R. Roberts 23 Annual Percentage Rate (APR) z The Annual Percentage Rate (APR), indicates the amount of simple interest earned in one year. » Simple interest is the amount of interest earned without the effect of compounding. » The APR is typically less than the effective annual rate (EAR) which incorporates the effect of compounding – Counterexample? z The APR itself cannot be used as a discount rate. » The APR with m compounding periods is a way of quoting the actual interest earned each compounding period: Interest Rate per Compounding Period = i = APR m periods / year Copyright © Michael R. Roberts 24 12 12 EAR vs APR z How do I convert an APR (not a discount rate) to an EAR (a discount rate)? m APR ⎞ ⎛ 1 + EAR = ⎜ 1 + ⎟ m ⎠ ⎝ » EAR increases with the frequency of ? » If compounding is once per year (m=1) then EAR= ? » Continuous Compounding: – In limit as m Æ ∞, (1+APR/m)m Æ exp(APR) z Some notation » R = APR (not a discount rate!) » i = APR/m = interest rate per compounding period Copyright © Michael R. Roberts 25 Valuing Monthly Cash Flows Revisited Example z Recall the problem on slide 22: z What is the APR (R) on this account ? z How much interest is earned each period ? » Monthly interest with an EAR of 6% » Same as before so… z How much do you have to save at the end of each month to accumulate $100,000 in 10 years ? » Same as before! Copyright © Michael R. Roberts 26 13 13 Converting the APR to a Discount Rate Example z Strategy: Compute the PV of the lease and compare it with the $150,000 Timeline: ? z This cash flow stream is an ? z with ? periodicity Copyright © Michael R. Roberts 27 Converting the APR to a Discount Rate Example (Cont.) z Computing the monthly discount rate: » Method 1: – We’re given an APR of 5% with semiannual compounding, which implies the EAR = ? – Convert annual discount rate into monthly discount rate ? » Method 2: – Compute an effective periodic interest rate from the APR, ? – Convert six-month discount rate into monthly periodic rate: ? Copyright © Michael R. Roberts 28 14 14 Converting the APR to a Discount Rate Example (Cont.) z With the monthly discount rate in hand, the PV of the annuity is ? z The PV of the lease is greater than the upfront payment of $150,000 so purchase the system outright Copyright © Michael R. Roberts 29 Nominal Versus Real Interest Rates z Nominal Interest Rate: The rates quoted by financial institutions and used for discounting or compounding cash flows, r z Real Interest Rate: The rate of growth of your purchasing power, after adjusting for inflation, rr Growth in Purchasing Power = 1 + rr = rr = 1 + r 1 + π = Growth of Money Growth of Prices r − π ≈ r − π 1 + π Copyright © Michael R. Roberts 30 15 15 US Interest Rates and Inflation Copyright © Michael R. Roberts 31 What Formulas Should I Know? z Notation: » » » » » » z r = discount rate R = APR T = # of years m = number of compounding periods per year N = Total number of periods = T * m (years * periods/year) i = R/m = effective periodic interest rate Given a discount rate r for one period, convert to an n-period discount rate: n − period discount rate = (1 + r ) − 1 n z Converting from an APR to an EAR: ⎛ APR ⎞ 1 + EAR = ⎜1 + ⎟ m ⎠ ⎝ m Copyright © Michael R. Roberts 32 16 16 What Formulas Should I Know? (Cont.) z Real Interest Rates rr = z Present and Future Value of a Single Cash Flow PV = FV (1 + i ) z ⇔ PV = FV (1 + r ) −N −T Present Value of a Growing Annuity PV = C × » z 1+ R −1 1+ π 1 (i − g ) N ⎛ ⎛1 + g ⎞ ⎞ ⎜1 − ⎜ ⎟ ⎟⎟ ⎜ (1 + i ) ⎝ ⎠ ⎠ ⎝ Implies: 1) Future Value of a Growing Annuity, 2) Future Value of an Annuity, and 3) Present Value of an Annuity Present Value of a Growing Perpetuity PV = » C (i − g ) Implies: 1) Future Value of a Growing Perpetuity, 2) Future Value of a Perpetuity, and 3) Present Value of a Perpetuity Copyright © Michael R. Roberts 33 Summary z Money has a “time unit” » Can only compare money in same units! » Compound to get future values » Discount to get present values z Future and Present Values are linear z Special streams of cash flows » Use them on “streams” of cash flows » Perpetuity » Annuity z Interest Rates » APR vs. EAR » Real vs. Nominal Copyright © Michael R. Roberts 34 17 17