Techniques for Valuing MBS

advertisement

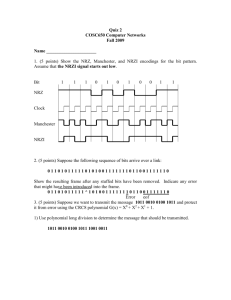

Techniques for Valuing MBS © Pristine – www.edupristine.com © Pristine FRM – II AIM Statements Calculate the static cash flow yield of a MBS using bond equivalent yield (BEY) and determine the associated nominal spread. Define reinvestment risk. Describe the steps in valuing a mortgage security using Monte Carlo methodology. Define and interpret option-adjusted spread (OAS), zero-volatility OAS, and option cost. Explain how to select the number of interest rate paths in Monte Carlo analysis. Describe total return analysis, calculate total return, and understand factors present in more sophisticated models. Identify limitations of the nominal spread, Z-spread, OAS, and total return measures. © Pristine FRM – II 1 Bond Equivalent Yield (BEY) and Nominal Spread The nominal spread is the difference between an MBS static cash flow yield and the treasury security with the same maturity as the average life of the MBS. The MBSs have monthly cash flows and treasury securities have semiannual cash flows. The yield of the treasury security is calculated by doubling the semiannual yield. 6 BEY = 2[(1 + im ) − 1] Where im = monthly mortgage yield © Pristine FRM – II 2 Problem The MBS has an average life of 10 years. The MBS has a monthly mortgage yield of 0.45%. If the 10-year treasury bond has a yield of 4.25%, calculate the BEY and nominal spread for this MBS. In this problem im = 0.45% 6 BEY = 2[(1 + im ) − 1] BEY = 5.46% Nominal Spread = BEY – Yield of treasury bond = 1.21% © Pristine FRM – II 3 Reinvestment Risk Risk of reinvesting the coupons payments at a lower rate due to the decrease in market rate market interest rates. MBSs are more prone to reinvestment risk than bonds. MBSs have monthly payments which consist of both interest and principal payments. When the interest rates falls, MBSs payments are subjected to higher prepayment rates. Bonds have less frequent semiannual payments that consist of interest only. © Pristine FRM – II 4 Dynamic Valuation The cash flows for MBSs are dependent upon the path that the interest rate follows and cannot be valued using the binomial model The CF from a pass-through security is a function of pre-payment rates and these are affected by interest rates from the past. If mortgage rates trend downwards many homeowners will probably refinance their mortgages and hence the prepayment rates will increase. If the mortgage rate still keeps falling, the prepayment rates might not fall further. This is known as refinancing burnout. This applies to MBS and other types of pass-through security cash flows. As it is path-dependent, the Monte-Carlo simulation technique is used to value these securities instead of the binomial model. © Pristine FRM – II 5 Monte Carlo Methodology The following four steps are required to value a mortgage backed security using the Monte Carlo methodology: Step1: Simulate the interest rate path and refinancing path. Step2: Project cash flows for each interest rate path. Step3: Calculate the present value of the cash flows for each interest rate path. Step4: Calculate the theoretical value of the mortgage security. Theoretica lValue = © Pristine FRM – II PV [ path (1)] + PV [ path ( 2 )] + ...... + PV [ path ( N )] N 6 Option Adjusted Spread Option adjusted spread (OAS) is defined as the spread K which when added to all the spot rates of all the interest rate paths, will make the average present value of the paths equal to the observed market price plus accrued interest. MarketValu e = PV [ path (1)] + PV [ path ( 2 )] + ...... + PV [ path ( N )] N OAS is determined with an iterative process. OAS indicated the potential compensation after adjusting for the prepayment risk. OAS is superior to nominal spread. © Pristine FRM – II 7 Zero Volatility Spread (Z-Spread) Zero volatility is the spread measure that the investor realizes over the entire spot rate the curve, assuming that the mortgage security is held till maturity. Z spread is the yield that equates the present value of the MBS cash flows to price of the MBS discounted at the treasury spot rate plus the spread. Iterative process is required to calculate the Z-Spread. Accounts for changes in principal payments ignores the impact of prepayment risk or changing prepayment rate have on value of MBS. Option Cost = Z Spread - OAS © Pristine FRM – II 8 Increasing the number of Rate Paths Increasing the number of simulated rate paths gives the better estimate of the theoretical value of MBS. Mean Standard Error (MSE) MSE = Variance of theoretica l values Number of trials Smaller MSE indicates the better estimate of the output value from Monte Carlo Simulation. © Pristine FRM – II 9 Total Return Analysis The parameters required to calculate the total return for a MBS are as follows: The initial security cost at the time of purchase. Projected cash flows for the security. The security's projected horizon value at the horizon date. PeriodicTo tal Re turn = Total Horizon Pr oceeds −1 Total Cost Annualized Total Re turn = ( PeriodicTo tal Re turn ) * 12 number of month in period The advantage of using this method is that it allows investors to specify reinvestment returns. © Pristine FRM – II 10 Problem – Total Return Analysis Calculate the total periodic return and the annualized total return for a Fannie Mae 5% pass through security over a 6 – month horizon with the information provided in below: Total Interim Cash Flows = 1,403,900 Total Horizon Value = 8,955,998 Total Cost = 10,049,500 © Pristine FRM – II 11 Factors to Consider for Return Calculation of MBSs Reinvestment and prepayment assumptions are very important. Cash flows are path dependent. Most models adjust for changes in interest rates either immediately, gradually over time or at the horizon. Total return models also consider profit and loss, return on equity and financing adjusted returns. © Pristine FRM – II 12 Limitations for MBS Valuation Measures Nominal spread does not consider prepayment risk. Another problem with nominal spread is the difference in timing of cash flows of MBS and treasury security. Z-Spread ignores the impact of prepayment risk or changing prepayment rate have on value of MBS. OAS has four major limitations:• Modeling risk associated with Monte Carlo simulations • Required adjustment to interest rate paths. • Assumption of constant OAS over the in the model. • The dependency of the underlying prepayment model. © Pristine FRM – II 13 Limitations for MBS Valuation Measures Nominal spread, Z-spread, OAS have a common limitation. All these measures assume that the security is held till maturity. Total return model output is dependent on the assumptions related to the horizon price and prepayment rates. Dynamic rate scenarios are not included in total return model. © Pristine FRM – II 14 Thank you! Pristine 702, Raaj Chambers, Old Nagardas Road, Andheri (E), Mumbai-400 069. INDIA www.edupristine.com Ph. +91 22 3215 6191 © Pristine – www.edupristine.com © Pristine FRM – II