Monthly FX Outlook

February 23, 2016

Currency Strategy Highlights

• With markets aggressively paring back potential Fed rate hikes, the USD has weakened

Economics

during the opening months of 2016. The currency should see a slight rebound over the

course of the next few months as a modest dose of monetary tightening gets priced back

in, but after that the USD’s two-year bull run will be over.

• In Canada, the use of fiscal instead of monetary policy, a bottoming out in oil prices and

Royce Mendes

ECONOMICS

TORONTO

(416) 594-7354

royce.mendes@cibc.ca

Andrew Grantham

ECONOMICS

TORONTO

(416) 956-3219

andrew.grantham@cibc.ca

Jeremy Stretch

MACRO STRATEGY

LONDON

+44 (0) 207-234-7232

jeremy.stretch@cibc.co.uk

Patrick Bennett

MACRO STRATEGY

HONG KONG

+852 3907 6351

patrick.bennett@cibc.com.hk

John H Welch

MACRO STRATEGY

TORONTO

(416) 956-6983

johnh.welch@cibc.ca

http://research.

cibcwm.com/res/Eco/

EcoResearch.html

a more dovish Fed mean that the CAD’s worst days are behind it. However, as US interest

rate increases come into clearer view, the loonie will depreciate modestly, albeit not to

the depths seen in January.

Events

to

Watch

in

Coming Month

• A host of central bank meetings will headline the international schedule over the next

month. The ECB (March 10th) is likely to ease policy again to combat weak inflationary

pressures. While the Fed (March 15-16th) will keep rates on hold, look for the statement

and projections to give some insight into the future path of rates.

• In Canada, the Federal budget (March 22nd) will outline the extent to which the Liberal

government is going to support the economy. In turn, that will shed more light on the

Bank of Canada’s upcoming monetary policy decisions.

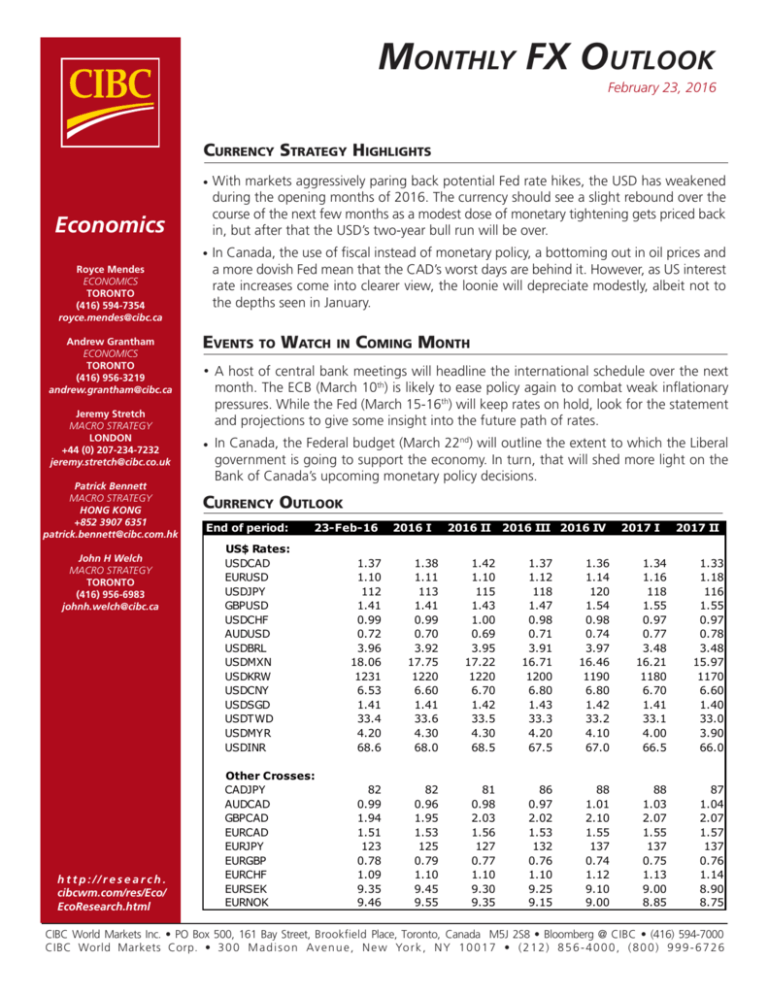

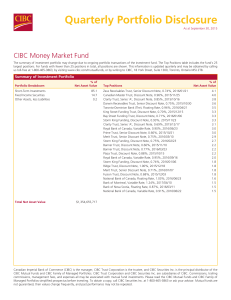

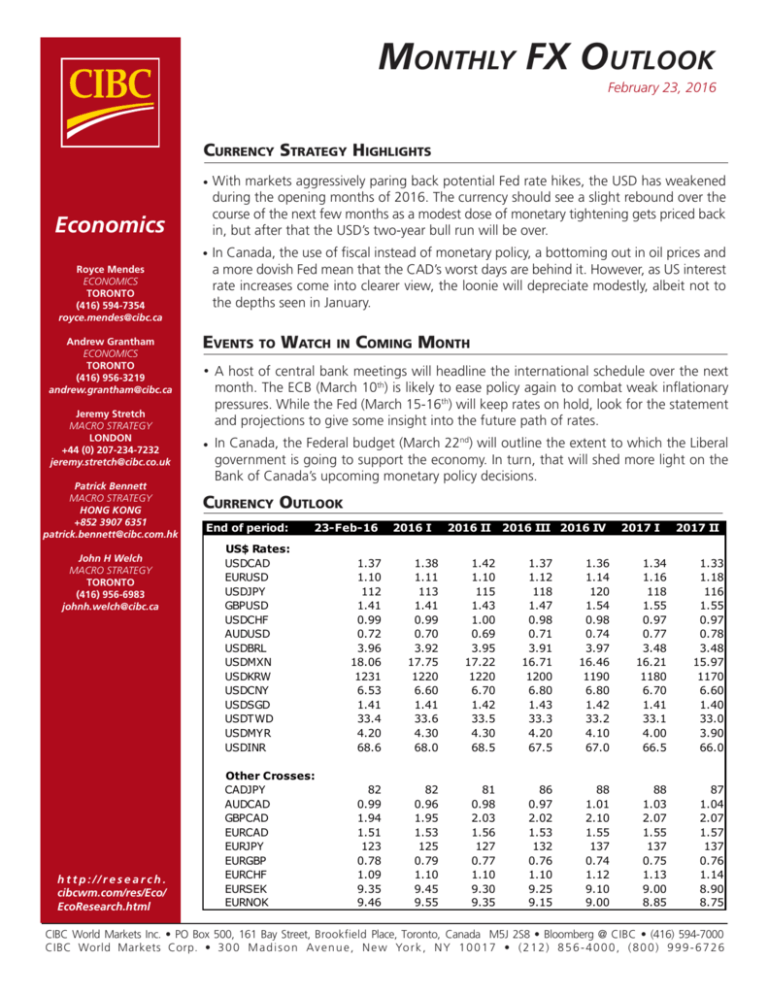

Currency Outlook

End of period:

23-Feb-16

US$ Rates:

USDCAD

EURUSD

USDJPY

GBPUSD

USDCHF

AUDUSD

USDBRL

USDMXN

USDKRW

USDCNY

USDSGD

USDTWD

USDMYR

USDINR

Other Crosses:

CADJPY

AUDCAD

GBPCAD

EURCAD

EURJPY

EURGBP

EURCHF

EURSEK

EURNOK

2016 I

2016 II 2016 III 2016 IV

2017 I

2017 II

1.37

1.10

112

1.41

0.99

0.72

3.96

18.06

1231

6.53

1.41

33.4

4.20

68.6

1.38

1.11

113

1.41

0.99

0.70

3.92

17.75

1220

6.60

1.41

33.6

4.30

68.0

1.42

1.10

115

1.43

1.00

0.69

3.95

17.22

1220

6.70

1.42

33.5

4.30

68.5

1.37

1.12

118

1.47

0.98

0.71

3.91

16.71

1200

6.80

1.43

33.3

4.20

67.5

1.36

1.14

120

1.54

0.98

0.74

3.97

16.46

1190

6.80

1.42

33.2

4.10

67.0

1.34

1.16

118

1.55

0.97

0.77

3.48

16.21

1180

6.70

1.41

33.1

4.00

66.5

1.33

1.18

116

1.55

0.97

0.78

3.48

15.97

1170

6.60

1.40

33.0

3.90

66.0

82

0.99

1.94

1.51

123

0.78

1.09

9.35

9.46

82

0.96

1.95

1.53

125

0.79

1.10

9.45

9.55

81

0.98

2.03

1.56

127

0.77

1.10

9.30

9.35

86

0.97

2.02

1.53

132

0.76

1.10

9.25

9.15

88

1.01

2.10

1.55

137

0.74

1.12

9.10

9.00

88

1.03

2.07

1.55

137

0.75

1.13

9.00

8.85

87

1.04

2.07

1.57

137

0.76

1.14

8.90

8.75

CIBC World Markets Inc. • PO Box 500, 161 Bay Street, Brookfield Place, Toronto, Canada M5J 2S8 • Bloomberg @ CIBC • (416) 594-7000

CIBC World Markets Corp. • 3 0 0 M a d i s o n A v e n u e , N e w Yo r k , N Y 1 0 0 1 7 • ( 2 1 2 ) 8 5 6 - 4 0 0 0 , ( 8 0 0 ) 9 9 9 - 6 7 2 6

CIBC World Markets Inc.

Monthly FX Outlook - February 23, 2016

USD Springs a Leak

Add it all up, and after a short rally, the two-year bullrun in the USD will have come to an end. It’s not all bad

news though. The slightly softer exchange rate should

be less of a drag on the economy as it tries to navigate

the choppy.

Risks to the Fed’s tightening cycle have always been

tilted to the downside. That’s why our fed funds

forecasts have exhibited a gentler path than those in

the FOMC’s Summary of Economic Projections.

Loonie Has Seen Its Worst

Even eight years after the financial crisis, the persistence

of weak inflationary pressures would have made it

difficult to implement the type of tightening suggested

by the FOMC forecasts. That said, recent financial

market jitters have added another headwind and, as a

result, a March rate hike has now been taken off the

table.

With Canadian monetary policy taking a backseat to

fiscal stimulus, Fed rate hikes being delayed until later

in the year and oil prices appearing to have bottomed

out we’ve strengthened our near-term forecast for the

Canadian dollar. Indeed, it’s now likely that the loonie

has seen the worst of the depreciation, even if it has

one slight dip ahead.

Indeed, sentiment has turned so sour that the futures

market is barely even pricing in 25bps of tightening

over the next two years (Chart 1, left). But recent talk

of a recession is overdone, and CIBC Economics is still

projecting two rate hikes in 2016. As markets move to

price in that modest dose of tightening, the USD should

regain some ground during the first half of the year.

The Bank of Canada’s decision to keep rates on hold

in January represented an important turning point for

the currency. Since reaching its weakest level on the

day before the announcement, a time when markets

were pricing in a high probability of further monetary

easing, the CAD has appreciated more than five

percent. In part, that strength reflects the perception

that Governor Poloz has given way to his boss, Finance

Minister Morneau.

However, even rate hikes won’t be able to stop the

currency from leaking lower during the latter part

of 2016. By that time, other economies will have

begun reaping the rewards of past stimulus, making

the outlooks for monetary policies less disparate. The

US’s trade deficit will also weigh on the greenback

as it becomes increasingly viewed in contrast to the

surpluses seen in regions like the euro area (Chart 1,

right).

The use of deficit spending by the Liberal government

to stimulate the economy means that the pressure on

the currency from potential monetary easing has been

significantly reduced. Indeed, according to a technical

report by the Bank of Canada, $10 bn worth of fiscal

stimulus has more of an effect on GDP than a reduction

of 100bps in the overnight rate (Chart 2 left).

Chart 2 - Planned Fiscal Stimulus Will Be More Potent Than

An Additional Rate Cut (L); Oil Market to Reduce Excess

Supply as Demand Accelerates (R)

2.5

2

0.4

1

0.3

0

0.2

1.5

0.25

-1

0.1

1.0

0.00

-2

0.0

0.75

Aug-17

Current

As of Dec.

Source: Bloomberg,

CIBC31, 2015

Nov-17

Feb-17

May-17

Nov-16

Aug-16

May-16

Feb-16

0.50

0.5

25bp Rate Cut $10B Fiscal

Stimulus

0.0

25bp Rate Cut

-0.5

$10B Fiscal Stimulus

Source: Bloomberg, CIBC

-3

-4

US

2.0

Eurozone

Source: Bloomberg, Haver Analytics, CIBC

16Q4

1.00

IEA Projected Oil Market

Balance (Millions of

Barrels Per Day)

16Q3

0.5

3.0

16Q2

1.25

Change in Annual

16Q1

3

0.6

15Q4

1.50

Current Account

Balance as a % of GDP

15Q3

4

Fed Funds Futures

15Q2

1.75

15Q1

Chart 1 - Futures Market Only Pricing in One Fed Rate Hike

Over the Next Two Years (L); US Current Account Will Weigh

on the Currency (R)

Source: Bank of Canada, IEA, CIBC

2

CIBC World Markets Inc.

Monthly FX Outlook - February 23, 2016

Pressure on the loonie from further Fed rate hikes has

also been delayed. Market volatility and a string of

soft data has seen the FOMC take a step back from

their hiking cycle. While the US central bank could still

raise rates later in the year, it would likely happen in

an environment of better global growth and higher

oil prices. CIBC Economics expects oil prices to recover

during the year with supply leveling off and demand

continuing to increase (Chart 2, right). That would

provide at least a partial cover for the loonie from wider

interest rate differentials. We say partial cover because

the currency will still depreciate as monetary policy

diverges, but it won’t reach the depths seen in January.

Chart 3 - Eurozone Inflation Expectations Have Moved

Lower Recently (L); With the Fed Delaying Rate Hikes,

Pressure on the Euro from Widening Spreads Should

Dissipate (R)

2.00

5Y5Y Inflation Expectations 1.25

1.00

1.20

1.25

1.15

1.75

1.50

1.10

1.75

1.05

1.50

1.00

Jan-15

EURUSD

As a result, the CAD shouldn’t deviate too far from its

current level over the remainder of the year. Looking

ahead, as oil prices grind higher, the loonie should

appreciate slightly, albeit remaining weak enough to

keep the non-energy export sector competitive on the

global stage.

1.25

Jan-15

Jul-15

Jan-16

2.00

Jan-16

5YR US-Germany Spread

(RHS,

Inverse)

Source:

Bloomberg, CIBC

Source: Bloomberg, CIBC

than what markets currently expect, the currency is

unlikely to depreciate much from current levels. That’s

because the one-way policy divergence trade with the

US is now much more uncertain (Chart 3).

EUR: What’s Left in Mario’s Cart?

ECB President Mario Draghi has already unleashed a

sizeable wave of central bank stimulus, but it hasn’t

been enough to combat the deteriorating outlook for

inflation. Over the past two months, 5y5y inflation

expectations have fallen 40bps, reaching their lowest

level on record. While it’s often argued that these

market-based inflation expectations are not perfect

measures of the actual level of expectations, the move

lower is nonetheless troubling for the ECB.

Just as ECB policy appears to be reaching its limits,

FOMC voters are stepping away from a March rate

hike. As a result, look for the euro to decline slightly

following the next round of easing, but to remain

above the 1.10 mark over the next couple of quarters.

JPY: Who Surprised Who?

It will likely influence some of the hawkish board

members to vote in favour of more substantive easing

during the central bank’s upcoming meeting on March

10. As a result, look for the ECB to cut the deposit

rate another 20bps, taking it down to -0.50%. In an

attempt to protect banks, following the example of

the BoJ, lower rates would likely be accompanied by a

move to a tiered system where existing deposits don’t

incur additional costs. The banking sector has already

been hit by new bail in rules that took effect on January

1, the ECB doesn’t want to add to the negativity

surrounding the sector.

The BoJ surprised just about everybody when it took

rates into negative territory a few weeks ago. But the

market may have gotten the last laugh, as it stunned

the central bank by bidding up the value of the yen in

the aftermath.

While President Draghi will play up the central bank’s

ability to ease policy further, questions will be raised

about how much firepower he really has left. Markets

have yet to fully price in additional easing, as they don’t

want to get caught offside for a second meeting in a

row. However, even if the central bank delivers more

However, that misconception can’t explain why

the currency has continued to appreciate or why

speculators are maintaining their elevated level of

long yen positions (Chart 4). Despite a broad softening

in the US dollar, USDJPY is now trading around its

average during the last quarter of 2014.

After taking a few days to digest the details of

the policy move, markets decided that it was less

aggressive than initially believed. As the BoJ will now

have different tiers of reserves, it seems that only

about 12% will be impacted by the newly announced

negative rates.

3

CIBC World Markets Inc.

Monthly FX Outlook - February 23, 2016

While we admit that the likelihood of a BoE hike this

year is fading, pricing an ease at this point appears

extreme. The BoE’s projections show that the output

gap is narrower, despite downgraded GDP forecasts.

And the unemployment rate has moved down again.

Wage inflation has eased again after seeming to be on

an uptrend earlier, but that could be because of the

link between pay increases and headline CPI. With

oil prices stabilizing, albeit at lower levels, signs of CPI

and wage inflation starting to pick up should be more

evident in the second half of the year.

Chart 4 - Despite the Recent Appreciation in the Currency,

Speculative Positions in the Yen Remain Long

Net Speculative Yen Positions

40000

20000

0

-20000

-40000

-60000

-80000

-100000

-120000

So while sterling could remain on the defensive in the

near-term thanks to speculation on EU membership

(Chart 5, right), an expected decision to remain part

of the European community and a modest pick-up in

inflation should see it recover to 1.54 versus the USD

by year-end.

Feb-16

Source: Bloomberg, CIBC

Nevertheless, given that the reduction in rates wasn’t as

aggressive as initially thought, it does leave some tools

in Kuroda’s toolbox for future use. That leaves risks

skewed toward further action out of the central bank,

since the longer the currency remains at these levels,

the less likely it will be that the CPI target is achieved.

AUD: Lost in Transition

Much like here in Canada, the central bank of Australia

is trying to guide the economy through a period of

transition between resource-fuelled growth and an

economy supported by other drivers. Judging by the

Q4 employment figures, it appeared at first as if the

economy was managing this period of transition very

well. However, the Secretary of the Treasury later

described the strong employment gains over this period

as being the result of “technical issues”.

Sterling a Risky Bet in Near Term

In a risk off world, Sterling remains an underperformer.

Uncertainty regarding the UK’s place in Europe and

the country’s reliance on capital inflows thanks to a

large current account deficit have kept sterling on

the defensive since the start of the year. And that

underperformance could continue through the first half

of the year as well.

The RBA appears to be of two minds regarding policy.

It welcomes a cheaper currency as providing a boost

A June 23rd date for the UK’s referendum on EU

membership has been confirmed, leaving plenty of

time still for opinion polls to provide impetus for the

currency. However, much like during run up to the

general election and Scottish referendum, we suspect

that the deteriorating opinion polls overstate the risk

of “Brexit” (Chart 5, left).

Chart 5 - EU Membership Opinion Polls Have Deteriorated

Recently (L), Just as the Topic is Gaining More Attention (R)

UK Opinion Polls on Staying vs

Internet Search Popularity

Leaving EU (%-pt difference, 120

(Index 100 = max)

20%

rolling avg)

100

16%

Majority in Favour

80

12%

Grexit

of Staying

Brexit

60

8%

4%

Jan-16

Nov-15

Jul-15

Sep-15

May-15

0

Jan-15

Jan 2016

Dec 2015

Jun 2015

-4%

20

Majority in Favour

of Leaving

Nov 2015

0%

40

Mar-15

Fear that the UK could leave the EU isn’t the only

source of sterling weakness, however. Downgrades to

growth expectations and the uncertain international

outlook has seen financial markets move from pricing

in the probability of a BoE rate hike not long ago, to

pricing a 40% likelihood that Carney and co. will follow

the lead of the ECB and cut rates below their Great

Recession lows.

Oct 2015

Jan-16

Dec-15

Nov-15

Oct-15

Sep-15

Aug-15

Jul-15

Jun-15

Apr-15

Source: Bloomberg, CIBC

May-15

Mar-15

Jan-15

Feb-15

-140000

Sep 2015

60000

Source: Bloomberg, CIBC

Source: Bloomberg, CIBC

4

CIBC World Markets Inc.

Monthly FX Outlook - February 23, 2016

SEK to gradually gain ground against the euro, as the

ECB continues to ease policy.

to parts of the economy exposed to international

pressures. Yet it says that the currency is merely a

reflection of lower commodity prices, and is reticent

to ease interest rates again due to rising private sector

credit and home loans. In his semi-annual Parliamentary

testimony, Governor Stevens indicated that the bank

maintains a bias toward easing due to a benign

inflation backdrop, but that there is no rush to cut

rates further.

NOK Moving With Oil Prices

With weak oil prices impacting the economy, look for

the Norges bank to cut rates by 25bps to 0.50% on

March 17. However, unlike most other economies in

the area, there are no deflation concerns at this point.

As a result, the central bank should be able to avoid

negative territory on rates for now.

With uncertainty remaining regarding the global

economic backdrop, it is hard to call a trough in

commodity prices or by extension the Aussie dollar yet.

However, a brighter outlook for commodity demand by

year-end should see a recovery to 0.74 versus the USD.

While weaker oil prices highlight the fact that growth

will remain weak, we expect oil prices to gradually

increase over the course of the year. That should

support both the economy and the EURNOK exchange

rates. Look for the currency to follow oil prices

moderately higher during the year and into 2017.

Swiss Policymakers to Follow ECB

Given that we expect the ECB to cut rates again in

a few weeks, it seems likely that the Swiss National

Bank would have to follow suit. To keep the EURCHF

exchange rate stable, Chairman Jordan will have to

make good on his statement that the deposit rate has

yet to reach rock bottom.

Brazilian Inflation Still Charging Ahead

Brazilian markets came back from the Carnaval festival

buffeted by international markets and the return of

activities in congress. USDBRL quickly caught up with

global market sentiment, spiking to above 4.00 and

has oscillated around that level since then. General

pessimistic sentiment remains, especially with the

lack of fiscal adjustment. The government delayed

announcing necessary expenditure cuts once again and,

even then, most expect them to prove insufficient to

guarantee a primary surplus in 2016. Monetary policy is

tight, but inflation continues to accelerate. As a result,

we think we have seen the highs in USDBRL and look

to sell it on any spike (Chart 6).

As a result, we expect the twin policies of foreign

exchange market intervention and negative deposit

rates to persist for some time. Despite removing the

peg to the euro, the central bank has seen reserves

increase by about 15%, highlighting the fact that

policymakers remain very active in the foreign exchange

market.

Look for the SNB to undertake as much easing as is

necessary to keep the exchange rate stable around

current levels for the rest of the year.

Chart 6 - USDBRL Spot, the SELIC Policy Rate, and Inflation

Riksbank Trying to Outdo the ECB

16%

Despite the economy growing at around three percent

for the second year in a row, the Riksbank has been

aggressive with regards to recent policy moves. The

deposit rate was unexpectedly taken further into

negative territory, albeit on the back of a very close

vote. It appears that the central bank is trying to get

ahead of the ECB, which is expected to add additional

stimulus in the near future.

IPCA inflation (% YoY, L)

SELIC rate (L)

USD/BRL (R)

14%

12%

4.0

3.5

2.5

8%

2.0

6%

TARGET

4%

2%

0%

Aug-10

4.5

3.0

10%

At this point, Governor Ingves seems more concerned

with inflation rather than exacerbating inflated asset

prices or leveraged consumers. But we still expect the

Forecast

1.5

1.0

0.5

Dec-11

May-13

Sep-14

0.0

Jan-16

May-17

Source: Bloomberg, CIBC

Source: Banco Central do Brasil, IBGE, CIBC

5

CIBC World Markets Inc.

Monthly FX Outlook - February 23, 2016

THE IBGE reported that January inflation accelerated

to 1.3% or 10.7% year/year, well above consensus of

1.1% and just a bit above our 1.2% forecast. In our

view, that should convince the COPOM to raise the

SELIC rate again in March. The BCB’s needs to tighten

further, but political pressure to stay on hold or even

cut the SELIC remains high.

Chart 7 - Mexico: USDMXN, Fondeo Rate, Headline and Core

Inflation (year/year %)

6.0

5.0

4.0

3.0

Inflation should stay above 9.0% throughout 2016.

Inflation dynamics have not yet turned, but tight

monetary policy could lead to better price dynamics.

However, with the change of Finance Minister, further

substantial fiscal adjustment is less likely.

2.0

1.0

0.0

Aug-10

December 2015 fiscal numbers showed significant

deterioration, but at least markets are now getting

transparent and true numbers. Government fiscal

dynamics, however, remain dangerous. Nevertheless,

look for the currency to gradually gain ground from the

very weak levels seen recently as tight monetary policy

begins to have more of an effect.

19

18

17

16

15

14

13

12

11

10

9

8

7

6

Feb-16 Bloomberg,

Jul-17 CIBC

Source:

Forecast

CPI inflation (y/y %, Left)

Core inflation (y/y %, Left)

Fondeo rate (Left)

USD/MXN (Right)

Jan-12

May-13

Oct-14

Source: Banxico, Bloomberg, CIBC

that the high USDMXN have had on prices could delink

Mexico’s monetary policy from the Fed and prompt it

to raise the overnight rate sooner.

Mexican Central Bank Surprisingly Tightens Policy

Moreover, we noted that 1M USDMXN vols had jumped

above 16 for the first time since September 2013 and

that the last time 1M vols approached 16 (August 2015

and September 2015) Banxico announced new USD

auction measures or modified existing ones. We see

this joint action by Banxico, the FX commission, and the

Ministry of Finance as a proactive measure to correct

the overshot USDMXN. Moreover, we do not see a

significant impact on our growth estimates and expect

2016 GDP growth to come in at 3.00%.

The recent rout in oil prices took USDMXN above

19.00, which in turn caused Banxico to take action

less than two weeks since the last policy meeting.

The central bank increased the fondeo rate by 50 bps

to 3.7%, causing USDMXN to close at 18.00 before

retracing some of the move (Chart 7).

The central bank stated that the hike does not imply the

start of a tightening cycle. However, they will continue

to monitor the exchange rate and its impact on prices

and the relative monetary stance between Mexico and

the US. We expect two more 25bp increases in the

fondeo rate, meaning that it will end 2016 at 4.25%.

CNY, CNH – Depreciation Moderating

There remains a high degree of scrutiny surrounding

Chinese financial markets and the future path of

the yuan, although the overwhelming bearishness

witnessed around the turn of the year has eased

considerably. The softening in the negative tone has,

in part, been associated with a greater acceptance that

the capital outflows seen over the last few months

were a combination of foreign debt repayments,

which is welcome, and companies invested in China

hedging exposures, which will keep some pressure on

the currency though needn’t be destabilizing in the

medium to long-term.

The FX commission suspended its daily USD

auctions, but left open the possibility of discretionary

interventions if the exchange rate deviates from

fundamentals. In a complementary move, Finance

Minister Luis Videgaray, announced MXN 132 bln

expenditure cut equivalent to around 0.7% of GDP. The

federal government will cut MXN 32 bln whereas the

remaining MXN 100 bln will come from PEMEX.

Although the intra-meeting rate announcement took

the market by surprise, this decision responded to the

increase in the upside volatility experienced in USDMXN

since the previous rate announcement. Banxico hinted,

last week, that the fiscal situation and the pressures

To be sure, there has also been some degree of

speculative outflows, but we expect that these have

peaked, at least absent any further deterioration in the

economic outlook.

6

CIBC World Markets Inc.

Monthly FX Outlook - February 23, 2016

The challenge for policymakers has been to educate

the market about their reform intentions. All told, the

process of Chinese market reform and shift toward

international norms is taking time and has hit a few

snags along the way – a great deal of it related to how

other markets have reacted.

For our part, we continue to take a pragmatic view of

the situation. We are forecasting a weakening of the

CNY, but also stick to a view of selling strength rather

than chasing the market at any point. The recent

narrowing between spot USDCNY and USDCNH is a

signal of a nearly neutral market position, thus showing

the opportunity to establish or add to USDCNH longs.

For reference, the spread between USDCNY and

USDCNH is currently around 10-15bps, that’s much

narrower than the 1450bps seen in early January.

Talk of a precipitous decline in the CNY as a result of

capital outflows, a policy to depreciate the currency to

boost exports, or as a result of having to print money

to bail out the banking sector, individually and in

combination, are powerful ingredients for a sensational

narrative. Nevertheless, the PBoC and other officials

have urged that such a result is not justified.

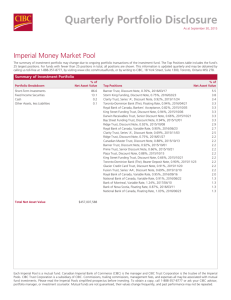

Interest Rate

and

1-year outright USDCNH points that traded near

3500bps are now around 2500bps. That prices around

a 3.8% annualized depreciation of the currency. We

believe the market is currently appropriately priced.

Economic Outlook

End of period:

Canada Overnight target rate

2-Year Gov't Bond

10-Year Gov't Bond

Federal Funds Rate

US

2-Year Gov't Note

10-Year Gov't Note

Eurozone Refin.operations rate

2-Year Gov't Bunds

10-Year Gov't Bunds

Bank rate

UK

2-Year Gilts

10-Year Gilts

Overnight rate

Japan

2-Year Gov't Bond

10-Year Gov't Bond

2016 I 2016 II 2016 III 2016 IV

0.50

0.50

0.50

0.50

0.45

0.50

0.55

0.70

1.20

1.35

1.50

1.60

0.38

0.63

0.63

0.88

0.70

0.95

1.00

1.30

2.00

2.25

2.50

2.60

0.05

0.05

0.05

0.05

-0.45

-0.45

-0.25

-0.20

0.30

0.30

0.40

0.50

0.50

0.50

0.50

0.75

0.50

0.60

0.75

0.90

1.75

1.95

2.15

2.25

0.10

0.10

0.10

0.10

-0.10

-0.15

-0.15

-0.15

0.10

0.10

0.10

0.15

Canada

US

Eurozone

UK

Japan

Real GDP growth (%)

Unemployment rate (%)

CPI (%)

Real GDP growth (%)

Unemployment rate (%)

CPI (%)

Real GDP growth (%)

Unemployment rate (%)

CPI (%)

Real GDP growth (%)

Unemployment rate (%)

CPI (%)

Real GDP growth (%)

Unemployment rate (%)

CPI (%)

2015

1.2

6.9

1.1

2.4

5.3

0.1

1.5

10.9

0.0

2.4

5.5

0.0

0.6

3.4

0.9

2016

1.3

7.2

1.7

2.2

4.4

1.5

1.9

10.1

1.0

2.3

5.0

1.1

1.0

3.1

0.8

2017

2.3

7.0

2.5

2.1

4.2

2.9

1.6

9.5

1.6

2.2

4.8

1.9

0.6

3.2

1.3

This report is issued and approved for distribution by (a) in Canada, CIBC World Markets Inc., a member of the Investment Industry Regulatory Organization of Canada, the Toronto Stock Exchange, the

TSX Venture Exchange and a Member of the Canadian Investor Protection Fund, (b) in the United Kingdom, CIBC World Markets plc, which is regulated by the Financial Services Authority, and (c) in Australia, CIBC Australia Limited, a member of the Australian Stock Exchange and regulated by the ASIC (collectively, “CIBC”) and (d) in the United States either by (i) CIBC World Markets Inc. for distribution

only to U.S. Major Institutional Investors (“MII”) (as such term is defined in SEC Rule 15a-6) or (ii) CIBC World Markets Corp., a member of the Financial Industry Regulatory Authority. U.S. MIIs receiving

this report from CIBC World Markets Inc. (the Canadian broker-dealer) are required to effect transactions (other than negotiating their terms) in securities discussed in the report through CIBC World

Markets Corp. (the U.S. broker-dealer).

This report is provided, for informational purposes only, to institutional investor and retail clients of CIBC World Markets Inc. in Canada, and does not constitute an offer or solicitation to buy or sell any

securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. This document and any of the products and information contained herein are not intended for the

use of private investors in the United Kingdom. Such investors will not be able to enter into agreements or purchase products mentioned herein from CIBC World Markets plc. The comments and views

expressed in this document are meant for the general interests of wholesale clients of CIBC Australia Limited.

This report does not take into account the investment objectives, financial situation or specific needs of any particular client of CIBC. Before making an investment decision on the basis of any information

contained in this report, the recipient should consider whether such information is appropriate given the recipient’s particular investment needs, objectives and financial circumstances. CIBC suggests that,

prior to acting on any information contained herein, you contact one of our client advisers in your jurisdiction to discuss your particular circumstances. Since the levels and bases of taxation can change,

any reference in this report to the impact of taxation should not be construed as offering tax advice; as with any transaction having potential tax implications, clients should consult with their own tax

advisors. Past performance is not a guarantee of future results.

The information and any statistical data contained herein were obtained from sources that we believe to be reliable, but we do not represent that they are accurate or complete, and they should not be

relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. CIBC has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof.

Each such address or hyperlink is provided solely for the recipient’s convenience and information, and the content of linked third-party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk.

© 2016 CIBC World Markets Inc. All rights reserved. Unauthorized use, distribution, duplication or disclosure without the prior written permission of CIBC World Markets Inc. is prohibited by law and may

result in prosecution.

7