Positive vs. normative:

Positive vs. normative:

Positive analysis: description and prediction of human behavior (using models)

Model : – a simplified theory applied to a specific situation, from which a prediction can be derived

– contains variables and parameters.

Normative analysis: evaluation of the outcome(s) of positive analysis with regard to any given criterion (in Economics, this would be welfare or efficiency) .

Example of a positive theory : market equilibrium.

Example of a positive model : with negative externalities, the amount traded (in equilibrium) is greater than the efficient amount.

Example of normative analysis : levying a Pigovian tax in order to internalize a negative externality results in efficient behavior.

In Economics, normative analysis always is based on a positive core.

20050803.doc - 1 Dr. Roland Kirstein, Visiting Professor UCSB

Law and Economics 117A, Summer Session B

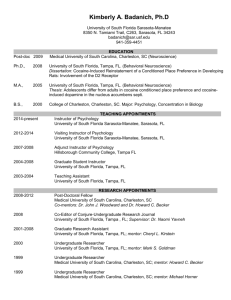

Pre-test results

14

13

12

12

14

11

10

8

6

4

2

9

3

7

0

0 1 2 3 4 5 6

Number of Bonus Points

Only 17 out of 72 (23.6%) gave 6 or more correct answers!

7

4

8

5

9

0

10

1

20050803.doc - 2 Dr. Roland Kirstein, Visiting Professor UCSB

Law and Economics 117A, Summer Session B

Solutions to the Pre-test

#1 Derivation of the results: a) W=300-2p <=> 2p=300-W <=> p(W)=150-0.5W b) p(W)=MC <=> 150-0.5W = 0.5W <=> W=150 into p(W)

Note that because the demand curve represents the marginal utility of W, the area under the demand curve represents the total utility of a certain amount of W.

The competitive equilibrium (p*, W*) allows for two interpretations:

• positive - this is the outcome predicted for profit-/utility-maximizing actors;

• normative - this quantity maximizes net social welfare. c) R=p(W)W=150W-0.5W

2 => MR=150-W; MR=MC => W M =100 into p(W)

The monopoly solution leads to a welfare loss (triangle). d) SMC = 50+0.5W => p(W)=SMC(W) => W’=100 into p(W)

The negative externality will be internalized if a Pigovian tax is levied. Another way to achieve efficiency would be to allow for a monopoly in the market. This is typical for second-best problems: adding a deviation from perfect competition (such as a tax or monopoly) to another one (an externality) does not necessarily decrease welfare, but may even increase it.

20050803.doc - 3 Dr. Roland Kirstein, Visiting Professor UCSB

Law and Economics 117A, Summer Session B

20050803.doc - 4 Dr. Roland Kirstein, Visiting Professor UCSB

Law and Economics 117A, Summer Session B

#2: Game theory = interactive decision making

Normal form game (N,S,U)

• Set of players N={1; 2}

• Each player’s strategy set S i

= {C; D}, i ∈ N

• Each player’s payoff function U x S

2 i

: S

1

→ IR

WHO may DO WHAT, and with WHAT consequences?

A Nash-Equilibrium is a pair of strategies with the following property: No player wants to reconsider his choice, given that the other player chooses her equilibrium strategy. a) Prisoners’ Dilemma b) coordination game c) pure conflict

1,2 C

C 3,3

D

1,4

1,2

C

C D

4,4 1,3

1,2

C

C

4,3

D

1,4

D 4,1 2,2 D

Nash-Equilibria in pure stratgies:

3,1 2,2 D 3,2

D,D D,D and C,C none

2,1

20050803.doc - 5 Dr. Roland Kirstein, Visiting Professor UCSB

Law and Economics 117A, Summer Session B