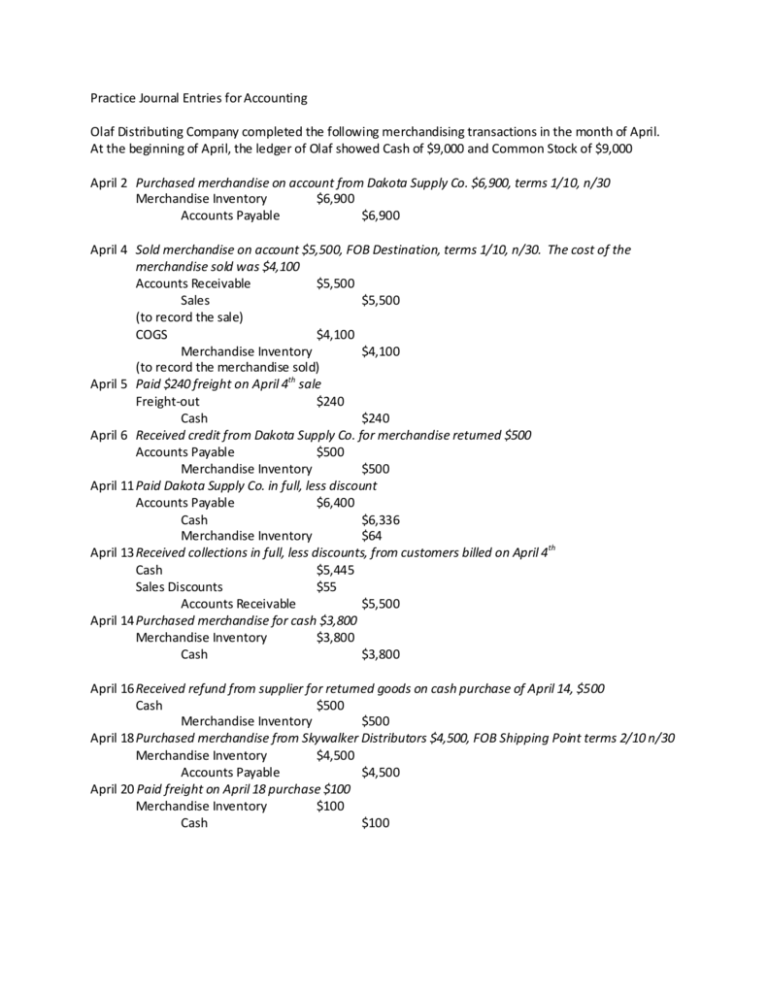

Practice Journal Entries for Accounting Olaf Distributing Company

advertisement

Practice Journal Entries for Accounting Olaf Distributing Company completed the following merchandising transactions in the month of April. At the beginning of April, the ledger of Olaf showed Cash of $9,000 and Common Stock of $9,000 April 2 Purchased merchandise on account from Dakota Supply Co. $6,900, terms 1/10, n/30 Merchandise Inventory $6,900 Accounts Payable $6,900 April 4 Sold merchandise on account $5,500, FOB Destination, terms 1/10, n/30. The cost of the merchandise sold was $4,100 Accounts Receivable $5,500 Sales $5,500 (to record the sale) COGS $4,100 Merchandise Inventory $4,100 (to record the merchandise sold) April 5 Paid $240 freight on April 4th sale Freight-out $240 Cash $240 April 6 Received credit from Dakota Supply Co. for merchandise returned $500 Accounts Payable $500 Merchandise Inventory $500 April 11 Paid Dakota Supply Co. in full, less discount Accounts Payable $6,400 Cash $6,336 Merchandise Inventory $64 April 13 Received collections in full, less discounts, from customers billed on April 4th Cash $5,445 Sales Discounts $55 Accounts Receivable $5,500 April 14 Purchased merchandise for cash $3,800 Merchandise Inventory $3,800 Cash $3,800 April 16 Received refund from supplier for returned goods on cash purchase of April 14, $500 Cash $500 Merchandise Inventory $500 April 18 Purchased merchandise from Skywalker Distributors $4,500, FOB Shipping Point terms 2/10 n/30 Merchandise Inventory $4,500 Accounts Payable $4,500 April 20 Paid freight on April 18 purchase $100 Merchandise Inventory $100 Cash $100 April 23 Sold merchandise for cash $6,400. The merchandise sold had a cost of $5,120 Cash $6,400 Sales $6,400 (to record the sale) COGS $5,120 Merchandise Inventory $5,120 (to record the merchandise sold) April 26 Purchased merchandise for cash $2,300 Merchandise Inventory $2,300 Cash $2,300 April 27 Paid Skywalker Distributors in full, less discount Accounts Payable $4,500 Cash $4,410 Merchandise Inventory $90 April 29 Made refunds to cash customers for defective merchandise $90. The returned merchandise had a scrap value of $30 Sales Returns and Allowances $90 Cash $90 (to record the return) Merchandise Inventory $30 COGS $30 (to record the merchandise returned) April 30 Sold merchandise on account $3,700, terms n/30. The cost of the merchandise sold was $2,800 Accounts Receivable $3,700 Sales $3,800 (to record the sales) COGS $2,800 Merchandise Inventory $2,800