05 Competitive Analysis - New York City Economic Development

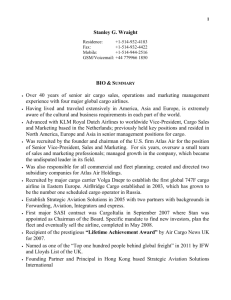

advertisement