Management Accounting Fundamentals

advertisement

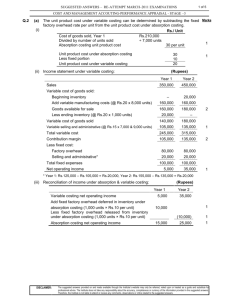

Management Accounting Fundamentals Exam Review Lectures and handouts by: Shirley Mauger, HB Comm, CGA Exam Review - Table of Contents Part Content 1 2 3 4 5 6 7 8 9 10 11 12 Preparing and studying for the exam Course review: modules 1-5 Course review: modules 6-10 Review question: Cost of goods manufactured and cost flows Review question: Process costing and normal spoilage Review question: Break-even, special order and pricing Review question: Process costing and variance analysis Review question: Activity based costing Review question: Absorption and variable costing income statements Review question: Cash budget Review question: Decision making – process further or drop product line ‘Final notes on the final’ 2 Regarding this review • The audio and visual portions of all lectures including this review are designed to be used together. • I do not know what is on the final examination • This review is only a summary. – It does not cover all topics in the course. – You are responsible for all of the topics presented in the lesson notes and textbook 3 MA1 – Exam review Part 1 Preparing and studying for the exam 4 Part 1 – Preparing and studying for the exam Final exam resources available online: 1. MA1 exam blueprint 2. MA1 review questions and solutions (ma1_modR_handout1) 3. MA1 practice examination 4. MA1 past examinations 5 Part 1 – Preparing and studying for the exam Question Item Percentage Weighting Multiple-choice questions Short-answer questions Quantitative problems Qualitative/worksheet-related questions 20–30% 10–20% 50-60% 10-20% 6 Part 1 – Preparing and studying for the exam Module weighting 1. 2. 3. 4. 5. 6. 7. Basic concepts of management accounting Job-order costing Process costing Cost behavior and cost-volume-profit analysis Activity-based costing and service department costing Absorption and variable costing and budgeting Standard costs for materials, labour, and variable overhead 8. Flexible budgets and decentralization 9. Relevant costs for decision making and inventory management 10. Pricing and trends in management accounting 2-5% 3-8% 3-8% 15-20% 8-12% 14-18% 9-12% 12-16% 12-16% 2-5% 7 Part 1 – Preparing and studying for the exam General studying tips: 1 Practice, practice, practice • Past exam questions • Questions covered in lectures 2. Remember the exam blueprint when focusing your studies 3. Do more questions that relate to topics which are problem areas for you • Try entering topic numbers as search terms into Adobe when downloading past examinations. 8 Part 1 – Preparing and studying for the exam General studying tips (continued): 4. Make a list of formulas (you can use the list on handout 1 as a starting point) 5. Review theory 6. Study ALL of the material 7. Focus on being successful…. 9 Part 1 – Preparing and studying for the exam General exam writing tips: 1 RELAX 2 Scan through the entire exam 3 Start with a question that you feel most confident about the answer 4 You may get a question that is different than those you’ve seen before. Remember to focus on the tools you have learned in the course 5 If you’re stuck on a question, move on to another question 6 Show all calculations 7 Answer what is asked! 10 MA1 – Exam review Part 2 Course review (module summaries and key points) Modules 1 - 5 11 Part 2 – Course review: modules 1-5 Module 1 – Basic concepts of management accounting Topic Source Difference between managerial and financial accounting Just-in-time systems, total quality management, process re-engineering, theory of constraints Part 1,slide 10 p. 6-9 Part 2, p. 12-20 • Know the purpose of each • Advantages and disadvantages Prime costs and conversion costs Part 2, p. 33-34 Product costs vs. period costs Part 2, p.35-36 How do deal with overtime Part 4, slide 60 p. 34 Part 3, p.39-40 Format of a schedule of cost of goods manufactured 12 Part 2 – Course review: modules 1-5 Module 2 – Job-order costing Topic Source Difference between job and process costing Predetermined manufacturing overhead rate Estimated total overhead manufacturing costs Estimated allocation base Part 1, p. 87-90 MOH applied = overhead rate x actual activity (usually hours but read the question carefully) Part 3, p. 88 Flow of costs through direct materials, work-in-process, finished goods and cost of goods sold Parts 2 and 3 p. 93-102 See exam review question (December 1995 exam) 13 Part 2 – Course review: modules 1-5 Module 2 – Job-order costing (continued) Topic Source Journal entries to allocate over or underapplied overhead • Close to cost of goods sold • Allocate among work in process, finished goods and cost of goods sold (MOH clearing account must go to zero) Direct materials • All materials used that are traced to the product Raw materials • Can include both direct materials and indirect materials. Part 3, p.103-106 14 Part 2 – Course review: modules 1-5 Module 3 – Process costing Topic Source Know the format and calculations to complete Parts 2 & 3 an entire production report using both the p. 152-160, 165-170 FIFO and weighted average methods. •STEP 1:Prepare a quantity schedule •STEP 2:Compute cost per equivalent units (also part 1) •STEP 3:Prepare a cost reconciliation Normal and abnormal spoilage •When there is inspection, there is potential spoilage. •Unless told otherwise, inspection takes place when goods are complete •If inspection takes place on partially complete products, WIP may need to be included when calculating spoilage. Part 4, Reading 3-2 See exam review question, (December 1994) 15 Part 2 – Course review: modules 1-5 Module 3 – Process costing (continued) Topic Source Transferred-in costs • Treat as 100% complete Know the basic differences between FIFO and weighted average Parts 1 & 8(Q1) p. 149-150 Part 3, slide 62 p. 167-168 16 Part 2 – Course review: modules 1-5 Module 4 – Cost behavior and cost-volume-profit analysis Topic Source Variable costs (and step variable) and the relevant range Part 1, p.188-191 Fixed costs (discretionary vs. committed) Part 1, p. 192-196 Relevant range and affect on variable and fixed costs Part 1, p.191-192 & 195 Cost function and the analysis of mixed costs • Y=a+bX • Scattergram plot (scattergraph) • High-low method NOTE: select the occurrence with the highest and lowest activity, NOT cost. • Regression analysis (least squares) (advantages & disadvantages of each) Part 2, p.196-208 17 Part 2 – Course review: modules 1-5 Module 4 – Cost behavior and cost-volume-profit analysis (continued) Topic Source Cost volume profit equation • SP x(units) – VC x (units) – FC = Profit (also referred to as NIBT) • to change income to after tax $ divide by 1-taxrate Part 3, p.241-242 Breakeven point calculation (CM method) • Units: FC/CM •Sales $: FC/CM ratio Part 3, p.242-244 Degree of operating leverage Part 4, p.247-249 Margin of safety Part 4, p. 244 Cost volume profit analysis assumptions Part 5, slide 66 p. 253 p. 243-244 18 Part 2 – Course review: modules 1-5 Module 5 – Activity-based costing and service department costing Topic Source Plantwide and departmental overhead application rates Part 1, p. 326-327 Activity based costing Part 1, p.327-328 • Steps in designing Part 2, p. 328-339 • Advantages and disadvantages and comparison to a traditional costing system Part 2, slide 7 Part 2, slides 3435 p. 339-347 Allocating service department costs • direct, step, and reciprocal methods Parts 3 & 4 p. 741-745 19 MA1 – Exam review Part 3 Course review (module summaries and key points) Modules 6 - 10 20 Part 3 – Course review: modules 6-10 Module 6 – Absorption and variable costing and budgeting Topic Source Absorption costing vs. variable costing • Gross margin = absorption costing • Contribution margin = variable costing Part 1, p.284-286 • Preparation of income statements Part 2, p.286-292 • Reconciliation of the difference between Part 2, p.293-296 both Difference between income = FMOH costs in ending inventory less FMOH costs in beginning inventory. Fixed overhead rates may be different for beginning and ending inventories • Advantages of each Part 2, p.299-300 21 Part 3 – Course review: modules 6-10 Module 6 – Absorption and variable costing and budgeting (continued) Topic Source Components of the master budget Part 3, p.389-390 •Know formats of each budget Parts 3 & 4, p.391404 •Focus on the cash budget format (it’s the toughest) Part 4, p.399-401 22 Part 3 – Course review: modules 6-10 Module 7 – Standard costs for materials, labour, and variable overhead Topic Source Standard cost card : DM, DL, VOH, and FOH Part 1, p.436-440 Perform analysis of: • Direct materials price and quantity variances • Direct labour rate and efficiency variances • Variable overhead spending and efficiency variances •Direct materials mix and yield variances Part 2, p.441-455 Journal entries to record standard costs and variances Dealing with variances Part 3, p.470-471 Part 4, p.447-450 Part 5, p.455-457 23 Part 3 – Course review: modules 6-10 Module 7 – Standard costs for materials, labour, and variable overhead (continued) Topic Source Advantages and disadvantages of standard costs Part 5, p.457-459 Balanced scorecard advantages • Financial perspective • Customer perspective • Internal business process perspective • Learning and growth perspective Part 5, p. 460-462 Delivery cycle time Throughput time •Process + inspection + move + queue time Manufacturing cycle efficiency •Value added time/throughput time Part 5 , slide 69 p.465-467 24 Part 3 – Course review: modules 6-10 Module 8 – Flexible budgets and decentralization Topic Source Difference between a static and flexible budget Part 1, p.500-504 Interpret variable overhead variances Part 1, p.506-509 Calculate and interpret FOH variances (budget and volume) Part 2, p.510-517 25 Part 3 – Course review: modules 6-10 Module 8 – Flexible budgets and decentralization (continued) Topic Source Prepare and interpret contribution margin and Part 3, p.547-555 segment margin statements • Traceable vs. common fixed costs • Segment figures AND totals • Include % based on sales (sales=100%) Sales variances Part 4, p.560-563 • Sales mix and quantity variances • Market share and market size variances Calculate and interpret rate of return and residual Part 5, p.566-574 income 26 Part 3 – Course review: modules 6-10 Module 9 – Relevant costs for decision making and inventory management Topic Source Avoidable, differential, sunk, and opportunity costs Part 1, p.616-617 Adding and dropping product lines, divisions, segments, etc. Part 2, p.621-624 Make or buy decision Part 3, p.624-628 Special orders Part 3, p.628-629 Use of constrained resources Calculate the CM per unit of scarce resource Part 4, p.629-632 Joint product costs Part 5, p.632-634 Economic order quantity (EOQ) • Total cost of ordering and carrying inventory • Safety stock • Reorder point Part 6, Reading 9-1 Reading 9-2 27 Part 3 – Course review: modules 6-10 Module 10 – Pricing and trends in management accounting Topic Source Cost plus formula to calculate the markup % •Absorption vs. contribution approach Target costing • Sales minus profit = target cost For both, ROI must be in before tax $ Part 1, p.637-639 Time and materials pricing Part 2, p.641-643 Quality costs and reporting • Prevention, appraisal, internal failure, external failure costs. Part 3, p.54-60 Part 2, p.640-641 Part 7 review question 28 MA1 – Exam review Part 4 Review question: Cost of goods manufactured and cost flows (download ma1_modR_handout1.pdf) 29 Part 4 – Review question: Cost of goods manufactured and cost flows Question 1 December 1995 Handout pages 3 to 5 a. Prepare, in proper format, a statement of cost of goods manufactured b. Calculate the following i. Cost of goods sold ii. Indirect labour iii. Various overhead items iv. Accounts payable, July 1, 1995 Stop the audio, read and attempt the question in the handout then come back to listen to 30 the solution. Part 4 – Review question: Cost of goods manufactured and cost flows Question 1 December 1995 Handout pages 3 to 5 a. Prepare, in proper format, a statement of cost of goods manufactured b. Calculate the following i. Cost of goods sold ii. Indirect labour iii. Various overhead items iv. Accounts payable, July 1, 1995 31 Part 4 – Review question: Cost of goods manufactured and cost flows Question 1 December 1995 Handout pages 3 to 5 a. Prepare, in proper format, a statement of cost of goods manufactured b. Calculate the following i. Cost of goods sold ii. Indirect labour iii. Various overhead items iv. Accounts payable, July 1, 1995 32 MA1 – Exam review Part 5 Review question: Process costing and normal spoilage (download ma1_modR_handout1.pdf) 33 Part 5 – Review question: Process costing and normal spoilage Question 4 December 1994 Handout page 6 Compute: • the cost of goods completed • The cost of ending inventory of work in process Stop the audio, read and attempt the question in the handout then come back to listen to 34 the solution. MA1 – Exam review Part 6 Review question: Breakeven, special order and pricing (download ma1_modR_handout1.pdf) 35 Part 6 – Review question: Breakeven, special order & pricing Question 2 March 1994 Handout pages 7 - 8 a. Calculate the breakeven point in units and dollar sales b. Should this special order be accepted? c. What price should be charged in order that Hoagie can earn a profit of $5,000? Stop the audio, read and attempt the question in the handout then come back to listen to 36 the solution. Part 6 – Review question: Breakeven, special order & pricing Question 2 March 1994 Handout pages 7 - 8 a. Calculate the breakeven point in units and dollar sales b. Should this special order be accepted? c. What price should be charged in order that Hoagie can earn a profit of $5,000? 37 Part 6 – Review question: Breakeven, special order & pricing Question 2 March 1994 Handout pages 7 - 8 a. Calculate the breakeven point in units and dollar sales b. Should this special order be accepted? c. What price should be charged in order that Hoagie can earn a profit of $5,000? 38 Part 6 – Review question: Breakeven, special order & pricing Question 2 March 1994 Handout pages 7 - 8 a. Calculate the breakeven point in units and dollar sales b. Should this special order be accepted? c. What price should be charged in order that Hoagie can earn a profit of $5,000? 39 MA1 – Exam review Part 7 Review question: Process costing and variance analysis (download ma1_modR_handout1.pdf) 40 Part 7 – Review question: Process costing and variance analysis Questions 2 & 3 June 1998 Handout pages 9-10 (question 2) a. Calculate the equivalent units of performance for materials. b. Calculate the equivalent units of performance for conversion costs. Stop the audio, read and attempt the question in the handout then come back to listen to the solution. 41 Part 7 – Review question: Process costing and variance analysis Questions 2 & 3 June 1998 Handout pages 9-10 (question 2) a. Calculate the equivalent units of performance for materials. b. Calculate the equivalent units of performance for conversion costs. 42 Part 7 – Review question: Process costing and variance analysis Questions 2 & 3 June 1998 Handout pages 9-10 (question 2) c. Calculate material costs used in the computation of cost per equivalent materials d. Calculate direct labour costs used in the computation of cost per equivalent unit for labour e. Calculate overhead costs used in the computation of cost per equivalent unit for overhead f. Calculate actual cost of the ending work in process 43 Part 7 – Review question: Process costing and variance analysis Questions 2 & 3 June 1998 Handout pages 9-10 (question 2) c. Calculate material costs used in the computation of cost per equivalent materials d. Calculate direct labour costs used in the computation of cost per equivalent unit for labour e. Calculate overhead costs used in the computation of cost per equivalent unit for overhead f. Calculate actual cost of the ending work in process 44 Part 7 – Review question: Process costing and variance analysis Questions 2 & 3 June 1998 Handout pages 11-12 (question 3) Compute: a. Materials price variance b. Materials usage variance c. Direct labour rate variance d. Direct labour efficiency variance e. Overhead budget variance f. Overhead volume variance g. Total overhead variance 45 Part 7 – Review question: Process costing and variance analysis Questions 2 & 3 June 1998 Handout pages 11-12 (question 3) Compute: a. Materials price variance b. Materials usage variance c. Direct labour rate variance d. Direct labour efficiency variance e. Overhead budget variance f. Overhead volume variance g. Total overhead variance 46 Part 7 – Review question: Process costing and variance analysis Questions 2 & 3 June 1998 Handout pages 11-12 (question 3) h. Give brief explanations for the following: i. An unfavorable materials quantity variance ii. An unfavorable labour rate variance iii. A favourable labour efficiency variance iv. A favourable variable overhead spending variance 47 MA1 – Exam review Part 8 Review question: Activity based costing (download ma1_modR_handout1.pdf) 48 Part 8 – Review question: Activity based costing Question 5 December 2006 Handout pages 13-15 a. Using traditional overhead allocations, calculate the total manufacturing overhead allocated to chairs and side tables. b. Using activity based costing calculate the total manufacturing overhead that would be allocated to chairs and side tables. What is the cost per unit? c. Compare the total costs between both methods. What effect do you think the adoption of activity-based costing might have on product pricing for this company? Stop the audio, read and attempt the question in the handout then come back to listen to 49 the solution. Part 8 – Review question: Activity based costing Question 5 December 2006 Handout pages 13-15 a. Using traditional overhead allocations, calculate the total manufacturing overhead allocated to chairs and side tables. b. Using activity based costing calculate the total manufacturing overhead that would be allocated to chairs and side tables. What is the cost per unit? c. Compare the total costs between both methods. What effect do you think the adoption of activity-based costing might have on product pricing for this company? 50 Part 8 – Review question: Activity based costing Question 5 December 2006 Handout pages 13-15 a. Using traditional overhead allocations, calculate the total manufacturing overhead allocated to chairs and side tables. b. Using activity based costing calculate the total manufacturing overhead that would be allocated to chairs and side tables. What is the cost per unit? c. Compare the total costs between both methods. What effect do you think the adoption of activity-based costing might have on product pricing for this company? 51 Part 8 – Review question: Activity based costing Question 5 December 2006 Handout pages 13-15 a. Using traditional overhead allocations, calculate the total manufacturing overhead allocated to chairs and side tables. b. Using activity based costing calculate the total manufacturing overhead that would be allocated to chairs and side tables. What is the cost per unit? c. Compare the total costs between both methods. What effect do you think the adoption of activity-based costing might have on product pricing for this company? 52 MA1 – Exam review Part 9 Review question: Absorption & variable costing income statements (download ma1_modR_handout1.pdf) 53 Part 9 – Review question: Absorption & variable costing income statements Question 5 June 2007 Handout pages 16-17 a. Prepare an absorption costing income statement b. Prepare a variable costing income statement c. Explain any differences between the results in parts (a) and (b) Stop the audio, read and attempt the question in the handout then come back to listen to 54 the solution. Part 9 – Review question: Absorption & variable costing income statements Question 5 June 2007 Handout pages 16-17 a. Prepare an absorption costing income statement b. Prepare a variable costing income statement c. Explain any differences between the results in parts (a) and (b) 55 Part 9 – Review question: Absorption & variable costing income statements Question 5 June 2007 Handout pages 16-17 a. Prepare an absorption costing income statement b. Prepare a variable costing income statement c. Explain any differences between the results in parts (a) and (b) 56 Part 9 – Review question: Absorption & variable costing income statements Question 5 June 2007 Handout pages 16-17 a. Prepare an absorption costing income statement b. Prepare a variable costing income statement c. Explain any differences between the results in parts (a) and (b) 57 MA1 – Exam review Part 10 Review question: Cash budget (download ma1_modR_handout1.pdf) 58 Part 10 – Review question: Cash budget Question 5 December 2005 Handout pages 18-19 a. How much will be collected in September from sales made in August? b. What is the amount of expected accounts receivable collections during July? c. How much merchandise should Beta purchase in August? d. State two benefits of cash budgeting. Stop the audio, read and attempt the question in the handout then come back to listen to 59 the solution. Part 10 – Review question: Cash budget Question 5 December 2005 Handout pages 18-19 a. How much will be collected in September from sales made in August? b. What is the amount of expected accounts receivable collections during July? c. How much merchandise should Beta purchase in August? d. State two benefits of cash budgeting. 60 Part 10 – Review question: Cash budget Question 5 December 2005 Handout pages 18-19 a. How much will be collected in September from sales made in August? b. What is the amount of expected accounts receivable collections during July? c. How much merchandise should Beta purchase in August? d. State two benefits of cash budgeting. 61 MA1 – Exam review Part 11 Review question: Decision making - process further or drop product line (download ma1_modR_handout1.pdf) 62 Part 11 – Review question: Decision making – process further or drop product line Question 4 June 1995 Handout pages 20-21 a. b. Advise the management of Wedersen: – Should they sell the products at split off or sell them in their fully processed form? – Should they discontinue production or employ some other course of action Should Wedersen product Deteron rather than Ceteron? Stop the audio, read and attempt the question in the handout then come back to listen to 63 the solution. Part 11 – Review question: Decision making – process further or drop product line Question 4 June 1995 Handout pages 20-21 a. Advise the management of Wedersen: – Should they sell the products at split off or sell them in their fully processed form? – Should they discontinue production or employ some other course of action b. Should Wedersen product Deteron rather than Ceteron? 64 Part 11 – Review question: Decision making – process further or drop product line Question 4 June 1995 Handout pages 20-21 a. b. Advise the management of Wedersen: – Should they sell the products at split off or sell them in their fully processed form? – Should they discontinue production or employ some other course of action Should Wedersen product Deteron rather than Ceteron? 65 MA1 – Exam review Part 12 ‘Final notes on the final’ 66 Part 12 – ‘Final notes on the final’ If I were you, I would…. • Work through the modules in order – – – – – Make notes of the important terms Include main concepts, advantages and disadvantages Write down and memorize the formulas Work through the chapter review problems Work through the review problems from the lecture handouts Do the multiple choice quiz at the textbook online learning centre (you will find a link near the audio lectures) 67 Part 12 – ‘Final notes on the final’ If I were you, I would…. • Then concentrate on those topics that need more work – • Work through the past examinations available on the website Remember to allocate your time based on the percentage weighting in the exam blueprint. ……and 68 Part 12 – ‘Final notes on the final’ If I were you, I would…. Go watch a movie the night before the final….. All the best! 69