audit of sales, debtors and prepayments

advertisement

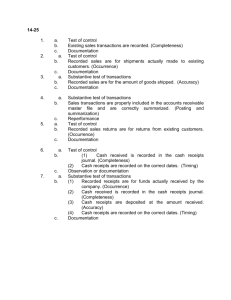

AUDIT OF SALES, DEBTORS AND PREPAYMENTS PRESENTED BY AUDIT AND ASSURANCE DEPARTMENT: PEAK PROFESSIONAL SERVICES IN HOUSE SEMINAR SERIES NO 6 PEAK PROFESSIONAL SERVICES (CHARTERED ACCOUNTANTS) NIGERIA A member of Kreston International | A global network of independent accounting firms 1|P ag e INTRODUCTION As part of the year-end audit of a company's financial statements, external auditors test sales transactions and the internal controls over those transactions to ensure that the company is not materially misstating its revenues or accounts receivable. The sales and collections cycle in a business refers to the set of processes that begin when a customer makes a request for the purchase of goods or services and ends when the company receives complete payment for the purchase. The overall objective in the audit of sales and collection cycle is to evaluate whether the account balances affected by the cycle are fairly presented in accordance with relevant accounting standards. It should be noted that there are various accounts that are involved in the sales and collection cycle of a business. The name given to the various types of accounts in the sale and collection cycle vary from business to business. For example, the name given to sales in a retail business will be SALES while in an Insurance business it would be PREMIUM. Though the names differ, it is important to note that the key concepts and principles are the same. Debtors and Prepayments form significant part of the assets of most companies. While sales figure is key to determining the overall result and performance of a business. It is therefore important that the auditor carries out appropriate audit procedures to verify the accounts in the financial statements of a company being audited. This paper covers the audit of Sales, Debtors and Prepayments. It is hoped that at the end of the presentation members of staff will be able to identify the processes involved in any sales cycle and carry out audit procedures to verify the associated balances in the financial statements of our clients. The topics covered in this paper are as follows: Definition of terms Understanding the client’s Revenue System Internal Controls over the Sales System Audit of the Revenue/Sales System 2|P ag e Audit of Cash Sales/ Receipts Audit of Accounts Receivable/Debtors Audit of prepayments Definition of Terms Revenue Revenue is defined by the International Accounting Standard (IAS) 18 as income that arises from the course of ordinary activities of an entity. This could be referred to by a variety of different names such as Sales, Fees, Interest, Dividends and Royalties. It is important to note that sales are generated from the ordinary course of the business. Incomes generated from the activities that are not part of the core business of an entity are regarded as gains and not sales. For instance, sale revenue of a business whose main aim is to sell biscuits is income generated from selling biscuits. If the business sells one of its factory machines, income from the transaction would be classified as a gain rather than sale revenue. Debtors Trade debtors also known as account receivables are the value of revenue invoiced for which money is still owed to the business after the sale is made or service rendered. In practice, this usually happens when goods are dispatched or service rendered and invoice issued to the customer. Debtors are recorded in the balance sheet of the accounts as a current asset at the time that sales are recorded, but before cash has been received from the customer. The debtors control account in the balance sheet will be the net of all invoices to customers (debits) less the receipts from all customers (credits), and should always be a debit balance. Prepayments Prepayments are amounts paid for one period which relates to the next period. They are sometimes referred to as deferred charges and could be related to different expense heads such as Prepaid Rent, Prepaid Insurance, and Prepaid Trade Marks etc. 3|P ag e Understanding the Entity’s Revenue System We stated at the beginning of this paper that the sales and collections cycle in a business refers to the set of processes that begin when a customer makes a request for the purchase of goods or services and ends when the company receives complete payment for the purchase. The process begins with a request by a customer and ends with the conversion of material or service into accounts receivable and ultimately cash. Kindly note that the process is common to all types of business no matter what they are engaged in. What would be different is the names and degree of details. In order to have a good understanding of a company’s sale system, we must understand that every company has specific functions that are associated with the sales cycle. It is important that we understand the functions and the documents that are used for each function whenever we set forth to perform audit on any company. In order to facilitate our understanding of the sales system, we present a summary of the functions in the table below: BUSINESS FUNCTION DOCUMENT USED ACCOUNTS AFFECTED CLASSES OF TRANSACTIONS 1 Processing of Customer Sales and Sales customer orders Order/ Sales Accounts Order Receivable 2 Granting Credit Customer Order/Sales order 3 Shipping Goods/Rendering Service Shipping Sales and Sales Documents/ Accounts Waybills, Receivable Certificate of completion etc 4|P ag e Sales and Sales Accounts Receivable 4 Billing Customers Sales invoice, Sales and Sales and recording Bills, Sales list Accounts sales Receivable 5 Processing recording receipts and Remittance Cash in Bank Cash Receipts cash Advice, and Accounts Prelisting of Receivable Cash Receipts 6 Processing recording returns allowances and Credit Memos, sales Sales Returns and Journals and allowances Journals Sales Returns Sales Returns and Allowances and Allowances and Accounts Receivable Accounts 7 Writing uncollectable accounts receivable off Uncollectible Accounts authorization Journal, General Journal Form Accounts Write Off of Receivable and Uncollectible Provision for Accounts Bad Debt Account 8 Providing for Bad General Journal Debts Bad Expense Provision Bad expense account Debt Bad and expense for accounts Debt Debt The table is now explained as follows: When carrying out the audit of a client’s sales cycle, we must understand and document the activities in the table above. Such understanding will help us to design the nature of audit test to be performed. It would also help us to fulfill the requirements in ISA 315 Understanding the entity and its Environment. CUSTOMER ORDER A customer order is a request for goods or service by a customer. This could take the form of telephone, letter or a printed form. The form can be sent by post, hand delivered or by internet. 5|P ag e Sales Order This is a document that is used for communicating the description, quantity or related information for goods or and services ordered by a customer. Sometimes the sales order also includes details relating to credit. It is important to note that before services are rendered or goods are shipped to customer, a properly authorized person must approve credit to the customer for credit sales. Shipping of Goods/ Rendering of Service This is the most important function in the sales cycle. It is the point at which risks and rewards of an asset are transferred to the customer. At this point, most companies recognize income. The document for this important stage is known as the shipping document. It indicates the description of goods, the quantity shipped and other relevant data. The name given to a shipping document could be waybill, bill of laden or any other name depending on the nature of business. Billing Customers Billing customers is the means by which customer is informed of the amount of goods shipped or services rendered. The most important aspects of billing are: All shipments or services have been billed (Completeness) No shipment or service has been billed more than once (Occurrence) Each one is billed for the proper amount (Accuracy) Billing is normally done by means of a sales invoice. A sales invoice is a document indicating the description and quantity of goods sold, the price and other relevant terms. In a computerized accounting system, it is usually possible to obtain what is often referred to as a Sales Transaction File. This file includes all information entered into the system and information for each transaction such as the customer name, date, amount, account classification etc. 6|P ag e This file can also be varied to obtain what is known as the Sales Journal. The Sales Journal is a listing or report which also includes the product line or division. NOTE The transaction functions explained above are necessary for getting the goods and services into the hands of the customers, correctly billing them and reflecting the information in the accounting records. The other four functions are concerned with collection and recording of cash, sales returns and allowances, write off of uncollectible accounts and providing for bad debt expense. PROCESSING AND RECORDING CASH RECEIPTS Processing and recording cash receipt involve receiving, depositing and recording cash. Kindly note that cash includes currency, cheques and electronic funds transfer. The auditor’s concern here is the possibility of theft and misappropriation of the asset. Sometimes customers will include a remittance advice when making payments, such advice helps the seller to keep track of what has been paid for in order to pass the accounting entries. In the case of electronic funds transfer or purchase of goods by credit cards, the bank provides information to the company to prepare the accounting entries. Most computer system can also generate a cash receipt transaction file that will indicate the name of the customer and invoice details. PROCESSING AND RECORDING OF SALES RETURNS AND ALLOWANCES When a customer is dissatisfied with the goods or services, the seller often accepts the return of goods and grants a reduction in the charges. The company prepares a receiving report for returned goods and returns them for storage. These are recorded in the sales returns transaction file. Credit memos or credit notes are raised to indicate a reduction in the amount due from a customer. 7|P ag e A sales return journal is used to record sales returns and allowances, though some companies might use the sales journal to also record sales returns. WRITING OFF UNCOLLECTIBLE RECEIVABLES When the company has assessed that certain amount is not collectible, it must be provided for. The process is done by making use of an internal document known as the uncollectible Account Authorization Form. PROVIDING FOR BAD DEBTS When it becomes clear that an amount cannot be collected for example the customer has become bankrupt, the amount must be written off as bad debt expenses EXERCISE 1. Each member of staff is required to take a particular business and explain their sales process using the 8 sales cycle function above. The explanation should clearly indicate the document that are used for each function 2. Explain the difference between bad debt and allowance for bad debt and tell us how this is treated in the accounts INTERNAL CONTROL SYSTEM OVER SALES Internal Control is defined as the process designed and effected by management to provide reasonable assurance about the entities objectives with regard to the reliability of financial reporting, effectiveness and efficiency of operations and compliance with applicable laws and regulations. From the above, it would be observed that internal controls are designed to enable the business achieve specific business objectives. In this section, we shall be looking at what the control objectives of the sales systems and the control procedures which are put in place to achieve the objectives. 8|P ag e REVENUE OR SALES SYSTEM OBJECTIVES The objectives of any revenue system can be broadly classified into three categories. Ordering and granting of credit Dispatch and invoicing Accounting The details of each component are as follows: ORDERING AND GRANTING OF CREDIT 1. Goods and services are supplied to customers with good credit standing 2. All Orders are recorded correctly 3. All Orders are met 4. Goods and Services returned by customers are recorded DISPATCH AND INVOICING 1. 2. 3. 4. All invoices raised relate to goods and services supplied by a business All dispatches and Services are accurately recorded Any Credit notes are only given for valid reason Cut off procedures are correctly applied to recording dispatch of goods ACCOUNTING 1. All invoices and credit notes are properly recorded in the books of accounts 2. All receipts from customers are properly recorded 3. All payments are for goods and services which have been supplied 4. All credit notes given have been properly recorded in the books and records of the business 5. All entries to the receivable ledger are in the correct customer accounts 6. Potential or actual bad debts are identified 7. Cut off procedures are applied Based on the objectives mentioned above, an entity’s sales control system will be designed to achieve the set objectives. 9|P ag e In addition to the set objectives, the sales control system would be designed to minimize the possibility of fraud. ELEMENTS OF CONTROL PROCEDURES When reviewing the Internal Control Procedures put in place by management to achieve the sales system objectives, the relevant aspects to examine are: Organizational Controls Segregation of duties Physical Controls Authorization Arithmetic and Accounting Controls The application of the elements to the three objectives is summarized in the following table. ORDERING AND GRANTING OF CREDIT 1 Organizational controls There should be written procedures for receiving orders and granting of credits Authority for approving new credit customers must be well defined There should be procedures for checking the suitability of customers for credit 2 Segregation of duties Different members of staff should be involved in different aspect of the sales process. For example, the same staff should not be involved in dispatching of goods and raising invoices 3 Physical Controls There should be physical control over access to sales order documents Sales order forms should be pre- numbered 4 Authorization Changes in customer database can only be made with proper authority Changes to credit limit must be properly authorized 5 Arithmetic and accounting Prices are correctly quoted Discounts are calculated correctly 10 | P a g e Matching of customers orders to dispatch notes Accurate computation of VAT SHIPPING AND INVOICING 1 Organizational controls There should be written procedures for dispatching of goods and invoicing Authority level for selling prices and discounts There should be authority for issuing credit notes to customers 2 Segregation of duties Different members of staff should be involved in different aspect of the sales process. For example, the same staff should not be involved in dispatching of goods and raising invoices 3 Physical Controls There should be monitoring of quantity and condition of goods supplied. Delivery notes should be pre- numbered Sales invoices should be pre numbered Goods returned notes should be pre numbered Goods delivery notes/service performance notes should be signed by customers There should be pre numbered goods returned notes 4 Authorization Authorization of selling prices Authorization of discounts Matching of sales invoices with dispatch notes Matching of credit notes with goods returned notes 11 | P a g e ACCOUNTING 1 Organizational controls There should be written procedures accounting for sales and receivables There should be written procedures for write off of bad debts 2 Segregation of duties Different members of staff should be involved in posting invoices and maintaining customer accounts receivable. They should also be different from those responsible for receiving cash from customers 3 Physical Controls Sales invoices should be numbered consecutively There should be control over unused invoices There should be control over the computer system used for creating invoices Restriction of access to unauthorized persons 4 Authorization Authorization to implement credit control procedures 5 Arithmetic and accounting Checking invoices for prices and calculations Invoices and credit notes are entered into accounting records promptly Sending Statements to customers Production of aged receivable reports and credit control procedure Reconciliation of receivable ledger control accounts with receivable ledger subsidiary account Cut off checks to ensure that goods dispatched but not invoiced are dealt with in the correct period Analytical review procedures PRACTICAL APPLICATION Most of the issues raised in the above tables can be ascertained and documented by administering a standard Internal Control Questionnaire on the Sales process to a client. 12 | P a g e An example of a typical ICQ on sales is as follows: PEAK PROFESSIONAL SERVICES INTERNAL CONTROL QUESTIONNAIRE- SALES CLIENT: 1 2 COMPLETED BY: DATE---------------------- REVIEWED BY DATE---------------------- QUESTIONS ANSWERS N/ Y N A GENERAL INFORMATION TECHNOLOGY What software is used to record and manage customer information Is it the same thing as the General Ledger Software SALES ORDERS/SERVICE REQUEST 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 What record is kept of service request/ Sales Orders Who receives the order Upon receipt of the order is there a verification of the approved buyer If yes, how is this function performed Who is responsible for inputing the order into the system Are customer orders approved before execution If yes, how is performance evidenced? Is there Automatic matching of price by the computer system For non standard billing terms when and how is the billing terms set up Are customers credit limit checked before orders are performed Does the Company have a Credit Policy is it documented? obtain a copy If yes, how often is the policy subject to review Are new Customers required to submit credit application If yes, is it standardized If so who performs the task How is the performance evidenced Who are those that have access to the order entry system What controls are in place to check unathorised access to the order entry system What record is kept of orders received but not yet performed How often is the record reviewed Who is responsible for the review PERFORMANCE OF SERVICE/DISPATCH OF GOODS 1 List the major centres at which Goods/ Services are sold 13 | P a g e REMARKS 2 3 4 5 6 7 8 9 1 2 3 4 5 6 7 8 9 10 1 2 3 4 5 6 7 9 10 11 12 13 14 15 16 17 18 What records are kept of Goods Sold/ Services rendered to customers Are these records under numerical control Are these records kept by a person independent of the Sales/ Invoice Processing Are acknowledgement of the receipts of goods or service performance obtained from customers How is it evidenced How does the system ensure that all services performed or Goods sold are covered by the issue of sales Invoice? What records are kept of short deliveries or inadequate performance of service Are these records under numerical control CONTROLS OVER CREDIT MEMOS How does the system ensure that Credit Notes are issued for all returns from customers or claims by customers List other conditions that warrant the issue of Credit Notes Who is authorized to issue credit notes Is this person Independent of the collection function Is this person independent of operations/ Dispatch of Goods What level of approval is required for various Credit Notes Are Credit Memos Pre numbered Is there an Independent Review of the Schedule of Credit Memos If yes by whom How often is this done CONTROLS OVER BILLING AND INVOICING Does the Company have a billing policy Does the policy specify the period in which a bill must be issued after task is performed? Who or which department is responsible for raising Invoice Is the person/ department separate from the collection function From what sources of Information are Invoices prepared How many copies of sales Invoices are Prepared How are they distributed Are Invoices/Bills prenumbered Does the Bill/Invoice have contact information How are cancelled, altered and no charge invoices authorized Are Provisional or proforma invoices rendered? If yes, how are they treated for accounting purposes? Is there a procedure for reconciling service request and performance of service to invoices issued Is there a software for raising Invoices If yes, what is the software Is it Integrated with the General Ledger Is it Integrated with the operational/service delivery and Goods 14 | P a g e 19 20 21 22 23 1 2 3 4 5 6 7 8 9 10 11 issued? Does the billng process involve automatic validation check on price (per standard tarif or contract terms and quantity (as per stores records and service request/operational records) Is there an authorized price list/ tariff if yes who is authorized to change it Is there a restriction of access to invoicing software to only authorized personnel If yes how is it done GENERAL Do sales to related parties have the same process as third party sales If no kindly describe the system for processing Intercompany sales Are Customers given Month end statements If yes who is responsible for this function Does the computer automatically post transactions to account receivable master file and General Ledger Is the account receivable master file reconcile with the General Ledger on a Monthly basis? Is there a memorandum Invoice Account? If yes is there a reconcilition of the Invoice listing to the Chart of accounts Who performs this function How often are Journal entries into the Sales Ledger reviewed? Describe the procedure for authorizing, controlling and recording sales to Employees, sale of scrap and cash on delivery/cash sales AUDIT OF THE SALES SYSTEM The nature and timing of audit procedures will depend on the assessment of the client’s system which is obtained from an understanding and assessment of the system. Typical and practical steps that will be taken would be a combination of the following: 1. Obtain the client’s sales journal and review for unusual transactions and amounts 2. Check new accounts and credit limits are properly authorized and credit procedures are operating 15 | P a g e 3. Check that sales invoices are supported by customer orders, and signed delivery notes or evidence of work performance 4. Check for prices, arithmetic and calculations of invoices 5. Check that invoices are correctly coded with customer codes 6. Test numerical sequences of invoices and enquire into missing invoices, sales orders, delivery notes and goods returned notes 7. Check goods returned are supported by goods returned notes, evidence of correspondence with customers and credit note authorized. 8. Observe whether monthly statements are sent to customers 9. Observe whether accountant compares subsidiary ledger total with control totals 10. Account for the sequence of dispatch/shipping documents 11. Trace selected dispatch documents to sales journal to be sure that each one has been included 12. Account for the sequence of sales invoices to the sales journal 13. Trace selected sales invoice numbers from the sales journals to the accounts receivable ledger 14. Sample selected sales invoices and check supporting documents for internal verification 15. Test selected invoices with customer order checking for customer name, product description, quantity, date, contracts and credit approval 16. Obtain prelisting of cash receipts and trace amounts to the cash receipt journal testing for names, amounts, dates and internal verification 17. Trace cash receipt entries to bank statement 18. Trace selected entries from the cash receipt journal to entries in the customer subsidiary ledger As stated above, how the above procedures are combined in the audit of sales will depend on our assessment of the clients system of internal controls over sales ANALYTICAL REVIEW As with most audit exercise, we should carry out relevant analytical procedures when carrying out the audit of sales. Prepare summary for present year and previous 16 | P a g e two years to compare – Sales Cost of Sales Gross Profit G.P. % Stock at Balance Sheet date Trade Debtors 2.Explain material fluctuations in above. 3. Explain any significant changes in type of business carried on, method of operating source of earning, etc. AUDIT OF CASH REVENUE In certain types of businesses, a significant proportion of sales is carried out in cash. For example, shops, supermarkets, bars and restaurants. In these instances, the auditor must be aware that the activities are highly susceptible to fraud. Therefore audit procedures must be designed to verify sales revenue and to detect fraud. Some of the steps to be undertaken by the auditor are as follows: Review the procedures for recording cash revenues e.g cash sheets, tills etc Review and test the reconciliation of cash taking to the records above Review and test bank transactions by ensuring that: Cash takings are banked intact Reconciliation and banking of cash receipts are carried out by persons independent of revenues Ensure cash takings are banked the same day or the next date by checking pay in slips 17 | P a g e TESTING FOR LAPPING OF ACCOUNTS RECEIVABLE AND PROOF OF CASH RECEIPTS Lapping of account receivable is the postponement of entries for the collection of receivables to conceal an existing cash shortage. The fraud is perpetrated by a person who handles cash receipts and then enters them into the computer system. This fraud can be prevented by separation of duties and mandatory vacation policy for employees who handle both cash and entry into the system. A useful audit procedures for testing whether all recorded cash has been deposited in the bank is the proof of cash receipts. In this test, the total cash receipts recorded in the cash receipts journal is compared with the actual cash deposited in the bank for a given period say one month. Differences observed should be reconciled and explained. AUDIT OF SALES RETURNS AND WRITE OFF OF UNCOLLECTIBLE ACCOUNTS The audit procedures for sales returns are similar to the procedures adopted for sales. We should however test recorded transactions to ensure that theft of cash is not concealed with sales returns. The point also applies to write off of uncollectible accounts. The major control for these transactions is proper authorization by a designated official. AUDIT OF ACCOUNTS RECEIVABLES (DEBTORS) Receivables also known as debtors form part of the sales receivable cycle. It is therefore important to carry out the compliance procedures in the sales audit as part of the debtors audit procedure. In summary, check to ensure that the system for receivables has the following features: Only bona fide sales bring receivables All such sales are to approved customers All such sales are recorded Once recorded, the debts can only be eliminated by receipt of cash or on the authority of a responsible official Debts are collected promptly 18 | P a g e Balances are regularly reviewed and aged, a proper system of follow up exists and if necessary adequate provision for bad debt exists. We are required to carry out further audit procedures to verify debtors’ balances at year end on the completion of our compliance review. See section 13 of our file divider 1. Obtain and check or prepare schedules of all debtors in detail and summary per Balance Sheet showing 1. Trade Debtors 2. Hire Purchase Debtors 3. Sundry Debtors 4. Staff Accounts 5. Deposits 6. Prepayments 7. Others 2. Circularize major accounts as at or prior to year end and tabulate results in normal form i.e. (i) (a) number and value of all debtors (b) number and value of all confirmations requested (c) number and value of replies received and agreeing (d) number and value of replies received and disagreeing (e) percentage results achieved (f) 19 | P a g e (1) Replies Received (2) Replies Agreeing (3) Replies Disagreeing Remittances to date from those not replying (ii) Investigated disagreed replies and record reasons. (iii) Pass requests from customers for information to client. 3. Agree all control accounts with Ledger Balances. 4. Obtain Age analysis of debtors 5. Identify balances to specific invoices. 6. Explain nature of all Sundry Debtors and Deposits. 7. Vouch authority for Staff Loans and ensure being repaid regularly. Trace sample repayments to payroll 8. Review all accounts to determine if provision necessary and indicate on schedules all information given to us in arriving at decision 9. Prepare schedule of movements on Bad Debts – Provision Accounts and Debts written off. 10. Check and file calculations of major prepayments. 11. Review cut-off procedure for sales with stock audit by appropriate schedules showing:(a) That all sales made within the last two weeks of the accounting period had been entered in the stock records before the end of the period. (b) Goods relating to purchase invoices taken up in the books and actually been received. (c) That sales invoices after the year end do not relate to the preceding year – also purchases. 20 | P a g e CUT OFF PROCEDURES Cut off is a very important term that has implications for sales, purchases and inventory. We should read it up and discuss in our next seminar. AUDIT OF PREPAYMENTS In the audit of prepayments, the auditor reviews the clients system for ensuring that all prepayments are recorded The auditor obtains a schedule from the client or prepares one that includes the opening figures of the previous year, the current year additions and write offs and the ending balance of prepayments. Re-performing the calculations for arithmetic accuracy Reviewing previous year working papers for evidence that the same prepayments existed previously We could also carryout certain analytical procedures such as: Comparing the ratio of prepaid expense to the total of related expense for the current and previous year Compare the actual expense with prior year figure 21 | P a g e

![Job Description [DOCX - 56 KB]](http://s3.studylib.net/store/data/006627716_1-621224f86779d6d38405616da837d361-300x300.png)