SCICOM Annual Report

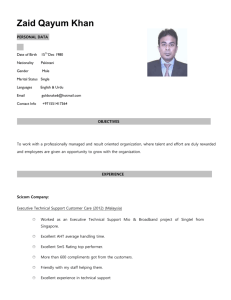

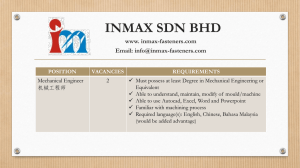

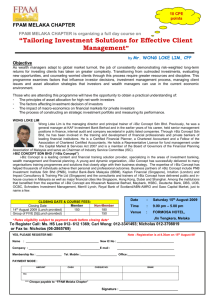

advertisement