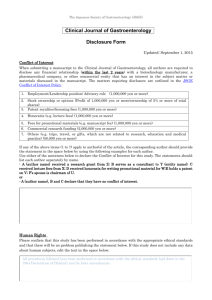

Annual Report

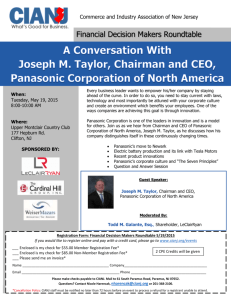

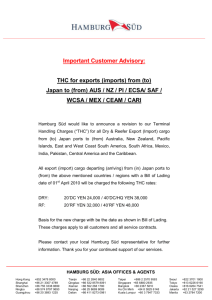

advertisement