Panasonic Manufacturing Malaysia Berhad Annual Report 2014

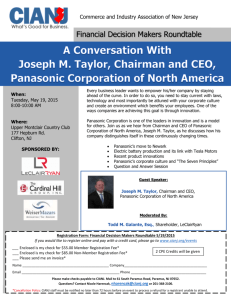

advertisement