ECON 201 10074 - Western New Mexico University

FINAL CRN 10074, 201210 1

PRINCIPLES OF MACROECONOMICS

WESTERN

FALL

NEW MEXICO

UNIVERSITY

******2011******

COURSE NUMBER: ECON 201 CRN: 10074

SCHOOL OF BUSINESS

ADMINISTRATION & ECONOMICS

TITLE: Principles of Macroeconomics

CATALOG DESCRIPTION: The theory of national income accounting and aggregate income determination in the American economy, monetary theory, functioning of financial institutions, monetary and fiscal policy, and international trade and payments (3 HMCCN ECON 2113).

STUDENT ACADEMIC OUTCOMES (What the student who completes the course should know or be able to do):

1.

Analyze markets using supply and demand.

2.

Interpret economic reporting based on and related to national income accounts such as employment, investment, economic growth, inflation, government spending, and incomes.

3.

Develop and use index numbers.

4.

Utilize income and expenditure framework to discuss government spending, taxation, investment, consumption, and international trade.

5.

Discuss the impact of fiscal policies designed to address normative macroeconomic goals such as full employment and economic growth.

6.

Compare alternative models of money supply (Bonds and Money vs. quantity theory of money) and discuss their impact on government, consumer, and investment spending.

7.

Be familiar with the structure and activities of the Federal Reserve System.

8.

Propose and forecast the impact of alternative monetary policies used by the Federal Reserve in pursuit of low inflation and economic growth.

9.

Describe the impact of expansion of trade, interpret balance of payments accounts, and discuss the impact of macro economic variables (interest rates, government spending, incomes, inflation, etc.) on predicted exchange rate movements.

10.

Identify and articulate normative (ethical and social) policies that reflect society’s concerns with current economic issues regarding aging, income distribution, education, and health. Use positive economic analysis to evaluate associated social programs such as social security, medicare, student loan programs, and assistance to needy families.

11.

Write using appropriate economics terminology to state positive economic theory and apply it to normative issues arising from collective and individual behavior.

MEANS OF ASSESSMENT (How the student’s achievement of the above academic outcomes will be evaluated):

Assessment means

Outcomes Assessed Point Total Percentage of final grade

Aplia Homework

Learning Activities

Mid Term Exam

1-11

1-11

1-8,11 100

20%

25%

20 %

Miscellaneous Quizzes

Final Exam

1-11

1-11 100

TOTAL

Grade Scale: A= 90-100, B= 80-89, C= 70-79, D= 60-69, F= 59 or below.

(Signature of Instructor) (Date)

15%

20%

100%

George Muncrief, Ph.D.

August 12, 2011

1

FINAL CRN 10074, 201210 2

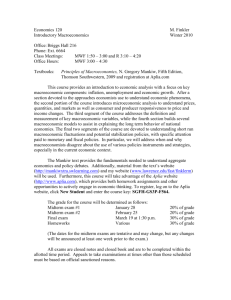

Course No: Econ 201 CRN:

PRINCIPLES OF MACROECONOMICS

10074

FALL 2011

Credit: 3

Days: Tuesday, Thursday

Instructor’s Name:

George Muncrief, Ph.D.

Office: PHELPS DODGE 238

Office Hours:

Monday-Thursday, 1- 2p.m.

Tuesday, 3:30-5:00 p.m.

& By Appointment

First Class Meeting:

August 16, 2011

Time: 2-3:15 p.m. Room: PD 114

Instructor’s Phone Numbers:

(W) 575-538-6258

(H) 575-388-4771

(

E-Mail: muncriefg@silver.wnmu.edu

Instructor’s Mailing Address:

Western New Mexico University

School of Business Administration

& Economics

P.O. Box 680

Silver City, New Mexico 88062

School of BSAD & ECON:

(FAX) 575-538-6264

(Office) 575-538-6322

Text (s):

(Required)

(Required)

(Recommended)

(Recommended)

(Required)

McEachern, William. ECON MACRO 2, 2010-2011,

Southwestern Cengage Learning, Mason, Ohio: 2010

Aplia Homework & Quizzes Principles of

Macroeconomics. Aplia, Belmont, California: 2009.

Wall Street Journal

Macroeconomics, Student's Guide to the Key Principles of Macroeconomics, Quick Study Academic, BarCharts,

Inc. ISBN 631-5 , www.barcharts.com

.

“The Story of Money,” “The Story of Foreign

Trade,” “Too Much, Too Little,” “The Story of Inflation,” “Once Upon a Dime,” “A Penny

Saved.., “ “The Story of Banks,” “The Story of the Federal Reserve System,” “The Story of

Checks,” “ The Story of Consumer Credit,” &

“The Story of Monetary Policy.” New York

Federal Reserve Bank, 1997, 98, 99, 00. www.ny.frb.org/pihome/educator/ (Under

Quick Picks , select Order Publications )

(Comic books distributed by the School of Business)

I.

Academic Outcomes

:

(What students completing assigned learning activities will know or be able to do).

A. Introduction

1.

Participate in discussions using a basic vocabulary of micro and macroeconomics.

2.

Utilize mathematical tools such as slope, percentages and graphical relationships.

3.

Recognize constraints of nature and their role in establishing economics as the science of choice.

2

FINAL CRN 10074, 201210 3

4.

Use a production possibilities curve to represent opportunity cost.

5.

Apply the concepts comparative advantage and absolute advantage.

6.

State and discuss the questions an economic system must address.

7.

Distinguish between normative and positive economics.

8.

Critique the competitive price system with respect to market failure, income distribution, and market structure.

B. Know definitions of Supply and Demand.

1. Describe the ceteris paribus conditions of Demand and Supply and indicate how changes in each of the conditions affect Supply and Demand and Equilibrium price and quantity.

2. Use supply and demand to describe behavior of sellers and buyers in individual markets including characterization of market equilibrium. a. Distinguish between a change in quantity demanded and a change in demand. b. Distinguish between a change in quantity supplied and a change in supply. c. Describe the idealized market structure: pure competition.

C. Macro Introduction

1.

Recognize the roles of Households, Government, Firms, and International Trade in the Macro

Economy.

2.

Describe different forms of Business Organization.

3.

Explain the sources of Government revenue and expenditure patterns.

4.

Describe the business cycle.

5.

Define Aggregate Demand and Supply.

6.

Use the Aggregate Demand and Supply curves to represent inflationary and recessionary episodes.

7.

Define Productivity and explain its significance for the U.S. Economy and welfare of U.S. citizens.

D. Unemployment

1.

Define and calculate the unemployment rate.

2.

Describe four types of unemployment

3.

Suggest normative policies to address different types of unemployment.

E. Inflation and Recession

1.

Know definitions of inflation and recession.

2.

Be able to describe situations, events and factors that contribute to inflation and recession.

3.

Describe the impact of inflation and recession on employment, output, and interest rates.

F. Name and describe relationship of leading indicators with levels of economic activity.

G. Economic Aggregates and Macroeconomic activity

1.

Discuss the treatment of inventory accumulation as unintended investment.

2.

Distinguish between intermediate and final goods and services.

3.

Define the concept: Gross Domestic Product.

4.

Define Consumption, Investment, Inventories, Government spending, and Net Exports components of the Expenditure Approach to measuring GDP.

5.

List and define the components of the Incomes approach to measuring GDP.

6.

Explain the concept of value added.

7.

Define Depreciation and describe how it is accounted for in national income accounting.

8.

Calculate the Gross Domestic Product using the Incomes approach and using the

Expenditures approach.

H. Index Numbers

1.

Define, critique, and use the Consumer Price Index.

2.

Define, critique, and use the GDP Deflator.

3.

Define, critique, and use the GDP Chain Weighted Index.

4.

Distinguish between Real and Nominal Gross Domestic Product.

5.

Calculate price indices and use them to analyze changes in real purchasing power and output.

I. Keynesian Expenditure Model

1.

Use Keynesian Expenditure Model Expenditures Approach to estimate GDP.

2.

Use Keynesian Leakages and Injections Approach to estimate GDP.

3.

Examine Factors that shift the Consumption Function and their impact on GDP.

3

FINAL CRN 10074, 201210 4

4.

Calculate the Simple Expenditure Multiplier using the Marginal Propensity to Consume and

Marginal Propensity to Save.

5.

Review of Investment and determinants of investment in the Keynesian Model.

6.

Calculate the Tax Multiplier

7.

Utilize the Keynesian Model to examine the impact of alternative fiscal policies (taxes and government spending) on GDP.

J. Aggregate Demand and Aggregate Supply

1.

Aggregate Demand

Develop Aggregate Demand from the Keynesian Expenditure Model.

Note factors that produce movements along the aggregate demand curve.

Describe factors that shift the aggregate demand curve.

2. Aggregate Supply and Supply Side Theories

Derive the Short Run Aggregate Supply Curve

Derive the Long Run Aggregate Supply Curve

Examine Shifters of the Short Run Aggregate Supply Curve

Examine Shifters of the Long Run Aggregate Supply Curve

State supply side policies for Economic Growth

K. Use the AD and AS model to examine fiscal policies to close expansionary and contractionary gaps

L. Monetary Theory, the Federal Reserve System, and Monetary Policy

1.

Review the functions of money, types of money, monetary measurements, and functioning of financial intermediaries.

2.

Know the basic functions and organization of the Federal Reserve System

3.

Balance sheets a. Become familiar with the Federal Reserve Balance Sheet. b.

c.

Be familiar with individual bank balance sheets.

Relate the individual bank and Federal Reserve balance sheets.

4.

Describe the process through which banks create money.

5.

Calculate the Simple Deposit Multiplier

6.

Distinguish between a simple deposit multiplier and the money multiplier.

7.

Know the monetary policies of the Federal Reserve and how they can be used to affect the money supply. a.

b.

Open Market operations

Discount Rate c.

Reserve Requirements

8.

Know the Keynesian Theory of Money (indirect channel) based on the relationship between bonds and money.

9.

Quantity Theory of Money: Know the equation of exchange and assumptions to convert it into the quantity theory of money (velocity of money assumed to be constant).

10.

Use monetary theory to examine Federal Reserve policies to address inflation or recession.

M. Know the trade off between inflation and unemployment expressed by the Phillips Curve.

N. Discuss Rational vs. Adaptive Expectations.

O. Discuss the crowding out issue relative to Federal Government Deficits.

P. International Trade and Payments.

1.

Exchange Rates a. Learn the effect of exchange rate movements on exports and imports b. Discuss factors that affect exchange rate movements c. Examine attractiveness of foreign financial instruments and investment relative to exchange rate movements. d. Be able to distinguish between floating and fixed exchange rates and their consequences for the domestic economy.

2.

Balance of Payments

4

FINAL CRN 10074, 201210 5 a. Become knowledgeable about the components of the Current Account and Capital Account b. Explain the long run tendency of the Balance of Payments to balance under floating exchange rate regimes.

3.

Trade Policies a.

b.

Compare Quotas and Tariffs for their impact on consumers, producers, and resource use.

Become Knowledgeable about international organizations that facilitate trade: European

Union, World Trade Organization and NAFTA. c.

Examine other trade issues such as Dumping.

II. Special Instructions (Requirements or activities unique to this course): Always check course homepage for updates to the course syllabus. Updates will be made as needed for clarification.

A.

Evaluation and Academic Integrity:

1. Evaluation of learning activities and exams will be based on process, content, accuracy, completeness and organization. Performance can be enhanced by carefully reading questions and instructions, and following suggested formats. For clarification, always consult with the instructor.

LATE LEARNING ACTIVITIES, QUIZZES, AND APLIA HOMEWORK WILL NOT BE

ACCEPTED .

2. Work submitted for a grade must be your own. Plagiarism and copying the work of others and representing it as your own is academic dishonesty.

The WNMU academic integrity policy and

Dept. of Business Administration Academic Integrity Statement govern penalties for cheating and plagiarism. Standards of academic honesty and integrity, student requirements, administration of penalties, and appeal processes are described in the WNMU2011-2012 Catalog, pages 61-65. The

School of Business Administration and Economics implementation of integrity policy is described in the school’s “Academic Integrity Statement” posted on the course homepage.

B. Attendance, Study Time, Weather Closings, Special Needs, and Routine Communication:

1. Attendance is not optional. Students accumulating three hours or more of unexcused absences may be administratively dropped from the class. Students are responsible for missed work and approved make up work.

2. Study time is estimated by the following rules of thumb: for undergraduate classes a minimum of two hours of outside work for each hour in class and three hours for graduate courses.

3. “WNMU’s policy requires that all official communication be sent via Mustang Express. As a result, all emails related to your enrollment at WNMU and class communication – including changes in assignments and grades – will be sent to your wnmu.edu email address (

For ECON 201 communication will be through the course web site:

https://wnmu.blackboard.com/webct/entryPage.dowebct

). Please access your Mustang Express e-mail periodically to check for university correspondence.

4. WNMU closings due to inclement weather: It is the responsibility of the WNMU administration to determine when to close and to notify the public of its decision. The instructor’s responsibility in case of official closings is to assist students as needed in order to fulfill the course objectives.

5.

Disability Services at WNMU:

Services for students with disabilities are provided through the Academic Support Center’s Disability Services

Office in the

MEChA Building 2

nd

floor

.Some examples of the assistance provided are: audio materials for the blind or dyslexic, note takers, readers, campus guides, audio recorders, a quiet testing area, and undergraduate academic tutors. In order to qualify for these services, documentation must be provided by qualified professionals on an annual basis. Disability Services forms are available in the Academic Support Center. The Disability Services

Office, in conjunction with the Academic Support Center, serves as Western New Mexico University's liaison for

5

FINAL CRN 10074, 201210 6 students with disabilities. The Academic Support Center’s Disability Services Office can be contacted by phone at

575.538.6400.

C.. Special Requirements:

The following materials are required to fully participate in ECON 201: Syllabus, calculator, graph paper, text, APLIA access, business sections of major metropolitan newspapers or the Wall Street

Journal, and a personal computer.

D. ECON 201 is a WEB enhanced course. Some uses of Blackboard (Course Web Site) are:

1.

Student grades. Students see only their own grades and are responsible for monitoring the grade roster to verify that grades are accurately recorded.

2.

Bulletins and announcements

3.

Main discussion/forum board.

4.

E-mail between the student and instructor.

5.

Submission of written assignments as specified.

6.

Homework submission as requested.

7.

Calendar, notice of instructor posting of feedback, and changes in due dates.

8.

Syllabus: Learning Objectives, Evaluations, Reading Assignments, Instructions.

9.

Assignment Due Dates (see Aplia web site for Aplia homework due dates).

10.

Feedback: Homework and Forums as needed

11.

Power Point slides.

12.

Links to Economics U$A

E.

Grade Components: Student Homepage, Forum Commentaries & Responses, Homework, Quizzes,

Final Exam, and Reaction Papers.

1. Exams: a. Midterm Exam, 20% of final grade. b. Final Exam, 20% of final grade. A comprehensive final exam evaluates the success of the student and instructor in realizing the academic outcomes of the course. The final will include multiple choice, short answer and analysis, and True False (if false tell why it is false). The short answer and analysis portion may include a take home portion, not to exceed 20 percent of the value of the final.

2. Quizzes: 15% of final grade.

3. Learning Activities, 25 percent of final grade, graded S/U. a. Learning Activity Due Dates: Same day as distributed in class. b. Learning Activity Cut Off Date: Next class period. No homework makeup or editing possibilities are planned. c. Excused Absences: Learning Activity is due at the first class following the period of time covered by the excused absence. d. Activity and homework grading criteria Learning activities are graded S/U. S= satisfactory and receives full credit. U= unsatisfactory and receives no credit.

A homework assignment that is only partially completed is unsatisfactory.

# of Questions

Responsible party

Shows Work

Due dates

PASS

Attempts all questions

Original Work

Shows a repeatable solution process (for example, equations, outline of solution, etc)

Timely Submission:

FAIL

Missing responses

May have been copied

Does not show work, answer only.

Late

6

FINAL CRN 10074, 201210 7

1

3

2.

Readability

Graphs when required or useful

Legible

Complete Graphs

Completeness of responses Complete Responses

Can’t be read

Incomplete or no graphs

Too brief to determine if concept is understood or mastered

Content of responses Substantive Responses Responses not related to the question or concepts

4.

Aplia Homework, 20 percent of final grade. http://www.aplia.com/ See last page of syllabus for

Aplia Account Activation. Assignment due dates are posted on the Aplia website, due dates will be changed to reflect class coverage of course content. Aplia homework has strict cutoff dates.

F. Class Participation (zero percentage points of the final grade).

Reaction Paper Practice, Power Point

Slides, Handouts, Class Activities, Discussions, Syllabus, and Economics U$A. A reaction paper may be assigned as a graded learning activity (See scoring the reaction paper below).

1. Power Point Slides: See the Icon for Power Point Slides at Blackboard . The slides are useful for organizing the course material emphasized by the instructor.

2.

Handouts: See Course Web Page for Instructor handouts.

3.

Forum Feedback: Posted at Forum Feedback Icon after Instructor evaluates the Forum

(Forums may be used by the instructor in place of quizzes or a class meeting).

ANALYSIS a. qualitative b. graphical

4.

Organization and evaluation of a reaction paper.

5.

Publisher Web site.

ELEMENTS

CITATION

SUMMARY

SCORING THE

REACTION PAPER

AUTHOR, TITLE, SOURCE, DATE,

PUBLISHER

Copy of the article required

If Internet: Complete URL a. Article description b. topic sentence for the selected application c. Normative information d. Elements that match theory e. Impact of changes

1. explain summarized info with appropriate econ model and terminology

2. describe a result or give a prediction

3. identify and name changes that shift or modify a relationship

1. graph

2.

correctly label the graph

3.

show changes on graph

4.

show old and new equilibriums

Pass/Fail

1= P, 0=F

1

1

1

1

4

TOTAL

7

FINAL CRN 10074, 201210 8

H. Instructor Resources

1. Handouts.

2. Power Point Slides.

3. Learning Activities.

I. ECONOMICS U$A

Log on to the Corporation for Public Broadcasting site to view the ECON USA series. High Speed Internet connection required. http://www.learner.org/resources/series79.html?pop=yes&vodid=175448&pid=338#

J. Note taking: Notes help you distinguish between “need to know” and “ nice to know.” A good set of notes reflects structure of the course, and organizes and guides study time. First, outline the main points of each class (a start is the instructor outline written on the board at the beginning of each class). Create a heading for each major topic and number the points under each topic as they are introduced. Leave space to insert explanations given by the instructor and amplification that you add at a later time. If graphs or pages of the text are referred to in feedback, discussions, or conversations with the instructor, note the page and graph numbers. Immediately after each class session devote one half to one hour reviewing and expanding your notes. Write in definitions and correlate notes with text material and homework assignments. Strive to make your learning ACTIVE rather than PASSIVE.

Review by asking yourself “what have I learned today?”

K . Organizing Weekly Learning Activities in ECON 201.

1.

Check course website daily (E mail and calendar).

2.

Match alternate course outline with major topics of Principles of Macroeconomics.

3.

Read text reading assignment

4.

Read assigned handouts.

5.

View Power Point Slides

6.

Complete and submit assigned homework on the Aplia Web site.

7.

Read and select potential articles for class discussion.

8.

Prepare for midterm, quizzes, and final exam.

9.

View CPB-Annenberg Economics U$A Movies

10.

Verify that grades are accurately recorded.

11.

Utilize publisher’s web site learning resources

8

FINAL CRN 10074, 201210 9

COURSE OUTLINE

PRINCIPLES OF MACROECONOMICS

INTRODUCTION, CONSTRAINTS, SUPPLY & DEMAND: Chapters 1, 2, 3, 4, 5, 6. Power Point:

Introduction (PPT are available on Course Web Page).

1 8/16 Course Orientation Appendix Chapter 1.

Introduction

Graphing

Economic Problem,

Science and Art of Economic Analysis

Chapter 1 & Syllabus

Economics U$A:

Resources and

Scarcity http://www.learner.org/reso urces/series79.html?pop=ye

2 8/18 Learning Activity # 1, Graphing and Macroeconomic Statistics s&vodid=175448&pid=338

#

C3, C5 (Economic

3 8/23 Opportunity Cost,

Comparative & Absolute Advantage,

Terms of Trade, Benefits of Free Trade.

Production Possibilities Frontier

Increasing and Constant Costs

Fluctuations & Growth),

C6

C2

C18, “the gains from trade.”

Economics U$A:

Markets and Prices

4 8/25 Learning Activity #2, Absolute and Comparative Advantage and

Gains from Trade.

5 8/30 Economic Aggregates,

Actors (Households/income, G/taxes, Businesses/Receipts,

Trade/imports & exports)

Productivity,

Rule of 70

C 3

C6

Economics U$A:

U.S. Economic Growth

6 9/1

Sources of Growth (labor is number 1)

Proportional, Progressive, Regressive Taxes

Ability vs. Benefits tax principles

Tax incidence

Learning Activity #3, Progressive vs. Regressive Taxes

Demand

Ceteris Paribus Conditions of Demand

Change in Demand vs. Change in Quantity Demanded

C4

7 9/6

10 9/15

Supply, Ceteris Paribus Conditions of Supply

Change in Supply vs. Change in Quantity Supplied,

Equilibrium

Rationing Function of Prices.

Guiding Function of Prices

C 4

Economics U$A: and Demand

Supply

8 9/8

Reaction Paper Practice.

Learning Activity #4, Demand, Supply, & Equilibrium

MEASURING THE MACRO ECONOMY: UNEMPLOYMENT & INFLATION, NATIONAL INCOME

ACCOUNTING, PRICE INDICES: CHAPTERS 5, 6, 7, 8. Power Point: Income Accounting

9 9/13 Leading Economic Indicators

Business Cycles

Aggregate Demand

C5

Economics U$A:

Booms and Busts

Aggregate Supply

Circular Flow Model C7, C7 appendix

9

FINAL CRN 10074, 201210 10

11 9/20

National Income Accounting,

Gross Domestic Product,

Value Added,

Critique of GDP

Learning Activity #5: National Income and Product Accounts

Index Numbers,

Consumer Price Index,

Real vs. Nominal,

Inflation

Learning Activity #6, Indices, Inflation, & Unemployment

C7

C8

Economics U$A:

Inflation

12 9/22 Unemployment,

Discouraged Workers,

Labor Force Participation

C8

KEYNESIAN EXPENDITURE MODEL, AGGREGATE DEMAND, AGGREGATE SUPPLY, FISCAL

POLICY: CHAPTERS 9, 10, 11, 12, 16. PowerPoint: Expenditure Model

13 9/27

14 9/29

15 10/4

Quiz: Keynes, Business Cycle

Introduction to the basic Keynesian expenditure model:

C, I, G, Net Exports.

Leakages & Injections

Shifters of the Consumption Function

Movements along the Consumption Function

Marginal Propensity to Save,

Marginal Propensity to Consume,

Expenditure Multiplier

Quiz: Expenditure Model, Stagflation, Fiscal Policy

Economics U$A:

Booms and Busts;

Economics U$A:

John Maynard

Keynes

C9.

Handout: Expenditure

Model Example

Economics U$A:

Fiscal Policy

;

16 10/6

17 10/11

Mid Term Exam

Learning Activity #7 Keynesian Expenditure Model

Economics U$A:

Stagflation

Chapters 1-8

18 10/13

19 10/18

Investment Demand and Interest Rates,

Role of Inventories

Government

Tax Multiplier

Aggregate Demand

Price level changes vs. shifts in AD.

C9

C10, appendix B

C10

Handout: Expenditure

Rounds for a New

Equilibrium.

Handout: Expenditure

Model with Lump Sum Tax

C10, pp. 198-202

C10, pp. 203-212

10

FINAL CRN 10074, 201210 11

20 10/20

21 10/25

AD & Equilibrium in the Keynesian Model.

Short Run Aggregate Supply

Long Run Aggregate Supply

Natural Rate of Output

C11

Economics U$A:

Productivity

Aggregate Supply and Labor Markets,

Potential vs. Actual GDP,

Supply Shocks,

Natural Rate of Unemployment,

Supply Side Policies for Growth.

Learning Activity #8: Aggregate Demand & Aggregate Supply

Fiscal Policy to close expansionary gaps

Fiscal Policy to close contractionary gaps

Active vs. Passive Fiscal Policy,

Lags in Fiscal Policy

Automatic Stabilizers

Impact of Price Level Changes on Effectiveness of

Expenditure Multipliers

Rational Expectations

Adaptive Expectations

Federal Budgets & Public Policy

Learning Activity #9: Keynesian Tax Multiplier

C12 & Appendix C12,

C13,

C17

Economics U$A:

Federal Deficits

MONETARY THEORY & POLICY, ACTIVE VS. PASSIVE MACRO POLICIES, FEDERAL RESERVE:

CHAPTERS 13, 14, 15, 16, 17. PowerPoint: Monetary Theory

22 10/27 Barter & Origin of Money, handout: Medium of

Exchange in Jail Functions of Money

Types of Money, for example, commodity money.

A good money is……

Fractional Reserve Banking System

Financial Intermediaries,

C14

Economics U$A: The

Banking System

Federal Reserve, the Great Depression,

23 11/1

Recent Banking Events

Monetary Aggregates: M1 & M2.

The Bank Balance Sheet: Sources and Uses of Funds.

Fed Funds Rate vs. Discount Rate

C15

Handout: “Bank Balance

Sheet.”

24 11/3 How Banks create money:

Reserves,

required reserves, excess reserves, vault cash.

Simple Deposit Multiplier

Handout: “Notes: Banks

Create Money”

C 15

25 11/8

26 11/10

Money Multiplier

The Fed’s Tools: Open Market Operations, Discount Rate, &

Reserve Requirements

Goals of the Fed,

Federal Reserve Balance Sheet,

Fed Creates Money Out of “Thin Air.”

Policy Rules vs. Discretion

Reform of Glass-Steagall

Learning Activity #10: Banks, Money Creation, Fed Tools, & Monetary

Policy

C15

WEB CT Handout: Fed’s

Balance Sheet.

Economics U$A:

The

Federal Reserve

11

FINAL CRN 10074, 201210 12

27 11/15 Indirect Channel (Short Run), a Keynesian View:

Bonds and Money

Money Supply,

Interest Rates,

Investment,

Aggregate Expenditures and Aggregate Demand.

C16

WEB CT Handout: Price of Bonds and Interest Rates

Learning Activity #11: Bonds and Money

28 11/17 Direct Channel (Long Run), a Monetarist View:

Equation of Exchange,

Velocity,

Quantity Theory of Money

Money & Macro Economic Equilibrium

C16

Economics U$A:

Monetary Policy

Learning Activity #12: Quantity Theory of Money C17

Economics U$A:

Stabilization Policy

INTERNATIONAL TRADE AND PAYMENTS, TARIFFS AND QUOTAS: CHAPTERS 18, 19. PowerPoint:

International Trade

29 11/29

Foreign Exchange Markets and Exchange Rates

Appreciation and Depreciation under floating exchange rate regimes

Revaluation and devaluation under fixed exchange rate systems

Factors affecting Foreign Exchange Rates:

Short Run (The Lake: interest rates and expected exchange rates)

Long Run (income, productivity, price level, tastes and preferences)

C19

Handout: “International

Trade Questions”

Economics U$A:

Exchange Rates

C19

Handout: “The Lake

Diagram”

Purchasing Power Parity & Big Mac Index

Learning Activity #13: Exchange Rates, International Capital

Flows, and Purchasing Power Parity.

30 12/1 Quotas vs. Tariffs,

Winners & losers from trade restraints

Producer and Consumer Surplus,

Trade Policies

Learning Activity # _14__: Tariffs and Quotas

C18,

Economics U$A:

International Trade

3

4

5

31 12/8

Balance of Payments: Capital and Current Accounts

FINAL EXAM Thursday, December 8 th

, 12:30-2:30 p.m. Comprehensive

Scheduled Learning Activities ECON 201 (some Learning Activities may be eliminated due to time constraints)

Number

1

2

Description

Graphing

Comparative Advantage & Absolute

Advantage

Completed

Progressive vs. Regressive Taxes

Supply & Demand

National Income & Product

Accounting

12

FINAL CRN 10074, 201210 13

6

7

8

9

10

11

12

13

14

15

16

Exchange Rate Risk

Tariffs, Trade, and Efficiency

Balance of Payments

Reaction Paper

1 GET A JOB.

ECON 201

PRINCIPLES OF MACROECONOMICS

ALTERNATE COURSE OUTLINE

"A course in macroeconomics in 25 words or less."

Interpretation: How to remember major components of

Macroeconomics

National Income

Accounting & Inflation

2

3

4

BORROW ALL YOU CAN.

AVOID TAXES.

Fixed vs. Chained Weight Index

Keynesian Expenditure Model

Aggregate Demand & Aggregate

Supply

Keynesian Expenditure Model with

Taxes

Monetary Policy

Bonds and Money

Equation of Exchange & Quantity

Theory of Money

SPEND ALL OF YOUR MONEY. and Unemployment

Keynesian Expenditure

Model

Monetary Theory and

Policy

Fiscal Policy

Expanded Definitions

Measuring and Tracking the Economy

5 BUY AMERICAN. International Trade,

Payments, and Foreign

Exchange http://www.learner.org/resources/series79.html?pop=yes&vodid=175448&pid=338#

Log on to the Corporation for Public Broadcasting site to view the ECON USA series.

# Date

Completed

1

#

1

Title

Resources and Scarcity Wilderness preservation and

WWII productivity show how society allocates and transforms resources.

2 2.

Markets and Prices

Developer William J. Levitt's lowcost housing and Reggie

Jackson's contract help explain the powerful forces of supply and demand.

Interdependence of economic units

Money, Banks, and the

Federal Reserve

Taxes and Government

Spending

Measuring and Tracking

Net Exports, Capital Flows and impact of Exchange

Rate Movements and

Normative Trade Policies

13

FINAL CRN 10074, 201210

3

4

5

6

7

8

9

10

11

12

13

16.

3.

4.

7.

5.

6.

8.

11.

10.

12.

Supply and Demand

Booms and Busts

U.S. Economic Growth

Inflation

Productivity

The California drought, the Arab oil embargo, and the designer jeans craze reveal the forces of supply and demand.

This episode documents the

GNP's greatest achievements and failures since its introduction in the 1930s.

America's roller-coaster economy is examined in light of the economic theories of Marx,

Schumpeter, Keynes, and Say.

This program examines the economic and social costs of the inflationary spiral of the early

1960s and questions whether the problem of inflation has been solved.

The cause of America's great productivity slide is examined, along with possible solutions.

John Maynard Keynes

This program introduces

Keynesian economic theory and analyzes the Depression.

Fiscal Policy

Stagflation

Federal Deficits

The Banking System

This program explores how the government's tax and spending policies are used to reduce the severity of business cycle fluctuations.

Demand-pull and cost-push inflation: looking at the economic crises of the 1970's and the economic expansion of the 1990's. Updated 2002.

This program examines efforts to reduce the deficit, including the

Gramm-Rudman Act and a proposed constitutional amendment requiring balanced budgets. Updated 2003.

The S&L crisis is reviewed with a discussion of deposit insurance and the accountability of financial institutions. This program was revised in 1992.

9.

The Federal Reserve The rising power of the Federal

14

14

FINAL CRN 10074, 201210

14

15

16

17

13.

14.

28.

Monetary Policy

Stabilization Policy

Exchange Rates

27.

International Trade

Reserve Board and the pros and cons of increasing reliance on monetary policy are examined.

Three Federal Reserve Chairmen

— Arthur Burns, Paul Volcker, and Alan Greenspan — are examined.

Updated 2002.

This program covers the debate between monetarists and

Keynesians, supply-side economics, and the 1985 Bonn

Economic Summit.

This program discusses the effects of international trade, tariffs, and quotas versus free trade. Updated 2002.

Governments try to control exchange rates, as seen in the

Plaza Accord of 1985 and the

Louvre Accord of 1987.

Updated 2003.

15

15

FINAL CRN 10074, 201210 16

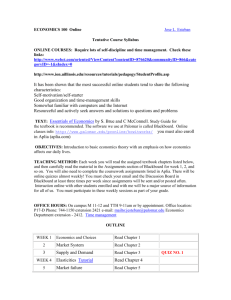

How to access your Aplia course

ECON 201 Principles of Macro 201210 CRN 10074

Instructor:

George Muncrief

Start Date:

08/16/2011

Course Key:

SAW6-A5FF-Y24S

Registration

Aplia is part of CengageBrain, which allows you to sign in to a single site to access your Cengage materials and courses.

1.

Connect to http://login.cengagebrain.com/.

2.

If you already have an account, sign in.

From your Dashboard, enter your course key

( SAW6-A5FF-Y24S ) in the box provided, and click the Register button.

If you don't have an account , click the Create an Account button, and enter your course key when prompted: SAW6-A5FF-Y24S . Continue to follow the on-screen instructions.

Payment

Online: Purchase access to your course (including the digital textbook) from the CengageBrain website.

Bookstore: Purchase access to Aplia from your bookstore. Check with the bookstore to find out what they offer for your course.

If you choose to pay later, you can use Aplia without paying until 11:59 PM on 09/05/2011.

16