Case Studies of Value Added Production and

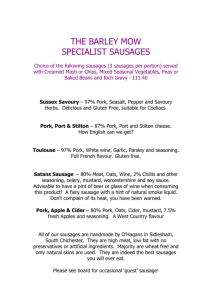

advertisement