The Gabelli Equity Income Fund

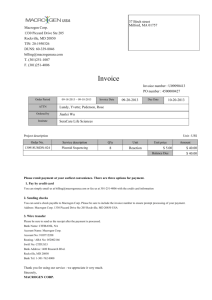

advertisement