SVU-AA2EM-BL2015

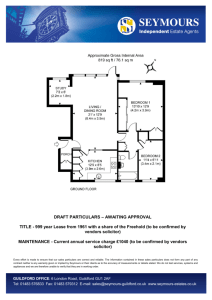

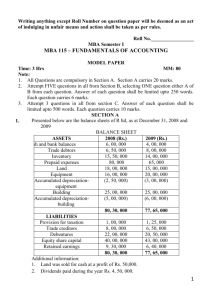

advertisement