A market-wide drift – downwards

advertisement

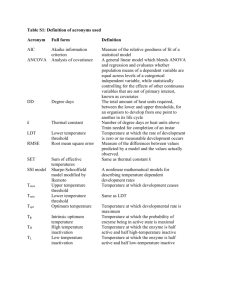

companies & markets Photo: Andreas Schlatterer Hebei Express was sold for demolition in Bangladesh at a healthy $325/ldt A market-wide drift – downwards SALE and purchase markets continued to drift across the sectors, as sellers pulled back and buyers took a view that continuing inertia would point the market downwards. Various holidays, including Golden Week in China, also contributed to the torpor. Dimitris Koukas, managing director at Optima Shipbrokers in Athens, reviewing the latest transactions with Fairplay, said, “it is clear that the ‘wait and see’ approach during the past weeks has brought very few sales on the second-hand market, which seems to be stalling.” Compass Maritime in New York, noting the same tentativeness among buyers and sellers, took a slightly different view, with the coda that “others continue to step up to the plate – sales activity picked up this week, but prices dipped slightly.” Bargain hunters One group of companies under the Navios umbrella continue to show how a confluence of bargain hunting and financial resources will drive the market for selected new or modern DORIS & NAESS Ship management at its best with of�ces in Amsterdam, Geneva, Manila, New York For further details contact Nicolas Wirth at Doris Geneva Tel: (+41 22) 301 11 12 Fax: (+41 22) 301 04 44 Email:doris@doris.ch Web:www.doris.ch Container & Multipurpose MILESTONE (General Cargo Ship) ex-Silver Seaway: sold by Government of The People’s Republic of China, China, to undisclosed interests, Philippines, $5.50M. 1994. 7,758dwt, 6,155gt. Built Nishi Co Ltd, B&W/12kt. MINERAL MONACO (Bulk Carrier): sold by NV CMB SA, Belgium, to undisclosed interests, China, $52.00M. Last Sale: $37.50M (2008), 2005. 180,263dwt, 90,091gt. Built Imabari. Saijo Shipyard, B&W/15kt. Bulkers OCEAN PREDATOR (Bulk Carrier) ex-Brilliant Star: sold by Allocean, United Kingdom, to undisclosed interests, Turkey, $23.50M. Last Sale: $38.20M (2006), 2002. 48,635dwt, 27,656gt. Built The Hakodate Dock Co Ltd, Mitsubishi/14kt. BLUE ARIES (Bulk Carrier): sold by Toko Kaiun Kaisha, Japan, to undisclosed interests, Germany, $13.50M. Last Sale: $12.00M (2009), 1998. 23,612dwt, 14,446gt. Built KK Kanasashi, Mitsubishi/14kt. ORIENT SAORI (Bulk Carrier) ex-Sea Navigator: sold by undisclosed interests, to undisclosed interests, Greece, $14.20M. 1997. 30,835dwt, 18,866gt. Built Minami-Nippon. Mitsubishi/14kt. 36 Fairplay 1 October 2009 SHANGOR (Bulk Carrier): sold by Bourbon, France, to undisclosed interests, $23.00M. 2001. 48,910dwt, 27,198gt. Built Nantong COSCO KHI Ship Engineering Co Ltd (NACKS), B&W/14kt. Tankers KURZEME and VIDZEME sold en bloc by Latvian Shipping Co (Latvijas Kugnieciba), Latvia, to undisclosed interests, United Kingdom, $53.00M. KURZEME (LPG Tanker): 1997. 23,469dwt, 18,503gt. Built Hyundai HI Co Ltd, B&W, 9,891bhp/16kt. VIDZEME (LPG Tanker): 1997. 23,479dwt, 18,503gt. Built Hyundai HI Co Ltd, B&W, 9,891bhp/15kt. www.fairplay.co.uk sale & purchase vessels. Navios Maritime Holdings was able to fund the purchase of the Supramax Navios Celestial (a ‘Tess 56’) on a resale set to deliver in October 2009 from a Japanese yard, according to brokers. Some sources hinted that the vessel, possibly the Anna Johanna, set to deliver from Tsuneishi Cebu to a German owner, was reportedly resold (to a new Chinese owner) several weeks ago. The total price of $36.2M was funded mainly with cash (coming on the heels of an institutional share offering), but partly with the $5M in newly issued convertible preferred shares that will be held by the yard. In analogous Capesize deals announced three months ago, Navios issued similar shares to a Korean yard. Brokers were also reporting a three-ship resale within China, from Zhejiang Zhenghe to buyer Nanjing Ocean Shipping (NASCO). A 57,000dwt Supramax, five holds/hatches and four cranes at 30 tonnes, with December 2009 delivery, was transacted at $29M. Two sister ships for delivery in 2010 were agreed at $27M each. The 1999-built (Sumitomo) Panamax Jacaranda was reported sold to US-based buyers for around $27M. As evidence of a downward drift, Compass noted that a similar vessel, but built in 1998, achieved the same price in early August. Smaller and older tonnage favoured Continuing a pattern from recent weeks, most of the market activity centred on smaller older dry bulk tonnage. Chinese buyers were said to have agreed to buy the 1994 IHI-built 43,000dwt Handymax Lake Globe for $16M. The putative seller, Globus, has been reducing its fleet during the year, by selling two other Handymaxes in the past few months, most recently Gulf Globe for $16M in early June, and using proceeds to build liquidity and pay down banking debt. Bulgarian-built, 38,461dwt Scanda, was reported sold for $8.5M, while the 32,755dwt Imandra RACER A (Oil Products Tanker) ex-Racer: sold by Ancora Investment Trust, Greece, to undisclosed interests, Indonesia, $2.50M. Last Sale: $13.25M (2001), 1989. 29,998dwt, 18,033gt. Built Minami-Nippon. B&W/14kt. Sold for Demolition B. PRUS (General Cargo Ship) ex-Concordia Sun: sold by undisclosed interests, $2.40M (280.00/ldt), 1979. 24,400dwt, 16,869gt, 670TEU. Built Kaldnes Mek. Verksted AS, Sulzer/18kt. CAPTAIN VALENTIN K (Container Ship) ex-Noble River: sold by Chester Shipping, Greece, $0.99M (174.00/ldt), 1983. 13,996dwt, 9,948gt, 827TEU. Built Orenstein & Koppel AG, MaK/14kt. www.fairplay.co.uk (built in Szczecin, 1985) went for $8.5M. In the multi-purpose arena, the Keppel-built Clipper Sterling, (21,000dwt, three 36-tonne cranes, built 1999), with ability to handle 847teu, was sold for $13.1M. On the tanker front, another ‘distress’ situation might be playing out with a financial angle, amid complex legal manoeuvering, concerning US Shipping Partners, LP (USSLP), which declared bankruptcy last April. So far bids for the company ranging between $255M and $300M have been received. A court review of USSLP’s pre-packaged bankruptcy is set for this week. Its fleet comprises 11 Jones Act vessels (including four units facing OPA-phaseouts) and a newbuild programme of as many as 10 additional refined product and chemical vessels. The demolition area continues to be busy. Optima’s Koukas told Fairplay that “it is absolutely certain that demolition activity will be growing exponentially in the coming weeks.” After pointing to an escalating supply of vessels, he continued, “the majority of the supply will come from the tanker market due to the dramatic drop in the chartering market.” Mindful of looming regulatory deadlines, he said that the additional available vessels supply would be boosted with single-hull phase-outs. Reported bulker sales include two Romanian built Panamaxes, Frank Zheijang (17,790ldt) which attained a healthy $317/ldt, and the Hebei Express, which achieved $325/ldt, both sold to Bangladesh. China’s demolition yards paid less. Five Stars Global (8,542ldt) managed only $265/ldt to Chinese breakers. The 1985-built Aframax Agate (14,314ldt) was reported sold into Bangladesh, at $365/ldt. An MR vessel, Anawan (11,270 ldt), went for a stronger $393/ldt. In contrast, Turkish customers paid $185/ldt for the 4,000dwt tanker Zeynap Ka. Valuations: an alternative approach GERMAN shipping banks and shipowners may be able to avoid crippling asset writedowns following the approval of the new Hamburg Ship Evaluation Standard by PricewaterhouseCoopers. The formula for the calculation of a ship’s longterm asset value (LTAV) which takes into account charter employment, market prospects and historical asset prices, represents an alternative approach to value assessments. As a discounted cash flow method, it arrives at more conservative values than the extreme highs and lows recorded in the sale and purchase markets during booms and slumps. The deviation from traditional spot value assessments tends to be within a 15% corridor, the Hamburg Shipbrokers Association (Vereinigung Hamburger Schiffsmakler und Schiffsagenten, VHSS) said. Banks and owners can use the scheme to back up higher ship value estimates than seen in recent fire sales, concluded under what they regard as abnormal market conditions. They can thus keep loan-to-value ratios on wellperforming vessels under control and avoid covenant breaches that would strain the balance sheets of both banks and owners. A survey by PricewaterhouseCoopers, presented in Hamburg on 22 September found that the LTAV formula is a plausible and appropriate tool. Details of the standard, including forward interest rate curves and forecast periods, have been revised since its first introduction in February in order to comply with German accountancy standards (IDW-S1). Both HSH Nordbank and Deutsche Schiffsbank have declared that they intend to apply the formula for fleet valuations. CATTLEYA ACE (Vehicles Carrier): sold by Mitsui OSK Lines (MOL), Japan, $3.86M (285.00/ldt), 1988. 18,762dwt, 56,823gt. Built Oshima, Mitsubishi/22kt. FIVE STARS GLOBAL (Bulk Carrier) ex-Beta I: sold by Government of The People’s Republic of China, China, $2.26M (265.00/ldt), 1977. 40,754dwt, 23,705gt. Built Sanoyasu, Sulzer/14kt. CRYSTAL IRIS sold en bloc by Lomar Shipping, United Kingdom, to undisclosed interests, Russia, $1.89M (325.00/ldt) CRYSTAL IRIS (Refrigerated Cargo Ship) ex-Silver Night: 1981. 10,452dwt, 9,715gt, 140TEU. Built Astilleros Alianza, Sulzer/20kt. JO OAK (Chemical/Oil Products Tanker): sold by Executive Ship Management, Singapore, $7.28M (680.00/ldt), 1983. 39,161dwt, 22,772gt. Built AS Bergens Mek. Verksteder, B&W/16kt. ETERNAL ACE (Vehicles Carrier): sold by Mitsui OSK Lines (MOL), Japan, $4.00M (285.00/ldt), 1988. 18,701dwt, 55,380gt. Built Mitsui, B&W, 13,510bhp/19kt. SANTA FE (General Cargo Ship): sold by Swiss Marine, Greece, $3.12M (330.00/ldt), 1978. 15,011dwt, 11,524gt, 449TEU. Built Nipponkai HI, B&W/15kt. All details given in good faith but without guarantee 1 October 2009 Fairplay 37