IMMIGRANTS' GUIDE TO BECOMING a CGA or CMA in BC

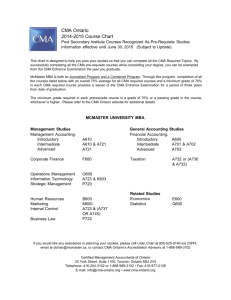

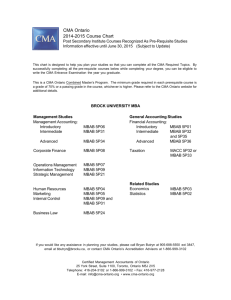

advertisement