Destination CPA: 2015-2016 Enrolment Overview Do I need to

advertisement

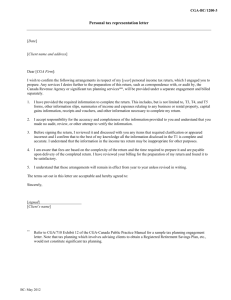

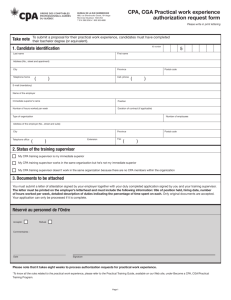

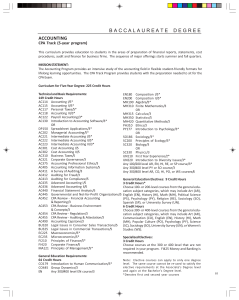

Destination CPA: 2015-2016 Enrolment Overview As we near the final sessions of the CGA Program, it is vital that students take the time to familiarize themselves with CPA policies, deadlines, and important changes. This update will provide important information about the bridging process both for Graduating or Legacy Completer CGA students, and for CGA students transitioning to the new CPA program. Please ensure that you read this email carefully to ensure that you experience a smooth transition. Please forward all merger/ CPA related enquiries to advising@bccpa.ca. Updates are also posted on the Merger Updates section of our website. Terminology: Transitioning CGA student— Transitioning students are current CGA students who will have course requirements (including PA1 and PA2) remaining after the end of session 4 2014-2015. These students will transition to the CPA program – into either the CPA Prerequisite Education Program (PREP) or the CPA Professional Education Program (PEP). Legacy Completer CGA student —Legacy Completer students are current CGA students who expect to complete all CGA legacy course requirements by the end of Session 4 2014-2015, but will have the degree and/or practical experience requirements outstanding. Graduating CGA student— Graduating students are current CGA students who will have completed all CGA program requirements by the end of session 4 2014-2015 (including degree and practical experience). Bridging/ transition– The process of transitioning between CGA and CPA programs that is unique to each individual CGA student based on their level of educational achievement, degree attainment and practical experience completion. Do I need to bridge to CPA? All students who have outstanding CGA academic course requirements following session 4 marks release are required to bridge to the new CPA program. Please note that current CGA students do not need to reapply to CPA. Transitioning CGA students will be bridged to CPA automatically, as long as they pay their 2015-2016 student dues in August 2015. 2015-2016 Enrolment Overview Annual Dues All current CGA students (unless graduating in session 3) are required to pay 2015-2016 student dues. Students will pay using a new enrolment system, which will be available mid-late August 2015. st st Please note that the new CPA fiscal year runs from April 1 to March 31 . As such, the 2015-2016 annual st st dues will be prorated from August 1 2015 to March 31 2016. The next billing cycle (i.e. 2016-2017) will occur around March 2016, and every March subsequently thereafter. While students are not required to be continuously enrolled in modules, Transitioning and Legacy students will be required to pay full annual dues from 2015-2016 onwards. There will no longer be a non-active fee option. Annual Dues for 2015-2016 will be $457.00 (net of tax) for all students. Any Graduating CGA Students accepted into membership will have their annual student dues adjusted against the annual member dues as is the normal practice. Enrolling in CPA Modules Wondering how to enrol in your first CPA module? Once your 2015-2016 student dues are paid and your final CGA course mark is confirmed, there will be a reasonable delay while your information is transferred to the new system, at which point you will be sent the relevant CPA enrolment information. Taking a CGA course or exam in session 4? You will be sent the relevant CPA enrolment information following session 4 exam marks release in November. Not taking a CGA course or exam in session 4? You will be sent the relevant CPA enrolment information following the payment of your 2015-2016 annual dues in September. To plan ahead: Check your My CGA-BC – “Course Marks History” to see which CGA courses you have completed successfully. Conduct a CPA Self-Assessment using the Bridging Assessment Tool and CGA to CPA Course Mapping chart on the “Merger Updates” page of the CGA Legacy website. Check the CPA PREP and CPA PEP schedules to confirm module enrollment, start, and exam dates. As with the CGA legacy course schedule, not every CPA module is offered every session. Don’t Forget! Be sure to check the CPA PREP and CPA PEP module prerequisite requirements. Previously completed CGA courses will transfer to CPA as per the CGA to CPA Course Mapping chart. Transitioning CGA students will not have to re-do equivalent courses they have already passed. CGA PACE to CPA PEP Course Mapping Update Credit towards the CPA Program modules will be assessed in accordance with the CGA to CPA Course Mapping chart. Important Update: Please note that current CGA Legacy students who have successfully completed any two CGA PACE electives will be able to transfer into Capstone 1 of the new CPA program as long as they have successfully passed at least one PA exam and attempted the other. This means that students who attempt but do not pass their final PA1 or PA2 exam will still need to transition to CPA, but they will not be required to complete Core 1 and Core 2, or any additional electives. In this circumstance, they receive Advanced Standing in PEP and would transition directly into Capstone 1. However, we caution students in this category to take the necessary steps to prepare for direct entry into Capstone 1. We will have more information on suggested preparation materials as we near the close of Session 4 – see also Module Zero section. Module Zero Module Zero is a free, online, self study course that transitioning students must complete before starting CPA PEP. As the CPA PEP entry requirement includes competencies that are different to the legacy programs, Module Zero is designed to help fill any knowledge gaps prior to starting Core 1. Transitioning students will gain access to enrol in Module Zero through their CPA student portal once transition is complete. Transfer Credits After bridging to CPA, transitioning students may still complete CPA PREP level modules for transfer credit at outside institutions. Please check the CPA Transfer Credit Guide for more information. All previously completed CGA courses will transfer to the new CPA program based on Legacy CGA Grading regulations and as per the CGA to CPA Course Mapping chart. Students do not need to re-do previously completed courses. Time Limit All transitioning students will be granted 6 years to complete CPA PREP and 6 years to complete CPA PEP. The time limit for program completion is not prorated or based on previously completed courses. Students with a Legacy CGA Graduation date of 2014-2015 will not need to request additional time to complete the program. However, if you have previous Appeal conditions to meet, you will need to connect with a student advisor as per your Appeal requirements. Legacy Completer CGA students will have until September 2018 to complete their practical experience requirement and June 2020 to complete their degree requirement, as applicable – please see the Practical Experience Requirement section below for more information. Practical Experience Requirement Graduating CGA students who have not submitted their CGA Practical Experience Required for Certification (PERC) for assessment will need to do so by the deadlines below: Session 4 2014-2015 September 11, 2015 Legacy Completer CGA students will have until September 1, 2018 to complete their PERC and will continue to refer to the PERC Guides and submit their work experience for assessment through the Tool. If students do not complete their PERC by September 2018, they will be transitioned to the CPA program. For Transitioning CGA students, the CPA program requires students/candidates to complete a 30 month term of relevant practical experience. If current CGA students have fulfilled their PERC, their qualified experience will transition to the CPA program and they will not have to submit again, however please note that approved experience is only valid for 3 years before a reassessment becomes necessary. Those students who have not fulfilled their CGA PERC will need to take the following steps as part of their CPA Practical Experience Reporting Tool (PERT) following transition: Familiarize yourself with the requirements Obtain relevant employment Secure a mentor Complete orientation course and quiz Create profile and initial report in PERT Begin reporting experience in PERT Transitioning CGA students who have not completed their practical experience are encouraged to wait until they have bridged to the CPA program to complete a PERT as outlined above. CGA practical experience ‘In Progress’ will not be transferred. Degree Requirement Have a degree? To avoid delays, make sure your degree has been updated on your CGA Student Record. Students can do this through their My CGA BC portal. All CGA assessed and accepted degrees will be recognized by the CPA program upon bridging. Don’t have a degree? Transitioning students will still be able to transition to CPA, but will need to complete a degree by June 1st 2020, and/ or before beginning the CPA Capstone 1 Module, which ever comes first. Legacy Completer CGA students will also need to complete a degree by June 1 2020 under current CGA requirements. If legacy students do not complete their degree by that time, they will be transitioned to the CPA program. Frequently Asked Questions General merger related FAQ’s can be found in the Merger Updates section of the website Can I apply to CPA now? No. Please do not apply to CPA—any applications received from current CGA students will be directed back to the Legacy CGA program. One also risks losing the benefits offered to CGA students who are transitioned to our CPA programs through the appropriate processes. When can I start my first CPA module? Once you have paid your 2015-2016 student dues, and your final CGA course mark is confirmed, there will be a reasonable delay while your information is transferred to the new system, at which point you will be sent your relevant CPA enrolment information. Why do I have to wait before I can enrol in my next CPA module? As with the Legacy CGA program, CPA prerequisites must be completed before a student can enrol in a module. In addition, not every module is offered every enrolment period. As such, some students may experience downtime while their final CGA mark is confirmed and CPA enrolment becomes available. What courses will I have left to complete? CPA BC has provided a CGA-CPA Course Bridging Tool to confirm remaining requirements for students who need to transition. Please note that this tool does not reflect the transferability of attempted PA1 and PA2 courses, as outlined above under the “CGA to CPA Course Mapping Update” section of this communication. Can I enrol in my next CPA module if I’m awaiting my final CGA mark? Currently, no. For most students, all Legacy course marks must be confirmed before students may transition. How many years will I be granted to complete the CPA program? All transitioning students will be granted 6 years to complete the PREP program and 6 years to complete the PEP program regardless of where they are placed. The time limit for program completion is not prorated as it was under the Legacy CGA program. I have already had three attempts on FN2, I wonder if these attempts will be carried over to PEP? No. Previous failed attempts for any PACE level course will not carry over to the PEP level of the CPA program. However, an appeals process preceding the transfer to PEP may be required – this is still under discussion. How many attempts are we permitted for each CPA module? Students are permitted 3 attempts at each CPA module. Who to Contact Until September 2015, all enquiries from current CGA student are to be directed to the Legacy CGA program office. We will send students updated CPA contact information in August 2015.