0 - Rumo ALL RI

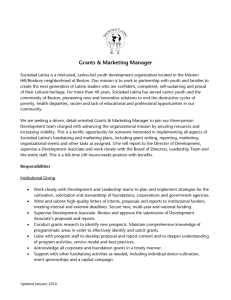

advertisement