Powerball Fact Sheet

advertisement

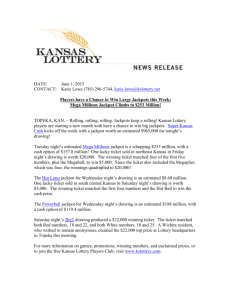

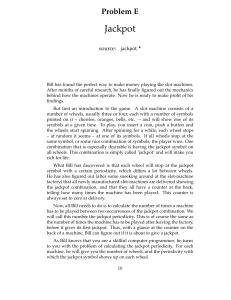

Effective 10/4/2015 Launch Powerball® sales began on April 19, 1992. The first drawing was on Wednesday, April 22, 1992. Powerball replaced Lotto*America. Drawings Watching Drawings Sales Cutoff Starting Jackpot How to win the Jackpot Odds to Win the Jackpot Record Powerball Jackpot Wednesday & Saturday at 9:59 p.m. Central time. Powerball drawings are conducted in the Florida Lottery’s studio, located in their Tallahassee headquarters. http://www.powerball.com/pb_video.asp 9 p.m. on drawing days (lottery terminals operate from 5 a.m. to midnight) $40 million Match the first five (white ball) numbers and the Powerball (red ball) number. The white balls are numbered from 1 to 69 and the red Powerballs are numbered 1 to 26. 1 in 292.2 million $590.5 million (Florida) May 18, 2013 Minnesota Jackpot Winners 22 Record Minnesota Jackpot $228.9 million (1 winning ticket) on Aug. 10, 2011 – Thomas and Kathleen Morris of Burnsville. They selected the $123.6 million cash option ($83.7 million after tax withholding). SuperAmerica, 16161 Cedar Ave. in Lakeville, earned a $50,000 bonus for selling the winning ticket. Most Recent Minnesota Jackpot $448.4 million (3 winning tickets) on Aug. 7, 2013 – Paul White of Ham Lake won 1/3 of the jackpot ($149.4 million). He selected the $86 million cash option ($58.3 million after tax withholding). Holiday, 1442 N.E. Crosstown Blvd. in Ham Lake, earned a $50,000 bonus for selling the winning ticket. Winning Ticket Retailer Bonus Payment Options 1 $50,000 (jackpot), $5,000 (Match 5 with Power Play) and $1,000 (Match 5) Jackpot winners have 60 days from the claim date to select either the 30payment graduated annuity or the cash option. Jackpot winners will receive their first payment about two weeks after the drawing. The graduated annuity increases by 4 percent each year. Minnesota State Lottery Powerball Fact Sheet Powerball Lotteries (47) Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Puerto Rico, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, U.S. Virgin Islands, Vermont, Virginia, Washington, Washington D.C., West Virginia, Wisconsin and Wyoming. Frequently Asked Questions: If I die before I receive all the payments from a Lottery prize, like the Powerball jackpot, will my heirs receive the rest of my prize money? Yes. Payments continue to the winner's estate or the winner’s designated beneficiary until exhausted. The Lottery also permits the estate to request the present value of the securities held for the winner be turned over to the estate. This permits the estate to pay inheritance taxes immediately, avoiding any penalties, and to distribute the remainder to the heirs. Then, of course, no more payments exist. There are also certain lifetime prizes in the Lottery. These have a guaranteed minimum number of years, after which payments continue if the winner is alive. If the winner dies before the minimum number of years, payments continue until the end of that period. Do the odds of winning increase, decrease or remain the same depending on how many tickets are sold? It makes absolutely no difference how many tickets are sold or how many states play the game. You are always playing against the numbers drawn. What happens if a prize goes unclaimed? Unclaimed multi-state game jackpots including Powerball and Mega Millions® are returned to the participating states based on their percentage of sales that contributed to the jackpot pool. In Minnesota, all unclaimed prize money goes to the state General Fund. 2 Minnesota State Lottery Powerball Fact Sheet