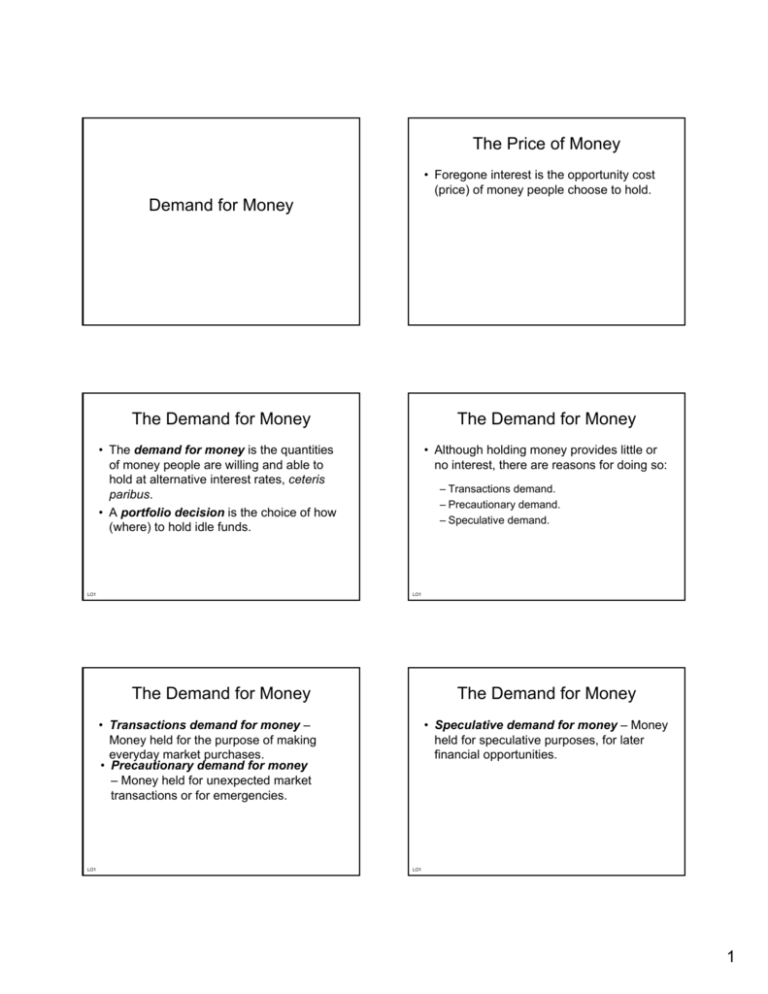

The Price of Money

• Foregone interest is the opportunity cost

(price) of money people choose to hold.

Demand for Money

The Demand for Money

The Demand for Money

• The demand for money is the quantities

of money people are willing and able to

hold at alternative interest rates, ceteris

paribus.

• A portfolio decision is the choice of how

(where) to hold idle funds.

• Although holding money provides little or

no interest, there are reasons for doing so:

LO1

– Transactions demand.

– Precautionary demand.

– Speculative demand.

LO1

The Demand for Money

The Demand for Money

• Transactions demand for money –

Money held for the purpose of making

everyday market purchases.

• Precautionary demand for money

– Money held for unexpected market

transactions or for emergencies.

LO1

• Speculative demand for money – Money

held for speculative purposes, for later

financial opportunities.

LO1

1

Why Hold Money

Why Hold money

• John Maynard Keynes noted that

people had three reasons for holding

money

• Economists have since identified four

factors that influence the three

Keynesian motives for holding money

– People hold money to make transactions

– People hold money for precautionary reasons

– People hold money to speculate

–

–

–

–

The Keynesian Motives for

Holding Money

The price level

Income

The interest rate

Credit availability

The Keynesian Motives for

Holding Money

• The transaction motive

– Individuals have day-to-day purchases for

which they pay in cash or by check

– Individuals take care of their rent or

mortgage payment, car payment, monthly

bills and major purchases by check

– Businesses need substantial checking

accounts to pay their bills and meet their

payrolls

Copyright ©2002 by The McGraw-Hill Companies, Inc. All rights reserved.

13-20

The Keynesian Motives for

Holding Money

– People will keep money on hand just in

case some unforeseen emergency

arises

• They do not actually expect to spend this

money, but they want to be ready if the need

arises

Copyright ©2002 by The McGraw-Hill Companies, Inc. All rights reserved.

13-21

Four Influences on the

Demand for Money

• The speculative motive

• The price level

– When interest rates are very low you

don’t stand to lose much holding your

assets in the form of money

– Alternatively, by tying up your assets in

the form of bonds, you actually stand to

lose money should interest rates rise

– As the price level rises, people need to hold

higher money balances to carry out day-to-day

transactions

– As the price level rises, the purchasing power of

the dollar declines, so the longer you hold money,

the less that money is worth

– Even though people tend to cut down on their

money balances during periods of inflation, as the

price level rises people will hold larger money

balances

• You would be locked into very low rates

– This motive is based on the belief that

better opportunities for investment will

come along and that, in particular,

interest rates will rise

Copyright ©2002 by The McGraw-Hill Companies, Inc. All rights reserved.

• The precautionary motive

13-22

Copyright ©2002 by The McGraw-Hill Companies, Inc. All rights reserved.

13-23

2

Four Influences on the Demand

for Money

Four Influences on the Demand

for Money

• Income

• Interest rates

– The quantity of money demanded (held)

goes down as interest rates rise

– The more you make, the more you

spend

– The more you spend, the more money

you need to hold as cash or in your

checking account

– Therefore as income rises, so does the

demand for money balances

• The alternative to holding your assets in the

form of money is to hold them in some type

of interest bearing paper

• As interest rates rise, these assets become

more attractive than money balances

13-24

Copyright ©2002 by The McGraw-Hill Companies, Inc. All rights reserved.

13-25

Copyright ©2002 by The McGraw-Hill Companies, Inc. All rights reserved.

Four Influences on the Demand

for Money

Four Influences on the Demand

for Money

• Credit availability

• Four generalizations

– If you can get credit, you don’t need to

hold so much money

• The last three decades have seen a veritable

explosion in consumer credit in the form of

credit cards and bank loans

• Over this period, increasing credit

availability has been exerting a downward

pressure on the demand for money

13-26

Copyright ©2002 by The McGraw-Hill Companies, Inc. All rights reserved.

The Demand Schedule for Money

The Three Demands for Money

A. Transactions demand

20

B. Precautionary demand

20

– As interest rates rise, people tend to

hold less money

– As the rate of inflation rises, people

tend to hold more money

– As the level of income rises, people

tend to hold more money

– As credit availability increases, people

tend to hold less money

13-27

Copyright ©2002 by The McGraw-Hill Companies, Inc. All rights reserved.

Total Demand for Money

20

18

C. Speculative demand

16

20

14

18

12

16

Precautionary

demand

14

Transactions

demand

10

Speculative

demand

10

10

Total demand

for money

8

12

6

10

4

8

2

6

4

0

200

400

600

800

1,000

1,200

1,400 1,600 1,800

Quantity of money (in $ billions)

2

100

200

300

400

100

200

100 200 300

Quantity of money (in $ billions)

400

Copyright ©2002 by The McGraw-Hill Companies, Inc. All rights reserved.

500

600

700

800

900 1,000

This is the sum of the transaction demand, precautionary demand, and speculative

demand for money shown in the previous slide

13-28

Copyright ©2002 by The McGraw-Hill Companies, Inc. All rights reserved.

13-29

3

Total Demand for Money and the

Supply of Money

20

18

M

Interest Rate (percent per year)

The interest rate of 7.2

percent is found at the

intersection of the total

demand for money and

the supply of money (M)

Money Market Equilibrium

16

14

12

10

7.2%

8

Total demand

for money

6

Since at any given time the

supply of money (M) is fixed

it can be represented as a

vertical line

4

2

0

200

400

600

800

1,000 1,200 1,400 1,600 1,800

Quantity of money (in $ billions)

Money supply

The amount of money

demanded (held) depends

on interest rates

9

E1

7

Money

demand

0

g2

g1

Quantity Of Money (billions of dollars)

Copyright ©2002 by The McGraw-Hill Companies, Inc. All rights reserved.

13-30

LO1

Constraints on Monetary

Stimulus

Liquidity Trap

• The liquidity trap is the portion of the

money-demand curve that is horizontal.

• People are willing to hold unlimited

amounts of money at some (low) interest

rate.

A liquidity trap can stop interest rates from falling

Interest Rate

Demand for money

E1

E2

The liquidity trap

g1

g2

Quantity Of Money

LO2

LO2

4