Urbanization with and without Industrialization

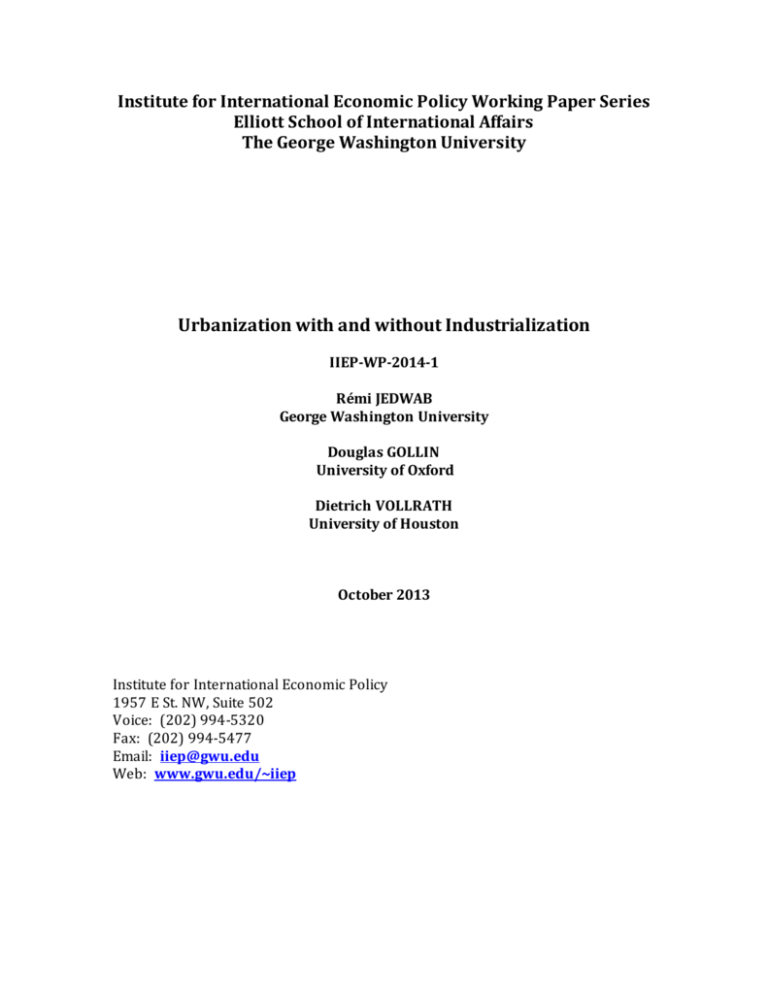

advertisement