Open File - Bankers Institute of the Philippines

advertisement

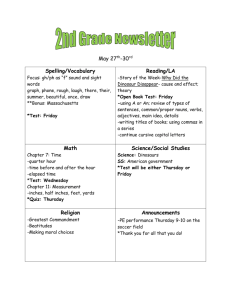

BAIPHIL MARKET WATCH 10 July 2015 Legend Improvement / Up Deterioration / Down No Movement FINANCIAL MARKETS AT A GLANCE PHILIPPINES ASIA-PACIFIC REST OF THE WORLD Financial Rates USD/PHP Current 45.2100 Stock Index Previous 45.1750 30-D PDST-R1 91-D PDST-R1 180-D PDST-R1 1-Y PDST-R1 10-Y PDST-R1 2.2017% 2.0250% 2.2251% 2.4371% 4.3733% 2.2050% 2.0542% 2.2424% 3.1767% 4.3800% 30-D PDST-R2 91-D PDST-R2 180-D PDST-R2 1-Y PDST-R2 10-Y PDST-R2 2.2033% 2.0103% 2.2249% 2.3997% 4.3750% 2.2050% 2.0438% 2.2466% 2.4518% 4.3700% Stock Index NIKKEI HANG SENG SHANGHAI STRAITS SET JAKARTA Current 19,855.50 24,392.79 3,710.27 3,267.40 1,472.57 4,838.28 Previous 19,737.64 23,516.56 3,507.19 3,284.99 1,470.25 4,871.57 Stock Index FTSEuro First 300 FTSE 100 DAX CAC 40 DOW JONES S&P 500 NASDAQ Current 1,511.64 6,581.63 10,996.41 4,757.22 17,548.62 2,051.31 4,922.40 Previous 1,477.81 6,490.70 10,747.30 4,639.02 17,515.42 2,046.68 4,909.76 PSEi Market Cap (Php Trillion) Total Volume (Php Billion) PSEi Performers Current 7,377.69 11.547 7.524 Closing Previous 7,363.43 11.533 19.377 % Change Top Gainers 4.65 193.00 57.95 +4.97 +3.76 +1.49 8.60 1,315.00 8.25 -1.94 -1.42 -1.20 Currency Exchange USD/JPY USD/HKD USD/CNY USD/SGD USD/THB USD/IDR Current 121.4500 7.7516 6.2078 1.3505 33.9300 13,332.00 Previous 120.7500 7.7528 6.2091 1.3515 33.9890 13,356.00 Various EUR/USD GBP/USD Gold Spot (USD/oz) Brent Crude(USD/bbl) 3-M US Treas Yield 10-Y US Treas Yield 30-Y US Treas Yield Current 1.1023 1.5374 1,159.10 58.58 0.01% 2.30% 3.10% Previous 1.1068 1.5367 1,158.70 57.23 0.01% 2.21% 2.99% MPI URC AEV Top Losers BLOOM GTCAP PCOR PHILIPPINES Local equities traded sideways Thursday rose by 14.26 points or 0.19% to close at 7,377.69. Despite heavy selloff in the morning trading session, the PSEi rebounded as bargain hunters were seen picking up value stocks and due to the sharp increase in the Chinese stock markets. Industrials, Mining & Oil, and Holding Firms Sectors were up by 0.94%, 0.58%, and 0.35%, respectively. Market breadth was still negative with 101 declines, 81 advances, and 42 names left unchanged. Total value turnover reached Php8.45 billion. Foreign investors were net sellers at Php1.16 billion. The peso depreciated against the dollar day-on-day in light of foreign selling pressure on the equities market. The local currency lost 5 centavos against the greenback to close at 45.21. In the local fixed income space, bond prices mostly rose Thursday with buying demand in the belly and long-end portions of the curve. Yields fell an average of 11.06 bps. The short end rose 4.7 bps while the belly and long ends fell 26.2 and 7.0 bps, respectively. The Bangko Sentral ng Pilipinas (BSP) said the country hit $80.8 billion in gross international reserves (GIR), the largest reported in four months. Net foreign currency deposits by the government and the BSP’s foreign exchange operations were the main reasons for this increase. This level of reserves serves as a cushion for the economy in volatile times. In the local fixed income space, bond prices mostly rose Thursday with buying demand in the belly and long-end portions of the curve. Yields fell an average of 11.06 bps. BAIPHIL Market Watch – 10 July 2015 Page 1 of 10 The short end rose 4.7 bps while the belly and long ends fell 26.2 and 7.0 bps, respectively. The peso depreciated against the dollar dayon-day in light of foreign selling pressure on the equities market. The local currency lost 5 centavos against the greenback to close at 45.21. A power interruption lasting up to three hours may affect parts of Pangasinan early Friday, the National Grid Corp. of the Philippines said Thursday night. In an advisory, the NGCP said the "emergency power interruption" is scheduled from 5 to 8 a.m. The NGCP said this will affect parts of Pangasinan Electric Cooperative III, Central Pangasinan Electric Cooperative and Dagupan Electric Corp. (Eastern and parts of Central Pangasinan). This is to allow the immediate repair of "hotspot/loose connection" inside NGCP's San Manuel Substation. But it added the schedule "may be implemented earlier depending on the criticality of the hots pot." The government has released more than 86 percent the budget for projects and agencies during the first half, the Department of Budget and Management (DBM) claimed on Thursday. About P2.26 trillion or 86.6 percent of the P2.61 trillion budgeted for the whole year was already released as of end-June. The amount includes more than P1.44 trillion or 94.6 percent of the total P1.19 trillion allocation for departments. In comparison, 86 percent or P1.95 trillion of the P2.26 trillion budget was released in the first half of 2014 and P1.15 trillion of what was allotted to departments. "Under the GAA-as-Release-Document regime, the DBM made the majority of funds available to agencies at the very start of the year. The remaining allotments are earmarked for later release, once agencies have complied with conditions or have requested the funds," Budget Secretary Florencio Abad said. Under the regime, the budget of agencies are generally considered released when the General Appropriations Act takes into effect. This allows the agencies to obligate their budget without waiting for DBM to issue a release document. "Given that our proposed budget for 2016 stands at P3.002 trillion, it is crucial that agencies – especially those with big-ticket projects and still-unreleased allotments – ensure the timely implementation of their programs this year," Abad said. A number of credit watchers and think tanks took note of the slow fiscal spending, citing it as the culprit in slowing down economic growth. Fitch Ratings Inc., for instance, said this would keep the Philippine economy from expanding by 7 percent. Government missed its revenue target from wages and income in the first four months of the year, the Department of Finance (DOF) said. DOF data showed that from January to April this year, revenues from withholding taxes on wages and individual incomes hit P95.16 billion, short by 3.3 percent from the P98.46 billion target for the period. The Bureau of Internal Revenue (BIR) said revenue from individual taxpayers missed its target by 22.5 percent in the four-month period. Only P8.92 billion was collected from individual taxpayers, way below the P11.51 billion target. Individual taxpayers include celebrities, doctors, lawyers, accountants and other self-employed individuals. Compared to the same period last year, revenue collection from individual taxpayers grew by only 1.5 percent at end-April. Revenues from withholding taxes on wages or from salaried workers, on the other hand, reached P86.94 billion in the period, slightly missing government's target. Finance Secretary Cesar Purisima earlier warned individual taxpayers engaged in highly profitable ventures but are paying less taxes that they will be tightly monitored by the tax agency. Government also said it has intensified its campaign against tax fraud due to the declining revenue collections from self-employed individuals. The Civil Aviation Authority of the Philippines (CAAP) gave the first company the permission to operate unmanned aerial vehicles, more commonly known as drones. Engineering firm SRDP Consulting Inc. was granted the first certificate of authority to operate drones for commercial use on Thursday. The company specializes in commercial aerial surveillance, ground exploration, topography, forestry and agriculture, transportation, research and disaster prevention and management. SRDP President Joel Cruz said the company sought the approval from CAAP as drones are a part of their mapping operations. CAAP requires that commercial drones be registered and for owners and operators to be certified by the regulator. The operator must undergo a three- to 10-day training to get a license, said CAAP Regulation Standard Department Manager Efren Rocamora. Licensed operators must file a flight plan before operating registered so that the UAV can be monitored. A penalty of P300,000 to P500,000 will be meted against those who violate the rules and regulations of CAAP on drones. However, CAAP Director General William Hotchkiss lll said the implementation of the rules and regulations is still a “work in progress." A contractor of the Bureau of Customs (BOC) was charged with tax evasion before the Department of Justice (DOJ) on Thursday for "willful attempt to evade or defeat tax, and deliberate failure to supply correct and accurate information in his income tax returns and quarterly value-added tax returns." Israel R. San Jose, sole proprietor of Manila-based ISJ Builders and Design, was charged by the Bureau of Internal Revenue (BIR) for an aggregate deficiency tax liability amounting to P271.02-million for taxable years 2009 up to 2012. San Jose is engaged in architectural, engineering activities, and technicaly consultancy business. BIR Commissioner Kim Henares said a letter request was sent to the BOC for certified true copies of disbursement vouchers showing details of payments, check vouchers, official receipts/invoices issued by San Jose, as well as their signed contract. It was found, based on a certification issued by the BOC on June 30, 2015, that San Jose received income payments amounting to P55.60-million in 2009; P68.10-million in 2010; P98.80-million in 2011; and P96.39-million in 2012, according to Henares. San Jose, however, allegedly declared gross income of only P8.79-million in 2009; P11.39-million in 2010; P10.98-million in 2011; and P10.48-million in 2012. The BIR complaint stated that San Jose "substantially underdeclared" his correct taxable income by 532 percent or P46.81-million in 2009; by 498 percent or P56.70-million in 2010; by 800 percent or P87.82-million in 2011; and by 820 percent or P85.91-million in 2012. The complaint against San Jose is among the 371st up to 377th filed by the BIR under its Run After Tax Evaders (RATE) program under the administration of Pres. Noynoy Aquino. Global debt watcher Standard & Poor's (S&P) has lowered its gross domestic product (GDP) growth forecast for the Philippines this year and next year. In its recent economic research report, S&P lowered its GDP growth forecast to 6 percent this year and 6 percent in 2016. This year's and next year's adjusted forecasts are lower than the earlier projection of 6.2 percent and 6.4 percent, respectively. S&P said the Philippines has hit a "soft patch" amid the China slowdown and normalizing interest rates in the US. "Even the Philippines, one of the star performers, has hit a soft patch," S&P said. Despite the lower forecast, the Philippine economy is still seen to grow faster than the 4.9 percent for this year and 5.1 percent for 2016 forecast for the ASEAN-4, which includes Indonesia, Malaysia, and Thailand. Indonesia's GDP is expected to grow 5.4 percent this year and 5.5 percent in 2016 while Thailand is expected to grow 3.4 percent this year and 3.7 percent next year. "Finally, the ASEAN-4 economies are also seeing subpar growth for a variety of reasons. Indonesia, the largest of this group, has seen growth slide closer to five percent from an average of about six percent in the post-financial crisis period. Growth in Thailand has recovered from the 2014 coup but remains subdued," S&P said. Economic managers in the Philippines are projecting GDP growth of 7 to 8 percent this year. In the first quarter, the Philippine economic growth slowed down to 5.2 percent from the 5.6 percent growth in the same quarter last year. The slowdown was attributed to lower public spending caused by delays in the implementation of infrastructure projects. Auto sales jumped to a record high last semester on improved performance across models, as the industry rode on the growth of construction, tanker and small businesses. A joint report the Chamber of Automotive Manufacturers of the Philippines, Inc. (CAMPI) BAIPHIL Market Watch – 10 July 2015 Page 2 of 10 and Truck Manufacturers Association released yesterday showed that their members sold a total of 24,185 units in June, 23% more than in 2014’s comparable month. This pushed the first-semester’s tally to 131,465 units, up by 21% from 108,957 vehicles in the comparable period last year. “Our automotive industry is riding with the other industries’ growth,” Rommel R. Gutierrez, CAMPI president and also a first vice-president at Toyota Motor Philippines (TMP), said in a statement yesterday. He said the expansion of micro, small, and medium enterprises resulted in “robust demand” for Asian utility, sport utility and light commercial vehicles, while the construction industry’s refleeting and growth in fuel hauling spurred the need for heavy duty vehicles. For the first half, sales of passenger cars surged by 30% year on year to 52,778 units from 40,609 vehicles. Commercial vehicle purchases rose 15% to 78,687 units from 68,348, led by AUVs and SUVs. “More notably, the heavy duty truck segment reached a hallmark as it has already exceeded its whole-year sales target of 490 units, having sold 493 units for the first semester,” CAMPI said. In terms of market share, TMP took the lion’s share with 43.9% in June. It had led the country’s 2014 auto sales charts and in the 12 years before that. Mitsubishi Motors Philippines Corp. came in second with a 19.2% market share, followed by Ford Motor Company Philippines, Inc. with 7.9%, Isuzu Philippines Corp. with 7.7% and Honda Cars Philippines, Inc. with 6.6%. “We just ended the first semester on a very strong note,” Mr. Gutierrez said, adding that the “industry is confident that it will reach the 310,000 units sales it set for this year.” CAMPI, which is composed of more than 20 auto companies representing multiple brands, ended 2014 with 234,747 units sold that in turn reflected a 30% jump from 181,283 vehicles sold in 2013. Publicly listed ATN Holdings Inc. plans to raise P1.0 billion from a share sale to finance a 30-megawatt solar power plant in Rizal province. The company is tapping Unicapital Inc. as financial advisor, issue manager and lead underwriter for the offering, according to a disclosure to the Philippine Stock Exchange Thursday. The company has an existing interest in ATN Philippines Solar Energy Group Inc., which obtained a contract from the Department of Energy to develop, operate and maintain a 30-MW solar power plant in Rodriguez, Rizal. Proceeds from the share offering will pay for site development works and commissioning of a sub-transmission line to Manila Electric Co. and associated components of the power plant. "The board of directors has determined that the preferred share is a favorable instrument for ATN Holdings to infuse additional equity into ATN Philippines," the company said, noting that this avenue is advantageous to existing shareholders since it does not entail a dilution of their equity holdings. "The timeline of the preferred shares offering shall be determined after further discussion with Unicapital," said Corporate Information Officer Paul Saria. Currently, ATN Holdings has 3.7 billion outstanding shares. The San Miguel Group is investing over $2 billion to build a nickel processing plant and two cement factories as the conglomerate diversifies further into new growth areas. Top Frontier Investment Holdings, Inc. is spending $1.5 billion to construct a high-pressure acid leach technology plant at its Nonoc nickel mine in Surigao del Norte, Ramon S. Ang, the company’s president, told reporters on the sidelines of the company’s shareholder meeting yesterday. San Miguel Corp., on the other hand, has allocated $800 million for two cement facilities, said Mr. Ang, who is also president of San Miguel. Top Frontier is San Miguel’s single biggest shareholder with a stake of 66.14% as of end-March, according to the conglomerate’s April 14 public ownership report. Top Frontier is in talks with equipment suppliers and is looking to break ground this year on the 200,000-tons-per-year plant to start processing output from the Nonoc nickel mine in about two years, Mr. Ang said. “Nonoc’s resource is good for 40 years, which makes the project feasible,” said Mr. Ang, adding that Top Frontier plans to raise 70% of the project cost through debt and 30% through equity. The two cement facilities, which are expected to be completed in 2017, will be funded by 50% debt and 50% equity, Mr. Ang said. San Miguel -- which had been diversifying from being the country’s largest food and beverage company in the past eight years to infrastructure, fuel and oil, energy, telecommunications, and banking -- had been tidying up its debt portfolio while borrowing fresh cash to finance new projects. Reuters reported on Wednesday that SMC Global Power Holdings Corp., the conglomerate’s holding firm for its energy investments, is borrowing $400 million to bankroll the expansion of a power plant. Yesterday, Mr. Ang however clarified that SMC Global Power does not need to borrow money since its power facilities are funded through project financing. “On mining, San Miguel may be taking a position since nickel prices are pretty low right now and they might be expecting a recovery. They may also think that the next administration will be more accommodating to mining,” Luis A. Limlingan, business development head at Regina Capital Development Corp., said in a phone interview. While Senate Bill No. 2374, which requires domestic processing of all mineral extracts in the country prior to export, awaits approval, Mr. Ang said: “Doon na rin papunta iyon (That is where it is headed).” Top Frontier, through subsidiary Clariden Holdings, Inc., holds the mining rights over an area of approximately 23,877 hectares in Surigao. “As for the cement [business], it complements their infrastructure business,” Regina Capital’s Mr. Limlingan said. San Miguel has started the construction of two cement facilities at Northern Cement Corp.’s plant in Pangasinan and another in Quezon province with an annual capacity of 2 million tons each. In 2013, SMC shelled out P3.5 billion to acquire a 35% stake in Northern Cement, which is owned by the conglomerate’s chairman, Eduardo “Danding” M. Cojuangco, Jr. San Miguel’s venture into the cement business comes as it participates in major infrastructure projects. San Miguel-led Optimal Infrastructure Development, Inc. bagged the contract for the P15.86-billion second stage of the Ninoy Aquino International Airport Expressway Project. The conglomerate is also building the P26.66-billion third stage of the Metro Manila Skyway and the TarlacPangasinan-La Union Expressway as well as expanding the South Luzon Expressway. Philippine Star Printing Company, Inc. (PhilStar) has acquired 76.63% of BusinessWorld Publishing Corp. from Hastings Holdings, Inc. in a move meant to “strengthen the distribution and operations” of the country’s premier business daily, PhilStar announced in a statement yesterday. “BusinessWorld remains the preeminent and most reputable business newspaper in the country. We believe that the synergies we can harness between PhilStar and BusinessWorld will greatly enhance the operations and financial results of both companies,” the statement quoted PhilStar President Miguel G. Belmonte, concurrently chief executive officer of BusinessWorld, as saying. Ray C. Espinosa, chairman of BusinessWorld and Philippine Star Group, said in the same statement: “This fulfills our strategy of making the Philippine Star Group a complete news and information organization with leading positions in general news, tabloid news, online news and now, business news.” “This wealth of sources will allow the Philippine Star Group to provide more comprehensive news and information across all delivery platforms,” he said. Abra Mining & Industrial Corp. (AMIC) has secured a P700-million investment from Europe's GEM Global Yield Fund LLC to finance projects already in the pipeline. The Luxembourg-based investment company committed a private placement worth 1 centavo apiece in the Philippine miner, according to a disclosure to the Philippine Stock Exchange. "Regulatory compliance are in progress for the immediate implementation of the private placement to ensure its immediate attainment of this opportunity to procure funding for its several mine projects," said AMIC. The investment "will bolster and strengthen its balance sheet to sustain investments for the full development and commercial operations of its high-grade Baticang lime project," the miner said. AMIC will also use part of the money to restart a technical and engineering program to relaunch the Patok gold project in Abra. Additional funds will be raised to fully develop the mine towards commercial operation. The company is also looking at advancing the Abra River alluvial gold and magnetite project. "AMIC will BAIPHIL Market Watch – 10 July 2015 Page 3 of 10 pursue capital raising endeavor at this favorable time to procure funds for several projects in the pipeline. Foreign groups are being engaged by the company for their expertise to clinch and ensure the success of the capital raising programs from global funders," it said. Retailer Puregold Price Club Inc. is diversifying into the remittance business, which is seen to contribute significantly to the company’s revenue in two to three years’ time. Newly appointed Puregold president Vincent Co said in a briefing Wednesday that “PurePadala” would be an additional service that could potentially position the company as a “one-stop-shop” supermarket chain. “It’s a new service for Puregold as we seek to tap the growing remittance business. But I challenged our team here because I don’t want to go into the remittance business just for the sake of going into it, we should have innovation,” said Co, son of Puregold chair Lucio Co. The younger Co said the difference between Puregold’s remittance services and those of other remittance companies is that overseas Filipinos would be assured that the money they were sending to their loved ones would be spent properly. The sender could specify how much of the amount being sent would be earmarked for groceries, which could be used at any Puregold store, utility bills, credit card payments, tuition; and how much should be encashed. The sender could even specify the non-inclusion of alcoholic beverages and cigarettes in the recipient’s grocery list. Also included in this remittance service is a “Negosyo package” worth P10,000 to P20,000, which OFWs can send to their families, who are looking to start a small sari-sari store business. This service can also be used by those wanting to send money to their families in the provinces. Co explained that the remittance recipient would receive a text message that should be presented to the Puregold customer service counter, which in turn would issue a confirmation receipt that would be honored at various bill payment centers and even schools. This service, powered by G-Cash, will be in its 239-strong retail network in the country, and will be available across the company’s 57 remittance partners in 27 countries. Manuel V. Pangilinan-led Metro Pacific Investments Corp., an active player in the administration’s public-private partnership program, has lured the interest of a number of foreign investment funds, a company official said. MPIC has been approached by at least five investors during a Philippine government-led roadshow in the United States last month, according to Rodrigo Franco, president of unit Manila North Tollways Corp. (MNTC), which operates the North Luzon Expressway. He said the groups included Japanese and USbased investors that participated in the event, which the Philippines used to drum up interest for more than 40 major PPP deals worth about $18.1 billion, the PPP Center said. MPIC, which owns the country’s biggest electricity retailer and has already won railway and tollroad PPPs, remains open to taking in investors but Franco said there was no urgency on MPIC’s part given the liquidity in the debt market. He said talks were still exploratory. MPIC tollroad arm Metro Pacific Tollways Corp., which owns MNTC, has long signaled that it was seeking either strategic or financial partners to support projects in its pipeline. MPIC has been taking a larger role in new infrastructure projects being launched by the administration. Its tollroad group recently won the P35.4-billion Cavite Laguna Expressway PPP, after unit MPCala Holdings offered a P27.3-billion premium payment to the Philippine government. Last year, MPIC and partner Ayala Corp. won a P65-billion project to operate the Light Rail Transit Line 1 in Metro Manila and expand the line to Cavite province. “They are interested in rails and roads. These are generally funds with infrastructure focus,” Franco said. The government has already awarded 10 PPP contracts to the private sector valued at about $4.2 billion, the PPP Center said. These include the Mactan Cebu International Airport, the country’s second-busiest gateway, and also non transport-related deals, such as the construction of new classrooms and the modernization of the Philippine Orthopedic Center. Top Frontier Investment Holdings Inc., a majority shareholder of the Philippines' most diversified conglomerate San Miguel Corp., plans to build a $1.5 billion nickel processing plant in the country's south. Top Frontier is in talks with equipment suppliers and is looking to break ground this year on the 200,000-tonnes-per-year plant to start processing output from the Nonoc nickel mine in Surigao province in about two years, said Top Frontier President Ramon Ang on Thursday after a meeting with stockholders. "Nonoc's resource is good for 40 years, which makes the project feasible," said Ang, who is also president of San Miguel. Top Frontier plans to raise 70 percent of the project cost through debt and 30 percent through equity, he said, speaking with reporters. The Philippines, which has 27 nickel mines and only two nickel processing plants - both partly owned by the country's top nickel miner Nickel Asia Corp. - is looking to require domestic processing of locally extracted ores that are mostly exported to China. Business process outsourcing (BPO) firm TaskUs is beefing up its operations in the Philippines with a $15 million additional investment. “The investment crystallizes our company’s expansion programs. This includes the opening of new locations outside Metro Manila and the improvement of infrastructure to enhance our ability to deliver better customer service,” said TaskUs co-founder and chief executive officer Bryce Maddock. Maddock said TaskUs recently opened its flagship regional corporate headquarters in Bonifacio Global City in Taguig, which comprises the first phase of the company’s expansion program. The new building capable of seating 400 employees will be the firm’s third site in the Philippines after the company opened offices in Imus, Cavite and in SM Aura in Taguig. Aside from expanding locations and strengthening the company’s infrastructure, Maddock said part of the budget would go to improvement of its employee enhancement programs. “Since our aim is to be the employer of choice among BPO companies, we are emphasizing on improving our present employee enhancement programs,” Maddock said. “Programs like the scholarship program for exceptional employees, the Learning Academy, and management training programs, to name a few, are all in place so we develop the best and most dynamic workforce in the industry and improve our customer service, while attracting other global customers to trust us with their business,” he added. To date, TaskUs employs a total of 3,500 employees across all its three local sites and serves more than 100 of the world’s most recognizable companies. The BPO firm is one of the fastest-growing outsourcing companies in the world according to the Inc 500 and the Inc 5000, list that ranks the top growing privately owned businesses in the United States. ASIA-PACIFIC BAIPHIL Market Watch – 10 July 2015 Page 4 of 10 Japanese stocks ended up on Thursday, pulling back from 3-month lows in volatile trade as China's markets stemmed their rout after Beijing slapped curbs on selling in the latest of a flurry of emergency measures to avert a full-blown crisis. The Nikkei average rose 0.6 percent to 19,855.50 after falling as much as 3.2 percent to 19,115.20 in the morning. "A plunge in early trade freaked out most investors, but those who shorted earlier seemed to have covered their short positions after China stocks rose," said Eiji Kinouchi, chief technical analyst at Daiwa Securities. He said that investors had braced for a sharp drop in the Japanese market since Nikkei futures in Chicago plunged overnight. "The Japanese market guarantees liquidity. Global investors sold Japanese shares because they wanted to hedge against the potential losses from their China positions," Kinouchi said. China's stock markets have plunged roughly 30 percent over the last three weeks. But the sharp selloff abated after drastic measures were unveiled by the Chinese securities regulator that ban shareholders with large stakes in listed firms from selling. The broader Topix index fell 0.2 percent to 1,579.89 after diving as much as 3.6 percent to 1,526.09, its lowest since April 1. Trading was heavy, with 3.7 billion shares changing hands, the largest since last November. The JPX-Nikkei Index 400 dropped 1.0 percent to 14,272.95. Hong Kong stocks jumped on Thursday, snapping a four-day losing streak, as mainland Chinese stocks rebounded after a flurry of rescue measures from the Chinese government. The Hang Seng index rose 3.7 percent to end at 24,392.79 points, its biggest oneday gain since April 8. The China Enterprises Index climbed 3.1 percent in the biggest gain since April 13, to 11,446.37 points. China shares rebounded sharply on Thursday, with the Shanghai Composite index posting its biggest percentage gain in six years, as a fresh round of government support measures stemmed panic selling. But analysts said it was too early to tell if the worst was over. Hong Kong Exchanges and Clearing, led gains in the Hong Kong blue-chip index, rising 14.9 percent. It was followed by China Resources Land surging 11.8 percent and China Overseas Land, which was up 10.7 percent. Chinese brokerages rebounded, after plunging sharply on concerns over their profitability amid the steep decline in equity markets. Guotai Junan jumped 34.4 percent, China Galaxy Securities surged 23.9 percent and CITIC Securities was up 17.5 percent. Southeast Asia could expand slower than earlier expected, in line with projected sluggishness elsewhere, the International Monetary Fund (IMF) yesterday said. In an update to its April World Economic Outlook report, the multilateral lender said ASEAN-5 -composed of the Philippines, Thailand, Malaysia, Indonesia, and Vietnam -- is expected to grow by an average of 4.7% this year and 5.1% next year, 0.5 and 0.2 percentage points lower than previously estimated for those respective years. The report, however, did not contain country-specific forecasts. The outlook for emerging markets and developing economies as a whole was likewise trimmed by 0.1 percentage point to 4.2% this year, while the growth projection for next year was kept at 4.7%. “Growth in emerging market and developing economies is projected to slow from 4.6% in 2014 to 4.2% in 2015, broadly as expected,” IMF said. “The slowdown reflects the dampening impact of lower commodity prices and tighter external financial conditions -- particularly in Latin America and oil exporters -- the rebalancing in China, and structural bottlenecks, as well as economic distress related to geopolitical factor -- particularly in the Commonwealth of Independent States and some countries in the Middle East and North Africa.” Nevertheless, improvement in economic conditions in a number of distressed emerging markets and developing economies is expected to lift overall growth of the grouping to 4.7% in 2016. Similarly, the IMF cut its growth forecast for advanced economies this year to 2.1%, down by 0.3 percentage point from the April estimate, but retained its 2016 outlook at 2.4%. “The unexpected weakness in North America, which accounts for the lion’s share of the growth forecast revision in advanced economies, is likely to prove a temporary setback,” IMF said, noting that underlying drivers for economic activity in the United States -- such as wage growth, labor market conditions, easy financial conditions, lower fuel prices, and a strengthening housing market -- “remain intact.” On the other hand, economic recovery in the euro zone appears to be “broadly on track,” while growth in Japan came in stronger than expected in the first quarter of the year amid a rise in capital investment. Consumption in Japan, however, remains “sluggish and more than half of quarterly growth stemmed from changes in inventories,” IMF noted. “With weaker underlying momentum in real wages and consumption, the pickup in growth in 2015 is now projected to be more modest.” Globally, growth of economic activity is expected to be more modest at 3.3%, down by 0.2 percentage point from earlier projection, while the 2016 outlook was kept at 3.8%, the report showed. “The distribution of risks to global economic activity is still tilted to the downside. Near-term risks include increased financial market volatility and disruptive asset price shifts, while lower potential output growth remains an important medium-term risk in both advanced and emerging market economies,” the IMF said. “Lower commodity prices also pose risks to the outlook in low-income developing economies after many years of strong growth.” Japanese Prime Minister Shinzo Abe said on Thursday he will work with Group of Seven countries and other Asian countries to ensure economic and finance market stability as the euro zone grapples with Greece's debt crisis. Abe, speaking at a seminar, also said excessive yen strength has been corrected due to economic policies he put in place when he took office in late 2012. Honda Motor Co said on Thursday it is recalling about 4.5 million more cars globally to replace air bag inflators made by supplier Takata Corp, the latest move in the Japanese automaker's efforts to deal with a safety scare that has seen firms around the world recall tens of millions of cars. Of the 4.5 million, 1.63 million are being recalled in Japan, Honda said. Takata is at the center of the recalls of vehicles equipped with air bag inflators that can explode with too much force and spray metal fragments inside vehicles. Regulators have linked eight deaths to the component, all in cars made by Honda. North America is not included in this latest recall, he said. The automaker independently collected about 1,000 Takata-made air bag inflators from Honda cars not covered in previous recalls for investigative purposes, which Takata then analyzed, the spokesman said. Honda, based on its own analysis of data provided by Takata, found that a variance in the density of gas-producing chemicals in inflators may lead to abnormal deployment of air bags in the future and issued the new recall, according to the spokesman. Earlier on Thursday, Honda Chief Executive Takahiro Hachigo told reporters that while his firm will continue to investigate the issue with Takata, and work as a business partner with the supplier, it has no plans to provide financial aid to Takata. Honda last month restated its financial results for the business year ended March, to account for additional costs related to its recalls of cars equipped with Takata air bag parts. Faced with a stomach-turning slide in share prices, many Chinese companies are taking matters into their own hands with a tactic that experts say is bound to backfire: they’re pressing the pause button. About half of the 2,800 stocks on mainland Chinese markets have been suspended from trading as companies attempt to stem further losses by sitting out the market upheaval. The trading halts appear to be separate from the flurry of measures rolled out by Beijing over the past week, as the country’s communist leaders made increasingly desperate attempts to stabilize tumbling markets. The Shanghai Composite Index has dived about 30 percent from its June 12 peak. The steep decline comes after a spectacular rally that sent the Shanghai index up 150 percent in the previous 12 months despite slowing growth in the world’s second biggest economy. The government fanned the rally by sending encouraging signals through state media that enticed the Chinese public to pile in to the market. But the ensuing downturn and Beijing’s frantic response, which includes BAIPHIL Market Watch – 10 July 2015 Page 5 of 10 banning major shareholders from selling stakes for six months, highlights the limits of its control over the market. Experts said the wave of trading suspensions could have the opposite of the intended effect. Instead of stabilizing the market, they could add to the selling pressure by transferring it to other shares that remain active. It’s a naive strategy that shows “how immature the China market is,” said Jackson Wong, an associate director at United Simsen Securities. Ordinary Chinese investors have mixed feelings about the trading halts. “I’m worried and happy at the same time,” said Shanghai resident Ella Hong, who plowed 300,000 yuan ($31,400) into six companies starting in May, just before the market turned. Trading in half of those stocks is now frozen, including two companies whose share prices have dropped by more than half. “What I’m happy about is that they would not lose more in these next few days,” said Hong. “But what I’m worried about is that I heard once the stock comes back to the market, it would drop anyway.” Her shares of seafood processor Shandong Oriental Ocean Sci-Tech Co. are stuck at 14.01 yuan after she bought them for 35 yuan. And her shares of hydraulic machinery maker Fujian Haiyuan Automatic Equipments Co., which she bought for 32 yuan a share, are stopped at 12.28 yuan. Both said this week they temporarily suspending trading pending the release of “relevant information,” which they have not yet disclosed. Hong said she turned to the rest of her portfolio and dumped half of those shares at a big loss. She started playing the market after seeing many other people making quick money and chose stocks based on recommendations from a master in feng shui fortune telling and a friend with investing experience. Her experience illustrates how China’s novice investors tend to be the biggest losers in the event of a market meltdown. That was the case in the 2007-08 market boom and bust, in which China’s stock market plunged 70 percent. The boom was a windfall for Chinese companies and big investors who sold before the peak. Small investors who had piled in late suffered huge losses. Most of the companies that have suspended trading are smaller businesses listed on the Shenzhen stock exchange. These firms have been hit harder than the big state firms listed in Shanghai because they don’t benefit as much from recent government support measures, such as a plan for brokerages to buy stocks. The Shanghai Composite Index rebounded 5.8 percent on Thursday, continuing a pattern of roller-coaster trading. The market turmoil is rattling neighboring markets. Hong Kong’s benchmark tumbled as much as 8.5 percent on Wednesday. However it’s unlikely to seriously affect U.S. investors because they have limited involvement in China’s largely hermetic markets. Analysts say the trading halts will make the Chinese markets more volatile in coming days. “If you hold other shares, you think: quick, sell them now before those are frozen,” said Michael Every, head of Asia-Pacific financial market research at Rabobank. “Anything you hold could be frozen at an unrealistic level and you can’t get out.” “There’s no easy solution to this but China still seems to think there’s a command-economy way to control something as chaotic as an equity market. And there really isn’t,” he said. China is also revealing to global investors that its markets aren’t fully developed, analysts said. For example, index compiler MSCI’s recent decision to delay China’s inclusion in its global benchmarks, which would have spurred more capital into the country’s markets, now seems justified. Anyone who was upset about the decision last month is now “probably thinking what a bullet they dodged,” said Every. With so many shares suspended from trading, many market watchers have suggested, partly in jest, that China completely shut its exchanges to let everyone cool off. History suggests that won’t be a cure either. Hong Kong’s stock exchange closed for four days after the Black Friday global market crash in October 1987. When it reopened, the benchmark Hang Seng index plunged 43 percent, an event that spurred fundamental changes aimed at better protecting investors. Thailand's prime minister defended on Thursday a decision to forcibly return nearly 100 Uighur Muslim migrants to China despite rights groups' fears they could face ill-treatment, saying it was not Bangkok's fault if they suffered any problems. Prime Minister Prayuth Chan-ocha also raised the possibility of shutting the Thai Embassy in Turkey after protesters attacked the honorary consulate in Istanbul, smashing windows and ransacking parts of the building, over the expulsion of the Uighurs back to China. China's treatment of its Turkic language-speaking Uighur minority is a sensitive issue in Turkey and has strained bilateral ties ahead of a planned visit to Beijing this month by President Tayyip Erdogan. Some Turks see themselves as sharing a common cultural and religious heritage with their Uighur "brothers" and Turkey is home to a large Uighur diaspora. "I ask that we look after the safety of the embassy staff first," Prayuth told reporters. "But if the situation gets worse then we might temporarily have to close the embassy in Turkey." Hundreds, possibly thousands, of Uighurs keen to escape unrest in China's western Xinjiang region, have traveled clandestinely via Southeast Asia to Turkey. China is home to about 20 million Muslims spread across its vast territory, only a portion of whom are Uighurs. "Thailand sent around 100 Uighurs back to China yesterday. Thailand has worked with China and Turkey to solve the Uighur Muslim problem. We have sent them back to China after verifying their nationality," Colonel Weerachon Sukhondhapatipak, deputy government spokesman, told reporters on Thursday. A group of more than 170 Uighurs were identified as Turkish citizens and sent to Turkey, he said. Fifty others still need to have their citizenship verified. "If we send them back (to China) and there is a problem that is not our fault," said Prime Minister Prayuth, the general who led a coup against Thailand's elected government in May 2014. Hua Chunying, a spokeswoman for China's foreign ministry, would not confirm whether the Uighurs had been deported to China but spoke in general terms about the issue at a daily news briefing in Beijing on Thursday, saying the Uighurs were "firstly Chinese". REST OF THE WORLD European shares rose on Thursday, supported by miners after a rally in metals and Chinese stocks, while some investors were betting Greece's creditors will look positively at reform proposals and finally agree a debt deal. The pan-European FTSEurofirst 300 index closed 2.3 percent up at 1,511.64 points. The euro zone's Euro STOXX 50 index added 2.8 percent, while Germany's DAX advanced 2.3 percent and Spain's IBEX gained 2.7 percent. Italy's FTSE MIB enjoyed its best day since early January, climbing 3.5 percent. In a speech to the European Parliament, Greek Prime Minister Alexis Tsipras called for a fair deal after EU leaders gave him five days to come up with convincing reforms. "Investors have a glimmer of hope from the fact that in Alexis Tsipras' speech he still refers to a deal being struck," said Lorne Baring, managing director at B Capital Wealth Management. "However, in the face of the Greek tragedy and China market turbulence, investors still have plenty to worry about." The STOXX Europe 600 Basic Resources index gained 1.9 percent as prices of major industrial metals rose on signs of stabilisation in share markets in China, the world's biggest metals consumer. Chinese stock markets have plunged about 30 percent in the past three weeks but surged about 6 percent on Thursday, helped by Beijing's frantic BAIPHIL Market Watch – 10 July 2015 Page 6 of 10 attempts to arrest the sell-off that has roiled global financial markets. "In itself, the crash of the Chinese stock market is not that dangerous for the foreign stock exchanges. But if the Chinese government does not succeed in stabilising the stock market, this could slow down economic growth in the country and this of course would be a bad thing for the rest of the world," Koen De Leus, senior economist at KBC in Brussels, said. Associated British Foods was the biggest gainer on the FTSEurofirst 300, rising 5.1 percent. The owner of budget fashion retailer Primark and British Sugar maintained current year guidance after posting a small rise in year-to-date revenue. Among mid caps, Finnish pharmaceutical company Orion jumped nearly 11 percent, the best performer in percentage terms, after raising its 2015 profit forecast. The world's largest listed hedge fund company, Man Group , climbed 5.9 percent. Traders and analysts attributed the rally to data showing a slight rise in the performance of Man Group's AHL funds and the fact that its funds may have benefited from a commodity price recovery, among other factors. U.S. stocks closed higher on Thursday after Wall Street found relief in Beijing's efforts to halt a rout in Chinese stocks, which lifted markets around the world. Shares of Apple bucked the market and logged their first five-day losing streak since January as investors worried that consumers in China might have less money to spend on iPhones. Wall Street had fallen sharply in the previous session as market turmoil in China, a rout in commodity prices, the Greek debt crisis and a major outage on the New York Stock Exchange spooked investors. China's securities regulator, in its most drastic step yet to arrest a selloff on Chinese stock markets, banned shareholders with large stakes in listed firms from selling for the next six months. About 30 percent has been knocked off the value of Chinese shares since mid-June. Some investors fear that the turmoil in the Chinese market could destabilize the global financial system, making it a bigger risk than the Greek crisis. Adding to cautious optimism on Wall Street, European markets rose on hopes that Greece might be able to win a deal that could keep it in the euro zone. Greek Prime Minister Alexis Tsipras has until midnight to propose spending cut plans. “There a relief that (China's selloff) didn't continue. There's a relief that there doesn't seem to be any belligerent tone coming out of Greece," said Steve Goldman, principal of Goldman Management in Short Hills, New Jersey. The Dow Jones industrial average rose 33.2 points, or 0.19 percent, to end at 17,548.62. The S&P 500 gained 4.63 points, or 0.23 percent, to 2,051.31 and the Nasdaq Composite added 12.64 points, or 0.26 percent, to 4,922.40. All three indexes earlier traded up 1 percent or more. "There was a bit more optimism this morning and then just a general fallback as the day went on," said Giri Cherukuri, head trader at OakBrook Investments LLC, which oversees $1.3 billion in Lisle, Illinois. Seven of the 10 major S&P 500 sectors were higher, with the financial index .SPSY leading the gainers with a 0.77 percent rise. The NYSE, which accounted for about 13 percent of the volume of U.S. stocks traded last month, said Wednesday's halt was due to a technical problem that stemmed from new software rolled out the previous evening. U.S. second-quarter earnings season is getting under way with major U.S. banks scheduled to report next week. Shares of Walgreens Boots Alliance, the largest U.S. drug store chain, jumped 4.24 percent after the company raised its full-year profit forecast. Coty's shares fell 4.7 percent after Procter & Gamble agreed to sell its beauty business to the company in a deal that values the business at $12.5 billion. P&G shares dipped 0.41 percent. Apple dropped 2.04 percent to $120.07, just over a dollar above its 200-day moving average, closely watched by traders. On Friday, investors will look to a press conference by Federal Reserve Chair Janet Yellen for new clues about when the central bank will begin to raise interest rates for the first time since 2006. A hike in interest rates increases the cost of borrowing, crimping corporate profit margins. Advancing issues outnumbered declining ones on the NYSE by 1,773 to 1,284, for a 1.38-to-1 ratio on the upside; on the Nasdaq, 1,757 issues rose and 997 fell for a 1.76-to-1 ratio favoring advancers. The benchmark S&P 500 index posted 9 new 52-week highs and 17 new lows; the Nasdaq Composite recorded 34 new highs and 84 new lows. The Greek government will seek a parliamentary vote on Friday to endorse immediate reform commitments it is offering euro zone creditors in a race to win a new loan and avert bankruptcy and a possible exit from the euro zone. A Greek official said lawmakers would be asked to authorize the leftist government to negotiate a list of so-called "prior actions" it must take before aid funds are disbursed, a key step to convince skeptical lenders of its serious intent. The announcement came as Prime Minister Alexis Tsipras prepared to send a detailed reform plan to the head of Eurogroup finance ministers before a midnight deadline in hopes of winning a deal to prevent a looming bank collapse and stay in the euro. Greek banks have been closed since June 29, when capital controls were imposed and cash withdrawals rationed after the collapse of previous bailout talks. Germany, the biggest creditor, meanwhile took a small step towards Athens by conceding that Greece will need some debt restructuring as part of a proposed new three-year loan program to make its economy viable. The admission by German Finance Minister Wolfgang Schaeuble came hours before a midnight deadline for Athens to submit a reform plan meant to convince European partners to give it another loan to save it from a possible exit from the euro. Greece has already had two bailouts worth 240 billion euros from the euro zone and the International Monetary Fund, but since the crisis started its economy has shrunk by a quarter, unemployment is more than 25 percent and one in two young people is out of work. Schaeuble, who makes no secret of his doubts about Greece's fitness to remain in the currency area, told a conference in Frankfurt: "Debt sustainability is not feasible without a haircut and I think the IMF is correct in saying that. But he added: "There cannot be a haircut because it would infringe the system of the European Union." He offered no solution to the conundrum, which implied that Greece's debt problem might not be soluble within the euro zone. But he did say there was limited scope for "reprofiling" Greek debt by extending loan maturities, shaving interest rates and lengthening a moratorium on debt service payments. Schaeuble also complained that he had not seen any sign of "prior actions" by the Greek government. Friday's vote should go some way towards disarming such criticism, although a further vote will be required to turn the "prior actions" into law next week if an agreement is reached, the Greek official said. European Council President Donald Tusk, who will chair an emergency euro zone summit on Sunday to decide Greece's fate, joined growing international calls for Athens to be granted some form of debt relief as part of any new loan deal. Tsipras chaired a marathon cabinet meeting to finalize a package of tax hikes and pension reforms to send to euro zone authorities in a scramble to secure agreement at the weekend on a third financial rescue. The leader of his junior coalition partner, Defence Minister Panos Kammenos, told reporters the Greek proposal had been approved by the cabinet and would be submitted shortly. Tusk said a realistic proposal from Greece will have to be matched by an equally realistic proposal on debt sustainability from the creditors. "Otherwise, we will continue the lethargic dance we have been dancing for the past five months," he said. Some large Greek banks may have to be shut and taken over by stronger rivals as part of a restructuring of the sector that would follow any bailout of the country, European officials have told Reuters. European leaders will gather on Sunday in a last-ditch attempt to salvage agreement with Greece after months of acrimonious negotiations that have taken the country to the brink of leaving the euro. But regardless of whether or not fresh funds are now unlocked for the government, some Greek banks, damaged by political and economic havoc, may have to be closed and merged with stronger rivals, officials, who asked not to be named, told Reuters. One official said that Greece's four big banks - National Bank of Greece, Eurobank, Piraeus and Alpha Bank - could be reduced to just two, a measure that would doubtless encounter fierce resistance in Athens. A second person said that although mergers of banks were necessary, this could happen over the longer term. "The Greek economy is in ruins. That means the banks need a restart," said the first person, adding BAIPHIL Market Watch – 10 July 2015 Page 7 of 10 that prompt action was necessary following any bailout between Athens and the euro zone. "Cyprus could be a role model." "You have a tiny bit of time ... you would do restructuring straight away." Greece's financial system has been at the heart of the current crisis, hemorrhaging deposits as relations between the radical left-wing government of Prime Minister Alexis Tsipras and creditors worsened. After Athens defaulted on debt owed to the International Monetary Fund last month, the ECB froze emergency funding for the banks, precip tating their temporary closure and a 60-euro daily limit on withdrawals from cash machines. A decision by Greek voters last week to reject bailout terms offered by the country's international creditors prompted the ECB to maintain its cap, meaning that the banks will run out of cash soon. A year ago, Greece's bankers thought they were on the cusp of a new era. They had restructured as part of the country's bailout deal, had raised fresh equity from international investors and had regained access to debt markets to fund lending. But the economic and political turmoil that has ensued since Tsipras came to power in January means that they are dangerously short of cash. Even after the immediate liquidity problems are worked out, any restructuring of the sector would first require a prompt recapitalization of Greece's strongest lenders because rising bad debts and exposure to Greek government bonds mean they are in danger of becoming insolvent. A timeline and exact plan for the sector's revamp could be finalised after a recapitalization. Such action would face stiff political resistance in Athens, where Tsipras has pledged to 'restore our banking system's functioning'. Bank mergers save money but cost jobs, making them unpopular. Reflecting such obstacles, a second person said: "There would be an interest in having less banks ... but I'm wondering whether this would make sense in the short term." Any closures, which would be managed primarily by Greek authorities under the watch of the European Central Bank's supervisors, would not typically affect customers as their deposits and accounts would migrate to the bank's new owner. Greece's finance ministry was not immediately available for comment, while a spokeswoman for the ECB said: "The ECB Banking Supervision is closely monitoring the situation of Greek banks and is in constant contact with the Bank of Greece." Any such revamp would be a stark reminder of the withered state of the country's financial system, where deposits had shriveled to their lowest level in more than a decade before savers were forced to ration cash withdrawals. Of Greece's four big banks, National Bank of Greece, Eurobank and Piraeus fell short in an ECB health check last year, when their restructuring plans were not taken into account. Only Alpha Bank was given an entirely clean bill of health. A restructuring could follow a similar pattern to Cyprus, where one of the island's two main banks was closed as part of its stringent bailout, and Ireland, where three lenders were either shut or merged with rivals. But a senior Greek banker, while acknowledging that the ECB could embark on fresh stress tests and "set the recapitalization, restructuring process going again", said any mergers would reduce competition. "If the argument is cost efficiency and whether Greece is overbanked, with four players there is a semblance of competition," he said. "With fewer players, competition will be reduced even more." New applications for U.S. unemployment insurance benefits rose last week to their highest level since February, suggesting some slowdown in the labor market recovery. Initial claims for state unemployment benefits rose 15,000 to a seasonally adjusted 297,000 for the week that ended July 4, the U.S. Department of Labor said on Thursday. Even with the rise in claims, the latest report marks the 18th consecutive week of new filings below 300,000, which is considered consistent with a firming labor market. The previous week's claims were revised to 282,000, showing that 1,000 more people filed than initially reported. Economists polled by Reuters had expected new applications to fall to 275,000 last week. The four-week moving average of claims, which smoothes out week-to-week fluctuations and is therefore considered a better gauge of the labor market, rose 4,500 to 279,500 last week. U.S. Treasuries erased some losses after the data, while the dollar trimmed gains against the euro and the yen. Stock index futures were unchanged. The claims report covered the period which included the U.S. Independence Day holiday, but a Labor Department analyst said there was nothing unusual in the state level data last week. He did note that claims data tends to be volatile in July because of retooling by auto plants during that period. Jesse Hurwitz, an economist at Barclays Capital, said that because of the holiday and auto plant shutdowns, he was inclined to look past the volatility in the report. "Trend readings of both initial and continuing claims remain low from a historical perspective, which we expect to continue," he said. Continued claims - the number of people still claiming jobless benefits after an initial week of aid - rose 69,000 to 2.334 million in the week ended June 27, the Labor Department said. The labor market has been tightening, with the unemployment rate not too far from the 5.0 percent to 5.2 percent range that most Federal Reserve officials consider consistent with full employment. A government report last week showed employers adding 223,000 jobs in June, a slowdown from the prior month, and the U.S. unemployment rate sliding to 5.3 percent. Coty Inc, the U.S. maker of Calvin Klein and Chloe perfume, will buy Procter & Gamble's perfume, hair care and make-up businesses for $12.5 billion in the biggest cosmetics merger in recent history. Coty would become the No. 1 perfume maker ahead of L'Oreal and No. 3 make-up provider behind its French rival and Estee Lauder. It would run the perfume licenses of Gucci, Hugo Boss and Dolce & Gabbana as well as make-up brands Cover Girl and Max Factor, more than doubling its size with combined sales of more than $10 billion. The deal comes as Coty's sales across categories have either been stagnating or declining for more than two years while P&G has been struggling to expand its beauty business. Coty shares fell 4.6 percent, while P&G slipped 0.4 percent as investors questioned the benefits of the mega-merger. "We are getting critical mass around the globe with access to key markets such as Brazil, Japan and Mexico," Coty Chairman and Chief Executive Bart Becht said in an interview on Thursday. Analysts said the mass beauty brands Coty is set to acquire is expected to do well in emerging markets due to low pricing but the company has to invest in new initiatives to revive growth in developed markets. "The deal is extremely transformative for Coty, but investors are uncertain of what this means for the company," retail research firm Conlumino's Chief Executive Neil Saunders said. The debt Coty will assume, fairly small savings and questions on how it will cope with the transition make investors nervous, he said. Coty said the deal would save $550 million, including $400 million in non-transferred overhead costs, but take on $2.9 billion of P&G Beauty' debt. But Coty's stock is still up about 17 percent from before Reuters' June 8 report that it was fighting rivals such as Henkel for P&G's beauty business and had submitted a bid for the P&G assets. The sale is part of P&G's plan to narrow its focus on fewer, faster-growing brands. The world's No. 1 household products maker said last year it could sell about half of its slow-growing brands. The 43 brands being sold generated sales of $5.9 billion, or 7 percent of P&G's total revenue in fiscal 2013/14, and adjusted income of $1.15 billion. By taking on P&G's hair brands Wella and Clairol, Coty is entering a whole new business, which ranked No. 2 in terms of market share. On a call with analysts, P&G said it prefers to execute the deal through a "Reverse Morris Trust" split off transaction in which its shareholders could exchange P&G shares for those of Coty and the new beauty businesses. However, if it is executed as a split-merge, P&G would establish a separate entity to hold these beauty brands which would be transferred to electing P&G shareholders in a tax efficient transaction. There will also be a simultaneous merger of the new entity with Coty. P&G said it expects to close the deal in the second half of calendar 2016 pending regulatory approvals. P&G shareholders would own 52 percent of the combined business while Coty's existing shareholders will own 48 percent. Coty shareholder JAB Holdings, the Luxemburg investment company of the billionaire German Reimann family, will own a third of the combined entity. BECHT'S BETCoty has gone through a painful three-year reorganization with departures by many top executives and marketing veterans. Becht, who will be running the combined business, said Coty would take on all of P&G's Wella and Clairol BAIPHIL Market Watch – 10 July 2015 Page 8 of 10 management teams as Coty had no experience in that sector. The company expects hair color products to account for 24 percent of total sales after the deal was completed. P&G's 10,000 employees will join Coty's 9,000, Becht said. P&G's beauty chief Patrice Louvet will not be part of the new entity, Becht noted. P&G refused to comment on specific management moves related to this deal. P&G estimated a one-time gain of $5 billion to $7 billion, depending on the value of the merger at closing. Goldman Sachs advised P&G, while Morgan Stanley was lead adviser for Coty. PepsiCo Inc (PEP.N) reported better-than-expected quarterly profit and sales and raised its full-year adjusted earnings forecast as higher prices helped drive revenue growth in its beverages business for just the second time in nearly four years. The company's shares rose 3 percent to $98.49 in premarket trading on Thursday. PepsiCo, like other soft drink makers, has been battling falling soda sales in the United States, with customers turning to healthier drinks that use more natural ingredients. However, revenue from the company's Americas beverages business, its largest, rose 1 percent to $5.34 billion in the second quarter, as its strategy of raising prices to offset the impact of a strong dollar paid off. Organic volume sales in the region also rose 1 percent, the company said. The company said on Wednesday that it would report results for its North America beverages business separately from the third quarter instead of clubbing it with Latin America beverage sales. Frito-Lay snacks sales in North America, PepsiCo's second-largest business, grew 2 percent to $3.45 billion in the second quarter. The business sells snacks such as Doritos tortilla chips and Cheetos. The company raised its forecast for 2015 adjusted earnings per share growth to 8 percent on a constant currency basis, or about $5 per share, from 7 percent. Net income attributable to PepsiCo rose marginally to $1.98 billion, or $1.33 per share, in the second quarter ended June 13, from $1.98 billion, or $1.29 per share, a year earlier. Excluding items, the company earned $1.32 per share. Net revenue fell 5.7 percent to $15.92 billion as a stronger dollar continued to weigh on overseas sales. Analysts on an average had expected earnings of $1.24 per share and revenue of $15.80 billion, according to Thomson Reuters I/B/E/S. Up to Wednesday's close, the company's shares had risen 6.6 percent in the last 12 months. UPDATED GUIDELINES ON SOUND CREDIT RISK MANAGEMENT – 07 August 2015 INVESTMENT 101 – 08 & 15 August 2015 DEVELOPMENTAL COURSE ON TREASURY PRODUCTS (8-Days) - Basics of Financial Math – 11 July 2015 - Basics of Fixed Income Securities and Bond Duration (2 Days) – 18 July & 01 August 2015 - Spot, Forwards and FX Swaps – 15 August 2015 - Interest Rate Swaps – 19 September 2015 - Bootstrapping – 26 September 2015 - Currency Swaps and Forward Rate Agreement – 03 October 2015 - Financial Options – 10 October 2015 For details, please contact BAIPHIL via telephone (853-4457/519-2433) or email training@baiphil.org. MEET YOUR FY 2015-2016 BOARD President First VP Second VP Secretary Treasurer Directors Rhoneil S Fajardo, Deutsche Bank Liza L Ortiz – Bank of Tokyo-Mitsubishi Irene DL Arroyo – PDIC Maria Elena S Guce - Citibank Domingo B Gavino – ING Bank Blesilda P Andres – BPI Ma Rhodora E Banares – Bank of Makati Maria Teresita R Dean – PBCom Evangeline S Nevado – PDS Holdings Marilou R. Prudente – BDO Bonifacio S Santos – MEGA ICBC July 01-15 July 02 July 03 July 04 July 09 July 12 July 13 July 15 Evelyn D Vinluan – Past President Josefina S Cortez – Associate Life Member Zacarias E Gallardo Jr. - PNB Frieda Carren E Sunga – BNP Paribas Visitacion DL Enriquez – RBank Carmelita R Araneta – BOC Ma Lourdes G Trinidad – RCBC Savings BAIPHIL Market Watch – 10 July 2015 Page 9 of 10 DEVELOPED ECONOMY - While there is no one, set definition of a developed economy it typically refers to a country with a relatively high level of economic growth and security. Some of the most common criteria for evaluating a country's degree of development are per capita income or gross domestic product (GDP), level of industrialization, general standard of living and the amount of widespread infrastructure. Increasingly other non-economic factors are included in evaluating an economy or country's degree of development, such as the Human Development Index (HDI) which reflects relative degrees of education, literacy and health. “When we love, we always strive to become better than we are. When we strive to be become better than we are, everything around us becomes better too.” - Paulo Coelho Why is there such a thing as leap year? People generally say there are 365 days in a year. By a year, I mean this is the time period it takes the earth to travel around the sun: 365 days. Actually, however, it takes the Earth 365.25 days to make this trip. In other words, for every year we gain one-fourth of a day and every four years we gain an extra day. If nothing was done about this, our calendar would move backwards one full day every four years in relation to our seasons. A woman and daughter walked into a restaurant. A man walked past and the women both said, “Hello, Father.” How is this possible? BPI Asset Management Business World Philippine Daily Inquirer Philippine Star Compiled And Prepared By: Research Committee FY 2015-2016 GMA News ABS-CBN News Bulletin Today Reuters Sources Bloomberg CNN Wall Street Journal Strait Times Investopedia Brainy Quotes Goodreads Corsinet – Trivia Trivia Of The Day Filipi-Know Phrases.Org.UK Fun, Trivia & Humor Director: Maria Teresita R Dean (PBCOM) Chair: Sheryll K. San Jose (Equicom Savings Bank) Members: Rachelle A Fajatin (Equicom Savings Bank)/ Catalina R Avila (DBP) DISCLOSURE: The BAIPHIL Market Watch (BMW) is for informational purposes only. The content of the BMW is sourced from third party websites and may be subject to change without notice. Although the information was compiled from sources believed to be reliable, no liability for any error or omission is accepted by BAIPHIL or any of its directors, officers or employees, and BAIPHIL is not under any obligation to update or keep current this information BAIPHIL Market Watch – 10 July 2015 Page 10 of 10