20007 L5 - Foundation Center

advertisement

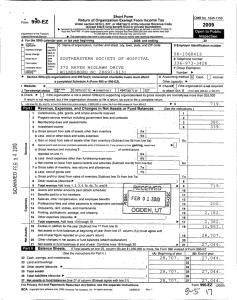

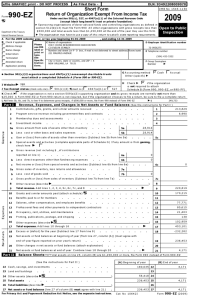

OMB No 1545-1150 Short Form Return of Organization Exempt From Income Tax Form 990-EZ Department of the Treasury Internal Revenue service A B E] ❑ For the 2007 calendar year , or tax year beginning , Zoo , 2007, and Check if applicable Please C Na ' use IRS Address chang e Ne v Jersey Academy of Science labe l or Name change Print or Rutgers University NCI iddres ❑ Initial return type ❑ Termination See ❑ Amended return Ss p ecific Instruc - ❑ Application pending tions 2007 D Employer identification : Website : 111 / % of 5 6 E Telephone numl;ler Room/suite 99 Avenue E I Beck Hall, Room 215 C'I 1 F Group Exemption ^ Number . Piscataway , NJ 08854 G Accounting method • Section 501 (c)(3) organizations and 4947(a)(1) nonexempt charitable trusts must attach a completed Schedule A (Form 990 or 990-EZ). I 20007 Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit trust or private foundation) ^ Sponsoring organizations, and controlling organizations as defined in section 512(b)(13) must file Form 990 All other organizations with gross receipts less than $100,000 and total assets less than $250,000 at the end of the year may use this form ^ The organization may have to use a copy of this return to satisfy state reporting requirements (c) 3 Insert no ❑ 527 ❑ 4947 a 1 or ❑ Accrual H Check ^ e if the organization Is not required to attach Schedule B (Form 990, 990-EZ, or 990-PF) 4DA2 J Organization type (check only Cash Other (specify) ^ if the organization is not a section 509(a)(3) supporting organization and its gross receipts are normally not more than $25,000 A return is K Check ^ not required, but if the organization chooses to file a return, be sure to file a complete return L Add lines 5b, 6b, and 7b, to line 9 to determine gross receipts, if $100,000 or more, file Form 990 instead of Form 990-EZ. ^ $ Revenue , Ex penses , and Chan g es in Net Assets or Fund Balances (See pag e 55 of the instructions. ) 1 2 3 4 Contributions, gifts , grants , and similar amounts received . Program service revenue including government fees and Membership dues and assessments . . . . . . Investment income . . . . . . . . . . . . . . . . contracts . . . . . . . 5a Gross amount from sale of assets other than inventory . ¢ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 2 3 4 7. -5-&nQ 4D 0 C . 5a 5b . b Less: cost or other basis and sales expenses c Gain or (loss) from sale of assets other than inventory. Subtract line 5b from line 5a (attach schedule) 6 Special events and activities (attach schedule) If any amount is from gaming , check here ^ ❑ a Gross revenue (not including $ of contributions 6a reported on line 1) 6b b Less: direct expenses other than fundraising expenses . . . c Net income or (loss) from special events and activities Subtract line 6b from line 6a . . . . 7a 7a Gross sales of inventory, less returns and allowances . . . . . 5c •, 6c 7b . . . . . . . . . . . . . . . c Gross profit or (loss) from sales^ °f inventory . Sybtr t line 7b from line 7a b Less. cost of goods sold m ups . . . . 8 Other revenue (describe ^ 9 Total revenue. Add lines 1, 2, 3, 4, 5c, 6c, 7c, and 8. 8 . 10 11 12 13 14 15 16 17 Grants and similar amounts paid (attach schedule) . . . . . Benefits paid to or for members . . . . . . . . . . . . Salaries, other compensation, and employee benefits . . . . Prof is to independent contractors Occ pancyREi1i j 1 main nance . . . . . . . . Pnn ing publieatieH9 , p rd shipping . . . . . . Oth rcip penses (describe ^ [n Tot pert^F.Q F^Icgli "$0 t r h 16 . . . . . . . v 18 Exc ss r (deficit) for the year. d ill act line 17 from line 9 . 0 V) 19 Z 20 21 22 Cash, savings, and investments d c M W 7c . ^ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0- Af'. o...C 491. 'fl 3 0i . d2 v? S.d 18 v2 =,i-3 i to . . . . . . . . . . . . Net sset n2 t be innin g of year (from line 27 , column (A)) (must a g ree with 1 / end pfil year's return) . . . . . . . . . . . . . . . Other changes in net assets or fund balances (attach explanation) . . . . . . 20 . Net assets or fund balances at end of year. Combine lines 18 through 20 . 21 [ ;^- ; ^ Balance Sheets-If Total assets on line 25, column (B) are $250,000 or more, file Form 990 instead of Form 990-EZ . . . . . . . . . . . . . . . Land and buildings . . . . . . . . . . ... . . . . . . . . Other assets (describe ^ Total assets . . . . . . . . . . . . . . . . . . . . . . Total liabilities (describe ^ Net assets or fund balances (line 27 of column (B) must ag ree with line 21 ) ror rrwacy MLI ana raperwortt neductton Act Notice, see me separate instructions . (B) End of year (A Beginn i ng of year (See page 60 of the instructions.) 23 3 24 25 26 27 . . 9 10 11 12 13 14 15 16 17 . . . . . . ) 6 31- P A1 1 1223 24 r 7, •'°""-" ./ Cat No 106421 1 26 7 / Y. ZForth VWU-LL (2007) L5 - fr Form 990 -P (2007) Page 2 Statement of Pro g ram Service Accom p lishments (See pag e 60 of the instructions. ) Expenses (Required for 501(c)(3) and (4) organizations What is the organization's primary exempt purpose? -arb Describe what was achieved in carrying out the organization's exempt purposes In a clear and concise manner, describe the services provided, the number of persons benefited, or other relevant information for each program title and 4947(a)(1) trusts, optional for others ) 28 ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Grants $ If this amount includes fore) ^ ❑ esc k here 29 - ---------------------------------------------------------------------------------------------------------------------------------- -- 28a ----------------------------------------------------------------------------------------------- ------------------------------------------------------------------- ----------------------------------------------------Grants If this amount includes for ' n rants check here Pi. E] 29a 30 ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Grants $ If this amount includes forei g n g rants, check here ^ ❑ 31 Other program services (attach schedule) . . . . . . . . . . . . . . . . . . . . . (Grants $ If this amount includes forei g n g rants, check here ^ ❑ 32 Total program service expenses . Add lines 28a through 31a 30a 31a . ^ 32 List of Officers, Directors, Trustees , and Key Employees (List each one even if not compensated See page 61 of the instructions) (B) Title and average hours per week devoted to posits (A) Name and address ----------------------- ----------------------- - (C) Compensation ( if not paid, )enter - 0-.) ( D) Contributions to mployee benefit plans & deterred comps ion (E) Expense account and other allowances -- ------- -------------------------------------------------------33 Other Information (Note the statement req uirement in General Instruction V. ) Did the organization make a change in its activities or methods of conducting activities? If "Yes," attach a 34 Were any changes made to the organizing or governing documents but not reported to the IRS? If "Yes," detailed statement of each change . . . . . . . . . . Yes No , , 33 attach a conformed copy of the changes , , , , , , , , , , , , , , , , , , , , , If the organization had income from business activities, such as those reported on lines 2, 6, and 7 (among others), but not repor te d on Form 990 - T, attac h a statement explaining your reason for not reporting the income on Form 990-T. a Did the organization have unrelated business gross income of $1 , 000 or more or 6033(e) notice , reporting, and proxy tax requirements ? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . b If "Yes ," has it filed a tax return on Form 990 -T for this year? . . . . . . . . . . . . . . . . 36 Was there a liquidation , dissolution , termination , or substantial contraction during the year? If "Yes," attach a statement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . , , . 34 35 37a Enter amount of political expenditures , direct or indirect, as described in the instructions . ^ b Did the organization file Form 1120- POL for this year? . . . . . . . . . . . 37a . . . :^-.- _ : 35a 35b 36 °' J"' ` . . . . . 37b . 38a 38a Did the organization borrow from , or make any loans to , any officer, director, trustee , or key employee or were any such loans made in a pnor year and still unpaid at the start of the period covered by this return? b If "Yes ," attach the schedule specified in the line 38 instructions and enter the amount involved 38b 39 501 (c)(7) organizations. Enter: a Initiation fees and capital contributions included on line 9 . . b Gross receipts , included on line 9, for public use of club facilities . . . . . . . 39a . . . . a, - s ' 39b Form 990-EZ (2007) Form 990-EZ (2 0 07) Page 3 Other Information (Note the statement requirement in General Instruction V.) (Continued) 40a 501 (c)(3) organizations. Enter section 4911 ^ /lam unt of tax imposed on the organ during the year under: , section 4912 ^/ d , section 4955 ^ b 501 (c)(3) and (4) organizations. Did the organization engage in any section 4958 excess benefit transaction during the year or did it become aware of an excess benefit transaction from a prior year? If "Yes," attach an explanation Yes No 40b c Enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912 , 4955 , and 4958 . . . . . . . d Enter amount of tax on line 40c reimbursed by the organization . . . . . e All organizations. At any time during the tax year , was the organization a transaction? . . . . . . . . . . ^ . ^ / t ^o to a prohibited tax shelter 41 List the states with which a copy o his return is filed ^ L a t/,.P 42a The books are in re of Located at _ b At any time during the calendar year, did the organlz'atio over a financial account in a foreign country (such as a b account)? . . . . . . . . . . . . . . . If "Yes," enter the name of the foreign country: ^ See the instructions for exceptions and filing requirements c At any time during the calendar year , did the organization If "Yes," enter the name of the foreign country ^ 43 Section 4947(a)(1) nonexempt charitable trusts filing Form 9 and enter the amount of tax - exempt interest received or ac Under nalties of perjury, I decla and jI f, it is true, correc t, anjil Co Please Sign Here S i g na re of officer 2 4.e_,:__ L j1AA - 0 Type or print name and title Paid Preparer's Use Only at I have examined this plete Declaration of pi Preparer's signature Firm ' s name (or yours if self-employed), OV self- i ^ L-J I EIN ^ Phone no ^ Form 990-EZ (2007) DESCRIPTION OF SELECTED ACTIVITIES OF THE NEW JERSEY ACADEMY OF SCIENCE • Senior and Junior Academy Annual Meeting is held in April of each year. Over 100 scientific papers and posters are presented throughout the day. A midday plenary session is highlighted by a keynote address by a distinguished scientist. We publish a Newsletter and The Bulletin, a scholarly, peer reviewed journal that welcomes contributions from many different scientific disciplines. The awardwinning student research presentations given at the annual meeting are also published in The Bulletin. The Newsletter contains items of scientific interest, reports of professional activities and academy announcements. • The Academy occasionally sponsors one of the Governor's Awards, namely the prestigious Thomas Alva Edison Science award, which was last presented to Dr. James L. Flanagen, Director of the Rutgers University Center for Computer Aids for Industrial Productivity. • Last October the NJAS cosponsored the "Conference on improving the Scientific Infrastructure in New Jersey" at Rutgers University in New Brunswick. More than 40 people from industry, government, and the K-12 and post secondary science education community attended and the results of this conference have been implemented in the NJAS Five-Year Action Plan. • The Grant-In-Aid Program of the Junior Academy is a valuable contribution to the science education of many New Jersey high school students. These grants provide funds to support student research activities. Working with an academic mentor, students develop and submit a grant proposal to support their own research project. The proposals are reviewed by a NJAS committee, which selects, awards and funds the proposals based upon the merit of each, and provides constructive feedback comments to all the applicants. The awardees work on their projects at school and, upon completion, produce oral and poster presentations to be presented at a NJAS Annual Meeting. These presentations are judged and the top winners are invited to present their research projects at the national AAAS meeting. The NJAS provides a portion of the travel expenses for these students. This past February, nine students attended the national meeting in Boston, Massachusetts. • The Science for Breakfast Program of the Junior Academy, a hands-on program, provides high school students interested in pursuing careers in science the opportunity to,interact with professional scientists and researchers in various fields of science, technology, research and development during roundtable discussions over breakfast. NJAS EXECUTIVE COMMITTEE AND OFFICERS 2007-2008 EXECUTIVE COMMITTEE Executive Secretary / Liaison Advisory Council: OPEN President : Dr Gail P Carter (2008) NJDEP, DSRT, P.O. Box 409, Trenton, NJ 08625-0409 Cell: 609-477-9218 Fax: 609-292-7340 e mail Bail carter( dep.state.nj us President - elect : Dr Laura Lorentzen (2008) Kean University, N.1 Center for Science, Technology & Mathematics Education, 1000 Morris Ave , Townsend Hall 117, Union, NJ 07083. Home. 718-720-5312 Work: 908-737-3424 Fax: 908-737-3425 e-mail LLorentz(hotmail com Past- President : Mr. Thomas H. Brown (2008) The Hawk Group, Raritan , NJ 08869 Home- 908-231-9323 Work: 908-231-9323 Fax 908-575-9054 Cell: 908-295-6050 e-mail: niacademyscienceOcaol.com Secretary : Dr Eric lannacone (2008) Fairleigh Dickinson University, 285 Madison Ave M-SBI-01, Madison, NJ 07940-1099 Cell 973-570-4446 Work 973-443-8747 Fax: 973-443-8766 e-mail erici cifdu edu Treasurer : Mr Carl L Evanouskas 71 Alpha Avenue, Old Bridge, NJ 08857 Home 732-679-8640 e-mail carlevanou(caol.com Editor , The Bulletin : Dr Michael Kennish Rutgers University, Institute of Marine & Coastal Sciences, 71 Dudley Rd, New Brunswick, NJ 08901 Home- 732-270-2220 Work 732-932-6555 x 240 Fax. 732-932-6557 e-mail- kennish(imarme rutgers.edu Editor , Newsletter: Dr Stephen J. Moornian UMDNJ-RWJMS, Dept. of Neuroscience & Cell Biology, 675 Hoes Lane, Piscataway, NJ 08854 Work: 732-235-4523 Fax 732-235-4029 e-mail- stephen.moormanCa)umdni edu Junior Academy Director: OPEN Grant-In-Aid Chairperson: OPEN Science Program , Annual Meeting Chair : Dr. Laura Lorentzen Kean University, NJ Center for Science, Technology & Mathematics Education. 1000 Morris Ave., Townsend Hall 117, Union, NJ 0708 Home- 718-720-5312 Work 908-737-3424 Fax- 908-737-3425 e-mail: LLorentz a hotmail com Member At Large: Dr. Paul A X Bologna Montclair State University, Department of Biology & Molecular Biology, Upper Montclair, NJ 07043 Home: 973-786-5581 Work 973-655-41 12 e-mail. boloenap(a,lmail montclair edu OFFICERS Membership / Finance: Gail P Carter ( See President above) Program Development Coordinator OPEN Web Manager: OPEN Office Manager : Mrs. Sabera M Shaikh Work 732-463-0511 Cellular - 732-763-0678 Work e-mail : niacadsc(n^rci . rutpers . edu Home e- mail: smmunshi(n)hotmail.com Main NJAS Office : NJAS c/o NJ Center for Science , Technology & Mathematics Education , Kean University, Townsend Hall T-1 17, 1000 Morris Ave, Union NJ 07083 Phone 908 -737-3420 Secondary Office : NJAS. Rutgers University, Beck Hall , Room 215, 99 Avenue E, Piscataway , NJ 08854-8040 Phone / Fax- 732-463- 051 1 e-mail niacadsc[)rci rutgers.edu Web site http://www nias org Updated- 3/5/08