Sunk Costs / Crash Costs / Time Trade

advertisement

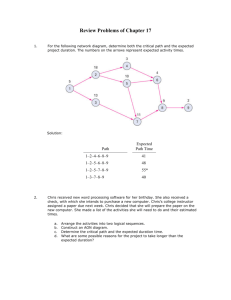

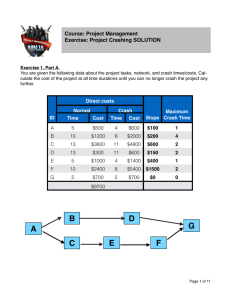

th 19 International Conference on Production Research SUNK COSTS / CRASH COSTS / TIME TRADE-OFFS: CONTRIBUTIONS FOR THE PROJECT MANAGEMENT M.B.F. Lima, A. Subramanian, G.R.S. Gomes, L.B. Silva Department of Production Engineering, Federal University of Paraíba, Centro de Tecnologia – Campus I – Bloco G – Cidade Universitária, Castelo Branco, CEP: 58051-970, João Pessoa, Paraíba, Brazil Abstract: This paper seeks to add contributions of the innovation and industrial Economics to more used techniques of crashing, in the Projects Management domain. First, it presents the brute force method, improved for the use of the MSProject. Second, it develops a linear program approaches for determining the earliest crash completion time and for determining a least costly crash schedule, for the same home-building project used in the brute force method. Third, it establishes costs laws, which allow inferring that the cost of a project does not depend only on the production rate but depending also on the time were the first unit of production will be available, on the global volume of production and on the project completion time. Concluding, it is pointed out the importance of the project management concerning the search of dynamic and innovative solutions to the more important productive problems of the emergent economies. Keywords: Project Management, Laws of Cost, Sunk Costs, Crash Cost. 1 INTRODUCTION Crashing the activities of a project relates to the costevaluation of reducing the duration of those activities which are in the critical path. After this evaluation, the activities that correspond to the lowest cost for crashing should be worked on. This means that the addition of more financial resources, manpower (extra hours, for example), materials or equipments, will cause an increase in the project’s budget [1]. The second section of this paper presents the brute force method which is used to crash a house construction project, an example extracted from Ragsdale [2]. It is important to emphasize that the MSProject speeds up considerably the development of this method, as also many applications of several others methods of planning, programming and controlling the projects ([3], [4], [5]). It is also important to point out that the technique mentioned above is fully accomplished by the MSProject. Section three presents some linear programming approaches with a view to determine the least possible time for a project’s completion; and to program the project’s crashing that would implicate the least additional cost, given a constraint imposed by contract’s condition, for instance, a pre-determined completion time. Some trade-off discussions concerning the crash costs, and project’s duration are also carried on. According to [6], trade-off, in economy, means the situation where there are conflicts of choices, i.e., when some economic action that aims to solve certain problem leads, inevitably, to other ones. Section four, deals with costs and products from a temporal point of view, within the scope related to the Industrial Economy and Innovation, by establishing socalled laws of cost that enable profound reflections concerning the project’s crashing. In conclusion, it is evident that, in the era of knowledge, the role to be played by the Project Management in this process of decision-making will be more and more relevant. 2 THE BRUTE FORCE METHOD This is the most known method, used for the crashing of a project, approached by various authors, among them Casarotto Filho [7]. The method is simple; however it takes much time and allows the occurrence of mistakes, which makes it inadequate to big projects. The steps of the brute force method are: 1. It is chosen the activity with lesser daily cost of crashing; 2. This activity is reduced to one time unit; 3. Table 1 is used to check the value of the daily compression cost related to the activity chosen; 4. The start and finish times of the network are recalculated. It is also checked if the reduction of one time unit, in the duration of the accelerated activity, has not modified the critical path; 5. Actions in the items 2, 3, and 4 are repeated until the duration of maximum acceleration is obtained or until a new critical path appears in the network; 6. In case of a new critical path appears in the network, there might be two parallel critical paths. Thus, in order to reduce the project duration in more one unit of time, it is necessary the simultaneous compression of the critical activities that have a lower daily compression cost in each critical path. By doing this, two parcels are being summed up to the project costs. It is necessary to verify if the sum of its daily costs is smaller than the marginal costs of another critical activity not accelerated yet. Table 1 and 2 summarizes the data related to the home construction project, which is an example extracted from Ragsdale [2]. Table 1 also brings the results obtained after implementing the Brute Force Method. It can be seen that the duration of the project was reduced to 28 days, leading to a additional crashing cost of $18.334, 00. th 19 International Conference on Production Research Table 1: Duration and normal and accelerated cost of the residence project NORMAL ACTIVITY DESCRIPTION A B D Excavate Foundation Lay rough plumbing Frame E ACCELERATED DAILY CRASHING COST Duration (Days) 3 4 Cost ($) 5.000 12.000 Duration (Days) 2 3 Cost ($) 6.000 15.000 3 3.000 2 3.500 500 10 20.000 6 25.000 1.250 Finish exterior 8 8.000 5 10.000 667 F Install HVAC 4 11.000 3 12.000 1.000 G H I J K Rough electrical Sheet rock Install cabinets Paint Final plumbing 6 8 5 5 4 3.500 5.000 8.000 4.000 7.000 4 5 3 2 2 4.500 6.500 9.500 5.500 8.500 500 500 750 500 750 L Final electric 2 2.000 1 2.500 500 M Install flooring Total 4 46 10.000 98.500 2 28 12.000 116.834 1.000 C 1.000 3.000 Table 2: Activities for residence project and its predecessors Activity A B C D E F G H I J K L M Predecessor - A B B D D D C, E, F, G H H I J K, L Variables: Ti Instant when the activity i starts ti Regular time of the activity i Ci Crashing time of the activity i Model: Min TM + t m − C m (1) Subject to: TB − T A ≥ t A − C A (2) TH − TC ≥ t C − CC (8) T J − TH ≥ t H − C H (13) TC − TB ≥ t B − C B (3) TH − TE ≥ t E − C E (9) TK − TI ≥ t I − C I (14) TD − TB ≥ t B − C B (4) TH − TF ≥ t F − C F (10) TL − T J ≥ t J − C J (15) TE − TD ≥ t D − C D (5) TH − T J ≥ t G − C G (11) TM − TK ≥ t K − C K (16) TF − TD ≥ t D − C D (6) TI − TH ≥ t H − C H (12) TM − TL ≥ t L − C L (17) TG − TD ≥ t D − C D (7) Ci ≤ Maximum crashing time available for the activity i Ti , C i ≥ 0 (18) (19) Chart 1: Linear Programming model th 19 International Conference on Production Research 3 LINEAR PROGRAMMING MODELS RELATED TO THE PROJECT CRASHING 3.1 Determining the earliest crash completion time According to Ragsdale [2], the projects manager might want to know the earliest date necessary to accelerate in order to satisfy the deadline. The formulation of a linear programming model to provide the solution to this problem is presented as follows in chart 1. The objective function (1) attempts to minimize the total amount of time necessary to finish the project. Constraints (2) – (17) make sure that a certain activity starts only after its predecessors have been completed. Restriction (18) guarantees that the crashing time of an activity does not violate the established limit. Finally, expression (19) is related to the nature of the variables. It is observed in the implanted model that the project duration of 28 days, corresponds to a crashing cost of $ 19.000, 00, lightly different to that obtained with the brute force method ($ 18.334, 00). 3.2 Including a time limit for concluding the project It is important to point out that in some situations, the time specified in the contract (Tp) can be smaller than the normal execution time (Tn) of the project, in other words, without crashing. Besides, a penalty value for each day passed over the established date is also considered. These characteristics lead the model to a closer proximity to the reality of the projects. However, conflicting problems come up concerning the total cost and the project crashing time, i.e., it might occur a trade-off between the elements mentioned. Thus, the following question has to be answered: is it worth to sufficiently crash the project in order to achieve the Tp or just crash or not a certain amount of time and pay the penalty? It can be verified that the model presented previously does not attend the conditions mentioned above. Thus, that objective function (1) has been adapted in order to fit the characteristics related to the project’s time, specified by the contract, and the existence of a penalty P. Therefore: M Min ∑CC ⋅ C − P(T − T ) i i e p (20) i= A where CCi is the crashing cost of the activity i, and Te is the execution time of the project (where Te ≥ Tp). The new objective function (20) tries to minimize the sum of the crashing costs and at the same time adds a daily penalty constant if Te > Tp. In other words, whenever the Te increases by one the objective function increases by P. The model was implemented using the software LINDO 6.1 and the following results were found: Project’s time = 43 days; Crashing Costs = $ 1500, 00; Penalty = $ 1500, 00. There are some situations where arises the necessity to accomplish some specific activity in a certain time horizon determined by a contract. Suppose that, in the house building’s example, the activity D has to be completed until the 16th day of the project. For that, the following constraint has to be added. Td + td − Cd ≤ 16 (21) The results obtained after including the restriction (19) were: Project’s time = 42 days; Crashing Costs = $ 2500, 00; Penalty = $ 1000, 00. 3.3 Considerations It can be observed that each one of the methods presented in this paper, has distinct characteristics to solve the same problem. It is not the objective of this work to discuss which is the most efficient, but the most effective according to the project’s manager reality. Matta and Ashkenas [8], discuss the use of project plans, chronograms and budgets by managers so as to reduce the “execution risk”. This risk is related to the possibility that the designated activities are not executed appropriately. The authors further observe that many decision-makers neglect two other critical errors: “blank-space risk”, which is associated with the fact that some activities may not have been predicted and therefore are not included in the original project; and the “integration risk” which relates to the situation where activities that are very different are not completed nearly simultaneously at the end of the project. Thus, one can observe the great potential of the use of the methods presented here as instruments of support for Project Management and minimization of errors mentioned above, each conserving their peculiarities. The linear programming presents several advantages. For example, it permits construction of flexible models which take into account the specific characteristics of a given project. Some of the disadvantages include the need to have adequate know-how to build up the model, knowledge of the mathematical programming techniques as well as the related softwares used to implement the models. 4 COSTS AND PRODUCTS IN A OPTICS ALONG THE TIME: THE NEW CONCEPTION OF THE NOTIONS OF COST AND PRODUCT The costs and the products analyzed under a dimension along the time, have a completely different conception from the usual one. This other conception has, as a specific feature, the fact that it inserts the capital theory in the core of the firm theory; it allows defining laws or propositions that are coherent with the empiric observation which, in turn, most of the times, concern the irregular systems of production, whose revenue is not synchronized with the expense [9]. In the regular or permanent production regimen the industrial company is technologically effective, in such a way that the supporting costs during the relevant period are, analytically imputable to the current production. Basically, the incomes are synchronized with the expenditures and the temporal dimensional is not significant to the cost analysis. The companies that operate on this regime consist mostly of industries where operations in chain provides manufacturing cycles of products and their lead times are denominated elementary periods. On the other hand, in the irregular or transitory regimen of production, the company is not very effective technologically since it is usually in a situation of construction of a new production capacity where the funds are not entirely used due, in some cases, to the problem of learning a new technology. Here, the concept of funds (in opposite to flows) corresponds to the elements that th 19 International Conference on Production Research participate in the production process without being destroyed, for instance, the land, the physical capital (buildings, machines and equipments) and the human resources. Therefore, in the irregular regimens there exists an imbalance between the cost and production profiles that do not allow the current costs to be analytically imputed in the current production. This fact would make the temporal dimension consideration unequivocal. In the context of such irregular regimen, a well defined production function does not exist due to the fact that the technology does not exist in principle and is in the process of constitution. The adequate analytical instrument seems to be a function of cost that, naturally, is not a derivative of the function of production anymore and, therefore, does not exclude situations of technological efficacy. This cost function should help to point out the role of time, in such a way that it is enrolled in an analytical perspective which is related to the temporal models of production. 4.1 The cost of production and modification of the capital value The way in which a temporal dimension can be introduced consists in defining the costs, like a modification in the company’s social capital value, resulting from a particular operation, assuming the change in income is omitted in the calculation of the variation of the social capital value. An example to illustrate this definition is as follows: presuming that at the beginning of an operation the actual value of the assets is 100 in a company and will be 80 at its conclusion, not taking into consideration the selling of the products of this operation in the market; the actual value of 80, where for example the updating rate is 6% will be 75.45. The operational cost in the present capital value is 25.43 (100 – 75.47). A cost expression in social capital unit is inserted here using a “funds” approach for company evaluation as opposed to materialistic approach used in the present case. Roughly speaking, the “funds” capital approach is based on the fact that, under a strategic point of view, the detention of the fixed asset by the companies constitutes for them a irreversible employment in relation to the future benefits the shareholders will be expecting. This is true especially in those cases where the detention of the machines becomes imperious due to the difficulty in replacing them in a short space of time by the market. This is equally true in those cases where the human resources are considered to be like collective ones. The materialistic approach basically consists in the fact that the capital is inassimilable in the immobilized assets, such as depreciation funds which are money reserves established by the companies and regulated by law. This is overcome by the company’s depreciation rate of the fixed asset (real estate, machines and equipments) and is destined to renovate this asset. A cost expression in social capital unit is in matter of fact coherent with the idea that the capital is inassimilable in immobilized assets, but constitutes a monetary value which is solely the future beneficiary values the shareholders will be expecting. Each of these characteristics mentioned to designate a production operation will affect the cost of production. In the case of project construction of a single product, for example a ship, x(t) will be equal to 1 unit/year, T and m will coincide in time, due to the fact the formulas below will not be of much use. In the small several residential construction projects like the case presented in this article, for example, T can be 45 days, x(t) will be 9 units/year and m will be equal to 40 days. The production is an operation that flows along the time. That is to say, it is like a program whose characteristics are the following: 1. A production tax (x) which is generally the only aspect considered in the economics standard analysis; 2. The total production volume (V) accumulated during the production program; 3. The completion time of the production (m). These three characteristics are summarized by the following formula: T +m V = ∑ x(t )dt (22) T Where V is the total production volume, x(t) is the production tax in the t moment, T is the moment in which the first product unit is given, and m is the time interval during which the production is made possible. Each of these characteristics mentioned to designate a production operation will affect the cost of production. In the case of project construction of a single product, for example a ship, x(t) will be equal to 1 unit/year, T and m will coincide in time, due to the fact the formulas below will not be of much use. In the small several residential construction projects like the case presented in this article, for example, T can be 45 days, x(t) will be 9 units/year and m will be equal to 40 days. 4.2 Production costs out of the permanent system: the laws of costs On the basis of the precedent observations, Alchian [8] elaborates a set of propositions on the manner by which the costs are affected by a variation of these variables or characteristics. Naturally, among the variables V, x, T e m, only three of them are independent, being the fourth a restriction contrarily to the permanent system where the four characteristics are invariable (this justifies the facto that only one of them is retained during the analysis). Let C be the cost function, namely, of modification of the social capital value, in a way that: C = F (V , x, T , m) Proposition 1: ∂C >0 ∂x(t ) T = T0 ; V = V0 (23) The value of the costs increase as the tax x, under which a certain volume is produced, is higher, the period of manufacturing of product m, is consequently reduced. For example, in the residential project mentioned in this article, let T remain as equal to 45 days, and V being fixed as 11 residences, x(t) will change from 9units/year to 11units/year, thus m will be reduced from 40 days to 32 days, due to this the company has to support higher costs for extra working hours. Proposition 2: ∂ 2C ∂x 2 >0 T = T0 ; V = V0 (24) The growing of the costs is a growing function in relation to the production tax. That is, if the additional cost incurred due to changing x(t) from 9 to 11 houses/year is $8,000.00, the change of x(t) from 11 to 13 houses/year will incur a cost greater than $8.000,00, with T = 45 days (fixed) and fixing V = 13 units. Proposition 3: th 19 International Conference on Production Research ∂C > 0 x = x0 ; T = T0 ∂V (25) The cost increases with the production volume for data x and T, consequently increasing the period of availability, m. In the present case, if x(t) = 11 houses/year and T is maintained constant in 45 days, the change from 11 to 13 units/year will clearly increase the cost. Proposition 4: ∂C V <0 ∂V T = T0 (26) The growing of the costs diminishes as the production volume increases. It is the phenomenon known as economics of scale which can be obtained from an experience curve as well as from the learning process that the human resources acquire along time. 5 CONCLUSION Speaking generally, one can assume that the Project Management can be directed mainly to the solution of production problems concerning innovative situations found in organizations whose tasks present a high innovation content level. Additionally, according to Casarotto Filho [7], Projects Management might considerably help organizations that search for a better market position, providing a higher significance to the competitive advantages to be developed by the company along the time, such as: costs, quality, speed (time), reliability, flexibility and innovations, in a growing importance order concerning aspects of the difficulties which the management of complex systems are submitted [11]. It is also important to mention the trade-off relevance between the project crashing costs, the completion time and the sunk costs. This way, the linear programming models presented in this paper are essential tools for obtaining useful references to the planning, programming and control of the productive systems. However, the project crashing estimated cost hardly presents the same value as the incurred actual cost. The consideration of the costs laws might contribute for the fulfilling of this gap, under the analysis of other important variables, such as the global production volume and the time in which the first unit of product will be available for commercialization. When dealing with the construction project of a single item as in the case of ship production, these variables are not of great importance. However, for the house project mentioned in this article variables V and T can turn out to be interesting. Thus, the average cost of production program decreases when the global production volume (V) and the rate of production x(t) increase, maintaining T and m constant. In the same manner, the cost of production program decreases when the variable T increases, reducing in that case the production rate x(t), provided all the remaining variables being constant. This occurs as a corollary to proposition 2. In effect, higher the T value, lower will be the rate value to which the inputs are compared, therefore also their prices, because the salesmen expenses are lesser on applying proposition 2 to them and thus lesser will be the cost of program production. 6 REFERENCES [1] Menezes, Luís C. de M. Gestão De Projetos. Editora Atlas, 2ª. Ed., São Paulo, 2003. [2] Ragsdale, Cliff T. Spreadsheet Modeling and Decision Analysis – A practical introduction to the management science. Southwestern college publishing, 3a edição, New York, 2001. [3] Vargas, Ricardo V. Microsoft Office Project 2003 conhecendo a principal ferramenta de gerenciamento de projetos de mercado. Brasport, Rio de Janeiro, 2004. [4] Writh, Almir. Planejando, replanejando e controlando com msproject 2000. Editora Book Express, 2ª. Ed., Rio de Janeiro, 2002. [5] Figueiredo, Francisco C. de, e Figueiredo, Helio. MS Project 98 utilização na Gerência de Projetos. Editora Infobook, Rio de Janeiro, 1999. [6] Sandroni, Paulo. Novíssimo Dicionário de Economia. Editora Best Seller, 3ª. Ed., São Paulo, 1999. [7] Casarotto Filho, N. Projeto de Negócio: Estratégias e Estudos de Viabilidade. Editora Atlas, São Paulo, 2002. [8] Matta, Nadim F. and Ashkenas, Ronald N. Gestão e implementação de projetos. Editora Campus, Rio de Janeiro, 2005, (p. 7 – 22). [9] Gaffard, J.L. Economie Industrielle et de l'innovation, Paris, Editora Dalloz, 1990, 470p. [10] Alchian, A. Economic Forces at Work, Indianapolis, Liberty Press, EUA, 1977. [11] Lima, Márcio B. Da F. Groupware, uso das Tecnologias da Informação e Organização do Trabalho: Contribuições à Economia da Inovação. Tese de Doutorado, UFSC, Florianópolis, 2002.