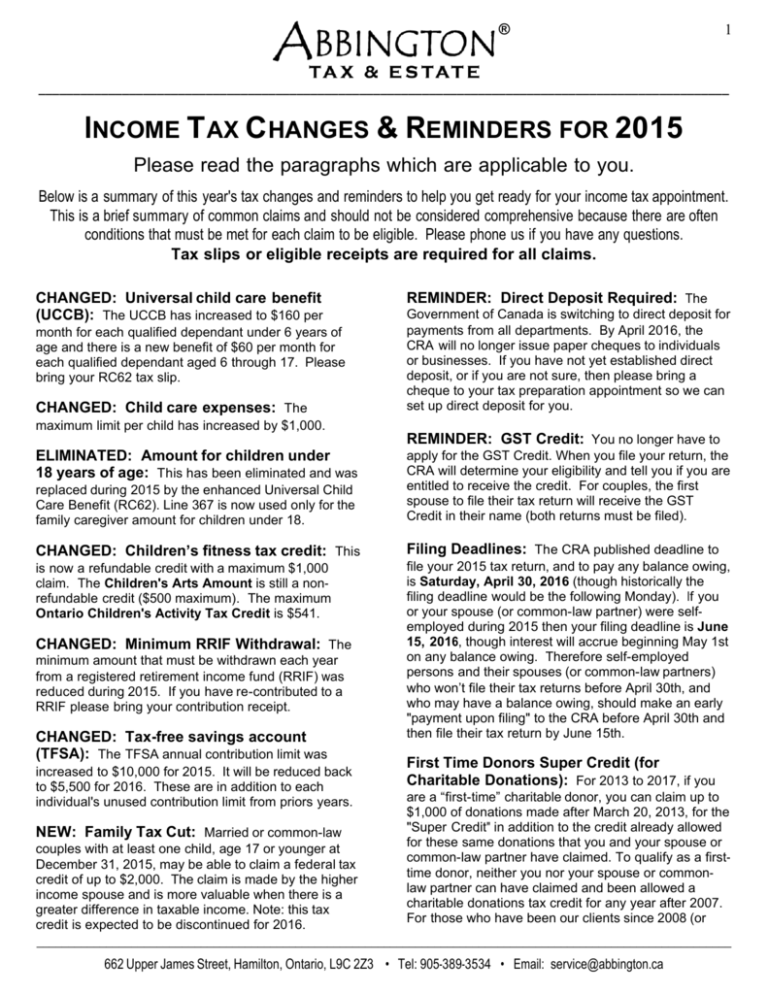

income tax changes & reminders for 2015

advertisement

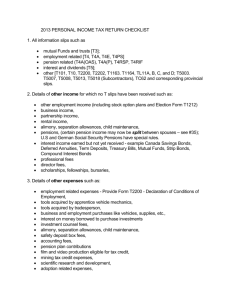

® 1 ___________________________________________________________________________________________________ INCOME T AX CHANGES & REMINDERS FOR 2015 Please read the paragraphs which are applicable to you. Below is a summary of this year's tax changes and reminders to help you get ready for your income tax appointment. This is a brief summary of common claims and should not be considered comprehensive because there are often conditions that must be met for each claim to be eligible. Please phone us if you have any questions. Tax slips or eligible receipts are required for all claims. CHANGED: Universal child care benefit (UCCB): The UCCB has increased to $160 per month for each qualified dependant under 6 years of age and there is a new benefit of $60 per month for each qualified dependant aged 6 through 17. Please bring your RC62 tax slip. CHANGED: Child care expenses: The REMINDER: Direct Deposit Required: The Government of Canada is switching to direct deposit for payments from all departments. By April 2016, the CRA will no longer issue paper cheques to individuals or businesses. If you have not yet established direct deposit, or if you are not sure, then please bring a cheque to your tax preparation appointment so we can set up direct deposit for you. maximum limit per child has increased by $1,000. REMINDER: GST Credit: You no longer have to ELIMINATED: Amount for children under 18 years of age: This has been eliminated and was replaced during 2015 by the enhanced Universal Child Care Benefit (RC62). Line 367 is now used only for the family caregiver amount for children under 18. apply for the GST Credit. When you file your return, the CRA will determine your eligibility and tell you if you are entitled to receive the credit. For couples, the first spouse to file their tax return will receive the GST Credit in their name (both returns must be filed). CHANGED: Children’s fitness tax credit: This Filing Deadlines: The CRA published deadline to is now a refundable credit with a maximum $1,000 claim. The Children's Arts Amount is still a nonrefundable credit ($500 maximum). The maximum Ontario Children's Activity Tax Credit is $541. file your 2015 tax return, and to pay any balance owing, is Saturday, April 30, 2016 (though historically the filing deadline would be the following Monday). If you or your spouse (or common-law partner) were selfemployed during 2015 then your filing deadline is June 15, 2016, though interest will accrue beginning May 1st on any balance owing. Therefore self-employed persons and their spouses (or common-law partners) who won’t file their tax returns before April 30th, and who may have a balance owing, should make an early "payment upon filing" to the CRA before April 30th and then file their tax return by June 15th. CHANGED: Minimum RRIF Withdrawal: The minimum amount that must be withdrawn each year from a registered retirement income fund (RRIF) was reduced during 2015. If you have re-contributed to a RRIF please bring your contribution receipt. CHANGED: Tax-free savings account (TFSA): The TFSA annual contribution limit was increased to $10,000 for 2015. It will be reduced back to $5,500 for 2016. These are in addition to each individual's unused contribution limit from priors years. NEW: Family Tax Cut: Married or common-law couples with at least one child, age 17 or younger at December 31, 2015, may be able to claim a federal tax credit of up to $2,000. The claim is made by the higher income spouse and is more valuable when there is a greater difference in taxable income. Note: this tax credit is expected to be discontinued for 2016. First Time Donors Super Credit (for Charitable Donations): For 2013 to 2017, if you are a “first-time” charitable donor, you can claim up to $1,000 of donations made after March 20, 2013, for the "Super Credit" in addition to the credit already allowed for these same donations that you and your spouse or common-law partner have claimed. To qualify as a firsttime donor, neither you nor your spouse or commonlaw partner can have claimed and been allowed a charitable donations tax credit for any year after 2007. For those who have been our clients since 2008 (or ______________________________________________________________________________________________________________ 662 Upper James Street, Hamilton, Ontario, L9C 2Z3 • Tel: 905-389-3534 • Email: service@abbington.ca ® 2 ___________________________________________________________________________________________________ earlier) we will already know your five prior years’ donations. We can also acquire this information from the CRA online for those who have named us as a Representative. RRSP Contribution Deadline: The deadline to contribute to a RRSP and claim the amount on your 2015 tax return is Monday, February 29, 2016. RRSP Contributions During 1st 60 Days of 2016: The CRA requires that RRSP contributions you made up to and including February 29, 2016, be claimed on your 2015 tax return. However, you may still choose to defer some or all of the RRSP deduction until a future year if better for you – please ask us how! Canada Pension Plan (CPP) contributions: As of January 1, 2012, the rules for contributing to the CPP changed. The changes apply to you if you are an employee or self-employed, you are 60 to 70 years of age, and you are receiving CPP retirement pension benefits. For more information check with your employer, or ask us, or go online to www.cra.gc.ca/cpp as well as www.servicecanada.gc.ca/cppchanges. Briefly, if you are under age 65 and receiving CPP Retirement Benefits while still working (whether employed or self-employed) you are still required to contribute to the CPP (post-retirement benefits). If you are over age 65 yet under age 70 and receiving CPP Retirement Benefits you can elect to stop contributing to the CPP. If employed, you may have already provided to your employer form CPT30 – Election to Stop Contributing to the Canada Pension Plan. Please bring the form CPT30 to your tax preparation appointment. However, if your only income was from self-employment then do not use form CPT30. Instead make the election on your tax return retroactive to the month you choose (and make sure you file your tax return by the deadline for selfemployed persons). Family Caregiver Amount (FCA): If you have one or more dependents with an impairment in physical or mental functions, you could be eligible for an additional amount of $2,058 per dependent in the calculation of certain non-refundable tax credits. You must have a signed statement from a medical doctor showing when the impairment began and what the duration of the impairment is expected to be. The Ontario Healthy Homes Renovation Tax Credit: This has been continued for 2015 to help with amounts paid or incurred for permanent home renovations. The credit can be claimed by seniors, whether they own their home or rent, and by individuals who share a home with a senior relative. Eligible expenses are for improvements to the residence that a) allow a senior to gain access to, or to be more mobile or functional within, the home or on the land; or b) reduce the risk of harm to a senior within the home or on the land or in gaining access to the home or the land. The expenses must have been paid during 2015 with a $10,000 claim limit. For lists of sample eligible expenses and non-eligible expenses please contact us. Pension Income Splitting: If you or your spouse (or common-law partner) received pension or RRIF income that is eligible for the Pension Income Amount, you may be eligible to split the income for tax purposes. If you received Foreign Pension Income please bring your annual pension statement or bank statements to verify the amount. Both spouses must sign a joint election form for Pension Splitting. Jeff’s Note: this does not mean that you should necessarily split the RRIF/pension income up to the maximum amount, or even equalize taxable income between each spouse. Basic Personal Exemptions: The 2015 Federal Basic Personal Exemption is $11,327 and the Ontario Basic Personal Exemption is $9,863. Age Amount: For seniors age 65 or older at Dec. 31, 2015, the maximum amount of this tax credit is increased to $7,033 federally and $4,815 for Ontario. Canada Employment Amount: The maximum claim has been increased to $1,146 (worth $171.90). Canada Child Tax Benefit (CCTB): If you are eligible to receive CCTB payments, you must notify the CRA of any change to your marital status by the end of the month following the month in which your status changes. However, in the case of marital separation, wait until the separation has been for more than 90 consecutive days. Separated/Divorced Parents: Each eligible parent in a shared custody situation will get half of the Canada Child Tax Benefit and credit payments for that child every month that they qualify. Split Investment Income for a Child under 18: A child under 18 may be subject to the tax on split income in respect of dividends on shares of a corporation. Any capital gain from the disposition of ______________________________________________________________________________________________________________ 662 Upper James Street, Hamilton, Ontario, L9C 2Z3 • Tel: 905-389-3534 • Email: service@abbington.ca ® 3 ___________________________________________________________________________________________________ those shares to a person who does not deal at arm’s length with the child (i.e. a relative) will be deemed to be a dividend. This deemed dividend is subject to the tax on split income and is considered to be an "otherthan-eligible" dividend for the purposes of the dividend tax credit. Therefore, if a parent is using an informal trust to invest for a child's future, redeeming the investment before the child is age 18 will cause tax to be payable by the parent. Medical Expenses: Your family's combined medical expenses must be greater than 3% of Net Income or $2,208 (whichever is less) in order to claim. Almost any payment made to, or prescribed by, a medical practitioner may qualify as a medical expense. These include payments for eyeglasses, prescriptions, dental, orthodontics, mobility aids, premiums paid to private health and dental service plans (including travel medical insurance), attendant care, long-term care in a nursing home, and many more. Eligible receipts are required. You may claim the most expensive 365 day period ending in the tax year (we’ll determine this). Allowable amount of Medical Expenses for other Dependants: Other Dependants may include adult children, financially dependent parents living in Canada, or any other family member for whom the tax filer provides ongoing financial support and care giving. Are you Self-Employed, a Landlord, or allowed to claim Employment Expenses?: If you have income from a business, profession, or rental property, or if you are allowed under contract to deduct employment expenses from your income, then please email or phone us now so that we may email, fax or mail to you some worksheets to help you get ready for your appointment. Note: to be able to claim employment expenses your employer must provide you a completed T2200 - Declaration of Conditions of Employment. Get Certain Receipts Online: Some types of tax receipts must be retrieved online. These may include receipts for 1) tuition slips (T2202A) from a university or college, 2) medical expenses for amounts not reimbursed by insurance companies, and 3) fees paid to an Ontario college or provincial association (for example if you are a nurse, teacher or engineer). T5013 - Statement of Partnership Income: These tax slips are frequently issued after April 15th. As soon as you have all your other tax slips please phone for an appointment to start the preparation of your tax return. We can later add the T5013 slip(s) during a second appointment (and avoid the last minute rush or a late filing penalty). Investment Capital Gains (or Losses): If you Disability Amount: Please tell us if you or a family member (including at a different residence in Canada) are markedly restricted in one of the basic activities of daily living: speaking, hearing, walking, dressing, feeding, elimination (bowel or bladder), or mental functions necessary for everyday life. First Time Home Buyers Amount: You may qualify for this credit if you or your spouse (or commonlaw partner) acquired a qualifying home and if you did not live in another home owned by you or your spouse (or common-law partner) in the year of acquisition or in any of the four preceding years. To Executors of Wills: If you are the Executor of a deceased person's Will, or if you know someone who is, then please phone or email us to request our special "Guide for Executors". held mutual funds, stocks, or bonds in a non-registered (open) account and sold the investment you may have a capital gain (or loss). To claim it, we will need the capital gain (or loss) shown on your account statement. Otherwise, we need the full transaction history for the investment holding. A capital loss can be used only to offset capital gains first in the current tax year, then carried-back to any of the prior three years, then carried forward indefinitely. Donations of publicly listed flow-through shares: If this may apply to you please ask us. Keep More of Your Money ! Please share this information with your family, relatives and friends. Your business and loyalty are greatly appreciated. We look forward to seeing you soon. ______________________________________________________________________________________________________________ 662 Upper James Street, Hamilton, Ontario, L9C 2Z3 • Tel: 905-389-3534 • Email: service@abbington.ca