NAFTA 20 Years Later - Institute for International Economics

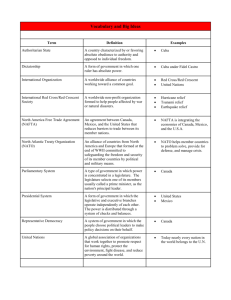

advertisement