our focus is on steady incremental returns from a

advertisement

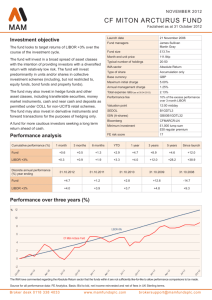

FUND IN FOCUS Miton CF Miton Total Return Fund Not for retail investors ‘Our focus is on steady incremental returns from a diversified approach’ Broker desk 0118 338 4033 www.mitongroup.com brokersupport@mitongroup.com FUND IN FOCUS CF Miton Total Return Fund Miton Fund highlights About the fund The CF Miton Total Return Fund aims for steady, incremental returns with a focus on low volatility. - The fund seeks long term returns ahead of cash -Ideally suited to investors looking for cash-style returns over a 3-5 year period Three year volatility comparison: - A fund with an absolute return focus aimed at the more cautious investor - The fund adopts a multi asset approach giving freedom to the fund manager to deliver the fund’s objective - Managed by experienced multi asset experts James Sullivan and Martin Gray since Q3 2008 Over three years (to end July 2013) the volatility of the fund is a low 2.76 compared to equities 12.54 (FTSE All Share), gilts 8.08 (FTSE British Government All Stocks) and corporate bonds 6.88 (iBoxx sterling non-gilts all maturities). The fund has delivered a positive return every year, apart from 2008, since launch. Launched in November 2006 the fund has been managed by proven multi asset managers James Sullivan and Martin Gray since Q3 2008. Broker desk 0118 338 4033 www.mitongroup.com “Our focus is on steady, consistent, incremental returns with low volatility, adhering to our benchmark at all times.” Fund Manager, James Sullivan brokersupport@mitongroup.com FUND IN FOCUS CF Miton Total Return Fund Miton Fund objective The fund aims to deliver total positive returns on an annual basis throughout all market conditions and cycles. The fund offers no element of capital preservation and no guarantee of a positive return. The fund will invest in a broad spread of asset classes with the intention of providing investors with a diversified return with relatively low risk. The fund will invest predominantly in units and/or shares in collective investment schemes (including, but not restricted to, equity funds, bond funds and property funds). The fund may also invest in hedge funds and other asset classes, including transferable securities, money market instruments, cash and near cash and deposits as permitted under COLL for non-UCITS retail schemes. The fund may also invest in derivative instruments and forward transactions for the purposes of hedging only. A fund for more cautious investors seeking a long term return ahead of cash. Key reasons to invest: • Alternative to cash based returns • Sound, low risk philosophy in a low interest rate environment • Focus on managing to a low volatility and defending downside risks • Has delivered a positive return in every calendar year, apart from one, since launch • Low correlation to traditional equity portfolios • Unconstrained mandates gives the manager freedom to pursue the investment objective • Managed by highly rated duo of James Sullivan and Martin Gray of CF Miton Special Situations Portfolio, CF Miton Strategic Portfolio and the Miton Global Diversified Income Fund Performance over three years 14.9% 11.8% Three year performance chart from month end 31.07.2010 to month end 31.07.2013 Source for all performance data: FE Analytics. Basis: Bid to bid, net income reinvested and net of fees in UK Sterling terms. Broker desk 0118 338 4033 www.mitongroup.com brokersupport@mitongroup.com FUND IN FOCUS CF Miton Total Return Fund Miton Performance analysis Cumulative performance (%) YTD 1 year 3 years 5 years Since launch Fund +4.7 +5.9 +14.9 +15.4 +18.0 LIBOR +3% +2.0 +3.6 +11.8 +23.1 +42.9 Discrete annual performance (%) 31.07.2013 31.07.2012 31.07.2011 31.07.2010 31.07.2009 Fund +5.9 +3.0 +5.4 +4.0 -3.4 LIBOR +3% +3.6 +4.0 +3.8 +3.7 +6.2 James Sullivan and Martin Gray have managed the fund since Q3 2008. Fund statistics over 3 years Annualised volatility (%) Annualised alpha (%) FE risk score 2.8 2.4 19 CF Miton Total Return Fund Annualised Volatility A measure which describes the fluctuation of a fund’s price over time. While volatility is specific to a fund’s particular mix of investments, higher volatility is generally considered to equate to higher risk. Annualised Alpha A measure of a fund’s performance by comparison to its sector representing the return of the fund when the sector is assumed to have a return of zero and indicates the extra value that the manager’s activities have contributed. FE risk score Measures the volatility of the fund relative to the FTSE 100 index, which has a risk rating of 100. Funds more volatile than the FTSE 100 have a score above 100 and vice versa. Source for all performance data: FE Analytics. Basis: Bid to bid, net income reinvested and net of fees in UK Sterling terms. Broker desk 0118 338 4033 www.mitongroup.com brokersupport@mitongroup.com FUND IN FOCUS CF Miton Total Return Fund Miton Asset allocation Cash 25.1% Global bonds 21.4% 18.6% ZDP* 15.6% Alternatives 11.7% Global equities 5.3% Property Market Neutral 2.3% *Zero Dividend Preference Shares. The fund invests across a broad spread of asset classes, with allocations decided on the basis of the conviction of managers James Sullivan and Martin Gray. Key facts Fund managers James Sullivan & Martin Gray (since Q3 2008) Launch date 21 November 2006 Fund size £13.0m No. of holdings 35 A Share class (Retail) B Share class (Institutional) N Share class (Retail) Minimum investment £1,000 lump sum £50 regular premium £100,000 lump sum £1,000 lump sum £50 regular premium Maximum initial charge 5.00% (currently fully discounted) 1.00% 5.00% (currently fully discounted) Annual management charge 1.25% 0.50% 0.75% Ongoing charges 1.96%* 1.21%* 1.46%** SEDOL B1GDTL3 B1GDTQ8 B846MV4 ISIN GB00B1GDTL32 GB00B1GDTQ86 GB00B846MV47 Bloomberg CFMARCR:LN CFMARCI:LN CFMARNA:LN IMA sector Absolute Return Type of share Accumulation only Base currency GBP Fund basis Non UCITS Retail Scheme (NURS) Capita dealing line 0845 606 6182 *Based on expenses as at 30.04.2013 **Estimated as at 30.04.2013 Source for all performance data: FE Analytics. Basis: Bid to bid, net income reinvested and net of fees in UK Sterling terms. Broker desk 0118 338 4033 www.mitongroup.com brokersupport@mitongroup.com FUND IN FOCUS CF Miton Total Return Fund Miton Investment philosophy & style Our philosophy is that we don’t believe in relative performance. We try to deliver the most attractive return possible in the most efficient risk-adjusted manner. The aim of the CF Miton Total Return Fund is not only to select investments from the best performing asset classes but to blend negatively correlated assets to produce smooth returns. When building a portfolio it is important to balance the level of risk to achieve the target rate of return whilst not exposing the investor to undue or unrewarded risk. The CF Miton Total Return Fund will seek to generate outperformance by actively managing the top down asset allocation process and then adding further value by the addition of carefully selected holdings within the selected asset classes. This fund is aimed at lower risk investors who would like a return slightly ahead of cash over the period of a full investment cycle. Macro Economics Macro Economics Cash Private equity Macro Economics Resources Bonds Miton Total Return Hedge Property Macro Economics Broker desk 0118 338 4033 Equities Macro Economics www.mitongroup.com Macro Economics brokersupport@mitongroup.com FUND IN FOCUS CF Miton Total Return Fund Miton Investment team James Sullivan Martin Gray James has worked in the finance industry since 1999 when he joined the investment team at the law firm Foot Anstey. The team then became the founder members of iimia plc in April 2002 when the law firm out sourced the investment operation. Rapid growth of the iimia business witnessed the merger with Miton Asset Management and Miton Capital Partners. James was subsequently appointed as co-manager to Martin Gray on the CF Miton Special Situations and CF Miton Strategic Portfolios and in May 2012 the Miton Global Diversified Income Fund. James is lead manager on the CF Miton Total Return Fund. Martin began his fund management career in 1979, he established the investment division of a UK authorised company in 1987, becoming a director in 1990. Martin joined Miton Group as a fund manager and director in 1994 and has been responsible for the management of the CF Miton Strategic Portfolio since launch in December 1996 and also the CF Miton Special Situations Portfolio which was launched a year later. Martin has won numerous fund management awards including the coveted asset allocator of the year award. Martin became a manager of the CF Miton Total Return Fund in August 2008 and the Miton Global Diversified Income Fund in May 2012. Available from The fund is available through some or all of the products of the above companies. Please contact the relevant distribution partner to confirm the basis on which deals can be made. Broker desk 0118 338 4033 www.mitongroup.com brokersupport@mitongroup.com FUND IN FOCUS CF Miton Total Return Fund Miton Business development team Neil Bridge, Head of Business Development T: 07850 740642 E: neil.bridge@mitongroup.com Jake Lewis, Business Development Manager T: 07912 271452 E: jake.lewis@mitongroup.com Ceri Morris, Business Development Manager T: 07831 750657 E: ceri.morris@mitongroup.com Broker support desk T: 0118 338 4033 E: brokersupport@mitongroup.com Important information Past performance should not be seen as an indication of future performance. The information in this document is as at 31.07.2013 and relates to the A share class unless otherwise stated. All performance figures have been sourced from FE Analytics. The value of investments and any income will fluctuate and investors may not get back the full amount invested. The views expressed are those of the fund manager at the time of writing and are subject to change without notice. They are not necessarily the views of Miton and do not constitute investment advice. Whilst Miton has used all reasonable efforts to ensure the accuracy of the information contained in this communication, we cannot guarantee the reliability, completeness or accuracy of the content. This document is provided for the purpose of information only. Before investing you should read the key investor information document as it contains important information regarding the fund, including charges, tax and fund specific risk warnings and will form the basis of any investment. Capita Financial Managers, from whom the prospectus, key investor information document and application forms are available, act as Authorised Corporate Director of the Fund (0845 606 6182) while Miton is the Investment Manager of the Fund (0118 338 4033). Miton is a trading name of Miton Asset Management Limited. Miton Asset Management Limited is authorised and regulated by the Financial Services Authority and is registered in England No. 1949322 with its registered office at 10-14 Duke Street, Reading, Berkshire, RG1 4RU. MFP13/316. Broker desk 0118 338 4033 www.mitongroup.com brokersupport@mitongroup.com