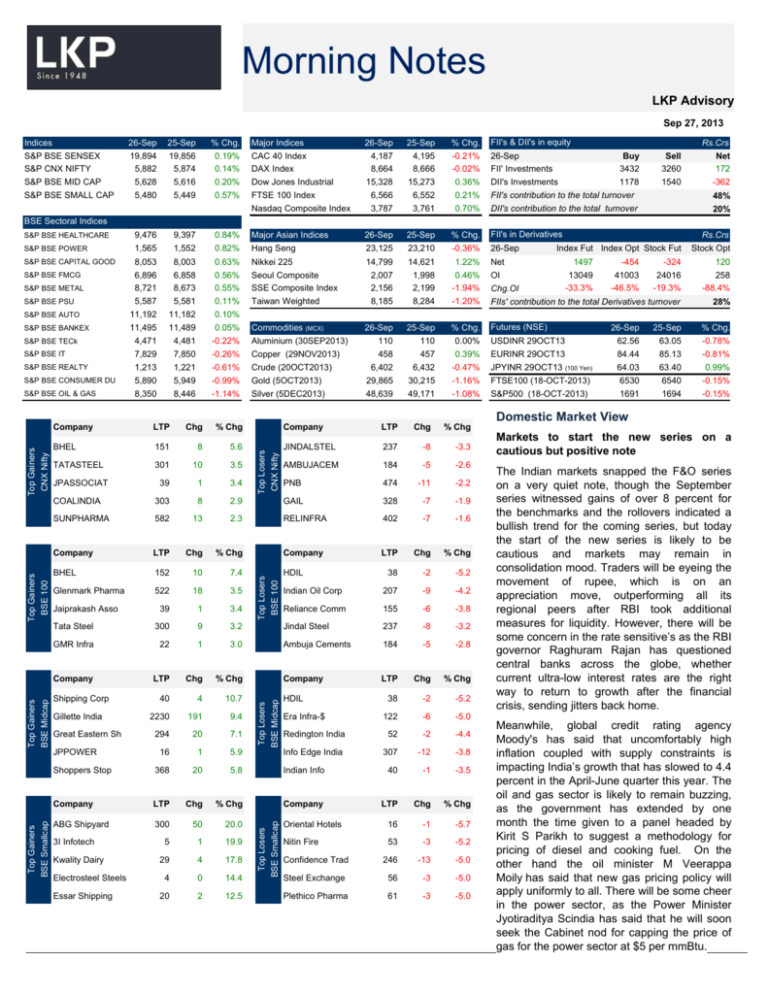

Morning Notes

advertisement

Morning Notes LKP Advisory Sep 27, 2013 Indices 26-Sep 25-Sep % Chg. Major Indices 26-Sep 25-Sep % Chg. FII's & DII's in equity S&P BSE SENSEX S&P CNX NIFTY 19,894 5,882 19,856 5,874 0.19% 0.14% CAC 40 Index DAX Index 4,187 8,664 4,195 8,666 -0.21% -0.02% 26-Sep FII' Investments Buy 3432 Sell 3260 Net 172 S&P BSE MID CAP 5,628 5,616 0.20% Dow Jones Industrial Ave 15,328 15,273 0.36% DII's Investments 1178 1540 -362 S&P BSE SMALL CAP 5,480 5,449 0.57% FTSE 100 Index Nasdaq Composite Index 6,566 3,787 6,552 3,761 0.21% 0.70% FII's contribution to the total turnover DII's contribution to the total turnover S&P BSE HEALTHCARE 9,476 9,397 0.84% Major Asian Indices 26-Sep 25-Sep % Chg. FII's in Derivatives S&P BSE POWER 1,565 1,552 0.82% Hang Seng 23,125 23,210 -0.36% 26-Sep S&P BSE CAPITAL GOOD 8,053 8,003 0.63% Nikkei 225 14,799 14,621 1.22% Net S&P BSE FMCG 6,896 8,721 6,858 8,673 0.56% 0.55% Seoul Composite SSE Composite Index (Sh 2,007 2,156 1,998 2,199 0.46% -1.94% OI Chg.OI 5,581 11,182 0.11% 0.10% Taiwan Weighted 8,185 8,284 -1.20% S&P BSE AUTO 5,587 11,192 S&P BSE BANKEX 11,495 11,489 0.05% 26-Sep 25-Sep % Chg. S&P BSE IT 4,471 7,829 4,481 7,850 -0.22% -0.26% Aluminium (30SEP2013) Copper (29NOV2013) 110 458 110 457 0.00% 0.39% S&P BSE REALTY 1,213 1,221 -0.61% Crude (20OCT2013) 6,402 6,432 S&P BSE CONSUMER DU 5,890 8,350 5,949 8,446 -0.99% -1.14% Gold (5OCT2013) Silver (5DEC2013) 29,865 48,639 30,215 49,171 Rs.Crs 48% 20% BSE Sectoral Indices S&P BSE METAL S&P BSE PSU S&P BSE TECk S&P BSE OIL & GAS Commodities (MCX) Rs.Crs Index Fut Index Opt Stock Fut Stock Opt 1497 -454 -324 120 13049 -33.3% 41003 -46.5% 24016 -19.3% 258 -88.4% FIIs' contribution to the total Derivatives turnover 28% Futures (NSE) 26-Sep 25-Sep % Chg. USDINR 29OCT13 EURINR 29OCT13 62.56 84.44 63.05 85.13 -0.78% -0.81% -0.47% JPYINR 29OCT13 (100 Yen) 64.03 63.40 0.99% -1.16% -1.08% FTSE100 (18-OCT-2013) S&P500 (18-OCT-2013) 6530 1691 6540 1694 -0.15% -0.15% Chg % Chg BHEL 151 8 5.6 TATASTEEL 301 10 3.5 JPASSOCIAT 39 1 3.4 COALINDIA 303 8 SUNPHARMA 582 Company Company LTP Chg % Chg JINDALSTEL 237 -8 -3.3 184 -5 -2.6 474 -11 -2.2 2.9 GAIL 328 -7 -1.9 13 2.3 RELINFRA 402 -7 -1.6 LTP Chg % Chg Company LTP Chg % Chg BHEL 152 10 7.4 38 -2 -5.2 Glenmark Pharma 522 18 3.5 39 1 3.4 Tata Steel 300 9 GMR Infra 22 Company Top Losers BSE 100 AMBUJACEM PNB HDIL 207 -9 -4.2 155 -6 -3.8 3.2 Jindal Steel 237 -8 -3.2 1 3.0 Ambuja Cements 184 -5 -2.8 LTP Chg % Chg Company LTP Chg % Chg 40 4 10.7 38 -2 -5.2 2230 191 9.4 294 20 7.1 16 1 Shoppers Stop 368 Company ABG Shipyard Shipping Corp Gillette India Great Eastern Sh 3I Infotech Kwality Dairy Electrosteel Steels Essar Shipping Top Losers BSE Midcap Indian Oil Corp Reliance Comm Jaiprakash Asso JPPOWER Top Gainers BSE Smallcap Top Losers CNX Nifty LTP HDIL 122 -6 -5.0 Redington India 52 -2 -4.4 5.9 Info Edge India 307 -12 -3.8 20 5.8 Indian Info 40 -1 -3.5 LTP Chg % Chg Company LTP Chg % Chg 300 50 20.0 Oriental Hotels 16 -1 -5.7 5 1 19.9 Nitin Fire 53 -3 -5.2 29 4 17.8 4 0 14.4 20 2 12.5 Top Losers BSE Smallcap Top Gainers BSE Midcap Top Gainers BSE 100 Top Gainers CNX Nifty Domestic Market View Company Era Infra-$ Confidence Trad 246 -13 -5.0 Steel Exchange 56 -3 -5.0 Plethico Pharma 61 -3 -5.0 Markets to start the new series on a cautious but positive note The Indian markets snapped the F&O series on a very quiet note, though the September series witnessed gains of over 8 percent for the benchmarks and the rollovers indicated a bullish trend for the coming series, but today the start of the new series is likely to be cautious and markets may remain in consolidation mood. Traders will be eyeing the movement of rupee, which is on an appreciation move, outperforming all its regional peers after RBI took additional measures for liquidity. However, there will be some concern in the rate sensitive’s as the RBI governor Raghuram Rajan has questioned central banks across the globe, whether current ultra-low interest rates are the right way to return to growth after the financial crisis, sending jitters back home. Meanwhile, global credit rating agency Moody's has said that uncomfortably high inflation coupled with supply constraints is impacting India’s growth that has slowed to 4.4 percent in the April-June quarter this year. The oil and gas sector is likely to remain buzzing, as the government has extended by one month the time given to a panel headed by Kirit S Parikh to suggest a methodology for pricing of diesel and cooking fuel. On the other hand the oil minister M Veerappa Moily has said that new gas pricing policy will apply uniformly to all. There will be some cheer in the power sector, as the Power Minister Jyotiraditya Scindia has said that he will soon seek the Cabinet nod for capping the price of gas for the power sector at $5 per mmBtu. LKP Advisory Domestic Market Overview September F&O expiry session ends on a quite note The September series futures and options contract expiry day turned out to be a lackluster session for the benchmark indices, as the session lacked the flavor of high volatility, which typically surfaces on F&O settlement day. During the session, the frontline equity indices traded in an extremely tight range hardly budging from the psychological 5,900 (Nifty) and 20,000 (Sensex) levels. Nevertheless, markets traded in the green terrain for most part of the day’s trade, as sentiments got some boost from Reserve Bank of India’s (RBI) assurance that it would provide liquidity to the market and can also undertake open market operations if required. RBI relaxed the minimum maturity tenure for banks’ foreign currency borrowings’ to one year from three years, in order to use the central bank's swap facility which was set up to support the ailing rupee. Sentiments also remained up-beat on report that indirect tax collections grew at 4.1 percent in the AprilAugust period of this fiscal total collection of indirect taxes stood at about Rs 1,67,000 crore during the first five months of the 2012-13 fiscal. Moreover, some support also came in from report that foreign institutional investors (FII) bought shares worth Rs 382 crore on September 25, 2013, while domestic institutional investors (DII) sold shares worth Rs 473 crore. Appreciation in Indian rupee too aided the sentiments; the partially convertible rupee was trading at 62.15 versus its previous close of 62.44/45. Some support also came in from buying in two-wheeler stocks on expectations of pick-up in sales during the upcoming festive season and on hopes of good rains this year which will boost rural sales. Sentiments also remained dampened as oil and gas sector declined over a percentage point led by Reliance Industries (RIL) despite Oil Minister M Veerappa Moily said that his ministry has not moved the Cabinet for appointing a consultant to study the reasons for falling gas output at the KG-D6 block operated by Reliance. Moreover, stocks related to consumer durables segment too declined after RBI banned zero percent interest rate scheme offered by the banks for purchase of consumer goods. Global Market Overview Most of Asian markets conclude Thursday’s trade in red Most of the Asian markets concluded Thursday’s trade in red as investors kept eye on controversial budget negotiations going in Washington. China’s Shanghai Composite fell as investors reduced exposure ahead of the long Golden Week holiday starting Tuesday. US markets rose on drop in jobless claims The US markets rose on Thursday, with the S&P 500 rebounding from its longest losing streak this year, as a larger-than-expected drop in jobless claims mostly overrode worries about a budget standoff on Capitol Hill. The Labor Department stated that the number of new applications for unemployment benefits fell by 5,000 to 305,000 in the week ended September 21. The average of new claims over the past month, which is a more reliable gauge than the volatile weekly number dropped by 7,000 and stood at 308,000. That’s the lowest level since June 2007. The US economy grew an unrevised 2.5% in the second quarter, according to the government’s third and final review of gross domestic product. While, the Commerce Department reported that companies restocked warehouse shelves less than previously reported, but state and local spending actually rose instead of falling. Exports also grew somewhat slower, at 8% compared to a prior reading of 8.6%. However, sales contracts on homes fell 1.6% in August -- a third month of declines -- led by drops in three of four US regions, data released by the National Association of Realtors showed. The Dow Jones Industrial Average added 55.04 points or 0.36 percent to 15,328.30, the S&P 500 gained 5.90 points or 0.35 percent to 1,698.67, while the Nasdaq was up 26.33 points or 0.70 percent to 3,787.43. LKP Advisory Corporate News ¾ Polaris Financial Technology, a leader in products, solutions and services that enable unprecedented operational productivity for the global Financial Services industry has been selected by Nationwide Financial to implement Polaris' Intellect Claims solution. Nationwide Financial has chosen to deploy Polaris' Intellect Claims solution comprising a Claims workstation, service portal, and an integrated beneficiary management system. ¾ Nucleus Software Exports, a leading provider of software products and solutions for the banks and financial services industry has launched FinnOne Mobility Solutions. This new software is available on mobile to add enhanced value to the banking and financial services industry. Delivering a combination of functionally rich, highly flexible, secure and scalable mobile banking solutions, the FinnOne Mobility product suite is compatible on mobile platforms including Android, Blackberry (RIM), Symbian, and Windows and can also work on low-end mobiles and tablets. ¾ Solix Technologies, Inc. an affliate to TechNVision Ventures and a leading provider of Enterprise Data Management (EDM) solutions, has unveiled Solix EDMS ILM Partitioning. Database partitioning improves application performance and reduces storage costs. By partitioning within an ILM framework, application performance improvements and storage cost savings may be realized within compliance and data management policy frameworks. ¾ Petron Engineering Construction has received advice of contract from Bharat Petroleum Corporation, (BPCL) Ernakulam, Dist. Kerala for Heater Package for VGO-HDT Unit for Integrated Refinery Expansion Project of its Kochi Refinery for an approximately contract value of Rs 55.00 corer. ¾ In a bid to strengthen its footprint in the domestic liquor market, Som Distilleries and Breweries is planning for two strategic acquisitions this year. Of the two strategic acquisitions, one will be a contract liquor manufacturing firm based out of Chhattisgarh, while the other will be a Tamil Nadu-based liquor firm. ¾ Mindtree, a global IT solutions company, has again been selected as a leader in the product engineering services space by Zinnov, a leading globalization and market expansion advisory firm, in its recently released report, 'Global Service Provider Ratings- 2013.' In the overall rankings, Mindtree is placed in the top leadership quartile for its services arid capabilities. Mindtree's expertise is highlighted in multiple sub-verticals including automotive, consumer electronics, semiconductor, enterprise software, computer peripherals and storage. ¾ Riga Sugar Company is planning to increase its bagasse-based co-generation capacity by 3 MW at its sugar mill in Bihar to 11MW from 8 MW at present. This will improve the company’s profitability through sale of excess power to the state electricity distribution utility. The company is expecting to garner Rs 2.5-3 crore through sale of around 3 MW excess power. ¾ The Insurance Regulatory and Development Authority (IRDA) has imposed a fine of Rs 5 lakh on Punjab & Sind Bank, a corporate agent of Aviva Life Insurance, for receiving higher commission. The regulator has asked the bank to pay the penalty within 15 days. ¾ Larsen & Toubro’s (L&T) subsidiary -- L&T Construction -- has bagged new orders worth Rs 2,683 crore during September 2013 across various business segments in the domestic and international markets. ¾ Bombay Rayon Fashions has received an approval for signing the documents, agreements pertaining to Corporate Debt Restructuring (CDR). The board of director at its meeting held on September 25, 2013 has approved for the same. ¾ Foreign fund house Credit Suisse has reportedly sold 2.14% of its stake in Gitanjali Gems for an estimated Rs 11.87 crore. Credit Suisse has sold 19.75 lakh shares of Gitanjali Gems at an average price of Rs 60.10 to Venus Capital Management. ¾ Havells India has unveiled its monoblock pumps which will fulfill water related needs of domestic and commercial establishments in the country. The company is targeting to garner Rs 100 crore this year with sale of these pumps. ¾ Tata Communications, a leading provider of A New World of Communications, has successfully showcased the next generation of capability for video distribution by relaying content from the 2013 Formula 1 Singtel Singapore Grand Prix directly to Formula One Management's Biggin Hill headquarters in the UK. The live video feed was sent using Tata Communications' Video Connect service on its LKP Advisory wholly-owned fibre network in what was Tata Communications' first live video contribution demonstration for Formula One Management and a group of leading broadcasters. ¾ Mphasis, a leading IT services provider, has unveiled Mphasis Upgrade and Transformation Services (MUSTS), a proprietary solution for upgrading to the latest versions of the Oracle E-Business Suite and Oracle’s PeopleSoft. This solution is designed to enable organizations to optimize the cycle time for upgrade, MUSTS is easy to deploy, provides cost-effective assessment and capitalizes on Mphasis’ best practices to ensure a virtually seamless implementation without compromising user experience. With Mphasis MUSTS, organizations can easily migrate from Oracle applications including the Oracle E-Business Suite 11i to the Oracle E-Business Suite 12.1 and Oracle’s PeopleSoft 8.0 to PeopleSoft 9.1. ¾ Mahindra and Mahindra (M&M), country’s major automobile maker’s business conglomerate Mahindra Reva has entered into a strategic partnership with the leaders in Cab Rental Industry, Carzonrent to launch first-of-its kind electric vehicle in the self-drive category in India. ¾ Maruti Suzuki is planning to increase prices across its entire range of models by up to Rs 10,000 per unit from the next month on account of rising input costs due to due to rupee depreciation. The price hike will be effective from the first week of October and the quantum of price increase will vary according to different models and fuel specifications. ¾ Jindal Steel and Power (JSPL) is planning to set up a 7 million tonnes per annum (mtpa) pellet plant at Angul in Odisha. In this regard, the company will invest around Rs 1,400 crore and it already has clearance from the state government to put up the plant. ¾ Shriram EPC (SEPC) has bagged orders worth Rs 389 crore from Tamil Nadu and Rajasthan in the municipal service vertical. Of total, the company has received order worth Rs 164 crore from Tamil Nadu Water Supply and Drainage Board, Madurai for construction of water treatment plant, infiltration wells, sumps, service reservoirs and pumps room, while it won two orders worth Rs 86 crore from Chennai Metropolitan Water Supply and Sewerage Board. ¾ In a bid to meet Securities and Exchange Board of India’s (SEBI) minimum public shareholding (MPS) norms, Oberoi Realty’s promoters are eying to dilute their stake through offer for sale (OFS) route. ¾ Kellton Tech Solutions is contemplating to invest in Kellton Tech, Inc., which is going to be 100% subsidiary company, after investment. The subsidiary company is incorporated in Deleware, USA and will be a holding company for further outbound US investments. ¾ Aurionpro Sena, a division of Aurionpro Solutions, has released its configurable and extensible BPM/BPEL(Business process management/Business Process Execution Language) workflow and routing tool that facilitates rapid implementation for businesses requiring image processing. Specifically designed to integrate with Oracle applications via an AXF framework, it supports strategic alignment by marrying implementation capabilities with overall organization goals. ¾ The Great Eastern Shipping Company (GE Shipping) has taken delivery of a 2005 built Medium Range (MR) product carrier ‘Jag Pranav’ of about 51,300 dwt. Following the induction of ‘Jag Pranav’, the company’s current fleet stands at 30 vessels, comprising 22 tankers (8 crude carriers, 13 product carriers, 1 LPG carrier) and 8 dry bulk carriers (1 Capesize, 3 Kamsarmax, 4 Supramax) with an average age of 9.0 years aggregating 2.42 mn dwt. ¾ Binny has received an approval for sale of entire holding of equity shares of Binny Engineering held by the company to The Thirumagal Mills for a consideration of Rs 3.44 crore. The board of director at its meeting held on September 25, 2013 has approved for the same. Economy ¾ CCEA approves Rs 3,001 crore road projects under NHDP programme In a move to develop the country’s infrastructure sector, the Cabinet Committee on Economic Affairs (CCEA) has approved two highways projects under its flagship road building programme National Highways Development Project (NHDP), entailing a total expenditure of Rs 3,001 crore. These two highway projects include four laning of Solapur- Yedeshi (Maharashtra) section of NH 211 and 6/8 laning of JNPT Port road project of Mumbai and will expedite infrastructure improvement in the state. LKP Advisory It is reported that the cost of the 99 km long Solapur- Yedeshi project is around Rs 1,057.82 crore, while, Jawahar Lal Nehru Port Trust (JNPT) Port road project cost is estimated to be around Rs 1943.37 crore including the cost of land acquisition, resettlement and rehabilitation and other pre-construction activities. The total length of JNPT Port road project will be approximately 43.912 kms of which 20.95 km will be of 6-laning and 22.962 kms will be of 8-laning. Further, JNPT project corridor highway includes NH-4B and NH-348, which connects the JNPT with the proposed Navi Mumbai International Airport in Maharashtra. ¾ RBI bans zero percent interest rate scheme for buying consumer goods The Reserve Bank of India (RBI) banned zero percent interest rate scheme offered by the banks for purchase of consumer goods, citing that such schemes is non-existent and only serve the purpose of alluring and exploiting the vulnerable customers. Under zero percent interest EMI schemes offered on credit card, the interest element is often camouflaged and passed on to the customer in the form of processing fee. As per the central bank regulations, banks should not resort to any practice that would distort the interest rate structure of a product as this violate the transparency in pricing mechanism which is very important for the customer to take informed decision. The RBI notified that zero percent interest is non-existent and such schemes only misguided the vulnerable customers. Fair practice demands that the processing charge and interest charged should be kept uniform product or segment wise, irrespective of the sourcing channel, it added. ¾ RBI plans more measures to ease liquidity condition In order to ease tight liquidity situation ahead of the festival season, the Reserve Bank of India (RBI) plans to take measures such as bond purchases to support the flow of credit to productive sectors of the economy. Currently, central bank injects about Rs 1.5 lakh crore into the system daily through the liquidity adjustment facility (LAF), marginal standing facility (MSF) and the export credit refinance facility. Inorder to restore adequate supply of money for credit flows, central bank has started a calibrated unwinding of exceptional steps taken since July. The RBI, has lowered the minimum maturity period for banks from three years to one year for the borrowings made on or before November 30, 2013 for the purpose of availing of the swap facility. However, foreign currency borrowing by banks beyond 50 percent of their tier I capital shall be of a minimum maturity of three years. The RBI said that present liquidity tightening condition in the market is mainly due to the prospective effects of banks' half-yearly account closure, seasonal pick-up in credit demand, festival-related demand for currency and sluggish deposit growth. Liquidity has also tightened due to uncertainties about the government's borrowing programme for the second half of 2013-14. The government has revealed that it would borrow Rs 2.35 lakh crore from the market in the second half of the current fiscal of the total Rs 5.79 lakh crore projected in the Budget. The government borrowing stood at Rs 3.44 lakh crore in the first half of FY14. ¾ Govt expects to resolve iron ore mining issue soon The government expects to resolve the iron ore mining issue within two months. Mines Minister Dinsha Patel has said that the government planning to export more iron ore, while consultation for filing a review petition on iron ore mining issue in the Supreme Court is going on. Through this petition, the government will urge the court to lift ban on iron ore mining in Goa. In order to boost the iron ore exports, the government is also planning to lower export duty on iron ore to 20 percent from the present 30 percent. The move will help to contain country’s high current account deficit (CAD), which widened to record high of 4.8 percent of GDP in the previous fiscal. Further, the government is likely to bring a note before the Cabinet Committee on Economic Affairs (CCEA) soon, for residual stake sale in Hindustan Zinc and Balco in order to meet its disinvestment target of Rs 54,000 crore for the current fiscal. The government already reported that all legal hurdles for residual stake sale in Hindustan Zinc and Balco have been cleared. At present, the government holds 29.5 percent stake in Hindustan Zinc and 49 percent stake in BALCO. The government had sold controlling stake in these two companies in 2001-2003. LKP Advisory ¾ TRAI recommends mobile number portability across the country within six months Going a step further to the telecom revolution, the Telecom Regulatory Authority of India (TRAI) has recommended implementation of mobile number portability across the country within six months. The government had allowed mobile number portability (MNP) within the same circle in January 2011 and presently MNP is available within the same service area only, but once the new directive comes into effect, this will allow users to retain their mobile numbers even when they shift their service area. Earlier this year in February, TRAI sought comments from stakeholders on the method that should be adopted and amendments required in the existing licence conditions of the MNP service licence, issues relating to processing of porting request, routing and charging of calls, method for implementing inter-service area porting, among various other matters. After analysis of the inputs received, extensive deliberations with the Telecom Service Providers (TSPs) and internal analysis, TRAI has finalised a method for processing cross-circle porting requests after holding consultations with the industry. Accordingly, a carrier that receives a porting request from a circle, for instance, Delhi, forwards it to the MNP provider that oversees this circle. Future porting requests of this number that may be within a circle or to another circle will be handled by the same MNP provider. http://www.lkpsec.com/news/corporate-news.aspx Source: Reuters, Ace Equity & LKP Research The information in this documents has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true and is for general guidance only. While every effort is made to ensure the accuracy and completeness of information contained, the company makes no guarantee and assumes no liability for any errors or omissions of the information. No one can use the information as the basis for any claim, demand or cause of action. LKP Securities Ltd., and affiliates, including the analyst who have issued this report, may, on the date of this report, and from time to time, have long or short positions in, and buy or sell the securities of the companies mentioned herein or engage in any other transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest with respect to companies mentioned herein or inconsistent with any recommendation and related information and opinions. LKP Securities Ltd., and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. LKP Securities Ltd. Ph: (91-22) 66351234 FAX: (91-22) 66351249 E Mail: lkpadvisory@lkpsec.com web: http://www.lkpsec.com