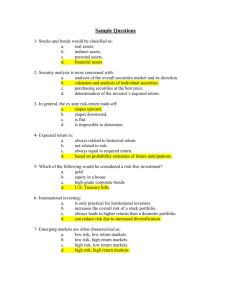

FINANCIAL MARKETS AND INSTITUTIONS

advertisement