2011 Transcendance Investors (K-1)

advertisement

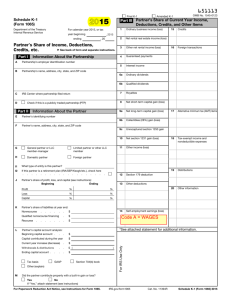

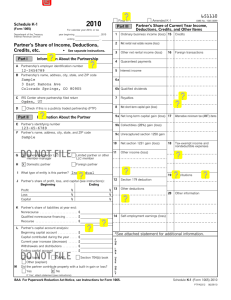

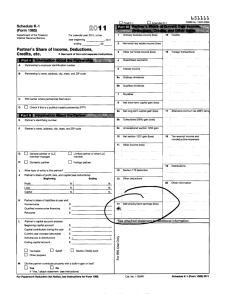

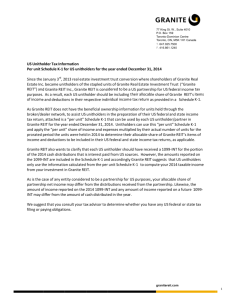

2 651111 Schedule K-1 (Form 1065) 2011 For calendar year 2011, or tax Department of the Treasury Internal Revenue Service Final K-1 year beginning 1 Ordinary business income (loss) ending 13,134. Partner's Share of Income, Deductions, | See separate instructions. Credits, etc. Part I Amended K-1 OMB No. 1545-0099 Part III Partner's Share of Current Year Income, Deductions, Credits, and Other Items 2 15 Credits Net rental real estate income (loss) -11,350. 16 Foreign transactions 3 Other net rental income (loss) Information About the Partnership A Partnership's employer identification number 4 Guaranteed payments B Partnership's name, address, city, state, and ZIP code 5 Interest income 20-5800820 ASCENDANCE MANAGER I LLC 200 WEST MADISON STREET SUITE 3200 CHICAGO, IL 60606 185. 6a Ordinary dividends 17 Alternative min tax (AMT) items 6b Qualified dividends A -496. C IRS Center where partnership filed return CINCINNATI, OH 7 Royalties D 8 Net short-term capital gain (loss) 18 Tax-exempt income and Check if this is a publicly traded partnership (PTP) Part II 9a Net long-term capital gain (loss) Information About the Partner E Partner's identifying number 9b Collectibles (28%) gain (loss) F Partner's name, address, city, state, and ZIP code 9c Unrecaptured sec 1250 gain 26-0328292 10 Net section 1231 gain (loss) A V* 185. 8,659. 11 Other income (loss) member Foreign partner PARTNERSHIP $ $ $ $( $ 12 Section 179 deduction 13 Other deductions Ending 38.8900000% 38.8900000% 38.8900000% 14 Self-employment earnings (loss) 47,272. 831,747. 0. 476,108. 236,578. 1,969. ) 714,655. *See attached statement for additional information. For IRS Use Only J Partner's share of profit, loss, and capital: Beginning 38.8900000% Profit 38.8900000% Loss 38.8900000% Capital K Partner's share of liabilities at year end: Nonrecourse ~~~~~~~~~~~~~~~~ $ Qualified nonrecourse financing ~~~~~~~~ $ Recourse ~~~~~~~~~~~~~~~~~~ $ L Partner's capital account analysis: Beginning capital account ~~~~~~~~~~ Capital contributed during the year ~~~~~~ Current year increase (decrease) ~~~~~~~~ Withdrawals & distributions ~~~~~~~~~~ Ending capital account ~~~~~~~~~~~~ 19 Distributions 20 Other information TRANSCENDANCE INVESTORS LLC 200 W MADISON STREET SUITE 3200 CHICAGO, IL 60606 X Limited partner or other LLC G General partner or LLC member-manager H X Domestic partner I What type of entity is this partner? nondeductible expenses X Tax basis GAAP Section 704(b) book Other (explain) M Did the partner contribute property with a built-in gain or loss? X No Yes If "Yes", attach statement (see instructions) 111261 11-04-11 LHA For Paperwork Reduction Act Notice, see Instructions for Form 1065. Schedule K-1 (Form 1065) 2011 2 ASCENDANCE MANAGER I LLC 20-5800820 }}}}}}}}}}}}}}}}}}}}}}}} }}}}}}}}}} ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ SCHEDULE K-1 UNRELATED BUSINESS TAXABLE INCOME, BOX 20, CODE V }}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}} DESCRIPTION }}}}}}}}}}} UNRELATED TAXABLE BUSINESS INCOME - PASSTHROUGH PARTNER FILING INSTRUCTIONS }}}}}}}}}}}}}}}}}}}}}}}}}}} SEE IRS SCH. K-1 INSTRUCTIONS TOTAL TO SCHEDULE K-1, BOX 20, CODE V AMOUNT }}}}}}}}}}}}}} 8,659. }}}}}}}}}}}}}} 8,659. ~~~~~~~~~~~~~~ ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ SCHEDULE K-1 FOOTNOTES }}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}} THE EXCEPTION FOR DEBT-FINANCED UBIT FOR QUALIFIED ORGANIZATIONS UNDER SEC. 514 (C)(9) APPLIES TO THE UBIT PRESENTED ON LINE 20V OF YOUR K-1. PLEASE CONSULT YOUR TAX ADVISOR. PARTNER NUMBER 2 2 Page Schedule K-1 (Form 1065) 2011 This list identifies the codes used on Schedule K-1 for all partners and provides summarized reporting information for partners who file Form 1040. For detailed reporting and filing information, see the separate Partner's Instructions for Schedule K-1 and the instructions for your income tax return. Code 1. Ordinary business income (loss). Determine whether the income (loss) is passive or nonpassive and enter on your return as follows. J K L Work opportunity credit Disabled access credit Empowerment zone and renewal community employment credit M Credit for increasing research activities N Credit for employer social security and Medicare taxes O Backup withholding P Other credits Report on 4. 5. 6a. 6b. 7. 8. 9a. 9b. Passive loss Passive income Nonpassive loss Nonpassive income Net rental real estate income (loss) Other net rental income (loss) Net income Net loss Guaranteed payments Interest income Ordinary dividends Qualified dividends Royalties Net short-term capital gain (loss) Net long-term capital gain (loss) Collectibles (28%) gain (loss) 9c. 10. 11. Unrecaptured section 1250 gain Net section 1231 gain (loss) Other income (loss) 2. 3. See the Partner's Instructions Schedule E, line 28, column (g) Schedule E, line 28, column (h) Schedule E, line 28, column (j) See the Partner's Instructions Schedule E, line 28, column (g) See the Partner's Instructions Schedule E, line 28, column (j) Form 1040, line 8a Form 1040, line 9a Form 1040, line 9b Schedule E, line 3b Schedule D, line 5 Schedule D, line 12 28% Rate Gain Worksheet, line 4 (Schedule D Instructions) See the Partner's Instructions See the Partner's Instructions Code A Other portfolio income (loss) B Involuntary conversions C Sec. 1256 contracts & straddles D Mining exploration costs recapture E Cancellation of debt F Other income (loss) See the Partner's Instructions See the Partner's Instructions Form 6781, line 1 See Pub. 535 Form 1040, line 21 or Form 982 See the Partner's Instructions 12. Section 179 deduction See the Partner's Instructions 13. Other deductions A Cash contributions (50%) B Cash contributions (30%) C Noncash contributions (50%) D Noncash contributions (30%) E Capital gain property to a 50% organization (30%) F Capital gain property (20%) G Contributions (100%) H Investment interest expense I Deductions - royalty income J Section 59(e)(2) expenditures K Deductions - portfolio (2% floor) L Deductions - portfolio (other) M Amounts paid for medical insurance N Educational assistance benefits O Dependent care benefits P Preproductive period expenses Q Commercial revitalization deduction from rental real estate activities R Pensions and IRAs S Reforestation expense deduction T Domestic production activities information U Qualified production activities income V Employer's Form W-2 wages W Other deductions 14. p n m n o Form 4952, line 1 Schedule E, line 19 See the Partner's Instructions Schedule A, line 23 Schedule A, line 28 Schedule A, line 1 or Form 1040, line 29 See the Partner's Instructions Form 2441, line 12 See the Partner's Instructions See Form 8582 Instructions See the Partner's Instructions See the Partner's Instructions See Form 8903 Instructions Form 8903, line 7b Form 8903, line 17 See the Partner's Instructions Note. If you have a section 179 deduction or any partner-level deductions, see the Partner's Instructions before completing Schedule SE. B C 15. Net earnings (loss) from self-employment Gross farming or fishing income Gross non-farm income Credits A B C D E F G H I 111262 11-04-11 Low-income housing credit (section 42(j)(5)) from pre-2008 buildings Low-income housing credit (other) from pre-2008 buildings Low-income housing credit (section 42(j)(5)) from post-2007 buildings Low-income housing credit (other) from post-2007 buildings Qualified rehabilitation expenditures (rental real estate) Other rental real estate credits Other rental credits Undistributed capital gains credit Alcohol and cellulosic biofuel fuels credit Foreign transactions A Name of country or U.S. possession B Gross income from all sources C Gross income sourced at partner level Foreign gross income sourced at partnership level D Passive category E General category F Other Schedule SE, Section A or B See the Partner's Instructions See the Partner's Instructions p n n n n n m n n n n o See the Partner's Instructions Form 1040, line 71; check box a See the Partner's Instructions See the Partner's Instructions Form 1040, line 62 See the Partner's Instructions p m o p m o Form 1116, Part I Form 1116, Part I Deductions allocated and apportioned at partner level G Interest expense Form 1116, Part I H Other Form 1116, Part I p m o Deductions allocated and apportioned at partnership level to foreign source income I Passive category Form 1116, Part I J General category K Other Other information L Total foreign taxes paid M Total foreign taxes accrued N Reduction in taxes available for credit O Foreign trading gross receipts P Extraterritorial income exclusion Q Other foreign transactions See the Partner's Instructions Self-employment earnings (loss) A 16. p n m n o Report on 17. Alternative minimum tax (AMT) items A Post-1986 depreciation adjustment B Adjusted gain or loss C Depletion (other than oil & gas) D Oil, gas, & geothermal - gross income E Oil, gas, & geothermal - deductions F Other AMT items 18. Tax-exempt income and nondeductible expenses A Tax-exempt interest income B Other tax-exempt income C Nondeductible expenses 19. Distributions A Cash and marketable securities B Distribution subject to section 737 C Other property 20. Other information A Investment income B Investment expenses C Fuel tax credit information D Qualified rehabilitation expenditures (other than rental real estate) E Basis of energy property F Recapture of low-income housing credit (section 42(j)(5)) G Recapture of low-income housing credit (other) H Recapture of investment credit I Recapture of other credits J Look-back interest - completed long-term contracts K Look-back interest - income forecast method L Dispositions of property with section 179 deductions M Recapture of section 179 deduction N Interest expense for corporate partners O Section 453(l)(3) information P Section 453A(c) information Q Section 1260(b) information R Interest allocable to production expenditures S CCF nonqualified withdrawals T Depletion information - oil and gas U Amortization of reforestation costs V Unrelated business taxable income W Precontribution gain (loss) X Section 108(i) information Y Other information Form 1116, Part II Form 1116, Part II Form 1116, line 12 Form 8873 Form 8873 See the Partner's Instructions p n m n o See the Partner's Instructions and the Instructions for Form 6251 Form 1040, line 8b See the Partner's Instructions See the Partner's Instructions p m o See the Partner's Instructions Form 4952, line 4a Form 4952, line 5 Form 4136 See the Partner's Instructions See the Partner's Instructions Form 8611, line 8 Form 8611, line 8 See Form 4255 See the Partner's Instructions See Form 8697 p n n n n n m n n n n o See Form 8866 See the Partner's Instructions 2 2 Illinois Department of Revenue Schedule K-1-P To be completed by partnerships filing Form IL-1065 or S corporations filing Form IL-1120-ST Partners and Shareholders receiving Schedule K-1-P should attach this to their Illinois tax return. Step 1: Year ending 12 11 Partner's or Shareholder's Share of Income, Deductions, Credits, and Recapture Month Year IL Attachment No. 10 Identify your partnership or S corporation 1 Check your business type X partnership S corporation 3 20-5800820 Write your federal employer identification number (FEIN). 2 ASCENDANCE MANAGER I LLC 4 Write your name as shown on your Form IL-1065 or Form IL-1120-ST. Step 2: 5 IL-1120-ST, Line 42. Otherwise, write "1." TRANSCENDANCE INVESTORS LLC 7 26-0328292 Social Security number or FEIN 200 W MADISON STREET SUITE 3200 8 Mailing address 38.8900000 Share (%) CHICAGO, IL 60606 City Step 3: State ZIP 9 Check the appropriate box individual X partnership corporation S corporation trust estate Figure your partner's or shareholder's share of your nonbusiness income A Member's share (See instructions.) 10 11 12 13 14 15 16 17 18 19 1.000000 Identify your partner or shareholder Name 6 Write the apportionment factor from Form IL-1065 or Form Interest Dividends Rental income Patent royalties Copyright royalties Other royalty income Capital gain or loss from real property Capital gain or loss from tangible personal property Capital gain or loss from intangible personal property Other income and expense B Member's share allocable to Illinois 10 11 12 13 14 15 16 17 18 19 Specify Step 4: Figure your partner's or shareholder's share of your business income (loss) A Member's share from U.S. Schedule K-1, less nonbusiness income 20 21 22 23 24 25 26 27 28 29 30 31 Ordinary income (loss) from trade or business activity Net income (loss) from rental real estate activities Net income (loss) from other rental activities Interest Dividends Royalties Net short-term capital gain (loss) Net long-term capital gain (loss). Total for year. Unrecaptured Section 1250 gain Guaranteed payments to partner (U.S. Form 1065 only) Net Section 1231 gain (loss) (other than casualty or theft). Total for year. Other income and expense 20 21 22 23 24 25 26 27 28 29 30 31 B Member's share apportioned to Illinois 13,134. -11,350. 13,134. -11,350. 185. 185. Specify Schedule K-1-P page 1 (R-12/11) ID: 2BX 149131 12-27-11 This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide this information could result in a penalty. 2 Write the partner's or shareholder's identification number from Line 7. Step 5: 32 33 34 35 36 37 Figure your partner's or shareholder's share of Illinois additions and subtractions A Additions Federally tax-exempt interest income Illinois replacement tax deducted Illinois Special Depreciation addition Related-Party Expenses addition Distributive share of additions Other additions (from Illinois Schedule M for businesses) Subtractions 38 a Interest from U.S. Treasury obligations (business income) b Interest from U.S. Treasury obligations (nonbusiness income) 39 a Enterprise Zone Dividend Subtraction b River Edge Redevelopment Zone Dividend Subtraction 40 High Impact Business Dividend subtraction 41 Contribution subtraction (Form IL-1120-ST filers only) 42 Form IL-1120-ST financial organizations only: a Enterprise Zone Interest Subtraction b River Edge Redevelopment Zone Interest Subtraction 43 Interest subtraction - High Impact Business within a Foreign Trade Zone (Form IL-1120-ST financial organizations only) 44 Illinois Special Depreciation subtraction 45 Related-Party Expenses subtraction 46 Distributive share of subtractions 47 Other subtractions (from Illinois Schedule M for businesses) Step 6: B Member's share from Form IL-1065 or IL-1120-ST Member's share apportioned or allocated to Illinois 32 33 34 35 36 37 38a 38b 39a 39b 40 41 42a 42b 43 44 45 46 47 3,996. 3,996. Figure your partner's or shareholder's (except a corporate partner or shareholder) A share of your Illinois August 1, 1969, appreciation amounts Member's share from Illinois Schedule F (Form IL-1065 or IL-1120-ST) 48 49 50 51 Section 1245 and 1250 gain Section 1231 gain Section 1231 gain less casualty and theft gain. See instructions. Capital gain Step 7: 52 a b c d e f g h i j k B Member's share apportioned or allocated to Illinois 48 49 50 51 Figure your partner's or shareholder's share of your Illinois credits, recapture, and pass-through entity payments Illinois credits Film Production Services Tax Credit Enterprise Zone Investment Credit River Edge Redevelopment Zone Investment Credit Tax Credit for Affordable Housing Donations EDGE Tax Credit Research and Development Credit Ex-felons Jobs Credit Veterans Jobs Credit Student-Assistance Contribution Credit Angel Investment Tax Credit New Markets Credit Member's or nonresident member's share from Illinois tax return 52a 52b 52c 52d 52e 52f 52g 52h 52i 52j 52k 52 Illinois credits (cont.) l River Edge Historic Preservation Credit m Live Theater Production Credit n Historic Preservation Credit o Replacement Tax Investment Credits. See instructions. 53 Recapture a Enterprise Zone or River Edge Redevelopment Zone Investment Credit b Replacement Tax Investment Credit recapture 54 Payments (See instructions) a Pass-through entity payment. b Composite return payment. Member's or nonresident member's share from Illinois tax return 52l 52m 52n 52o 53a 53b 54a 54b Schedule K-1-P page 2 (R-12/11) ID: 2BX 149132 12-27-11 2