BASES: Simulated Test Marketing

advertisement

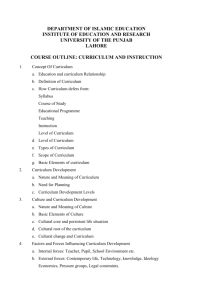

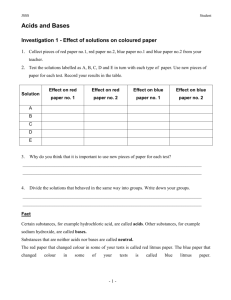

Simulated Test Marketing 2 STM products for evaluating new products BASES, Burke Marketing Research - Developed by Dr. Lynn Y.S. Lin in 1977 - Bought by Nielsen in 1998 Assessor, M/A/R/C Research, - Developed initially by Alvin J Silk and Glen L Urban in 1973 (Sloan School, MIT) Novaction - Developed Perceptor/Concept testing system based in Assessor in 1979 - Introduced Designor in 1986 - Bought by IPSOS in 2001 MicroTest (Research International) - Developed when RI was part of Unilever. RI became part of Kantar (WPP) in 1989. Unilever now uses BASES for most of their STM research 3 BASES: Simulated Test Marketing “BASES is a comprehensive, validated sales estimating system which integrates consumer response data with manufacturers’ marketing plans to assess the volumetric potential of concepts and products prior to introduction.” BASES = Booz-Allen Sales Estimating System 5 Agenda BASES – Theoretical framework BASES – The Methodology 6 Modelling Overview - Deflation Factors Consumers do not usually do what they claim to do. There is, however, a strong correlation between consumers’ claimed purchase behaviour and what subsequently transpires in the marketplace. Consumers tend to overstate their intended purchase behaviour (albeit with consistency). The level of overstatement varies by country, by culture, and by measure. 7 Modelling Overview Take consumer response data (what people say they will do); Deflate claims to adjust for overstatement Adjust for the impact of marketing activities; To yield behavioural data (a forecast of what people will actually do). 8 BASES Modelling Paradigm What consumers say they will do Consumer Response Data Remove bias Adjust for Overstatement Trial and Repeat Models Awareness Adjust for what the marketer will do to influence consumers Distribution Sampling Promotions Etc. What consumers will actually do Estimate For a combination of concept data, product data, and marketing plan 9 Volume Estimating Summarized Trial Volume + Repeat Volume # of Households in Population # of Households Trying X X Trial Rate Repeat Rate X X Average Trial Units Per Purchase Repeat Purchases Per Repeater = Total Volume Adjusted for overstatement X Average Repeat Units Per Purchase 10 Methodology 11 Field Methodologies BASES e-Panel of 225,000 panelists worldwide (of which 125,000 in US) Mall Intercept (CLT: Controlled Location Test) - Live interviewing in mall sites Interviews are computerized but conducted by interviewer - Use when have sniff or taste tests, or other techniques which require an in-person interview Other methodologies - Telephone interview - Door to door interviewing 12 Data Collection Process Concept Recruit Respondent in e-Panel or on location Show Concept Stimulus Product Place Items (In case of location interviews, respondent who claim they will not try are excluded) 2-week In-Home Usage (sample 300 – 500) 20-Minute personal/ e-Panel Interview (sample 150 – 200) 15-Minute phone/ ePanel Interview * “Definitely not try”, “Probably, not try” + For e-Panel studies, all respondents are placed 16 Concept Stimulus Concept board or commercial Should contain as much information as will be conveyed by advertising Should also contain prices, sizes, and varieties Nothing else - Should not contain any other information about the brand nor should it contain any competitive information 19 Introducing new Jasmine ambrosia drink ‘Refreshingly Nutritious’ Introducing a new ambrosia drink that is especially made for people seeking a nutritious, appetizing drink that helps release anxiety. Jasmine is made from nectar and green grape juice. It contains the essence of the Jasmine flower which is known to regulate breathing and reduce tension and anxiety. It contains no preservatives. Jasmine is a healthy drink that is well suited for the entire family. Sizes 330 ml: 6 x 330 ml: $ 1.20 $ 6.00 21 Introducing new Jasmine ambrosia drink ‘Refreshingly Nutritious’ Introducing a new ambrosia drink that is especially made for people seeking a nutritious, appetizing drink that helps release anxiety. Jasmine is made from nectar and green grape juice. It contains the essence of the Jasmine flower which is known to regulate breathing and reduce tension and anxiety. It contains no preservatives. Jasmine is a healthy drink that is well suited for the entire family. Sizes 330 ml: 6 x 330 ml: $ 1.20 $ 6.00 22 INTRODUCING NEW LUIGI’S HOMESTYLE PASTA SAUCES Pasta Lovers love the convenience of ready made sauce that tastes homemade. Preparing the right meals for your family is tough. Luckily, there is now an easy-to-make alternative to the dull boring foods usually available when you’re in a hurry: Luigi’s Homestyle. New Luigi’s Homestyle pasta sauces are 100% natural and prepared with only the freshest ingredients to make sure that your family gets the pasta sauce that they love, without Mom having to spend all day in the kitchen. Simply pour ready made Luigi’s Homestyle pasta sauce over prepared pasta and you have a nutritious 100% Natural meal prepared for your family that they will love. AVAILABLE IN your favourite shop TWO SIZES 250ml Jar at $6.49 500ml Jar at $12.69 THREE FLAVORS: TOMATO MEAT SWEET PEPPER & ONION 23 Questionnaire Outline Key Measures Purchase intent Units per purchase Value for the price Intensity of liking Uniqueness Diagnosis Attribute Ratings Likes/Dislikes Source of Volume Suggested Improvements (after use) 32 Interpretation 33 Data Interpretation Rating scale used for measuring purchase intent: Concept Definitely Would Buy Probably Would Buy After-use 12 29 41 Might/ Might Not Buy Probably Would Not Buy 35 40 Definitely Would Not Buy 15 10 8 6 4 good or bad? Are these scores good or bad? 34 Data Interpretation BASES’ Database is the primary device used for interpretation - Database has several thousand concepts, covering all categories (About 200,000 concepts in DB, in 2014) - Benchmarks exist for all key measures both at concept and after-use Success Targets set for after use measures - After-use Success Targets derived from products tested by BASES that achieved in-market success 35 New Product Success & Concept Purchase Intent Concept purchase intent is not strongly correlated with in-market success % respondents Concept Top-Two-Box Purchase Intent by In-Market Success Successful Marginal Failure 38 New Product Success & After-Use Purchase Intent (major determinant of long-term success) On the contrary, after-use purchase intent is strongly correlated with success % respondents After-Use Top-Two-Box Purchase Intent by In-Market Success Hurdle Successful Marginal Failure 39 BASES: Questions addressed What is the brand’s volume potential? Trial and Repeat: - What are the components of volume? Source of growth: - How much volume will come from your existing brand and how much from competitors? Diagnosis: - What marketing plan elements drive volume, and how can the plan be improved? - What are the strengths and weaknesses of the concept and product? 42 43