resource guide_saving

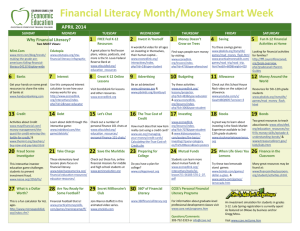

advertisement

The Time Value of Money Resource Guide United States Securities and Exchange Commission http://www.sec.gov/about/whatwedo.shtml The mission of the U.S. Securities and Exchange Commission is to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation. Investor.gov: In the Classroom http://investor.gov/classroom The United States Security and Exchange Commission Office of Investor Education and Advocacy offers resources to help individuals become better investors. The “In the Classroom” section of the website provides teachers, students, and parents with tools to develop an understanding of savings and investing focusing on key concepts that students need to know. FINRA.org http://www.finra.org/Investors/index.htm FINRA or the Financial Regulatory Authority is the largest independent regulator for all securities firms doing business in the United States. The chief role of FINRA is to protect investors by maintaining the fairness of the U.S. capital markets. FINRA oversees nearly 4,500 brokerage firms, 163,470 branch offices and 634,385 registered securities representatives. The section on “Smart Investing” offers essential tools for understanding the markets and basic principles of saving and investing. Lesson: The Benefits of Investing Early http://www.econedlink.org/lessons/index.php?lid=603&type=educator In this lesson from EconEdLink students examine the difference between opportunity costs and the time value of money. Students determine the wealth of investors who start saving money at times in their lives. Lesson: Developing a Financial Investment Portfolio http://www.econedlink.org/lessons/index.php?lid=566&type=educator In this lesson from EconEdLink students work as “financial advisors,” helping their clients grow an investment portfolio and tracking the investment over a period of weeks. Lesson: Climbing the Savings Mountain http://www.econedlink.org/lessons/index.php?lid=515&type=educator This EconEdLink lesson helps students find ways to save money, build financial goals, understand interest, and predict how inflation will influence money saved. 2011 WNET Additional resources for teaching financial education: W!SE http://www.wise-ny.org/ Working in Support of Education (w!se) is a nonprofit organization that offers financial education materials for schools all across the country. W!se seeks to support students for career and college, build civic engagement and financial literacy. The Muriel Siebert Foundation https://www.thesiebertfoundation.org/ The Muriel Siebert Foundation offers educational materials for the classroom that teach young people about basic financial skills and institutions, as well as how to use credit wisely. The lesson Lauren Popkoff presents in the video Teaching Students About Credit is adapted from a Muriel Siebert Foundation activity. Moneypower http://www.moneypower.org/wise/withframes.jsp Moneypower is a website for The New York Financial Literacy Coalition, a program made available to the public through w!se, that encourages financial education for young people. Wall Street Journal Classroom Edition http://www.wsjclassroomedition.com/index.html This site provides up-to-date articles and lesson plans covering economic matters in topics like cost/benefit analysis, supply and demand and incentives. EconEdLink: Economics and Personal Finance Resources for K-12 http://www.econedlink.org/ This website offers over 700 classroom resources for the K-12 teachers that cover topics on personal finance and economics. Council for Economic Education http://www.councilforeconed.org/ This site provides a variety of resources that look to promote personal finance for K-12 students. Resources include lessons, economic journals and access to Federal Reserve institutions around the country. The lesson Riza Lauden presents in the video The Time Value of Money is from Financial Fitness for Life, a comprehensive personal finance curriculum for K-12 students available through the Council for Economic Education. Family Economics and Financial Education http://fefe.arizona.edu/ This website from the University of Arizona offers financial education resources specific to each state that aim to promote smart financial planning. 2011 WNET It All Adds Up http://www.italladdsup.org/ This website is geared towards teens and offers resources to help them understand and set goals related to their financial future. Visitors can play games and learn about subjects ranging from money management to paying for college. Jump$tart Coalition for Personal Financial Literacy http://www.jumpstart.org/home.html Jump$tart is a coalition of organizations for Pre-K to college age students that distributes materials that seek to improve financial literacy. Junior Achievement http://www.ja.org/ Junior Achievement is a volunteer organization that offers K-12 programs that try to prepare young people for career and college by teaching work-skills, financial literacy, and entrepreneurship for tomorrow’s business professionals. The Mint http://www.themint.org/index.html This interactive website has large collection of materials for kids, teens, parents, and teachers that look to promote good financial habits. 2011 WNET